Wi-Fi Chipset Market Outlook:

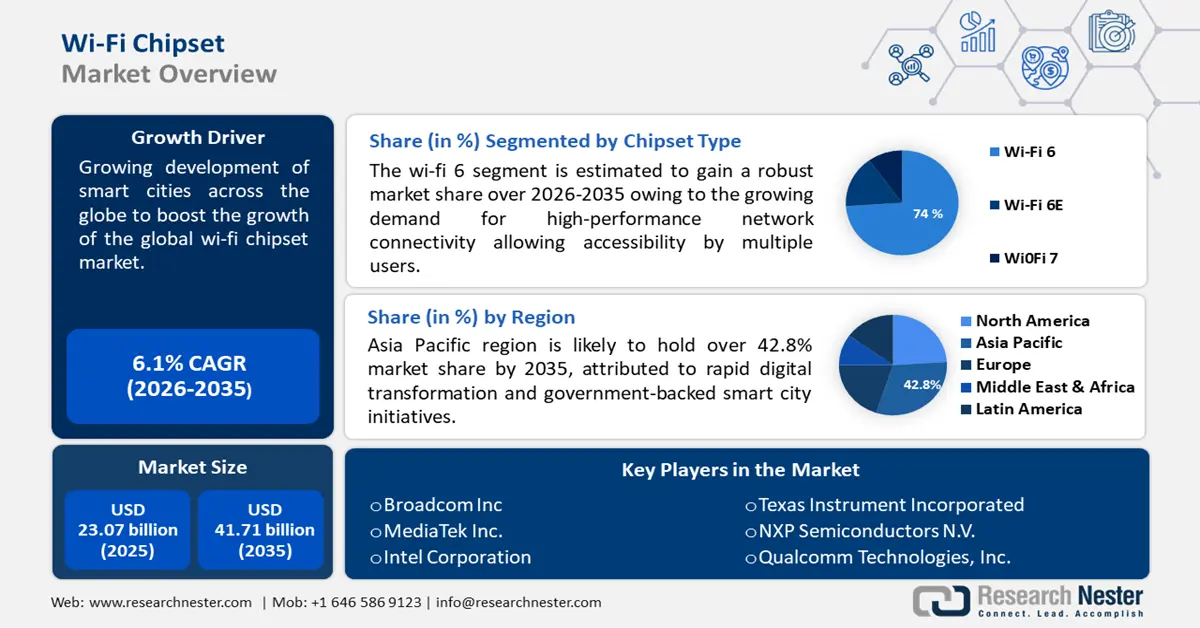

Wi-Fi Chipset Market size was valued at USD 23.07 billion in 2025 and is likely to cross USD 41.71 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of Wi-Fi chipset is estimated at USD 24.34 billion.

There is an increasing demand for stable and faster wireless connectivity, attributed to the continuous expansion of platforms such as multiplayer online gaming, smart home environments, and streaming. Consumers are increasingly adopting Wi-Fi chipsets, due to their ability to provide users with access to better internet connectivity, and are offering them low-latency data transmission and high-speed. The key players in the Wi-Fi chipset market are rolling out advancements in their products to enhance network stability. For instance, in November 2023, MediaTek launched its Filogic 860 and Filogic 360 Wi-Fi 7 chipsets, engineered to deliver ultra-fast and energy-efficient wireless performance for applications such as smartphones and routers.

Key Wi-Fi Chipset Market Insights Summary:

Regional Highlights:

