Public Cloud Market Outlook:

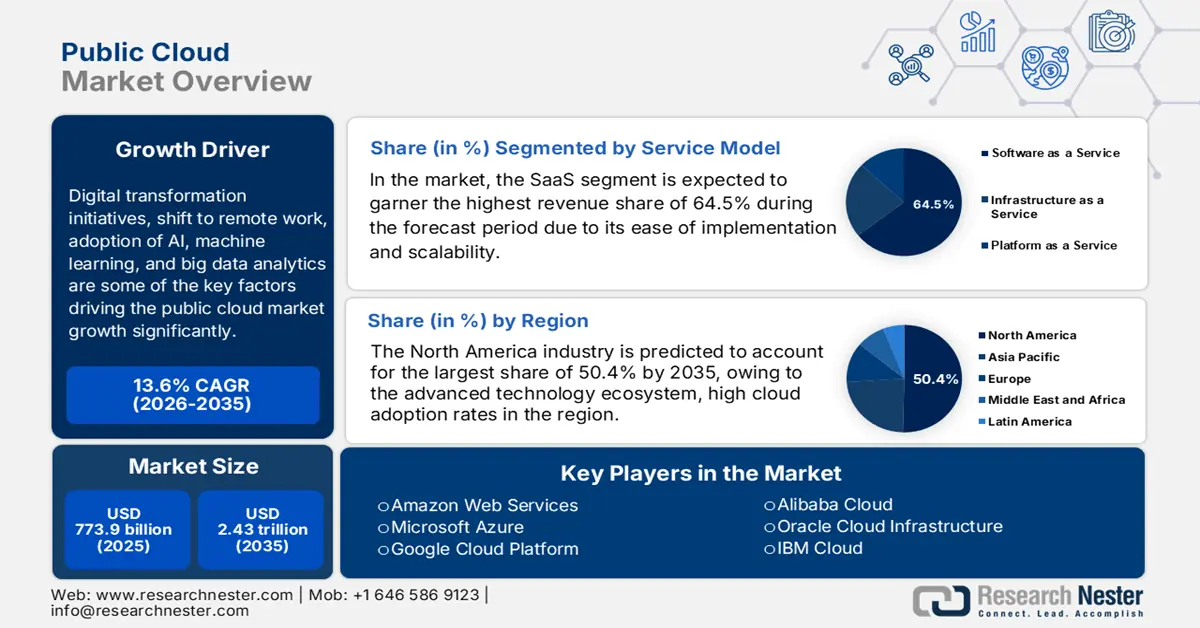

Public Cloud Market size was valued at USD 773.9 billion in 2025 and is projected to reach USD 2.43 trillion by the end of 2035, rising at a CAGR of 13.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of public cloud is evaluated at USD 879.1 billion.

Digital transformation initiatives, shift to remote work, adoption of AI, machine learning, and big data analytics are some of the key factors driving the market growth significantly. Besides, the public cloud technologies are embedded in national science, research, and AI infrastructure, which efficiently strengthens the long-term market growth and adoption. In this context, the U.S. National Science Foundation in August 2025 announced a funding opportunity of up to USD 100 million to establish a national network of AI-programmable cloud laboratories, which is aimed at accelerating automated scientific discovery and innovation. The NSF PCL Test Bed will enable remotely accessible, AI-enabled labs to test, validate, and scale technologies, initially focusing on biotechnology and materials science. This is aligned with the White House AI Action Plan and supports AI integration across all stages of experimentation, improving efficiency and data analysis, hence positively influencing market growth.

