Solar Panel Recycling Market Outlook:

Solar Panel Recycling Market size was valued at USD 348.9 million in 2025 and is projected to reach USD 691.6 million by the end of 2035, rising at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of solar panel recycling is evaluated at USD 376.4 million.

The solar panel recycling market is set to witness tremendous progress over the upcoming years, owing to the growing emphasis on sustainable energy and intensifying circular economy practices. Similarly, the ever-increasing adoption of solar energy, coupled with the approaching end-of-life phase of early-installed panels, is also driving demand for these recycling solutions. In this context, Texas Solar Society in October 2025 reported that Solar panel recycling is rapidly growing as an essential part of sustainable solar energy, efficiently preventing landfill waste and conserving critical minerals such as silver and copper. Companies across the globe are proactively developing end-to-end recycling solutions, repurposing materials, and creating collection networks, whereas dedicated recyclers, such as SolarCycle, recover high-value components. It also notes that with increasing capacity and financial incentives, the solar recycling sector is growing, ensuring both environmental and economic benefits for the industry.

Solar Panel Recycling in the U.S.: Market Growth and Impact at a Glance

|

Metric |

Value |

|

Projected solar panel waste by 2050 |

80 million tons |

|

Global solar recycling market value (2024) |

USD 333.5 million |

|

Projected global market value by 2034 |

USD 2.4 billion |

|

North America market share (2024) |

46.3% (USD 150 million) |

|

Projected CAGR |

22.3% |

|

Material recovery efficiency (SolarCycle) |

>95% |

|

Panel lifespan extension (SolarCycle) |

5 to 10 years |

Source: Texas Solar Society

Furthermore, the consistent efforts from both public and private entities to increase adoption are stimulating growth in the market. In this context, the Solar Energy Industries Association (SEIA) in October 2025 announced that it has launched SolarRecycle.org, which is a new online platform especially designed to advance the long-term sustainability of solar and storage by connecting industry leaders with recycling partners. SolarRecycle.org offers an interactive map of collection sites, guidance on recycling best practices, summaries of state and local legislation, and reports on environmental and safety standards for solar equipment. Originally, it was created by a coalition of clean energy experts, and the platform was acquired and updated by SEIA in 2025 to provide a proper resource for companies, policymakers, and the public. The initiative underscores the industry’s commitment to responsible end-of-life management and strengthening energy security by also supporting sustainable growth.

Key Solar Panel Recycling Market Insights Summary:

Regional Highlights:

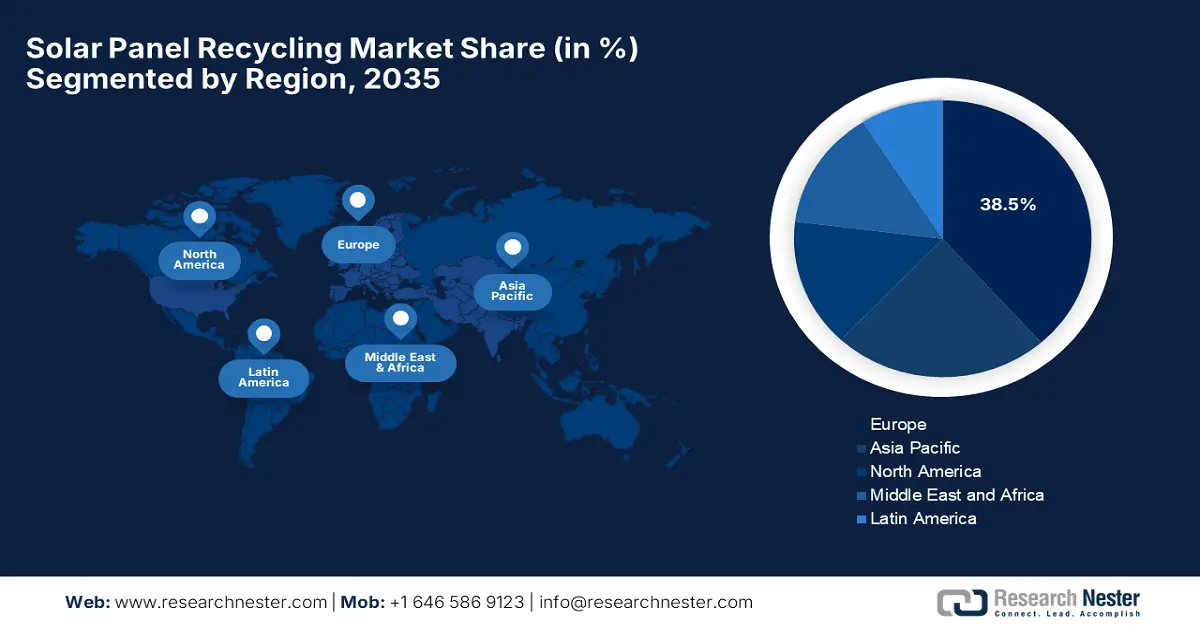

- Europe is forecast to account for an estimated 38.5% share by 2035 in the solar panel recycling market, underscoring its leadership as stringent EU WEEE regulations and mature recycling infrastructure continue to accelerate end-of-life PV material recovery.

- Asia Pacific is projected to witness the fastest expansion through the forecast period, as the concentration of aging solar installations across major economies amplifies demand for scalable and cost-efficient recycling solutions.

Segment Insights:

- Mechanical Process Segment is anticipated to capture a dominant 60.6% revenue share by 2035 in the Solar Panel Recycling Market, reflecting its industry preference as recyclers emphasize economical, scalable dismantling techniques anchored in widespread operational adoption.

- Glass-based Material Segment is expected to hold a considerable market share by the end of the forecast horizon, as escalating PV waste volumes and advancing separation efficiencies reinforce revenue generation supported by strong downstream reuse demand.

Key Growth Trends:

- Rapid growth in solar PV installations

- Increasing regulatory mandates & environmental policies

Major Challenges:

- Lack of standardization in panel design

- Regulatory and policy gaps

Key Players: First Solar, Inc. (U.S.), Reiling GmbH & Co. KG (Germany), Echo Environmental, LLC (U.S.), SILCONTEL LTD (Israel), Canadian Solar Inc. (Canada), SunPower Corporation (U.S.), Trina Solar (China), Aurubis AG (Germany), Solarcycle, Inc. (U.S.), The Retrofit Companies, Inc. (U.S.), Rinovasol Global Services B.V. (Netherlands), We Recycle Solar (U.S.), ROSI SAS (France), Etavolt Pte. Ltd. (Singapore), PV Industries Pty Ltd (Australia).

Global Solar Panel Recycling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 348.9 million

- 2026 Market Size: USD 376.4 million

- Projected Market Size: USD 691.6 million by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: India, United Kingdom, Canada, South Korea, Australia

Last updated on : 13 January, 2026

Solar Panel Recycling Market - Growth Drivers and Challenges

Growth Drivers

- Rapid growth in solar PV installations: The expansion of solar power installations across the globe prompts a growing future volume of end-of-life panels that need recycling infrastructure. Therefore, this rising waste stream creates a strong demand in the solar panel recycling market. In this context, in December 2025, the Central Pollution Control Board (CPCB) released India’s first draft guidelines for the safe storage, handling, and transportation of end-of-life solar PV panels under the E-Waste (Management) Rules, 2022. It also notes that the playbook emphasizes preventing environmental pollution from toxic metals by establishing take-back and collection systems and ensuring storage facilities meet safety and contamination-prevention standards. Further, by promoting scientific recycling, the guidelines aim to recover valuable materials, support sustainability, and manage the rapidly growing solar waste from the country’s expanding 110 GW solar capacity.

- Increasing regulatory mandates & environmental policies: Governments across most nations are imposing strict environmental regulations and waste management laws requiring proper disposal and recycling of photovoltaic modules, driving growth in the market. In this context November 2025 IEA reported that the EU’s WEEE Directive 2012/19/EU sets mandatory requirements for the collection, treatment, and recovery of electrical and electronic equipment, including photovoltaic (PV) panels, to minimize environmental harm and improve resource efficiency. It mandates free take-back systems, specific collection targets, and proper treatment of hazardous components, while also efficiently promoting eco-design for repair, reuse, and recycling. In addition, the directive also standardizes producer registration and reporting across member states, ensuring a harmonized approach to PV as well as other WEEE management.

