Third-party Optical Transceivers Market Outlook:

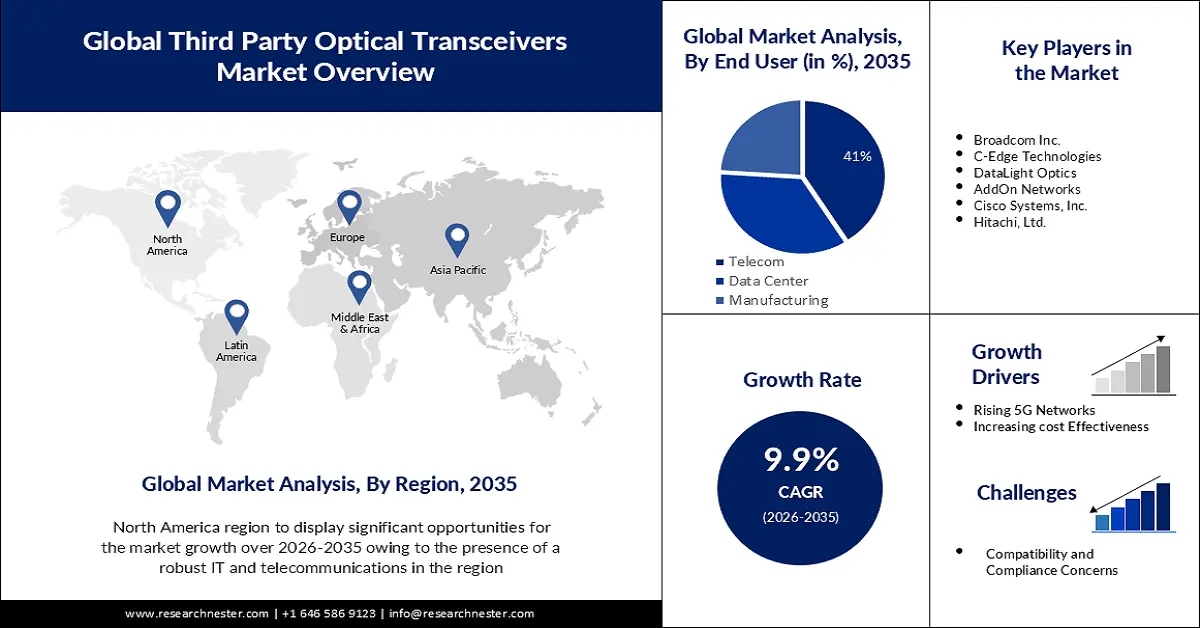

Third-party Optical Transceivers Market size was valued at USD 3.24 billion in 2025 and is expected to reach USD 8.33 billion by 2035, expanding at around 9.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of third-party optical transceivers is evaluated at USD 3.53 billion.

The market growth can be estimated by looking at the surging demand for cloud solutions. It is important for transmitting the data at high speed in cloud computing with more flexibility. More than 80 % of the companies around the globe use some time of cloud service.

The third-party optical transceivers offer eco-proportional solutions to promote energy efficiency, reduction in carbon footprint, and drive green practice at the industry level. The demand for environmentally friendly third-party optical transceivers has increased as a result of the increasing focus on sustainability and energy efficiency, which is in line with growing demands for responsible and ethical solutions.

Key Third-party Optical Transceivers Market Insights Summary:

Regional Highlights:

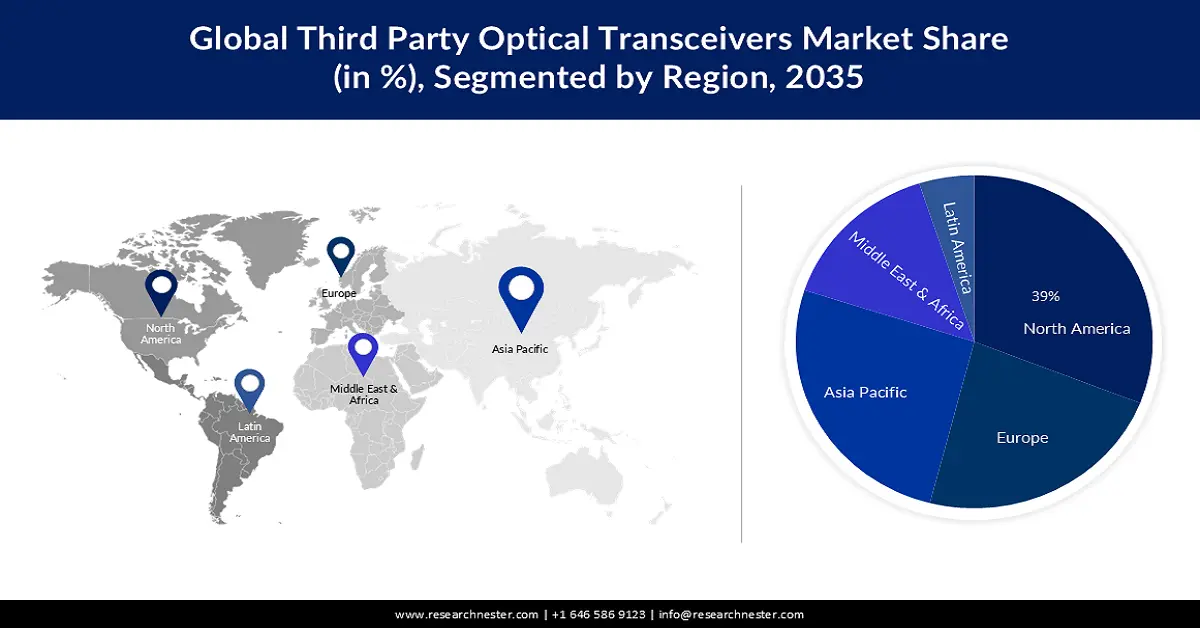

- North America is expected to command a 39% revenue share by 2035 in the third-party optical transceivers market, attributed to its strong IT and telecom ecosystem alongside rapid adoption of advanced network technologies such as 5G and cloud computing.

- Asia Pacific is projected to witness substantial growth through 2035, underpinned by rising OCT module adoption for data centers and escalating demand for high-speed FTNs and communication networks.

Segment Insights:

- By 2035, the QSFP segment in the third-party optical transceivers market is projected to secure a substantial share, supported by its expanding utilization in high-speed data center and storage networking environments.

- The telecom segment is anticipated to capture a 41% share by 2035, bolstered by escalating demand for data transmission services across emerging economies.

Key Growth Trends:

- Increasing Cost Effectiveness

- Rising 5 G Network

Major Challenges:

- Increasing Cost Effectiveness

- Rising 5 G Network

Key Players: AddOn Networks, SWOT AnalysisAmphenol ICC, Champion ONE, DataLight Optics, C-Edge Technologies, ETU-link Technology, Finisar Corporation, FluxLight Incorporated, Broadcom Inc., Eoptolink Technology Inc.

Global Third-party Optical Transceivers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.24 billion

- 2026 Market Size: USD 3.53 billion

- Projected Market Size: USD 8.33 billion by 2035

- Growth Forecasts: 9.9%

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Mexico

Last updated on : 19 November, 2025

Third-party Optical Transceivers Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Cost Effectiveness- One of the most significant drivers for the adoption of third-party optical transceivers is their cost-effectiveness compared to OEM-Branded Transceivers. Third-party options are often more competitively priced, which allows businesses to save money on network infrastructure without compromising on quality, leading the way in low cost is boosting the market.

-

Rising 5 G Network: Owing to next generation wireless network 5G rollouts vary by organization, no standardized infrastructural base has been established. Due to fast technical upgrades, many pre-deployed modules are likely to be abandoned. To limit the risk of uncertainty, the deployment of devices and modules at each stage necessitates cost-cutting methods. The 5 G network connections surged by nearly 75 % from the end of the year 2021 to end of the year 2022.

- Growing Benefits Provided by the Vendors-: Third-party optical transceiver vendors offer a wide array of options in terms of data rates, form factors, and reach capabilities. This allows network designers and administrators to tailor their networks to specific requirements, creating efficient and scalable solutions. Moreover, reputable third-party vendors often offer warranties and technical support that match or even exceed those provided by OEMs. This level of support gives businesses confidence in the reliability and performance of the transceivers they purchase.

Challenge

-

Support and Technical Issues in Third-party Optical Transceivers- Using third-party optical transceivers, there is a possibility that OEMs do not provide the same level of hardware support or technical assistance compared to their own branded transceivers. The lack of support can become problematic during troubleshooting network issues or diagnosing compatibility problems. OEMs may insist on using their own transceivers as a part of their support policy, which can lead to challenges in getting comprehensive technical assistance if third-party transceivers are being used. This lack of direct support from OMEs might result in longer solution times for network-related issues and hinder the overall reliability and maintenance of the network.

-

Compatibility and Compliance Concerns

- Limited Availability for Specific Configuration.

Third-party Optical Transceivers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.9% |

|

Base Year Market Size (2025) |

USD 3.24 billion |

|

Forecast Year Market Size (2035) |

USD 8.33 billion |

|

Regional Scope |

|

Third-party Optical Transceivers Market Segmentation:

Type Segment Analysis

The QSFP segment in the third-party optical transceivers market is set to show a tremendous share during the forecasted timeframe. QSFP+ is an optical transceiver that has the same physical connector as QSP but with support for faster speeds and more data channels. In high-speed networking applications, for example in data centers and the storage space network, this type of optical transceiver is used.

End User Segment Analysis

Third-party optical transceivers market from the telecom segment is estimated to hold the highest share in the upcoming years with a share of 41 %. The demand for optical transceivers in telecommunications applications is expected to increase as more and more users make use of data transmission services, particularly in emerging economies. Overall consumers of the telecom sector are nearly about 222.7 million people as per the reports.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Third-party Optical Transceivers Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 39% by 2035. This growth is due to the presence of a robust IT and telecommunications industry in the region. Moreover, the North America region has adopted the advancement of network technologies such as 5G, and cloud computing.

APAC Market Insights

Asia Pacific third-party optical transceivers market is projected to have significant growth during the forecast period as a result of factors like the increased adoption of OCT modules for data centers, and growing demand for FTNs & communication networks with higher speeds. For instance, the data centers in India are expected to reach more than 180 by 2025. In addition, the growth of this regional market is being driven by increasing development and initiatives in order to improve digital infrastructure and rising demand for more bandwidth.

Third-party Optical Transceivers Market Players:

- AddOn Networks

- Business strategy

- Key product offerings

- Financial performance

- Risk analysis

- Recent development

- Regional presence

- SWOT Analysis

Recent Developments

- Broadcom Inc, launched BCM85812, a 5nm 100/lane optic PAM-4 DSP PHY with integrated Transimpedance Amplifier (TIA) and lasers driver best suited for 800G DR8, fr4, 800G AOC module applications.

- Eoptolink Technology Inc., Ltd., has boosted its portfolio for 50G SFP56. The upgraded offer now includes longer distances of up to 40 km and trilateral support. In the 50G portfolio are available single fiber and duplex fiber optical transceivers. All models support the option of carrying up to 50G, 25G, or 10GEthernet in combination with a trirate capability.

- Report ID: 2191

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.