Furthermore, businesses are leveraging the public cloud to modernize their legacy systems, streamline operations, and innovate at a faster pace. Public cloud adoption is being accelerated as service providers strengthen their consulting, implementation, and industry-specific capabilities. These factors, in addition to growth initiatives undertaken by global public cloud market leaders, are also boosting the industry expansion in the years ahead. In this context, Accenture in January 2023 announced that it had acquired Inspirage, which is an Oracle Cloud specialist headquartered in Bellevue, Washington, to strengthen its digital supply chain and Oracle Cloud capabilities. The deal will enable Accenture’s Oracle Business Group to enhance expertise in supply chain management and emerging technologies such as digital twins and touchless supply chains. This strategic acquisition supports Accenture’s ability to help product-centric enterprises modernize operations and accelerate innovation using public cloud–based Oracle solutions, thereby supporting market growth.

Key Public Cloud Market Insights Summary:

Regional Highlights:

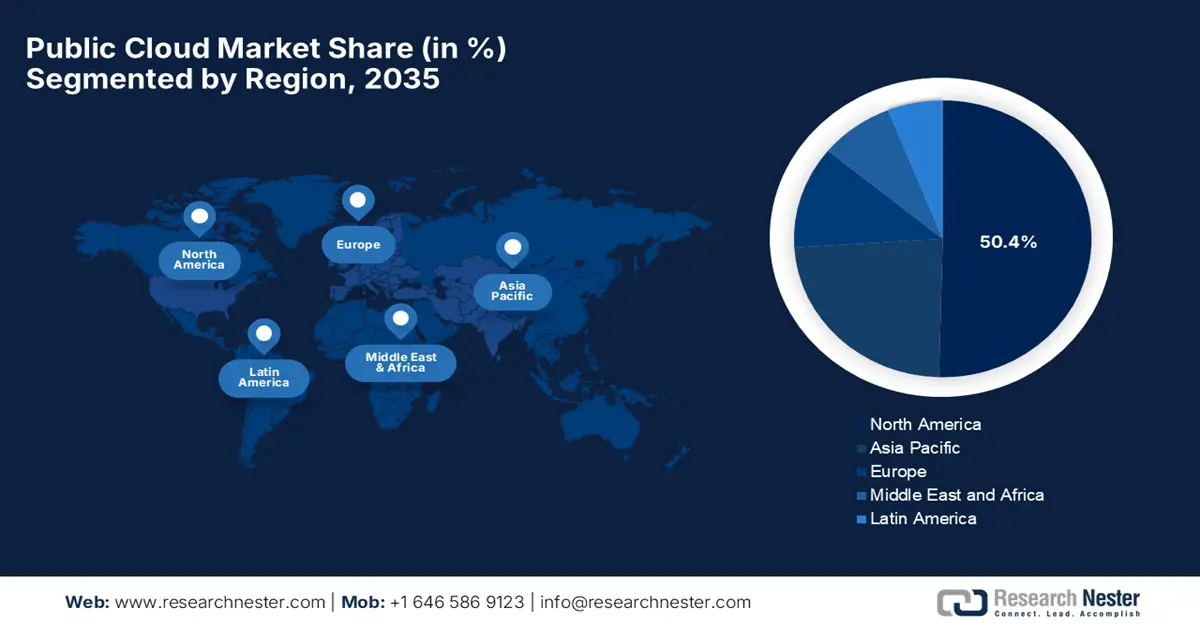

- North America in the public cloud market is expected to secure the leading position with a 50.4% share during the forecast period, reinforced by a mature technology ecosystem and strong enterprise uptake of AI-enabled and hybrid cloud platforms.

- Asia Pacific is projected to advance at an accelerated pace from 2026–2035, stimulated by widespread digital transformation programs and proactive government policies encouraging cloud adoption across key industries.

Segment Insights:

- The SaaS segment in the public cloud market is forecast to account for a commanding 64.5% revenue share during the forecast period, bolstered by its ease of implementation, scalability, and subscription-based delivery model.

- The large enterprises segment is set to witness considerable expansion over the forecast period, fueled by extensive IT spending capacity and demand for resilient, scalable cloud environments supporting complex global workloads.

Key Growth Trends:

- Increasing public cloud spending

- Disaster recovery and business continuity

Major Challenges:

- Concerns about vendor lock-in and interoperability in multi-cloud setups

- High initial migration costs and complexities in legacy system integration

Key Players: Amazon Web Services, Microsoft Azure, Google Cloud Platform, Alibaba Cloud, Oracle Cloud Infrastructure, IBM Cloud.

