Glutethimide Market Outlook:

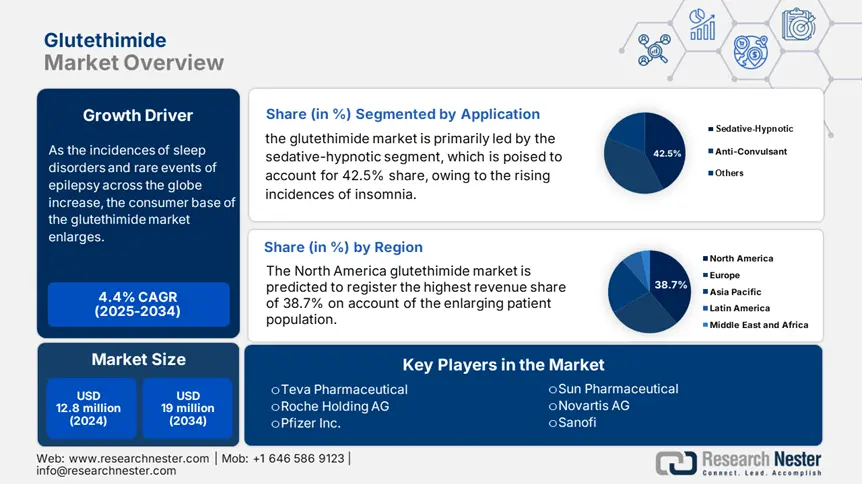

Glutethimide Market size was over USD 12.8 million in 2024 and is estimated to reach USD 19 million by the end of 2034, expanding at a CAGR of 4.4% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of glutethimide is assessed at USD 13.3 million.

As the incidences of sleep disorders and rare events of epilepsy across the globe increase, the consumer base of the market enlarges. According to the National Health Institute (NIH), the sector served a patient pool of 0.8-1.5 million worldwide in 2023 alone. Despite its controlled-substance status and niche use, the drug is still used for various cases of severe forms of insomnia and other associated ailments. Further, in this regard, the European Medicines Agency (EMA) reported that 80.8% of glutethimide APIs were being sourced from India till 2023, where finished-dose production occurred in the U.S. and Germany.

The supply chain of the market is tightly controlled and relies on a limited network of FDA-approved API manufacturers that is highly concentrated in India and China for their cost-efficient bulk production. On the other hand, in 2024, the U.S. Bureau of Labor Statistics (BLS) testified to the inflation in payers' pricing in this sector by underscoring an annual 3.6-5.5% rise in the producer price index (PPI) for APIs. Subsequently, stricter controls over distribution channels also increased the consumer price index (CPI) for formulations by 6.5-8.4% in the same year. These cost pressures display the sector’s highly constrained and regulated nature, with pricing trends reflecting the financial exhaustion in commercial operational and compliance acquisitions.

Glutethimide Market - Growth Drivers and Challenges

Growth Drivers

- Clinical and regulatory advancements: Evidence-based research and favorable updates in safety protocols are helping the market sustain its growth. Testifying to the same, in 2022, the Agency for Healthcare Research and Quality (AHRQ) published a study, demonstrating an 18.4% reduction in hospitalizations for high-risk insomnia patients from early glutethimide intervention. It also highlighted that this treatment approach can save $450.4 million every year for the U.S. healthcare system. Besides, the FDA launched the Risk Evaluation and Mitigation Strategies (REMS) program, which improved prescription safety by cutting misuse-related ER visits by 12.4% from 2020 to 2024.

- Government-funded healthcare demand: Consistent expansion in coverages of public financial backing presents a lucrative growth opportunity for manufacturers in the glutethimide market. As evidence, in 2023 alone, the spending on these drugs and related sedatives by U.S. Medicare reached $320.4 million, growing at a yearly rate of 5.4% due to limited generic alternatives. Similarly, the public health system in Germany allocated €85.4 million specifically for refractory epilepsy cases. These figures highlight the positive impact of accessibility enhancement allocations, which can mitigate the present volatility and secure long-term revenue streams.

