Glass Insulated Electrical Bushing Market Outlook:

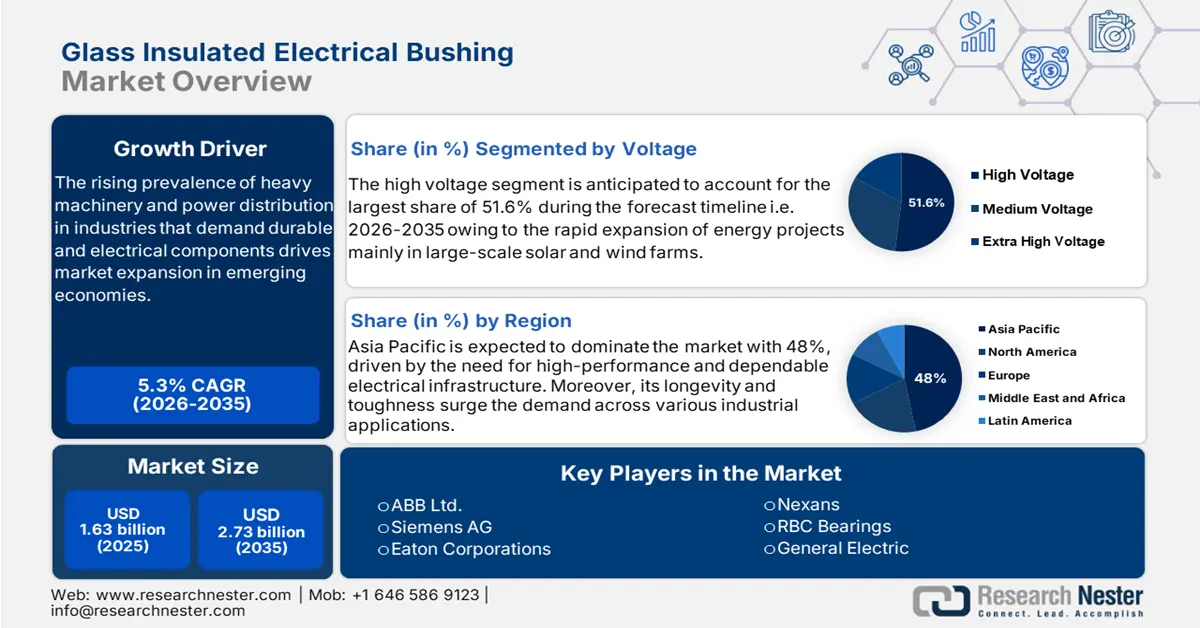

Glass Insulated Electrical Bushing Market size was valued at USD 1.63 billion in 2025 and is set to exceed USD 2.73 billion by 2035, expanding at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of glass insulated electrical bushing is estimated at USD 1.71 billion.

The glass insulated electrical bushing market has accelerated at a rapid pace attributable to the rising interest in efficient energy transmission systems. Glasses are preferably used as they provide superior insulation properties compared with other materials and also exhibit mechanical strength and resistance to environmental influences such as moisture or pollution.

Renewable energy projects are adding further to the increased demand for glass-insulated bushings, as wind and solar power are rising. Many countries are upgrading power infrastructure towards clean-energy-generation sources, making them ideal for power transformers, gas-insulated switchgear, and other high-voltage equipment. For instance, in February 2020, Indiana Michigan Power, an American Electric Power division, announced investing USD 77 million to modernize and construct new substations as part of its electric transmission network. The shift toward modernized and smart grids is enhancing the prospects for the glass insulated electrical bushing market.

Key Glass Insulated Electrical Bushing Market Insights Summary:

Regional Highlights:

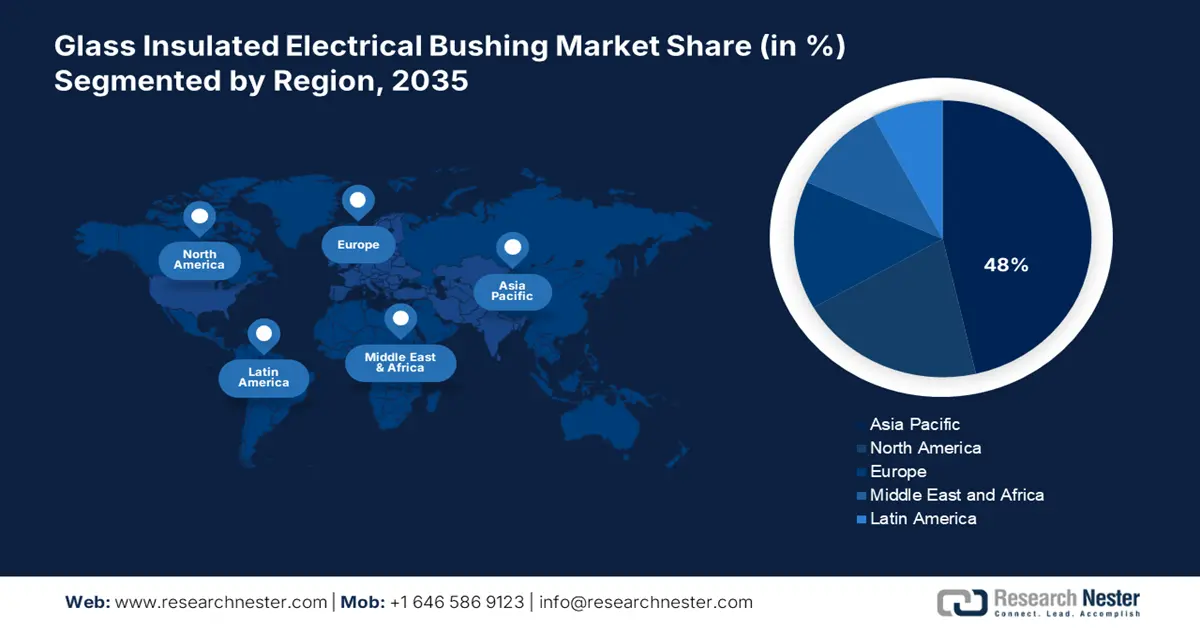

- Asia Pacific commands a 48% share in the Glass Insulated Electrical Bushing market, fueled by rapid industrialization and urbanization leading to demand for efficient power transmission, driving expansion through 2026–2035.

- North America's Glass Insulated Electrical Bushing Market is set for consistent growth through 2026–2035, fueled by investments in renewable energy and redevelopment of aging infrastructure.

Segment Insights:

- The High Voltage segment is expected to hold a 51.6% market share by 2035, propelled by industrialization, urbanization, and demand for energy infrastructure.

Key Growth Trends:

- Rising demand for energy transmission

- Grid modernization and smart grid development

Major Challenges:

- Fluctuating raw material costs

- Complex manufacturing process

- Key Players: Schneider Electric, Siemens AG, Eaton Corporation, General Electric, Nexans, RBC Bearings.

Global Glass Insulated Electrical Bushing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.63 billion

- 2026 Market Size: USD 1.71 billion

- Projected Market Size: USD 2.73 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, India, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Glass Insulated Electrical Bushing Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for energy transmission: As more population is migrating to urban areas, industrial development is evolving at a rapid pace thus, demand for energy utilization is increasing. Furthermore, glass insulated electrical bushing has appeared as one of the dominantly used materials in high-voltage applications for supporting growing energy infrastructure. The surge in renewable energy projects, such as wind and solar power, emphasizes the reliable and effective transmission systems to connect remote sites of renewable generation facilities to urban centers and industrial zones.

For instance, in June 2024, Schneider Electric launched EcoStruxure for Life Sciences, a digital technology platform. It aims to reduce carbon emissions by up to 70% by utilizing universal automation to create smart manufacturing, improve supply chains, expansion of facilities, and focusing sustainability. This expansion was made possible by intensive development and shows our dedication to providing our clients with dependable and high-quality products. - Grid modernization and smart grid development: There is an increasing need for high-performance, dependable bushings as utilities make the transition toward smart grids. They are perfect for applications as they provide an outstanding electrical insulation, thermal stability, and durability. Improved energy efficiency, heightened grid resilience, and sophisticated substation automation are among the influencing factors for growth. This emphasizes how important it is to enable effortless activities and sustainable grid operations.

For instance, in April 2023, Siemens introduced SIBushing, an intelligent and smart cable connection bushing, along with SICAM FCM, an earth fault and short circuit indication.

Equivalent SIPROTEC 5 series with Low Power Instrument Transformer (LPIT) inputs and the 7SY82 universal protection device. The portfolio additions provide a thoughtful solution for the switchgear of the future, all while keeping sustainability at the center of their design.

Challenges

- Fluctuating raw material costs: The fluctuations in the prices of raw materials are a key challenge for this glass insulated electrical bushing market. The supply chain disruptions, geopolitical tensions, and variations in environmental regulations impact the material-related inputs into its production. While dynamism in raw material price may translate directly into increased production costs for manufacturers, such cost volatility can undermine profit margins, making long-range planning even more difficult. Thus, cost management becomes a critical issue for producers when competing with this challenge.

- Complex manufacturing process: The glass insulated electrical bushings require state-of-the-art technology, accurate engineering, and quality material to be compatible with high-voltage applications. The complexity and errors at the manufacturing stage can lead to the failure of the product, posing the risk of safety and calling for replacement at an extra cost. The highly technical nature of the product adds to the labor-intensive process requiring skilled workers and high-tech machinery. Such high requirements for expertise and precision production hinder scalability and profitability of the industry.

Glass Insulated Electrical Bushing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 1.63 billion |

|

Forecast Year Market Size (2035) |

USD 2.73 billion |

|

Regional Scope |

|

Glass Insulated Electrical Bushing Market Segmentation:

Voltage (Medium Voltage, High Voltage, Extra High Voltage)

Through the crucial contribution to ensuring safe and efficient energy transmission over long distances, the high voltage segment is likely to dominate with 51.6%. The growth of industrialization, urbanization, integration of renewables, and an ever-growing demand for energy increases the need for high-voltage infrastructure. Moreover, high-voltage direct current (HVDC) transmission systems are preferred for linking offshore wind farms with long-distance renewable energy projects to the grid. Additionally, the modernization of power grids prioritizes improving efficiency and minimizing maintenance frequency.

Furthermore, the shift towards electrification in industries such as transportation and automotive for electric vehicles also aims to heighten investment in high-voltage infrastructure in both developed and developing regions. For instance, in April 2024, HUBBELL Power Systems, which offers exceptional customer service, introduced the new high-voltage oil-free PRC bushings which render our clients with better options to meet their bushing needs.

End user (Industries, Utility, Others)

The utility segment in the glass insulated electrical bushing market is expected to be dominant as it is essential for the generation, transmission, and distribution of energy. As energy consumption increases, utilities are pouring investments into upgrading and developing the power grid to increase supply in potentially expanding and urbanized areas. Furthermore, large-scale renewable energy projects need robust, high-voltage transmission systems, and hence, glass-insulated bushings become a crucial item in handling the higher voltages required for long-distance power transmission. Besides, grid modernization initiatives, especially within the developed economies, focus on upgrading aging infrastructure.

In addition, utilities face regulatory pressures for maintaining grid reliability and cutting down transmission losses, thereby compelling them to embrace the finest technologies, glass-insulated electrical bushings being one of them to enhance performance as well as effectiveness. While various industries such as manufacturing, petrochemicals, and mining scale up the scope of utility-driven projects such as national grid expansion, and renewable energy integration. Thus, the segment of utilities is likely to unfold more opportunities during the forecast period.