Global Public Cloud Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 773.9 billion

- 2026 Market Size: USD 879.1 billion

- Projected Market Size: USD 2.43 trillion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.4% Share during the forecast period)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 24 December, 2025

Public Cloud Market - Growth Drivers and Challenges

Growth Drivers

- Increasing public cloud spending: The global public cloud market is fundamentally driven by rising IT budgets as organizations prioritize cloud adoption to enhance scalability and support digital transformation. In this regard, Amazon Web Services in November 2025 announced that it is making a substantial investment of up to USD 50 billion to expand AI and high-performance computing infrastructure for U.S. government agencies, which includes nearly 1.3 gigawatts of compute capacity across AWS Top Secret, Secret, and GovCloud regions. It also mentioned that this initiative will provide federal customers with advanced AI services, such as Amazon SageMaker, Bedrock, and NVIDIA-powered infrastructure, thereby enabling faster data analysis, simulation, and decision-making across defense, cybersecurity, healthcare, and scientific research. As organizations worldwide migrate continuously to the cloud for digital transformation, public cloud spending is projected to remain very strong.

- Disaster recovery and business continuity: Public cloud platforms are essential for businesses seeking disaster recovery and business continuity solutions. With their ability to ensure data backup, rapid recovery, and minimal downtime, public cloud services provide cost-effective and scalable alternatives to traditional disaster recovery systems, making them a critical component of global cloud adoption. In September 2022, AWS announced that its AWS Elastic Disaster Recovery (AWS DRS) became available in the Asia Pacific (Jakarta) Region, which provides organizations with fast, reliable recovery for on-premises and cloud-based applications. The firm also notes that this service minimizes downtime and data loss by enabling point-in-time recovery across various infrastructures, including VMware, Hyper-V, and Amazon EC2 instances in different regions or availability zones.

- Data sovereignty and regional cloud localization: The increasing emphasis on data sovereignty and compliance with regional regulations is yet another important growth driver for the public cloud market. Over the recent years, organizations have sought cloud solutions that align with the domestic legal and operational requirements. In this context, both the public and private entities are mandating that sensitive data be stored and processed within national borders, which in turn is prompting cloud providers to expand localized cloud infrastructure. For instance, in September 2024, Avaya launched the Avaya Experience Platform public cloud in India, completing local availability of its unified customer experience platform and enabling enterprises in India to adopt cloud-based CX solutions by also meeting data residency and compliance requirements, hence making it suitable for standard market growth.

Global Public Cloud Market Opportunities and Strategic Investments (2024-2025)

|

Year |

Company |

Country |

Key Highlights |

Public Cloud Market Opportunity |

|

2025 |

Oracle |

Italy |

Second public cloud region in Turin; TIM Enterprise as host; supports AI, data sovereignty, public & private sectors |

AI & Cloud Infrastructure Expansion |

|

2025 |

Microsoft |

India |

USD 17.5 billion over 4 years; AI integration into e-Shram & NCS; skilling 20M by 2030 |

AI & Cloud Infrastructure Expansion |

|

2025 |

Deloitte + SAP |

India |

Launch of INTEGRATE on SAP S/4HANA Public Cloud; pre-configured industry solutions; accelerate digital transformation |

Cloud ERP Adoption |

|

2024 |

Oracle + NTT DATA |

Japan |

Oracle Alloy deployment in NTT DATA data centers; supports 150+ OCI services; USD 8 billion planned cloud & AI investment. |

Sovereign Cloud & AI |

Source: Company Official Press Releases

Challenges

- Concerns about vendor lock-in and interoperability in multi-cloud setups: Transitioning to the cloud necessitates substantial initial costs, which include expenses for data migration, system upgrades, and workforce training. Therefore, these technical complexities can delay deployment and increase project budgets, making it a barrier for small-scale firms. In this context, organizations must carefully evaluate vendor SLAs, service limitations, and compliance requirements, since reliance on a single provider can inherently affect both scalability and innovation. The aspects of regulatory restrictions in certain regions might also complicate multi-cloud adoption. Companies demand flexible exit strategies and interoperability standards to mitigate these risks; hence, these pose a major threat to the global market expansion, considerably.