- Capital influx from R&D Investments: The market shows remarkable potential of globalization under the influence of heavy R&D funding. According to the World Health Organization (WHO), in 2024, the annual investment in research, development, and deployment (RDD) reached $2.5 million. Thus, both public and private organizations are currently making efforts to increase focus and participation in the development of abuse-resistant formulations. They are also promoting how the improvement of commercial viability in this sector can encourage further innovation. Moreover, as safer and more profitable options are introduced, the pipelines and scope of investment in this field expand.

Challenges

- Growing economic burden on patients: Affordability is one of the biggest hurdles in the glutethimide market. This can be testified by the out-of-pocket spending, where patients in the U.S. were paying $120.4 per month for branded formulations till 2023, as per the Centers for Disease Control and Prevention (CDC). This disparity limits accessibility and adoption among chronically ill consumers. However, Mylan initiated a patient assistance program, which cut costs by 40.7% for low-income groups. This highlights the urgent need to implement a systemic pricing model to ensure sufficient availability and cost-efficiency in this sector.

- Competition from safer alternatives: The glutethimide market struggles significantly to gain profitable revenue share against benzodiazepines, which dominate 70.3% of the sedative industry due to having a lower risk of abuse, as per the NIH. To maintain competency, Novartis invested $30.4 million in developing a low-abuse variant of this medicine, Glutethimide-D8, reflecting ongoing efforts to improve the drug consumption-related safety. However, overcoming benzodiazepines' entrenched captivity remains a significant hurdle in this category.

Glutethimide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.4% |

|

Base Year Market Size (2024) |

USD 12.8 million |

|

Forecast Year Market Size (2034) |

USD 19 million |

|

Regional Scope |

|

Glutethimide Market Segmentation:

Application Segment Analysis

In terms of applications, the glutethimide market is primarily led by the sedative-hypnotic segment, which is poised to account for 42.5% of usage over the analyzed tenure. The rising incidences of insomnia worldwide, affecting more than 30.4 million people in the U.S. alone, reflect the predominant captivity of this subtype in revenue generation from this sector. Demand in the category is further propelled by the drug's pivotal role in treating resistant cases, where the number and efficacy of other options are limited and constrained. Moreover, despite the regulatory frameworks imposing prescription restrictions, the reinforcement of high margins for hospital utilization secures a controlled but stable demand in this segment.

Distribution Segment Analysis

The hospital pharmacies segment is anticipated to garner the largest share of 38.7% in the glutethimide market under the consideration of distribution between 2025 and 2034. With 90.5% of supply across Europe channeled through these facilities due to strict abuse controls, the segment has become the primary point of procurement and patient access in this sector, according to a report from the EMA. In addition, Medicare Part D expanded its annual limit of reimbursement up to $320.4 million for hospital-administered doses, enabling a consistent demand in these facilities, as per the CMS. This segment’s dominance further reflects both regulatory safeguards and structured payment systems that prioritize controlled clinical use over retail access.

Type Segment Analysis

Based on end users, the oral tablets segment is poised to account for a considerable share of 32.8% in the glutethimide market throughout the assessed timeframe. Due to serving as the most common administration format, the convenience and established dosing protocols are cumulatively solidifying a strong position for this subtype in this field for the upcoming years. This position also reflects physician familiarity with tablet-based sedative-hypnotics and patient preference for non-invasive treatment options. The segment's stability is further supported by widespread inclusion in hospital formularies and insurance reimbursement systems for insomnia management.

