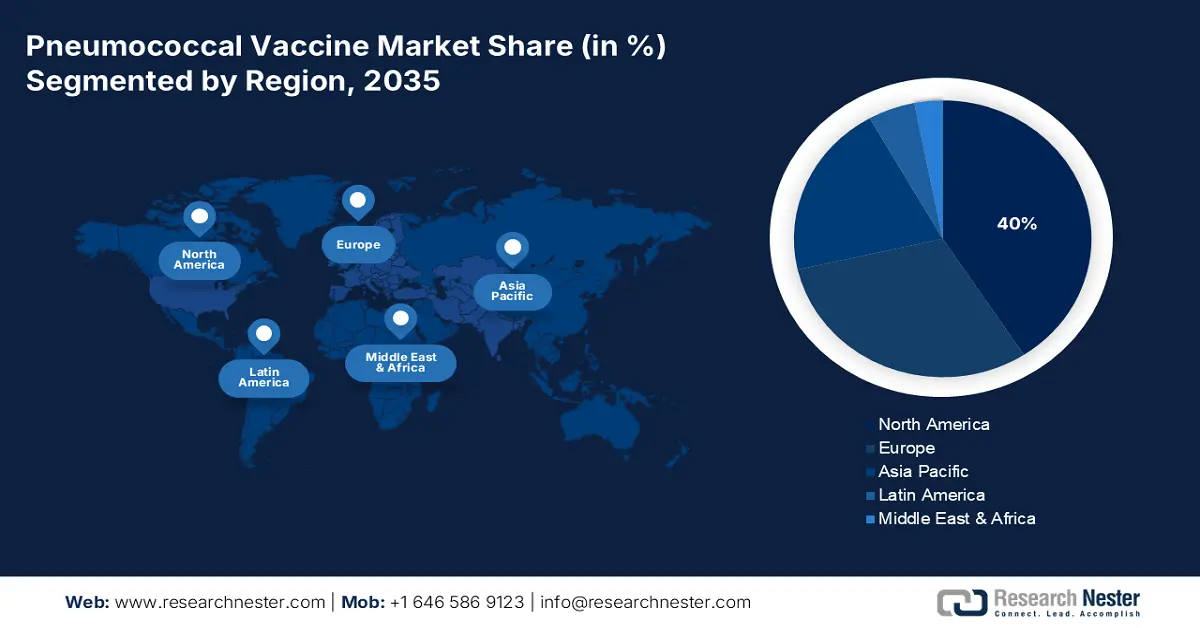

Pneumococcal Vaccine Market - Regional Analysis

North America Market Insights

The pneumococcal vaccine market in North America is poised to dominate the global landscape with the largest share of 40% over the forecast period. The presence of a robust healthcare system and continuous capital influx are the primary propelling factors for this region. The initiative by the regulating bodies is captured by several initiatives, including expansion of Medicare coverage, provincial and Federal financing, and budget-friendly procurement. As per a report by CMS published in June 2025, Medicare expenditures rose 8.1% to USD 1,029.8 billion in 2023, or 21% of total NHE. This heavy investment is a demonstration of the preventive healthcare commitment by the U.S. government, complemented further by increased vaccine accessibility and utilization.

The pneumococcal vaccine market in the U.S. is growing due to a strong reimbursement policy structure and financial support from payers. Moreover, the national evolution from lower to higher-valency vaccines is readily uplifting both domestic and foreign biopharma leaders to cultivate more innovative formulations. According to a report by CMS, June 2025, in 2024, National Health Expenditure (NHE) growth is projected to have reached 8.2%. Despite an anticipated 7.9% reduction in Medicaid coverage, the insured proportion of the population is anticipated to have remained high at 92.1%. This continued insurance coverage and healthcare usage trend is anticipated to directly drive higher pneumococcal vaccine consumption, supporting market growth nationwide.

Asia Pacific Market Insights

Asia Pacific is expected to hold the fastest-growing market in the pneumococcal vaccine market during the forecast period. The transmission of pneumococcal disease is being driven rapidly by the increasing rate of severe respiratory illnesses across all age groups, especially as the population matures quickly. This trend is generating a strong demand for protective measures, which is backed by various government programs and joint activities. For example, in emerging markets such as China and India, programs such as the Expanded Program on Immunization (EPI) and the Universal Immunization Programme (UIP) have highlighted the importance of adequate supply of pneumococcal vaccines for the citizens.

China is standing as the pillar of domestic production in the regional pneumococcal vaccine market. The country's exceptional manufacturing capacity is a result of immense government support and initiatives. As per a report by NLM, March 2023, patients with an immunocompromising condition need a third dose of PPSV23 at age ≥ 65 years, with a minimum time interval of 5 years after the second dose. Moreover, patients with cochlear implants, CSF leaks, or immunocompromising conditions should have a minimum time interval of 1 year after the last dose of PCV13 and 5 years after the last dose of PPSV23. These are anticipated to drive demand and fuel growth in the market.

Europe Market Insights

The pneumococcal vaccine market in Europe is growing due to rising awareness of respiratory conditions, increased vaccination programs in countries, and robust government incentives towards immunization programs for high-risk groups such as the elderly and those suffering from chronic diseases. Furthermore, high R&D spending is driving the formulation of next-gen vaccines with greater protection and enhanced efficacy. Governments in Europe are also strengthening funding mechanisms to enable vaccine access and affordability, further fueling market growth. Joint initiatives between public health authorities and pharmaceutical firms continue to spur innovation and delivery throughout the region.

The pneumococcal vaccine market in the UK is growing due to is growing due to rising awareness of respiratory illnesses, growing immunization programs within countries, and government support for immunization campaigns among risk groups such as the geriatric population and chronic patients. As per a report by ONS April 2025, the UK government's net expenditure in research and development (R&D) rose to £17.4 billion in 2023 from £16.1 billion in 2022, a rise of 8.2%. This enormous rise in R&D expense is expected to accelerate work on new generation pneumococcal vaccines with enhanced effectiveness and broader protection.

GDP spent on Research and development expenditure in Countries of Europe (2022)

|

Country |

Most Recent Value |

|

Austria |

3.2 |

|

Belgium |

3.4 |

|

Denmark |

2.8 |

|

France |

2.2 |

|

Germany |

3.1 |

|

Greece |

1.4 |

|

Italy |

1.3 |

|

Netherlands |

2.2 |

|

Portugal |

1.7 |

|

Spain |

1.4 |

|

Sweden |

3.4 |

Source: World Bank, February 2024