- High initial migration costs and complexities in legacy system integration: Most of the organizations in the market fear being locked into a single vendor’s ecosystem, which can limit flexibility and increase long-term costs. Vendor-specific tools and proprietary technologies make it challenging when integrating multiple cloud platforms. Also, ensuring interoperability between different providers becomes crucial to avoid data silos, thereby necessitating additional investment in middleware or API management solutions. Moreover, aligning legacy applications with modern cloud architectures necessitates skilled work professionals and proper planning, which in turn can add strain on IT resources. Furthermore, organizations need to adopt phased migration strategies and invest in training to maximize the benefits from the utilization of multi-cloud environments.

Public Cloud Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 773.9 billion |

|

Forecast Year Market Size (2035) |

USD 2.43 trillion |

|

Regional Scope |

|

Public Cloud Market Segmentation:

Service Model Segment Analysis

In the public cloud market, the SaaS segment based on the service model is expected to garner the highest revenue share of 64.5% during the forecast period. The dominance of the segment is effectively attributable to its ease of implementation and scalability. Also, businesses benefit from its subscription-based model, which diminishes the need for complex infrastructure while enabling automatic updates and seamless access to advanced features. Synopsys, Inc., in March 2022, announced that it launched a new cloud-optimized electronic design automation (EDA) solution on Microsoft Azure, by offering a pay-as-you-go SaaS model for chip design and verification. This approach provides semiconductor companies with very flexible, scalable compute resources, thereby accelerating time-to-market. By combining Synopsys Cloud with Azure’s high-performance infrastructure, chipmakers can optimize productivity, manage systemic complexity, and innovate more efficiently in a secure cloud environment, hence boosting the segment’s growth further.

Public Cloud and SaaS Spending and Vendor Distribution 2021

|

Metric |

Value |

|

Public Cloud Spending (Billion USD) |

411 |

|

SaaS Market Segment (Billion USD) |

178 |

|

SaaS Growth (%) |

24 |

|

Top Vendors & Market Share (%) |

Microsoft (11), Salesforce (10), SAP (5), Oracle (4), GCP (3) |

Source: The U.S. Department of the Treasury

Organization Segment Analysis

The large enterprises segment is predicted to grow at a considerable rate in the market over the discussed timeframe. The growth of the subtype is highly subject to their extensive IT budgets, complex global operations, and requirements for scalable, resilient infrastructure to support diverse workloads. These large organizations opt for multi-cloud and integrated SaaS, PaaS, and IaaS solutions to enable digital transformation at scale. In January 2023, Microsoft announced the general availability of Azure OpenAI Service, allowing businesses to access advanced AI models such as GPT-3.5, Codex, and DALL-E 2 on enterprise-grade Azure infrastructure. In addition, the large enterprises, including KPMG, are leveraging this service to streamline operations and gain insights from data, reflecting substantial cloud adoption at scale. Hence such instances, the significance of enterprise cloud spending for market growth is supporting complex, scalable workloads.

End use Segment Analysis

By the end of 2035, the BFSI segment is anticipated to capture a lucrative revenue share in the public cloud market due to stringent requirements for secure data handling, real-time analytics, and customer engagement platforms. Besides, cloud adoption enables digital banking, risk management, and advanced analytics by ensuring regulatory alignment. In addition, financial institutions are migrating core banking systems, payment platforms, and fraud detection tools to the cloud with a prime focus on enhancing operational efficiency and scalability. The adoption of AI and machine learning on cloud platforms further strengthens predictive analytics. Furthermore, collaborations with leading cloud providers help BFSI organizations maintain compliance with global data protection standards while reducing infrastructure costs is also prompting a continued revenue stream in this segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Service Model |

|

|

Enterprise Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Public Cloud Market - Regional Analysis