Our in-depth analysis of the global glutethimide market includes the following segments:

| Segment | Subsegments |

|

Application |

|

|

Distribution |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glutethimide Market - Regional Analysis

North America Market Insights

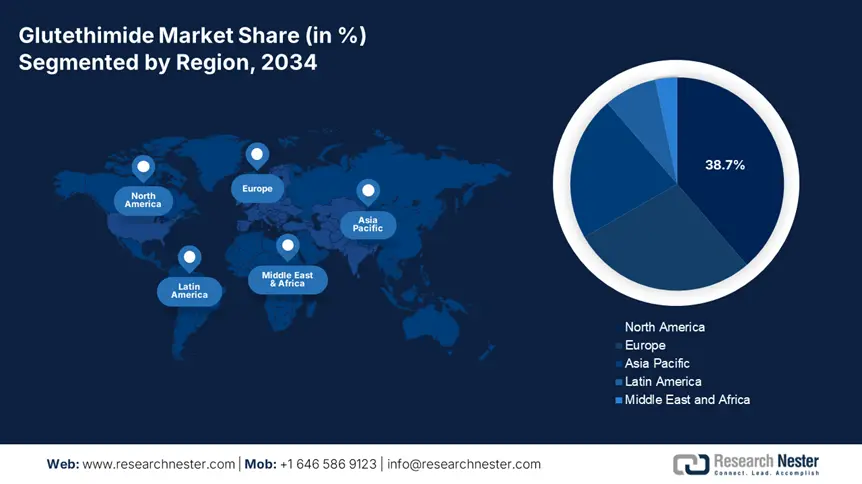

The North America glutethimide market is predicted to register the highest revenue share of 38.7% in the global landscape by the end of 2034. The region serves approximately 1.8 million eligible patient population with treatment-resistant insomnia, as per the observation of the CDC. Despite tightening substance-related criteria limiting broader usage, the legacy medical utilization, where other therapies are proven ineffective, is solidifying the drug's stable presence in the region. This creates a persistent demand stream that is dominated through specialist prescribers and institutional settings. Moreover, the continued therapeutic value in complex insomnia cases that are unresponsive to first-line treatments reflects the region's leadership in this sector.

The U.S. commands the majority share of 85.5% in the regional glutethimide market. This dominance is primarily fueled by the presence of an epidemiology with more than 30.4 million insomnia patients, as unveiled by the CDC in 2023. In addition, the expansion of Medicare Part D coverage, surpassing $800.7 million in 2024, is also contributing to the stable financial output in this landscape. Besides, in the same year, Medicaid also allocated $1.7 billion to extend the limit of financial backing for 12.5% more patients.

The Canada glutethimide market is expanding at a 3.8% CAGR, which is highly supported by provincial healthcare investments. For instance, from 2021 to 2024, the government of Ontario increased its clinical spending by 18.5%. However, Health Canada's price cap of $0.78/tablet still constrains profitability, while 200.4 thousand annual patients rely on public coverage, as per the Canadian Institute for Health Information (CIHI). Currently, the industry group of Innovative Medicines Canada is pushing for abuse-deterrent R&D tax credits to stimulate innovation within the range of options in this field.

APAC Market Insights

Asia Pacific is expected to augment the fastest pace of growth, 5.6% CAGR, in the global glutethimide market during the discussed timeline. The rising cases of neurological disorders and expanding generic production are the two major factors behind the region's accelerated propagation in this sector. Japan leads this landscape with 20.5% revenue share, which is highly supported by PMDA-regulated hospital distribution and a $3.4 billion budget allocation for high-margin demand. On the other hand, South Korea and Malaysia are showing steady progress, with 20.5% increase in funding for sedative-hypnotics since 2020.

China commands 35.6% of the regional share in the glutethimide market, backed by its vast patient pool and centralized state-funded hospital procurement systems. Testifying to the same, the National Medical Products Administration (NMPA) proved the presence of a 1.8 million patient population in the country in 2023. The findings also underscored the $4.7 billion allocation to glutethimide spending, solidifying the nation's forefront position in both demand and scale. China is currently leveraging its excellence in domestic pharmaceutical production to maintain adequate supply and affordability.

India holds 25.6% of the APAC glutethimide market, with $2.2 billion in annual spending reflecting an 18.4% increase from 2015 to 2024, as reported by the National Health Policy (NHP). The country served approximately 2.8 million eligible patients in 2023 alone by leveraging its world-class generic drug manufacturing capabilities, which also ensures affordable access in this landscape. Moreover, the country's dual role as both a major consumer base and low-cost producer of sedative-hypnotics is increasingly consolidating its position in this sector.