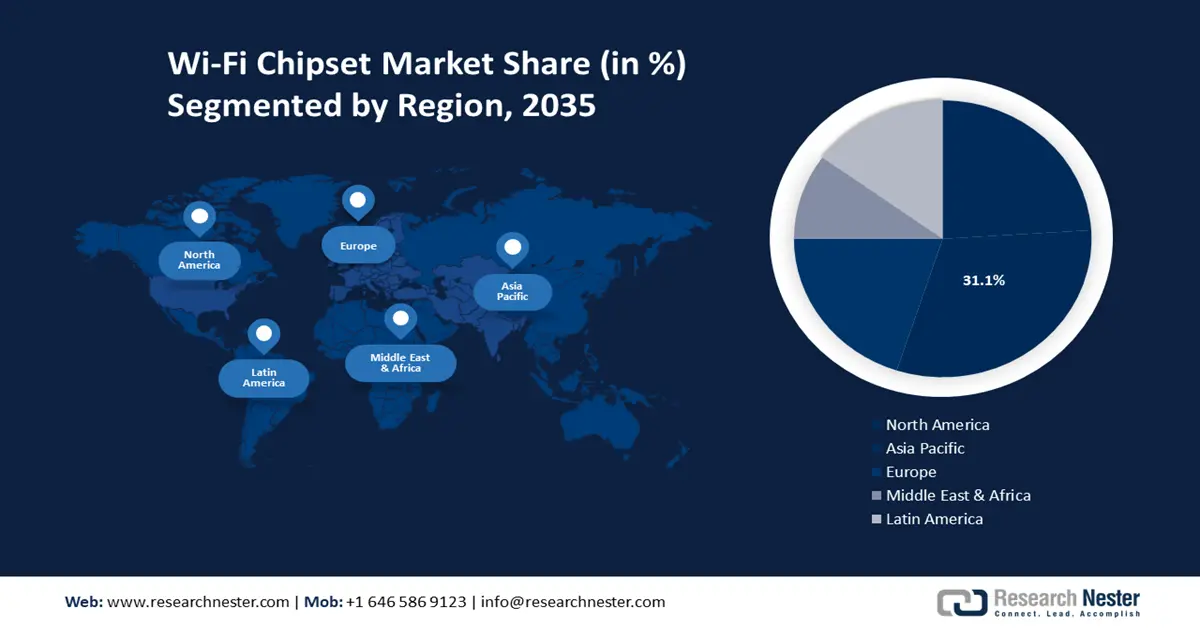

- Asia Pacific Wi-Fi chipset market will dominate over 42.8% share by 2035, driven by rapid digital transformation and government-backed smart city initiatives.

- North America market will achieve a substantial CAGR during 2026-2035, driven by expansion of smart infrastructure across cities and enterprises.

Segment Insights:

- The wi-fi 6 segment in the wi-fi chipset market is expected to achieve a 74% share by 2035, influenced by the need for enhanced connectivity in e-commerce and retail.

- The mu-mimo configuration segment in the wi-fi chipset market is expected to experience the fastest growth during 2026-2035, driven by the adoption of high-density public Wi-Fi networks.

Key Growth Trends:

- Government Support and Public Wi-Fi Infrastructure

- Surge in adoption of smart home

Major Challenges:

- Competition from alternative technologies

Key Players: Texas Instruments Incorporated, Broadcom Inc, Qualcomm Technologies, Inc, MediaTek Inc., Intel Corporation.

Global Wi-Fi Chipset Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.07 billion

- 2026 Market Size: USD 24.34 billion

- Projected Market Size: USD 41.71 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Taiwan, China, South Korea, Japan

- Emerging Countries: China, India, South Korea, Taiwan, Malaysia

Last updated on : 8 September, 2025

Wi-Fi Chipset Market Growth Drivers and Challenges:

Growth Drivers

-

Government Support and Public Wi-Fi Infrastructure: To address concerns such as the digital divide and to improve digital literacy globally, various governments are emphasizing public wi-fi infrastructure as a strategic tool. The initiatives, such as the Prime Minister Wi-Fi Access Network Interface (India) and SA Connect (South Africa), are fueling the demand for wi-fi chipsets embedded in mesh systems, routers, and access points utilized in urban and rural connectivity solutions. Companies such as MediaTek and Qualcomm are developing high-performance chipsets. For instance, in April 2024, Qualcomm introduced the QCC730 Wi-Fi SoC, designed for ultra-low-power applications, aiming to compete with Bluetooth in battery-operated IoT devices. This chipset is tailored to deliver efficient wireless connectivity in environments with numerous connected devices.

-

Surge in adoption of smart home: There is an increase in the adoption of smart homes with the rising demand for an easy and comfortable lifestyle. This trend is significantly fueling the growth of the market. Consumers are leveraging smart lighting, voice assistants, and remote settings in electronic appliances in their daily lives, with the help of Wi-Fi. To align with this trend, the manufacturers are implementing advancements in the chipsets and maintaining reliable connections across multiple devices. For instance, in November 2024, Amazon launched its next-gen Echo Show 21, featuring upgraded Wi-Fi 6E connectivity to ensure smoother streaming and more responsive smart home control.

Challenges

-

Competition from alternative technologies: The market is facing intense competition due to the availability of alternative wireless technologies such as LoRa, Z-Wave, Bluetooth, and 5G. Use cases such as remote monitoring, smart agriculture, and Industrial IoT significantly benefit from the features of these technologies, including enhanced efficiency, longer range, and less power consumption, which are often lacking in Wi-Fi. This competition among the technologies is restricting the expansion of the market in the developing wireless network ecosystem.

Wi-Fi Chipset Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 23.07 billion |

|

Forecast Year Market Size (2035) |

USD 41.71 billion |

|

Regional Scope |

|

Wi-Fi Chipset Market Segmentation:

Chipset Type

The Wi-Fi 6 segment in Wi-Fi chipset market is all set to account for the revenue share of 74% during the analysis timeframe, attributed to the consistently growing industries such as e-commerce and retail. The expansion of these industries necessitates wireless connectivity to manage and point-of-sale systems, inventory tracking, and customer engagement. Various retail stores are partnering with network providers and are increasingly adopting the AI-driven Wi-Fi 6 technology due to its reduced latency and enhanced capacity. In April 2023, Halfords, a UK-based provider of motoring and cycling products, partnered with Juniper Networks to deploy AI-based Wi-Fi 6 solutions across its stores, garages, and offices. This deployment aims to enhance operational efficiency and customer experiences by providing high-speed and reliable wireless connectivity.

MIMO Configuration

The MU-MIMO configuration segment is expected to register the fastest growth during the forecast period. The incorporation of MU-MIMO technology into modern Wi-Fi standards, particularly in the Wi-Fi 6 and the emerging Wi-Fi 7, improves wireless network efficiency and capacity. Companies are implementing technology advancements in MU-MIMO configuration, so that the Wi-Fi standards can transmit data simultaneously to multiple devices, optimizing bandwidth utilization and reducing latency.

