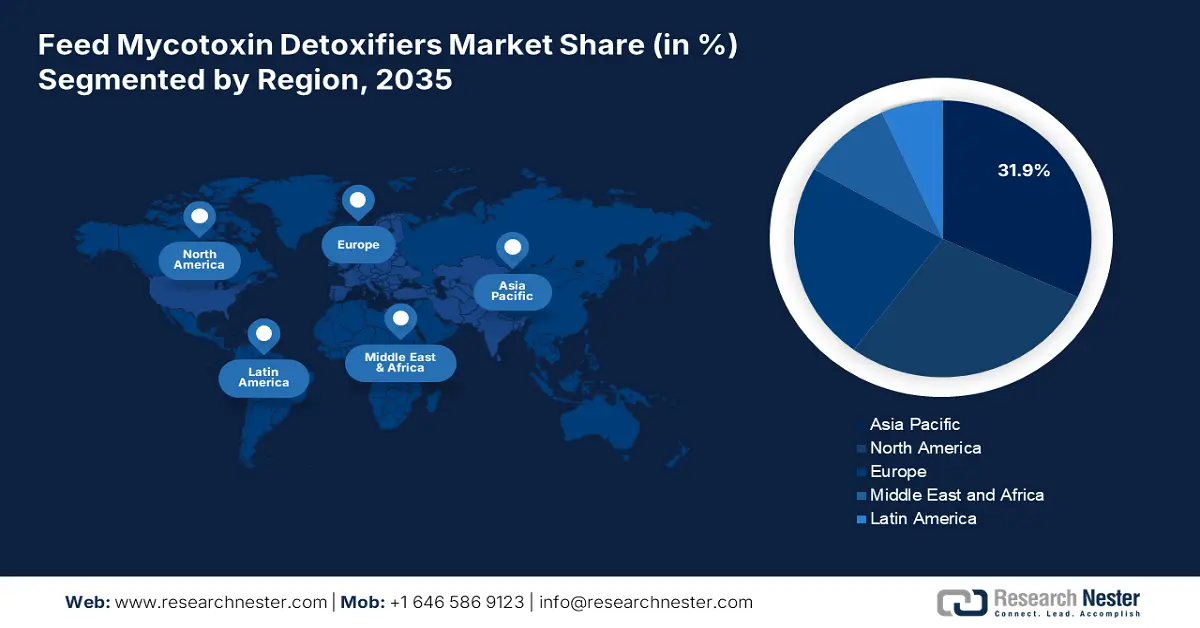

Feed Mycotoxin Detoxifiers Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 31.9% of the feed mycotoxin detoxifiers market share due to increasing livestock production and severe regulations centered on feed safety. High contamination rates of mycotoxins in companion and livestock feed, especially due to humidity and heat, are responsible for boosting the demand for detoxifiers. Southeast Asia has some of the largest mycotoxin contaminations in its animal feed and, as a result, will require an increased level of detoxification. China, India, and Japan will continue to consume the largest volumes of feed mycotoxin detoxifiers since these countries have many intensive animal and aquaculture feed applications primarily linked to poultry, swine, and aquaculture products.

China takes the largest share of the feed mycotoxin detoxifiers market in the Asia Pacific. Greater awareness of aflatoxin and deoxynivalenol threats and government policies are encouraging feed quality, which boosts demand and use of feed mycotoxin detoxifiers. Additionally, the Ministry of Agriculture, feed safety, and increased consumption of animal protein in China are all enabling customer buying decisions and will result in greater feed mycotoxin detoxifier usage by swine and poultry feed industries within the country. Moreover, in China, the farmers' grain reserves make up approximately 50% of the country’s total grain production (around 250 million tons). Based on a sample survey from the National Food and Strategic Reserves Administration of China, the average loss rate of stored grain is roughly 8% (40 million tons), with roughly 30% due to mycotoxin contamination being the major contributor.

North America Market Insights

The North American feed mycotoxin detoxifiers market is expected to hold 28.3% of the market share by 2035, due to the FDA regulations regarding mycotoxin limits in animal feed, eliminating the risk of profit of providing detoxifiers to detoxify feed in order to promote livestock health. As the demand for livestock continues to rise amid concerns raised over the safety of animal feed. The primary categories of consumption on livestock feed products are expected to be found in poultry and swine feed markets, with healthy consumption growth projected for both regions in the United States and Canada.

In the U.S, growth for feed mycotoxin detoxifiers is based upon the enforcement of regulations from the FDA and USDA that deal with (for example) mycotoxins like aflatoxins and fusarium toxins that can exceed safe levels in feeds that contain corn. The growth of feed mycotoxin detoxifiers in the U.S. is spurred on by greater investment into feeding safety technologies, as well as advances in toxin binders by leading manufacturers of feedstuffs across the nation. The clay minerals, especially bentonite, are widely used in feed mycotoxin detoxifiers due to their strong binding capacity, reducing toxin absorption, protecting livestock health, and improving productivity.

U.S. Clay Production

|

Clay Type |

2020 |

2021 |

2022 |

2023 (estimated) |

|

Ball clay |

985 |

1,080 |

1,030 |

1,000 |

|

Bentonite |

4,250 |

4,580 |

4,580 |

4,700 |

|

Common clay |

12,900 |

12,700 |

12,700 |

13,000 |

|

Fire clay |

635 |

675 |

622 |

660 |

|

Fuller’s earth |

1,980 |

2,130 |

2,160 |

2,300 |

|

Kaolin |

4,640 |

4,360 |

4,340 |

4,400 |

|

Total |

25,400 |

25,600 |

25,500 |

26,000 |

Source: USGS

Europe Market Insights

The European feed mycotoxin detoxifiers market is expected to hold 24.1% of the market share by 2035, due to strict regulations in the EU on the safety of animal feed and the subsequent use of mycotoxin binders and mycotoxin modifiers. This market is expected to grow due to increased demand for high-quality meat, dairy, and preparations of poultry, alongside heightened awareness of mycotoxin contamination risks. Climate variability is intensifying these concerns, pushing producers and consumers to adopt effective feed mycotoxin detoxifiers to ensure food safety, livestock health, and sustainable production practices.

Preparations of Poultry (2023)

|

Country / Region |

Export Value (USD thousand) |

Quantity (kg) |

|

United Kingdom |

139,067.00 |

27,636,700 |

|

Germany |

1,041,885.93 |

205,057,000 |

|

France |

400,441.20 |

67,037,100 |

|

Italy |

106,628.38 |

22,336,300 |

|

Spain |

141,924.83 |

29,214,800 |

Source: WITS