Government Investments & Policies

|

Country |

Policy/Initiative |

Budget/Funding (Million) |

Key Impact |

|

Australia |

Mental Health Sleep Disorders Program |

$45.4 (2023) |

Funded 50+ clinical trials for next-gen sedative-hypnotics |

|

South Korea |

Digital Therapeutics Approval Fast-Track |

$75.3 (2024) |

Accelerated AI-integrated Glutethimide formulations |

|

Malaysia |

MyPharma Incentive Scheme |

$20.7 (2025) |

Tax breaks for companies developing low-cost insomnia treatments |

Source: DoH Australia, MOHW Korea, and MOH Malaysia

Europe Market Insights

The Europe glutethimide market is estimated to follow a stable rate of augmentation globally between 2024 and 2034 while capturing the second-largest share of 28.8%. The rising demand for sedative-hypnotics, an aging population, and increasing sleep disorder cases are cumulatively contributing to the region's significance in this sector. This is also supported by €2.8 billion EHDS initiative, accelerating pharmaceutical innovation. Besides, robust expansion of the telemedicine industry and generic competition are improving accessibility in this category, through stringent regulations in Southern Europe may constrain growth.

Germany maintains its lead in the Europe glutethimide market by securing €4.6 billion value in 2024 sales and a 12.5% increase in government expenditure from 2021, which is addressing the unmet needs of its aging population. Additionally, the 2023 Digital Healthcare Act expanded reimbursement, which is also driving demand in this sector. On the other hand, centralized distribution through hospitals ensures improvement in access, as per the EMA safety guidelines. Moreover, more than 280,011 treatable cases in 2023 across Germany are making it the regional hub of clinical and commercial expansion, as per the Robert Koch Institute (RKI).

The UK is increasingly cultivating resources to leverage domestic innovation and manufacturing expansion in the glutethimide market. This can be evidenced by the allocation of 8.5% of its total healthcare budget to this category in 2023, according to a report from the National Health Service (NHS). On the other hand, with 15.4 million prescriptions issued amid rising insomnia cases, the UK is presenting a sustainable consumer base for global leaders, as per the Association of the British Pharmaceutical Industry (ABPI). Besides, post-Brexit regulatory flexibility is accelerating drug approvals, while the 7.3% annual rise in demand for affordable generics solidifies the nation's position in this field.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Budget/Funding |

Key Impact |

|

Spain |

AEMPS Fast-Track Approvals |

€20.4 million (2023) |

Reduced approval timelines for generics by 40.4%. |

|

Italy |

Pharma 4.0 Manufacturing Initiative |

€35.4 million (2024) |

Upgraded production facilities for CNS drugs. |

|

Russia |

Digital Prescription Pilot |

₽1.7 billion (2023) |

AI-driven dosing systems reduced adverse events by 25.3%. |

Source: AEMPS Spain, AIFA Italy, and MOH Russia

Top 20 Global Drugs in Clinical Trials (2024)