North America Market Insights

North America is projected to lead the market, registering the highest share of 50.4% during the forecast period. The region’s progress in this field is driven by an advanced technology ecosystem, high cloud adoption rates, and rising investments in AI, machine learning, and data analytics. The region benefits from the presence of strong cloud service providers and widespread hybrid and multi-cloud deployments across various industries. Google in August 2025, announced that it is making a USD 9 billion investment in Oklahoma over two years to expand cloud and AI infrastructure, which includes a new data center campus in Stillwater and enhancements to the existing facility in Pryor. It states that the initiative also supports workforce development through AI training and Google Career Certificates at the University of Oklahoma and Oklahoma State University, along with programs to expand the electrical workforce by 135 %. In addition, this investment aims to build a skilled talent pipeline, strengthen Oklahoma’s infrastructure, and advance U.S. leadership in AI and cloud technologies.

The U.S. is the dominant player in the North America market, efficiently fueled by early adoption of cutting-edge technologies, a high-end tech ecosystem, and a thriving startup culture. Government initiatives supporting cloud adoption and data security standards are also efficiently boosting the market expansion in the country. In this context, the U.S. Department of the Treasury, in May 2023, announced the launch of the cloud executive steering group, which is a public-private partnership dedicated to enhancing cloud adoption in the financial sector. Moreover, CESG aims to develop best practices, improve cloud security, standardize terminology, and thereby strengthen regulatory oversight for financial institutions, which in turn attracts more players to make investments in this field. Furthermore, this initiative underscores the collaboration between regulators and private firms that efficiently drives secure, compliant cloud adoption, supporting digital transformation in the BFSI segment.

Canada's public cloud market is growing rapidly, on account of increased demand for digital transformation and compliance with data residency laws. The country’s market also benefits from a strong emphasis on localized data centers, and partnerships between global and domestic providers support industries such as banking, healthcare, and public services. Leaseweb in June 2023, announced the expansion of Leaseweb Cloud Connect in the country to enhance and expand its fast and secure network connectivity to Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) from its data centers in Canada. Besides, this hybrid cloud solution allows organizations to distribute workloads across public and private clouds, enhancing flexibility, efficiency, and cost optimization. Thus, the initiative reflects growing enterprise adoption of hybrid cloud strategies to accelerate digital transformation by maintaining secure, high-performance IT operations in the country.

APAC Market Insights

The public cloud market in the Asia Pacific is progressing at an exceptional rate owing to the growing digital transformation initiatives across multiple industries, including manufacturing, retail, and BFSI. Most of the governments across this region are also promoting cloud adoption through policies supporting smart cities, e-governance, and digital infrastructure, which is driving demand for localized, secure, and compliant cloud solutions. In April 2023, SAP Southeast Asia announced the launch of Grow with SAP, which is a cloud ERP offering especially designed to help SMEs accelerate digital transformation and innovation. Besides, the solution deliberately combines SAP S/4HANA Cloud, SAP Business Technology Platform, which allows businesses to automate processes, build applications without coding, and scale efficiently. Furthermore, in partnerships with regional organizations, SAP aims to empower SMEs across Southeast Asia to improve governance and competitiveness in the digital economy.

China is continuing its growth trajectory in the public cloud market, primarily fueled by the presence of hyperscale providers such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud. Similarly, enterprises in the country are leveraging cloud platforms to enable AI, big data analytics, and IoT applications. In addition, the country’s market also benefits from government initiatives such as the Digital China Strategy and investments in 5G and smart city projects, which are remarkably fueling cloud adoption across both the public and private sectors. In September 2025, Tencent Cloud introduced a major AI-era upgrade to its Big Data Suite (TBDS) by integrating data engineering and AI capabilities for financial institutions in the country. The firm also noted that the platform enables unified management of multi-modal data, automates data and ML workflows, and enhances operational efficiency for complex financial situations. Hence, such milestones underscore Tencent Cloud’s role in accelerating digital transformation and AI adoption within China’s financial sector.