- Economic incentives & material recovery value: Solar panels contain valuable materials such as silicon, silver, copper, and aluminum that are expensive or challenging to source. Therefore, recovering these materials through recycling offers economic returns, reduces reliance on virgin raw materials, and helps mitigate supply chain risks. In October 2025, AGC Glass Europe and Germany-based cleantech startup SOLAR MATERIALS together announced that they entered into a strategic partnership to recycle end-of-life photovoltaic panels by integrating high-purity glass cullet into AGC’s float glass production. Besides, SOLAR MATERIALS’ chemical-free process recovers 98% of a panel’s weight, including glass, aluminum, silicon, and copper, reducing the need for virgin raw materials and cutting CO₂ emissions. In this context, this collaboration advances a circular value chain in Europe, thereby promoting low-carbon glass production for architectural, automotive, and solar applications, hence benefiting the solar panel recycling market.

Challenges

- Lack of standardization in panel design: The heterogeneity of solar panel designs presents a major challenge for the expansion of the market. The solar panels differ in terms of materials, laminates, and assembly techniques, which include crystalline silicon, thin-film, and bifacial modules, each requiring different types of recycling methods. In this context, any type of variation in soldering materials, adhesives, and encapsulants complicates the extraction of valuable resources such as silicon, silver, and copper. Therefore, this lack of standardization increases processing time, labor, and equipment complexity, reducing overall efficiency. Moreover, recyclers need to adapt to new technologies, which can be prohibitive in terms of expenses for small and medium-scale firms operating in this field.

- Regulatory and policy gaps: The absence of comprehensive regulations on solar panel recycling in many countries hampers market growth in the upcoming years. In some regions, particularly in Europe, have robust e-waste frameworks, whereas in large solar markets like the U.S., India, and parts of Asia, lack of mandatory recycling policies. Without proper legal requirements, panel owners are less incentivized to participate in recycling programs, thereby leaving recyclers to rely on voluntary collection programs, which most often fall short. Also, the aspect of inconsistent regulations across states or countries further complicates logistics and compliance. In addition, harmonized international standards and clear regulatory frameworks are essential to drive recycling adoption and promote investment in advanced recycling infrastructure.

Solar Panel Recycling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 348.9 million |

|

Forecast Year Market Size (2035) |

USD 691.6 million |

|

Regional Scope |

|

Solar Panel Recycling Market Segmentation:

Process Segment Analysis

In the process segment mechanical segment is expected to attain the largest revenue share of 60.6% in the solar panel recycling market during the forecast duration. The dominance of the segment is highly attributable to its cost-effectiveness, scalability, and wide adoption, especially for breaking down large panels into constituent materials without complex chemical requirements. In May 2025, SOLARCYCLE announced that partnered with RWE Clean Energy to recycle end-of-life solar panels from RWE’s U.S. projects, using its patented mechanical recycling technology to recover up to 95% of materials as aluminum, silver, copper, silicon, and glass. This process ensures high-purity outputs, which are verified by third-party testing, enabling these materials to re-enter domestic supply chains. The firm has facilities in Texas, Arizona, and Georgia. SOLARCYCLE provides national coverage, supporting a circular economy and RWE’s zero-waste solar goals by also processing nearly 500,000 panels in North America by 2025.

Material Segment Analysis

By the end of the forecast period, glass-based material is expected to garner a considerable share in the market. This is the most consistently recovered material driving revenue since PV waste volumes increase, and glass cullet has high reuse value in float glass and construction applications. Also, the process of glass recycling reduces energy use and raw silica demand relative to virgin materials. The advancements in terms of separation and delamination techniques are readily improving glass recovery efficiency from end-of-life PV modules. In addition, regulatory mandates that promote circular economy practices support higher glass recycling rates. Further, the heightened demand from the construction and automotive glass industries strengthens downstream consumption of recycled cullet. Together, the presence of all of these factors positions glass as a key revenue-generating material segment within the solar panel recycling industry.