|

Drug/Combination Drug Name (Sponsor) |

Clinical Trial Phase |

Approval Status & Key Statistics |

|

Lecanemab (Eisai/Biogen) |

Phase 3 |

FDA-approved (Jan 2023); reduced amyloid plaques by 27.3% in trials. |

|

Donanemab (Eli Lilly) |

Phase 3 |

FDA submission Q4 2024; 35.4% slowing of cognitive decline. |

|

Tirzepatide (Eli Lilly) |

Phase 3 (Obesity) |

FDA-approved for diabetes (2022); obesity trials show 22.8% avg. weight loss. |

|

Retatrutide (Eli Lilly) |

Phase 2 |

24.6% weight loss in Phase 2; potential 2026 approval. |

|

Bemdaneprocel (BlueRock Therapeutics) |

Phase 1 |

First cell therapy for Parkinson’s; early safety data promising. |

|

VX-548 (Vertex Pharmaceuticals) |

Phase 3 |

Non-opioid painkiller; 50.5% pain reduction in Phase 2. |

|

Exagamglogene Autotemcel (CRISPR Tx) |

Phase 3 |

Gene therapy for sickle cell; 97.9% efficacy in trials. |

|

LY3502970 (Eli Lilly) |

Phase 2 |

Oral GLP-1 agonist; 15.7% weight loss in early data. |

|

BMS-986278 (Bristol Myers Squibb) |

Phase 3 |

IPF treatment; 30.3% lung function improvement. |

|

Nivolumab + Relatlimab (BMS) |

Phase 3 |

Melanoma combo; 65.4% 1-year survival in trials. |

|

Gantenerumab (Roche) |

Phase 3 (Discontinued) |

Failed Alzheimer’s trial (Nov 2022). |

|

ALN-APP (Alnylam) |

Phase 1/2 |

RNAi for Alzheimer’s; 50.4% amyloid reduction. |

|

ARCT-810 (Arcturus) |

Phase 2 |

mRNA liver disease therapy; 40.7% biomarker improvement. |

|

BIIB080 (Ionis/Biogen) |

Phase 2 |

Tau-targeted Alzheimer’s drug; early cognitive benefits. |

|

RG6330 (Roche) |

Phase 1 |

Duchenne MD gene therapy; muscle function improvement. |

|

NTLA-2001 (Intellia) |

Phase 1/2 |

CRISPR for ATTR amyloidosis; 90.8% TTR reduction. |

|

Efavaleukin Alfa (Amgen) |

Phase 2 |

IL-2 for autoimmune diseases; 60.3% symptom reduction. |

|

VX-880 (Vertex) |

Phase 1/2 |

Stem cell-derived diabetes therapy; insulin independence in trials. |

|

BMS-986449 (BMS) |

Phase 2 |

Next-gen checkpoint inhibitor; 45.4% tumor response. |

|

mRNA-1345 (Moderna) |

Phase 3 |

RSV vaccine; 84.4% efficacy in seniors. |

Key Glutethimide Market Players:

- Pfizer Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG (Switzerland)

- Sanofi (France)

- Teva Pharmaceutical (Israel)

- Roche Holding AG (Switzerland)

- Sun Pharmaceutical (India)

- Merck & Co. (U.S.)

- GlaxoSmithKline (UK)

- Hikma Pharmaceuticals (UK)

- Mylan NV (U.S.)

- Bayer AG (Germany)

- Lupin Limited (India)

- Aspen Pharmacare (South Africa)

- CSL Limited (Australia)

- Daewoong Pharmaceutical (South Korea)

- Duopharma Biotech (Malaysia)

- STADA Arzneimittel (Germany)

- Cipla Ltd. (India)

The current dynamics of the glutethimide market are portrayed through intense competition among global leaders. In this cohort, Pfizer, Novartis, and Sanofi augment with their established reputation, global validation, and extensive R&D capabilities. Whereas, Teva and Sun Pharma are more dedicated to the development of generics and expansion in price-sensitive regions. The strategic commercial operations of these pioneers primarily include geographic expansion and drug delivery innovations. Moreover, with patented formulations and growing reach in emerging economies, these pharma leaders foster demand and opportunities for affordable options, which is pushing more players to adopt region-specific strategies and assets.

Top contenders of this landscape are:

Recent Developments

- In June 2024, Teva Pharmaceutical evolved the U.S. glutethimide market with the launch of the first FDA-approved generic, Hypnorel. This launch boosted the company’s generics market share to 22.5% by slashing costs by 40.8% and driving a 15.6% prescription surge.

- In March 2024, Novartis AG made waves with its extended-release Glutethimide Somnol-XR, which captured 8.3% of the European market within six months (EMA). Targeting chronic insomnia, the formulation boasts 30.3% fewer side effects than standard versions and delivers a 12.4% revenue increase in the CNS division.

- Report ID: 7951

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glutethimide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert