Electric Mobility Market Outlook:

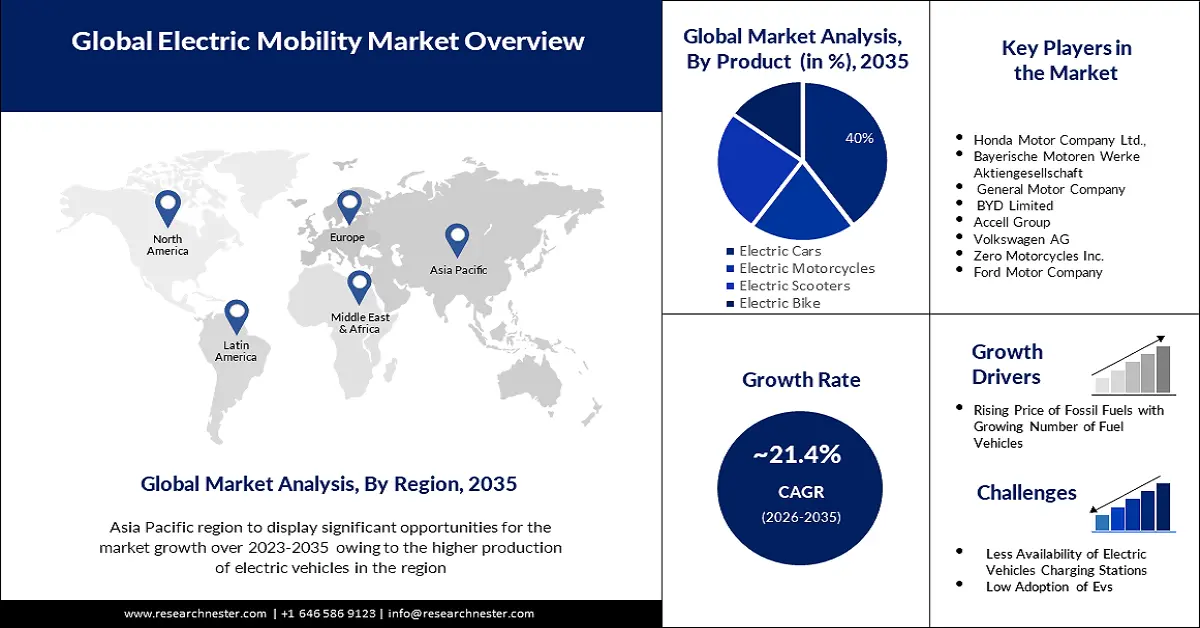

Electric Mobility Market size was valued at USD 527.04 billion in 2025 and is expected to reach USD 3.66 trillion by 2035, expanding at around 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric mobility is evaluated at USD 628.55 billion.

The growth of the electric mobility industry is driven by the implementation of electrically charged two and three-wheeled light vehicles. According to a report from the Press Information Bureau in April 2025, nearly 11,49,334 electric two-wheelers (e-2Ws) were sold during Financial Year 2024-25, while numbers increased by 21% compared to 9,48,561 units from the previous year. The sales of electric three-wheelers (L5 category) increased to 1,59,235 units during FY 2024-25 from 1,01,581 units in the previous financial year, accounting for a growth of 57%. The increasing emphasis on sustainable transportation options is attributed to government support, beneficial policies, expanding infrastructure, and rising consumer interest.

Governments maintain active support through policy measures such as tax benefits and infrastructure investments, as well as subsidies in public charging facilities. Various domestic and international manufacturers are directing substantial investments in research and development to improve electric two- and three-wheeler batteries, and recharging speed and functionality, thus accelerating their adoption in the region. The developments in electric light vehicles are propelling the market expansion and resulting in emission reduction in urban areas.

Key Electric Mobility Market Insights Summary:

Regional Highlights:

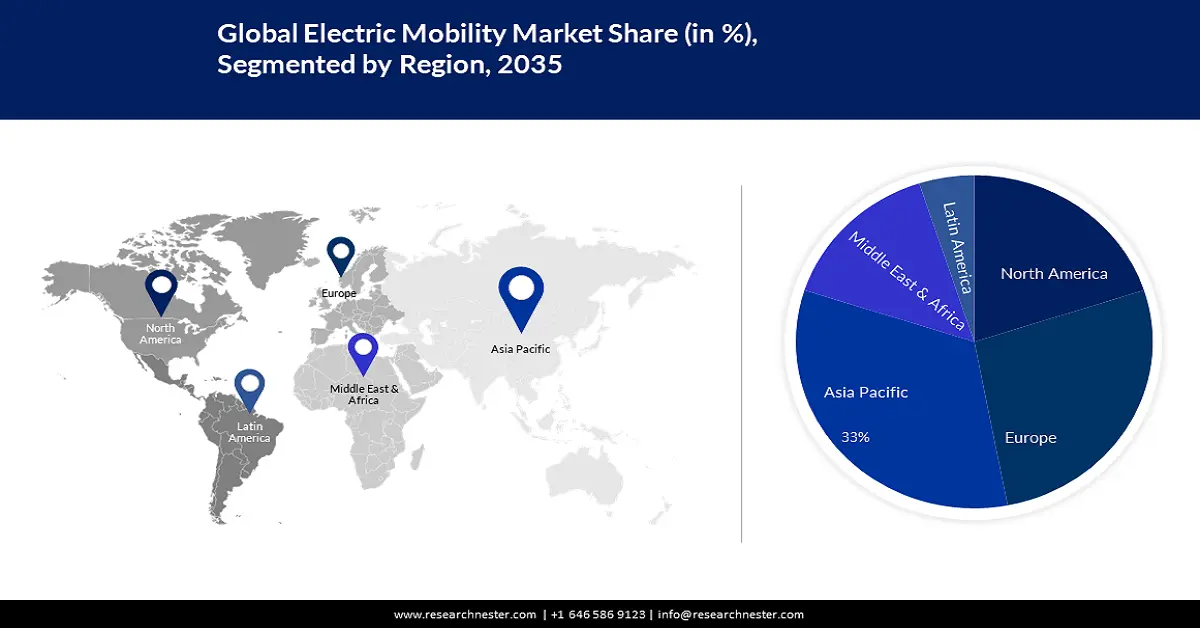

- Asia Pacific electric mobility market is predicted to capture 33% share by 2035, driven by government incentives, regulatory support, and rising EV adoption.

- Europe market will achieve substantial CAGR during 2026-2035, driven by expanded EV offerings and supportive industry regulations.

Segment Insights:

- The electric car segment in the electric mobility market is projected to hold a 40% share by 2035, fueled by consumer demand for luxury EVs and increased EV sales supported by sustainability efforts.

- The li-ion segment in the electric mobility market is anticipated to secure a significant share by 2035, driven by rising demand for lithium-ion batteries due to increasing EV requirements and advancements in battery recycling technologies.

Key Growth Trends:

- Development of manufacturing operations

- Growth in electric two and three-wheelers

Major Challenges:

- Lack of consumer awareness

Key Players: Tesla Inc., Honda Motor Company Ltd., Bayerische Motoren Werke Aktiengesellschaft, General Motor Company, BYD Limited, Accell Group, Volkswagen AG, Zero Motorcycles Inc., Ford Motor Company, Vmoto Limited.

Global Electric Mobility Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 527.04 billion

- 2026 Market Size: USD 628.55 billion

- Projected Market Size: USD 3.66 trillion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Netherlands

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Electric Mobility Market Growth Drivers and Challenges:

Growth Drivers

- Development of manufacturing operations: The electric mobility market is experiencing exponential growth, driven by the development of manufacturing operations in various countries. Companies are establishing manufacturing bases as a strategic move to expand their operations. In April 2025, VinFast announced that its new manufacturing facilities are likely to start operations in India by June 2025, followed by Indonesian operations by October 2025.

Moreover, VinFast initiated construction of its USD 200 million production plant in Indonesia in July 2024, to generate nearly 50,000 units yearly. This manufacturing expansion demonstrates a shift of industry-wide production toward high-growth regions as it decreases production costs while raising immediate customer service capabilities and enhancing supply chains.

- Growth in electric two and three-wheelers: Automobile manufacturers are integrating technologies such as AI to develop advanced smart transit solutions in the electric vehicle industry. In January 2025, Tata Motors launched Avinya as its next-generation EV platform, in which the company incorporated state-of-the-art AI technologies to optimize vehicle performance while enhancing user experience. Avinya is designed through a modern architecture that seeks to establish new standards worldwide for such vehicles in terms of range and efficiency. These automotive solutions driven by AI technology are gaining substantial enhancements of safety features while boosting energy performance and user satisfaction.

Challenge

- Lack of consumer awareness: Rural areas hold limited knowledge about environmentally friendly vehicles, which is hindering their adoption. Lack of awareness among consumers regarding environmental advantages, the overall cost of ownership, and government incentives for EVs act as restraining factors for the market. Furthermore, a lack of confidence concerning the performance of EVs, including their range and battery durability, hinders adoption and restrains market expansion.

Electric Mobility Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 527.04 billion |

|

Forecast Year Market Size (2035) |

USD 3.66 trillion |

|

Regional Scope |

|

Electric Mobility Market Segmentation:

Product Segment Analysis

The electric car segment is expected to account for 40% of the global e-mobility market by 2035. Consumer demand for luxury EVs plays a major role in expanding the segment’s growth. The EV sales are rapidly increasing as companies are actively contributing to environmental sustainability in automotive production. In January 2025, BMW Group exceeded its previous yearly results, delivering 426,594 fully-electric models, which represented a 13.5% sales increase. The BMW brand sold 368523 EVs, which demonstrated an 11.6% increase, and the MINI brand reached 56.181 EVs after experiencing a 24.3% growth. The Rolls-Royce brand surpassed other marques with an impressive growth rate of 479.6% to sell a total of 1,890 EVs. Rising incomes of consumers enable the purchase of premium zero-emission vehicles, offering environmentally friendly solutions, advanced technology, and performance capabilities.