Product Type Segment Analysis

In the solar panel recycling market, the crystalline silicon PV segment is likely to gain a significant revenue share by the end of 2035. The subtype’s growth is highly attributable to the majority of global installations and end-of-life panels entering recycling streams. Their dominance in installed capacity directly translates to a higher recycling revenue share. Crystalline panels have established recycling pathways and greater material recovery economies of scale. In September 2024, Canadian Solar announced a recycling partnership with SOLARCYCLE, positioning itself among the first crystalline silicon PV module manufacturers to offer upfront end-of-life recycling services to U.S. customers. It also notes that by integrating recycling at the point of module purchase, the initiative directly links the dominant installed base of crystalline silicon panels to structured recycling demand and revenue generation. Further, the partnership also enables recovery of high-value materials such as glass, aluminum, silver, and copper, reinforcing economies of scale in crystalline silicon PV recycling.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Process |

|

|

Material |

|

|

Product Type |

|

|

Technique |

|

|

Shelf Life |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Panel Recycling Market - Regional Analysis

Europe Market Insights

The Europe solar panel recycling market is forecast to emerge as the largest regional landscape, representing an estimated 38.5% share by the end of 2035. The region’s growth in this field is effectively attributable to stringent recycling regulations such as the EU’s WEEE Directive mandating electronic waste recycling and established recycling infrastructure. In September 2025, ROSI announced that it had partnered with SENS eRecycling, based in Switzerland, to provide end-of-life solar panel recycling services, thereby enabling domestic industry stakeholders to recover valuable materials such as glass, aluminum, high-purity silicon, silver, and copper. The collaboration also aims to create a circular economy for PV panels, turning waste into reusable resources while supporting strategic local supply chains. Hence, such a cross-country partnership demonstrates the significance of advanced recycling technologies in accelerating sustainable material recovery and strengthening regional resilience in this field.

Germany solar panel recycling market is maintaining a strong position in Europe owing to its long history of solar deployment and advanced waste management systems. The country’s market also represents a very high compliance rate, established recycling processes, and strong industry participation. In June 2024, SOLAR MATERIALS announced its plans to build an industrial-scale solar panel recycling plant in Magdeburg with a prime focus on expanding its annual recycling capacity to more than 10,000 tons of solar panels. The facility reflects rising demand in Germany, Europe’s one of the most prominent solar panel recycling industries, and demonstrates how increasing end-of-life PV volumes are driving investments in scalable recycling infrastructure. In addition, the project also highlights the commercialization of advanced processes that recover high-value materials such as silicon and silver, strengthening the economic viability in the country.

The U.K. solar panel recycling market is developing steadily as solar assets installed over the past decade are heading towards the end of life. The country’s market deeply emphasizes disposal and alignment with environmental standards, supported by organized collection and treatment networks. In addition, the growing focus on sustainability and resource efficiency is reshaping future market direction. In this regard, in March 2025, Waste Experts and City Electrical Factors (CEF) partnered with ROSI to launch a UK-wide solar panel recycling program, addressing the growing need for responsible end-of-life management under WEEE Directive standards. The firms also mentioned that this collaboration enables nationwide collection and processing of PV modules at ROSI’s advanced facility, by recovering up to 95% of materials, including silicon, silver, copper, aluminum, and glass, also reducing CO₂ emissions. Hence, this initiative establishes a scalable, circular solution for solar panels in the country, promoting sustainable resource recovery and minimizing landfill waste.

APAC Market Insights

The Asia Pacific solar panel recycling market is expected to register the fastest growth since it represents a significant share of worldwide solar installations. As large volumes of solar assets age across countries, the region is mainly focused on scalable and cost-efficient recycling solutions. In this regard, Sumitomo Corporation, SMFL, SMFL MIRAI Partners, ARBIZ, and SMART, in March 2024, announced that they have launched a demonstration project in Japan to establish a sustainable solar panel reuse and recycling business. This initiative is focused mainly on creating a circular supply chain by collecting, dismantling, transporting, and processing end-of-life solar panels, addressing the growing disposal challenge as solar installations expand. In addition, by integrating recycling and reuse, the project aims to reduce waste, recover valuable materials, and support Japan’s transition to a carbon-neutral and sustainable energy system, hence contributing to overall market growth.