A surge in the requirement for high-density public Wi-Fi networks at stadiums, airports, and in busy urban areas is boosting the adoption of MU-MIMO technology. Companies are developing MU-MIMO technology to enhance user experience and manage multiple simultaneous connections effectively in dense environments. For instance, in April 2023, TP-Link launched the Archer BE900 wireless router, featuring advanced MU-MIMO capabilities tailored for high-traffic public spaces, reflecting the industry's commitment to addressing connectivity challenges in densely populated settings.

Our in-depth analysis of the global market includes the following segments:

|

Chipset Type |

|

|

Protocol |

|

|

MIMO Configuration |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wi-Fi Chipset Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is likely to hold over 42.8% market share by 2035, attributed to rapid digital transformation and government-backed smart city initiatives. Countries such as India, China, and Japan are experiencing surging internet penetration, widespread adoption of mobile and IoT devices, and government-backed smart city initiatives. These developments are encouraging manufacturers to embed advanced Wi-Fi chipsets in a variety of devices, from smartphones and tablets to smart home systems and industrial equipment.

Additionally, the strong presence of leading semiconductor manufacturing hubs in countries like China, Taiwan, and South Korea is propelling the regional market forward. The availability of robust fabrication infrastructure, skilled labor, and R&D capabilities enables quick innovation cycles and cost-effective chipset production.

The market in China is projected to grow at a significant pace, due to the country’s focus on technological self-reliance. Government policies and initiatives aimed at reducing dependence on foreign semiconductor technologies are resulting in increased domestic investments in R&D and production capacity. This strategic focus is empowering local players to innovate and scale their capabilities for a broad range of applications, from consumer electronics to industrial automation.

Moreover, the booming e-commerce and digital services sectors are driving demand for high-speed, reliable wireless connectivity. As consumers increasingly rely on mobile apps, online entertainment, and smart home devices, manufacturers are integrating advanced Wi-Fi chipsets into their offerings to enhance user experience and maintain a competitive edge in a fast-moving digital economy.

North America Insights

The Wi-Fi chipset market in North America is expected to account for a substantial share during the analysis period, owing to the rapid expansion of smart infrastructure across cities and enterprises. The need for high-performance, secure Wi-Fi connectivity is increasing, as municipalities and corporations invest in connected systems such as intelligent transportation, energy management, and smart buildings. This is creating strong demand for advanced chipsets that can handle high data throughput and support a growing number of connected devices.

The Wi-Fi chipset market in the U.S. is projected to witness rapid growth due to increasing investments in advanced networking infrastructure across educational and healthcare institutions. These sectors are integrating high-speed, low-latency connectivity to support e-learning platforms, telehealth services, and real-time collaboration tools. Additionally, the rising emphasis on remote work and hybrid office environments in the country is accelerating demand for enterprise-grade Wi-Fi solutions. Companies are upgrading legacy systems to support secure, multi-device connectivity for dispersed teams, leading to increased integration of advanced chipsets in routers and mesh systems. This trend is further reinforced by a growing preference for cloud-managed networks, which rely heavily on chipsets that enable seamless data flow, bandwidth management, and improved user experience.

Wi-Fi Chipset Market Players:

- Texas Instruments Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Broadcom Inc.

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Intel Corporation

- ASUSTeK Computer Inc.

- GCT Semiconductor Inc.

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- Intel Corp.

- Realtek Semiconductor Corp.

- Samsung Electronics Co. Ltd.

- Skyworks Solutions Inc.

- Sony Group Corp.

- Marvell Technology Inc.

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- PERASO INC.

- Qualcomm Inc.

The highly competitive Wi-Fi chipset market is driven by continuous innovation and rapid adoption of advanced wireless standards like Wi-Fi 6, 6E, and 7. Key players such as Qualcomm, Broadcom, MediaTek, Intel, and Marvell are continually dominating the landscape, focusing on high-performance, low-latency chipsets for diverse applications including smartphones, routers, IoT devices, and laptops. These companies are investing heavily in research and development, and strategic collaborations to stay ahead. For instance, joint efforts between chipset manufacturers and device OEMs have accelerated time-to-market for next-gen Wi-Fi products. Here are some key players operating in the global market:

Recent Developments

- In March 2025, ASUS released the TUF Gaming Z890-Pro Wi-Fi motherboard, designed for gamers seeking functionality and ease of installation. The motherboard supports Intel Core Ultra 200 series processors and offers features like four DDR5 DIMM slots, multiple PCIe expansion slots, and four M.2 slots with dedicated heat sinks.

- In October 2024, MediaTek announced its flagship mobile chipset, the Dimensity 9400. Built on a 3nm process, it features significant improvements in performance and power efficiency. The chipset includes Arm's 12-core Immortalis-G925 GPU with enhanced ray tracing capabilities and an eighth-generation NPU for advanced on-device AI processing.

- Report ID: 2123

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wi-Fi Chipset Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.