Major companies are accelerating the segment’s growth through their rapid development of EV charging infrastructure. In October 2023, BP Pulse announced a USD 100 million agreement to acquire Tesla’s ultra-fast charging hardware, as part of BP's EV charging business division. Tesla's ultra-fast chargers will be purchased through a new agreement with a separate EV charging network. The charging infrastructure continues to evolve through novel developments that are providing better experiences to plug-in vehicle owners while accelerating the adoption of EVs.

Battery Segment Analysis

The Li-ion segment is expected to garner a significant share between 2026-2035. The increasing demand for lithium-ion batteries is a major factor that is stimulating the segment’s growth. As per the report from the International Energy Agency (2024), the demand for lithium batteries accounted for around 140 Kt in 2023. The surge in EV requirements is further intensifying the need for battery recycling methods to manage raw material deficits while cutting emissions and the disposal of used power packs. The advancements in battery recycling technologies drive manufacturers and automotive companies to extract materials such as cobalt, lithium, and nickel, which they can reintroduce to supply chains.

Our in-depth analysis of the global electric mobility market includes the following segments:

|

Product |

|

|

Voltage

|

|

|

Vehicle Type |

|

|

Battery |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Mobility Market Regional Analysis:

APAC Market Insights

The APAC electric mobility market is set to hold the largest share of 33% by the end of 2035, owing to the government incentives with regulatory guidelines. The governments in India and China are significantly investing through subsidies, grants, and tax rebates to encourage consumers to purchase EVs. Governments are implementing these policies to achieve environmental goals, including better air quality, lower carbon emissions, and reduced use of fossil fuels. The need for lower pollution and stricter emission regulations in cities is compelling manufacturers and consumers to choose electric vehicles.

The rapid innovations are a major driver that is strengthening the China market. Innovations in faster recharging systems, solid-state cell battery technology, and denser storage capacities are reducing electric vehicle costs while increasing their fuel efficiency. The rising registrations for eco-friendly vehicles are accelerating the market growth. The International Energy Agency in 2024 stated that the registrations for new electric cars in China reached 8.1 million in 2023, accounting for an increase of 35% in 2022. Such developments are addressing the consumer requirements, further fueling the market growth.

Europe Market Insights

In Europe, the market is expected to grow substantially during the assessment period. The existing and new automotive players are expanding their electric vehicle portfolio, which is creating lucrative avenues for market growth. The EV product range of various companies is rapidly expanding to accommodate a wide selection of consumer needs through sedan, SUV, and compact car options. An expanded line of electric vehicles from original manufacturers and new EV producers is offering consumers multiple price points and design choices, while delivering more performance options, thus expanding electric vehicle accessibility for a larger market segment.

The presence of automotive giants including BMW, Volkswagen, and Mercedes-Benz is bolstering the growth of the Germany electric mobility market. Major automakers are continually investing in electric vehicle manufacturing to satisfy increasing consumer demand for EV models. These manufacturers lead through research-based development of advanced technologies and infrastructure while supporting electric locomotion. The combined policies from the transportation and energy sectors are establishing an optimal environment for EVs, driving businesses and consumers to choose them for convenience and efficiency.

Electric Mobility Market Players:

- Tesla Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honda Motor Company Ltd.

- Bayerische Motoren Werke Aktiengesellschaft

- General Motor Company

- BYD Limited

- Accell Group

- Volkswagen AG

- Zero Motorcycles Inc.

- Ford Motor Company

- Vmoto Limited

The electric mobility market is experiencing high competition, as the major players span across battery manufacturers, automakers, and providers of charging infrastructure. Key automakers are providing financial aid in electric vehicles, and are rolling out diverse models to satisfy various consumer segments. Battery manufacturers are driving advancements in energy storage technology, enhancing EV performance. In addition, manufacturers around the globe are rapidly expanding EV charging infrastructure, which is beneficial for the overall growth. Here are some key players operating in the global market:

Recent Developments

- In April 2025, Saudi Aramco entered into a joint development agreement with Chinese EV giant BYD to collaborate on advancing new energy vehicle technologies. This initiative, facilitated through Aramco's subsidiary, Saudi Aramco Technologies Company (SATC), aims to improve vehicle efficiency and reduce environmental impact as part of Saudi Arabia’s transition to cleaner energy in transportation.

- In October 2023, BP Pulse, BP's electric vehicle charging business, announced a USD 100 million agreement to acquire ultra-fast charging hardware units from Tesla. This strategic move aims to expand BP's EV charging network across the United States, enhancing accessibility and convenience for EV users.

- Report ID: 4626

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Mobility Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.