China solar panel recycling market is well associated with its larger solar manufacturing and installation base. The country’s market is gradually strengthening regulatory oversight and encouraging recycling technologies that support domestic material recovery. In this regard, RESOLAR Energy Technology in February 2025 announced that it participated in the launch of the world’s first fully recycled photovoltaic module at the 2025 annual meeting of the Photovoltaic Recycling Industry Development Cooperation Center. By utilizing its GST green solution, the company efficiently separated high-purity glass and dismantled aluminum frames from decommissioned modules, which were then reused to manufacture new PV glass and frames. Therefore, this milestone demonstrates the feasibility of high-value recycling in China’s photovoltaic sector and represents a historic step toward circular and sustainable solar energy development.

In India, solar panel recycling is still at an early stage, but it is gaining traction, positively influenced by the expansion of utility-scale solar projects. India market is primarily shaped by the rising awareness of future PV waste and the need for sustainable disposal mechanisms. Testifying this, the Ministry of Environment, Forest and Climate Change in March 2023, notified its amendments under the E-Waste (Management) Rules, 2022 by making additions of solar PV modules, panels, and cells to the regulatory framework. In this context, manufacturers and producers are required to register on the portal, maintain inventories, store end-of-life solar waste, file annual returns, and ensure compliant processing, whereas recyclers must recover materials as per Central Pollution Control Board guidelines. It also mentioned that this regulation establishes an accountable solar waste management system in India through 2034-2035, hence indicating a positive market outlook.

North America Market Insights

The North America solar panel recycling market is evolving toward a more structured ecosystem, facilitated by the expansion in recycling infrastructure, manufacturer-led take-back programs, and partnerships between solar OEMs and specialized recyclers. On the other hand, policy discussions around waste management and sustainability are also supporting market formalization in the region. In August 2025, Illuminate USA signed a landmark five-year agreement with SOLARCYCLE with a prime focus on sourcing domestically produced solar glass for 15 GW of solar panels, supporting 3 GW annually at its Pataskala, Ohio, facility. In this context, SOLARCYCLE highlighted that it will use recycled glass from end-of-life panels to manufacture the specialized glass, advancing the circular economy for the country’s solar manufacturing. In addition, this partnership positions SOLARCYCLE’s Cedartown, Georgia, plant as the first U.S. factory producing crystalline-silicon solar glass from recycled materials, with initial deliveries targeted for early 2028.

The U.S. solar panel recycling market represents notable progress owing to the private-sector innovation, with manufacturers and recycling firms making continued investments in facilities and advanced material recovery technologies. Voluntary recycling programs from the country’s government and corporate sustainability commitments also play a key role in shaping market growth. The U.S. Department of Energy in March 2022 reported that to meet the Biden Administration’s goal of decarbonizing the U.S. electricity grid by 2035, solar installations must ramp up to 60 GW per year by 2030, with end-of-life (EOL) PV modules entering the waste stream due to aging, damage, or defects. Meanwhile, 95% of PV materials are currently recyclable, and recycling costs far exceed landfill fees, making policy support highly essential for critical sustainable EOL management. Moreover, the DOE’s SETO is developing databases to enable PV recycling, aiming to cut module recycling costs by more than half by the conclusion of 2030.

Canada solar panel recycling market is emerging along with its growing solar capacity, with an emphasis on environmentally responsible waste management. The country’s market benefits from collaboration between module manufacturers, recyclers, and project owners, which in turn is helping establish early recycling pathways. In 2024, Global Affairs Canada launched a challenge to develop scalable and cost-effective solar panel recycling solutions by targeting both crystalline-silicon and thin-film panels. This initiative seeks technologies that can safely recover critical materials such as aluminum, tellurium, gallium, and indium at any stage of a panel’s lifecycle, while preventing environmental contamination. Furthermore, this program aims to support the country’s net-zero 2050 goals by reducing landfill waste and minimizing the environmental and social impacts of solar panel disposal.