Our in-depth analysis of the glass insulated electrical bushing market includes the following segments

|

Voltage |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glass Insulated Electrical Bushing Market Regional Analysis:

Asia Pacific Market Statistics

The Asia Pacific is expected to continue its dominance in the glass insulated electrical bushing market during the forecast timeline i.e. 2026-2035 due to rapid industrialization and urbanization that has created an enormous need for efficient power transmission infrastructure, accommodating the installation of high-voltage equipment. Moreover, renewable energy sources focus on advanced electrical components and the installation of glass-insulated electrical bushings in substations and renewable energy projects. Innovations in the product development area have resulted in significant investments in research and development, aiming toward greater durability and improved thermal performance.

In January 2024, the International Energy Agency mentioned that China is evolving six years earlier than the government had targeted for the commitment to renewable energy development with a target of 1200 GW of installed wind and solar capacity by 2030. Furthermore, the integration of advanced electrical bushing components accelerates the demand clubbed with sustainability since firms are increasingly investing in developing greener manufacturing processes to minimize carbon composition.

With the inclination toward ensuring reliable power energy transmission and streamlining its distribution network, the local government of India has solidified the structure of the electrical framework through its Revamped Distribution Sector Scheme (RDSS). In February 2024, as notified by the Union Minister for Power and New & Renewable Energy, the government enlightened a total of USD 28.6 million households and electrified the un-electrified villages by rendering renewable sources.

North America Market Analysis

North America follows a consistent growth trend determined by investments in renewable energy sources and redeveloping old infrastructure. The glass insulated electrical bushing market is also expanding as the region’s energy demands and technological innovation in electrical insulation continue to emerge. Moreover, research and development coupled with increasing voltage levels in electrical networks give impetus to utilities and manufacturers opting for glass-insulated over conventional bushings. Their performance and lifespan are improved by using advanced materials and manufacturing processes, thus attracting utility companies looking for efficacy of the system's dependability.

In February 2023, the U.S. Energy Information Administration (EIA) report stated that almost 70% of the transmission lines in the U.S. are aged over 25 years. In addition, the replacement and upgrading of aging electrical components with glass-insulated bushings that have superior insulation properties and reliability is an absolute necessity. This transformation requires robust electrical infrastructure boosting glass insulated bushings owing to their rugged nature to withstand challenging environmental conditions.

The glass insulated electrical bushing market in Canada will grow stably, primarily because of the development in infrastructure and the transition towards sustainable energy solutions, in December 2022, Hitachi announced that it is advancing a sustainable energy future and has been chosen by Hydro-Québec for the transmission of electricity using its high-voltage direct current (HVDC) technology to ensure the sustainability of the energy exchange between the Quebec network in eastern Canada and New York State in the northeastern U.S.

Key Glass Insulated Electrical Bushing Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Siemens AG

- Eaton Corporation

- General Electric

- Nexans

- RBC Bearings

- Hubbell Incorporated

- S&C Electric Company

- Mersen

- CG Power and Industrial Solutions

- Bralco

- KEMA Labs

Companies are exhibiting their exponential efforts toward transforming the landscape of the glass insulated electrical bushing market through continuous product developments and expansions in their manufacturing capacity. Moreover, manufacturers have positioned advanced technologies at the forefront of producing high-quality glass-insulated electrical bushings to meet the growing demands of modern electrical systems. In addition, the companies are innovating their product portfolio to respond to the multiplying demand. For example, in July 2024, CG Power and Industrial Solutions announced that it is proceeding with a USD 6.62 billion capacity increase. Examples of such eminent contributors are:

Recent Developments

- In May 2024, Hitachi Energy introduced the GOB+ OIP Transformer Bushings range, which happened at CWIEME Berlin in 2024. The capabilities of these recently released bushings offer better performance with a larger voltage and current range and increased dependability through the use of sturdy sealing technologies and insulation.

- In April 2023, Eaton Corporations announced a stake of 49% in Jiangsu Ryan Electrical Co. Ltd. to advance the capacity of the distribution and transmission transformer.

- Report ID: 6559

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glass Insulated Electrical Bushing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.