India is also representing consistent progress in the public cloud market since organizations are moving workloads to the cloud to enhance agility, scalability, and cost efficiency. The country’s market is also propelled by initiatives such as the National Cloud Policy, Digital India, and the growth of startup ecosystems, which are accelerating demand for both public and hybrid cloud services. In December 2025, Amazon announced that it made an investment of USD 35 billion in the country through 2030, which is aimed at expanding AI-driven digitization, boosting exports. The firm also notes that the initiative will support 15 million small businesses with AI tools, empower 4 million students with AI education, and strengthen India’s digital and logistics infrastructure. Furthermore, it is being built on nearly USD 40 billion already invested, and Amazon’s expansion reinforces its role as a major driver of India’s digital transformation and economic growth.

Europe Market Insights

The Europe market is anticipated to register a considerable share from 2026 to 2035. The market’s growth in the region is efficiently driven by digital transformation, cloud-first strategies, and heightened demand for data sovereignty. Simultaneously, the regulatory frameworks such as GDPR play an important role in shaping cloud adoption, with a strong emphasis on security and compliance. In October 2023, Amazon Web Services announced that it had launched the AWS European Sovereign Cloud, which is an independent cloud designed to meet strict regulatory, data residency, and operational requirements for the public sector and highly regulated industries. It also mentioned that the cloud will be completely operated by EU-resident AWS employees and maintain all customer metadata within the region, with a prime focus on ensuring sovereignty and compliance. This initiative has been welcomed by regulators in Europe, governments, and major partners, providing secure, low-latency, and highly available cloud infrastructure by supporting digital sovereignty and economic development.

The UK public cloud market is representing rapid adoption across industries such as financial services, healthcare, and retail. Simultaneously, aspects such as post-Brexit regulatory alignment and the strong emphasis on domestic data centers have influenced cloud strategies. In this context, SAP SE in November 2024 announced the general availability of its Sovereign Cloud capabilities in the country, which is reported to be in accordance with the UK’s Data Protection Act 2018. It also stated that this launch will be providing secure, localized cloud solutions for the public sector, critical infrastructure, as well as highly regulated industries. The offering supports UK data residency and security requirements, and Cyber Essentials Plus standards, and includes SAP S/4HANA Private Cloud, SuccessFactors, BTP, and other enterprise solutions. Hence, such instances are efficiently driving digital transformation and compliance across sectors such as government, defense, and energy.

France’s public cloud market is benefiting from a focus on digital sovereignty and a preference for Europe-based cloud providers such as OVHcloud. On the other hand, the government’s Cloud of Trust initiative promotes secure and locally managed cloud services in this country. For instance, in June 2025, OVHcloud and Equans Digital together announced that they had launched the on-prem cloud platform in France, delivering a sovereign, secure, and domestically hosted cloud solution for industrial companies, local authorities, and healthcare providers. It also highlighted that this platform allows organizations to maintain control of sensitive data, also benefiting from high performance, low latency, and continuous availability, aligning with France’s digital sovereignty and cloud de confiance initiatives. Furthermore, this partnership builds on prior collaborations and reinforces the commitment of providers in France to offer trusted, local alternatives.

Key Public Cloud Market Players:

- Amazon Web Services (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Azure (U.S.)

- Google Cloud Platform (U.S.)

- Alibaba Cloud (China)

- Oracle Cloud Infrastructure (U.S.)

- IBM Cloud (U.S.)

- Tencent Cloud (China)

- Huawei Cloud (China)

- Salesforce Cloud Services (U.S.)

- SAP Cloud Platform (Germany)

- VMware Cloud (U.S.)