Key Solar Panel Recycling Market Players:

- First Solar, Inc. (U.S.)

- Reiling GmbH & Co. KG (Germany)

- Echo Environmental, LLC (U.S.)

- SILCONTEL LTD (Israel)

- Canadian Solar Inc. (Canada)

- SunPower Corporation (U.S.)

- Trina Solar (China)

- Aurubis AG (Germany)

- Solarcycle, Inc. (U.S.)

- The Retrofit Companies, Inc. (U.S.)

- Rinovasol Global Services B.V. (Netherlands)

- We Recycle Solar (U.S.)

- ROSI SAS (France)

- Etavolt Pte. Ltd. (Singapore)

- PV Industries Pty Ltd (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- First Solar, Inc. is one of the leading solar manufacturers that has integrated recycling into its operations for over a decade. The company operates a closed-loop recycling program for its thin-film modules by recovering critical materials such as cadmium, tellurium, glass, and aluminum. In addition, First Solar has its strong focus on sustainability and regulatory compliance, allowing it to position itself as both a manufacturer and environmental steward.

- Reiling GmbH & Co. KG is a Germany-based recycling pioneer that specializes in solar panel and e-waste processing. The company offers a broad range of services, including collection, dismantling, and recovery of high-value materials such as silver, copper, and silicon. Furthermore, the company has a robust regional presence, and it combines technological expertise and regulatory adherence to maintain a leading role in solar recycling infrastructure.

- Echo Environmental, LLC is a central player in this field that leverages an environmental services firm that specializes in solar panel decommissioning and recycling. The company provides end-to-end solutions, including logistics, on-site dismantling, and material recovery for crystalline and thin-film panels. In addition, Echo Environmental is focused on scalable solutions for commercial, industrial, and utility-scale solar projects by deeply emphasizing traceability and compliance with state and federal e-waste regulations.

- SILCONTEL LTD is a specialist in high-purity material recovery from decommissioned solar panels. The company is focused on proprietary chemical and mechanical processes, and it extracts many metals, enabling reuse in new solar manufacturing. The company targets industrial-scale recycling operations and works closely with solar manufacturers to integrate its solutions into supply chains, positioning it as a leader in advanced solar recycling technologies.

- Canadian Solar Inc. is one of the world’s most prominent largest solar module manufacturers, showcasing a growing commitment to solar panel end-of-life management. The company has initiated recycling programs to recover metals, glass, and semiconductor materials from retired modules, especially in regions that have strong regulatory frameworks. In addition, Canadian Solar integrates recycling considerations into its product lifecycle and partners with local recyclers to enhance circularity.

Below is the list of some prominent players operating in the global market:

The global market is extremely competitive and is leveraging both legacy solar manufacturers with specialized recycling technology firms. Companies such as First Solar are mainly focused on vertical integration to recover high-value materials, whereas regional players such as Reiling and ROSI are concentrating on expanding their capacity and geographic reach. Partnerships with utilities and project developers, investing in recycling technologies to improve material recovery, and scaling up recycling facilities are a few visible strategies opted for by pioneers in this field. In July 2025, ENGIE announced that it had partnered with SOLARCYCLE to pilot a precycling provision by integrating solar panel and component recycling into project agreements from the outset. The firm also notes that the initiative covers four projects totaling 375 MW and approximately one million panels, ensuring complete traceability and circularity by diverting 48 million pounds of material from landfills and reducing 33,000 tons of carbon emissions.

Corporate Landscape of the Solar Panel Recycling Market:

Recent Developments

- In December 2025, Jakson Engineers Limited announced the establishment of India’s first-ever hi-tech solar PV module recycling facility, where the plant will be capable of recycling around 300 MW or about 5,00,000 solar panels (13,500 tonnes) annually.

- In June 2025, Hanwha Qcells announced that it has launched EcoRecycle by Qcells which is, a new solar panel recycling business, expanding its U.S. manufacturing as a full-cycle clean energy provider. The first recycling facility in Cartersville, Georgia, will process up to 250 MW (about 500,000 panels) annually, recovering materials such as glass, aluminum, silver, and copper.

- Report ID: 1481

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Panel Recycling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.