- Baidu Cloud (China)

- NTT Communications Cloud (Japan)

- OVHcloud (France)

- Hetzner Online Cloud (Germany)

- Amazon Web Services AWS) is a subsidiary of Amazon, and is one of the largest public cloud providers globally, dominating the IaaS and PaaS sectors. Its services span compute, storage, databases, AI or ML, analytics, and serverless computing. Besides, AWS strongly emphasizes infrastructure expansion, hybrid and multicloud capabilities, and AI integration, which are efficiently allowing it to maintain leadership with scalable and reliable cloud solutions across the globe.

- Microsoft Azure is the second-largest public cloud provider, which is leveraging its enterprise software ecosystem and hybrid capabilities through Azure Arc. Azure is quite a popular brand name that offers computer, networking, AI, analytics, and developer tools, integrated with Microsoft 365 and Dynamics 365. AI services, sustainability, and regional expansion are a few strategies opted for by Microsoft that are also making it a preferred platform for enterprise cloud transformation.

- Google Cloud Platform is primarily focused on AI, machine learning, data analytics, and open-source technologies, and is offering compute, storage, databases, and serverless platforms. The company is expanding its global data center footprint and enhancing AI-based services, supporting hybrid and multicloud deployments via Anthos. In addition, GCP targets organizations that are looking for high-performance analytics, cloud-native development, and generative AI capabilities.

- Alibaba Cloud is China’s leading and most prominent public cloud provider that has an expanding presence in Asia and international scale. The firm offers computing, storage, networking, databases, security, and AI solutions. Further, Alibaba Cloud emphasizes regional expansion, AI integration, and industry-specific solutions for digital transformation by ensuring regulatory compliance and local data residency.

- Oracle Cloud Infrastructure combines infrastructure, platform, and SaaS solutions, thereby excelling in enterprise workloads, databases, and AI services. The firm makes its differentiation through high-performance computing, autonomous databases, and a growing global cloud network. Moreover, Oracle is strongly focused on cloud region expansion, AI services, and cloud deployments to enhance enterprise digital transformation.

Below is the list of some prominent players operating in the global market:

The global public cloud market is extremely concentrated, wherein the pioneers such as AWS, Microsoft Azure, and Google Cloud lead by a substantial margin. They are strongly focused on AI services, global data centers, and hybrid cloud solutions with a prime focus on capturing enterprise workloads. Also, companies in the market are focusing majorly on strategies such as geographical expansion to enhance service availability. For instance, in October 2022, Oracle announced that it had invested over USD 6.5 billion to open a public cloud region in Malaysia, offering 150+ infrastructure, platform, and SaaS services, which also include advanced AI capabilities and the OCI Supercluster with up to 131,072 NVIDIA GPUs. Moreover, this expansion aims to help organizations in Malaysia to modernize their workloads and achieve data sovereignty by supporting the country’s digital economy. Furthermore, firms in this sector are emphasizing localization of services, including language support and tailored industry solutions, to strengthen their global foothold.

Corporate Landscape of the Public Cloud Market:

Recent Developments

- In October 2025, Oracle and Google Cloud announced that they have enhanced Oracle Database on Google Cloud with new AI database services, which are currently available in eight regions worldwide. The platform enables enterprises to simplify multicloud deployments, scale workloads, and leverage AI and analytics securely.

- In June 2025, Alibaba Cloud and GoTo Group announced that they had successfully completed the migration of GoTo Financial’s infrastructure to Alibaba Cloud’s Jakarta data centers to support Indonesia’s data sovereignty by keeping all data within the country and enhancing operational efficiency for GoPay.

- In May 2024, AWS announced an investment of USD 8.17 billion in the AWS European Sovereign Cloud in Germany through 2040, reflecting the company’s long-term commitment to help meet Europe’s digital sovereignty needs.

- In January 2023, Rackspace Technology launched Rackspace Technology Modern Operations, which is a new managed service offering for the public cloud, intended to offer users a 24x7 unified support model for a broad range of services across AWS, Azure, and GCP, to focus on core business events.

- Report ID: 2390

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Public Cloud Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.