Glass Forming Machine Market Outlook:

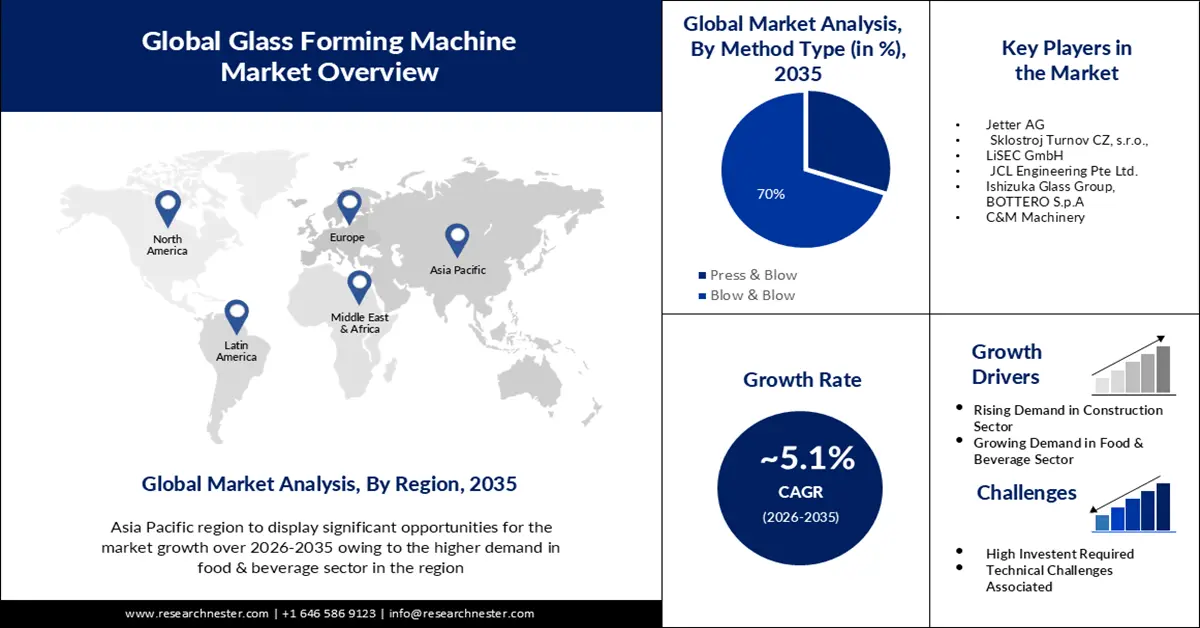

Glass Forming Machine Market size was over USD 2.08 billion in 2025 and is anticipated to cross USD 3.42 billion by 2035, witnessing more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of glass forming machine is assessed at USD 2.18 billion.

The growth of this market can be attributed to the back increasing demand in the food & beverage sector. Glass packing is regarded as a premium and sustainable option for food and beverage products leading to increased demand in this sector. PepsiCo aims to minimize the use of 67 billion plastic containers by 2025, and as an alternative, it is anticipated that glass bottles will be used.

With the introduction of glass forming machines and the expansion of new machinery technologies, conventional glass products - such as flat glass, dishes, boxes, tubes and rods, and fiberglass - that are created from glass melted during the melting process have undergone tremendous change. This is particularly true when producing big quantities of glass goods, which can greatly increase machinery sales. The production property of shaping machinery is driving up demand for it.

Key Glass Forming Machine Market Insights Summary:

Regional Highlights:

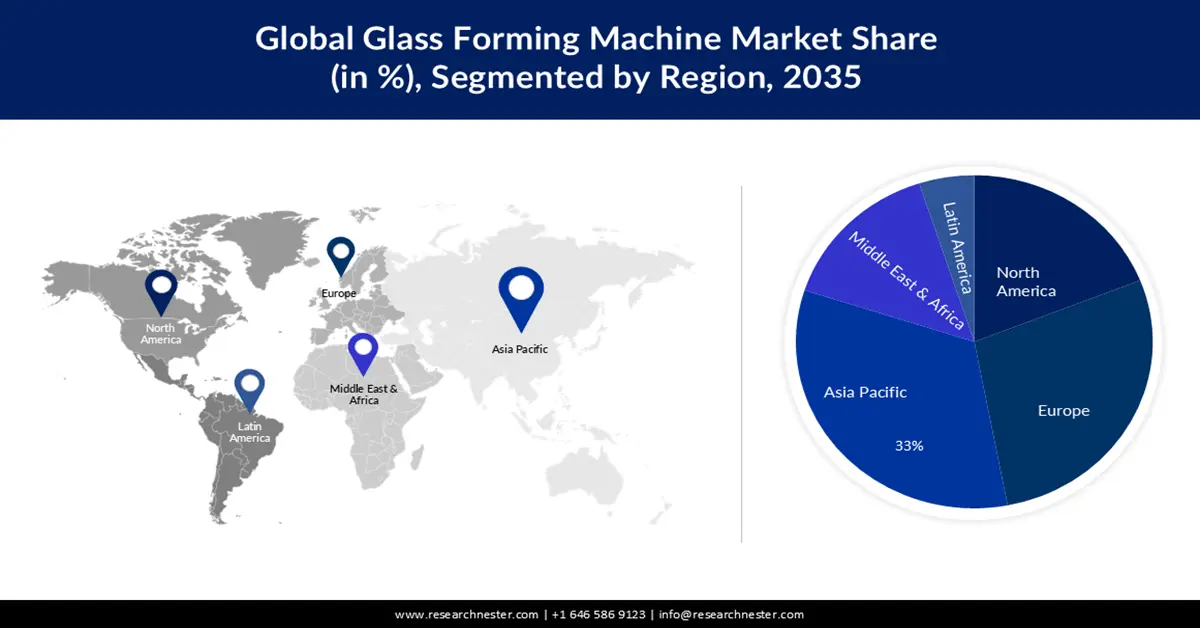

- Asia Pacific’s glass forming machine market will dominate more than 33% share by 2035, driven by high demand for glass molding machinery from food, chemical, and lab sectors.

- Europe’s market will register substantial CAGR during 2026-2035, attributed to strong export demand and continued production growth despite COVID-19.

Segment Insights:

- The food & beverage segment in the glass forming machine market is expected to achieve a 40% share by 2035, driven by high global penetration of packaged food, supermarket-driven sales, and continuous manufacturing investments.

- Press & blow method segment in the glass forming machine market is anticipated to exhibit substantial growth by the forecast year 2035, attributed to high use in narrow-neck glass containers, automation to improve efficiency, and development of lighter, stronger machines.

Key Growth Trends:

- Growing Demand for Sustainable Products

- Demand for 3D Printing in Glass

Major Challenges:

- Growing Demand for Sustainable Products

- Demand for 3D Printing in Glass

Key Players: BDF Industries SPA, Jetter AG, Sklostroj Turnov CZ, s.r.o., LiSEC GmbH, JCL Engineering Pte Ltd., Ishizuka Glass Group, BOTTERO S.p.A, C&M Machinery, Chongqing Life Furnace Technology Co., Ltd., GPS Glasproduktions-Service GmbH, Bucher Emhart Glass.

Global Glass Forming Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.08 billion

- 2026 Market Size: USD 2.18 billion

- Projected Market Size: USD 3.42 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Glass Forming Machine Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Sustainable Products - Growing emphasis on environmentally friendly and sustainable glass manufacturing is one of the most recent developments in the glass forming machine market. Although the manufacture of glass is already 30% lighter and 70% less energy-intensive compared to it was fifty years ago, the glass industry has already made significant progress toward decarbonization; zero carbon emissions are the ultimate aim. The glass sector is not an exception to the growing demand for sustainable products. Glass producers are searching for methods to lower their environmental impacts and use more environmentally friendly production techniques. This entails cutting back on waste, utilizing renewable energy sources, and employing less dangerous chemicals throughout production. It is anticipated that the need for environmentally friendly glass-forming equipment would increase as more people adopt sustainable habits.

- Demand for 3D Printing in Glass - Another big trend in the glass forming machine market is the application of 3D printing technology in the glass manufacturing process. Glass shapes that are complex and elaborate can be precisely and accurately produced by 3D printing. Because it produces glass goods with little material waste, this method can also reduce waste. Even while 3D printing is still relatively new in the glass industry, it is predicted to grow in popularity over the next few years, especially for products made to order.

Challenges

- High Initial Investment Required – Setting up a glass forming machine line requires significant capital expenditure making it difficult for small and medium-sized businesses to enter the market. The limits competition and hinders market expansion in the upcoming period.

- Fluctuation in Raw Material Prices are Set to Hamper the Market Growth in the Forecast Period.

- Challenges in Recycling and Reusing the Glass Containers are Predicted to Pose Limitation on the Market Growth Further

Glass Forming Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 2.08 billion |

|

Forecast Year Market Size (2035) |

USD 3.42 billion |

|

Regional Scope |

|

Glass Forming Machine Market Segmentation:

End-Use Segment Analysis

In terms of end user segment, the food & beverage segment is expected to hold 40% share of the global glass forming machine market by the end of 2035. In the manufacture of large volumes of glass products for end-use sectors, a glass-forming machine shall also be used extensively. Glass packaging is highly used in the food & beverage sector owing to the high penetration of food globally. The majority of food and beverage sales are generated by supermarkets and shopping centers, representing an 85 percent market share in 2021. However, sales are likely to improve over the assessment period despite lockdown and shelter-at-home guidelines limiting production activities. As a result, the growth of the food and beverage sector has been driven by continuous investments in manufacturing as well as production linked to them, thereby maintaining market growth for glass-formed machinery throughout the pandemic period.

Method Type Segment Analysis

Glass forming machine market from the press & blow segment is predicted to grow significantly registering a substantial growth by the end of the forecast period. This method is highly utilized to make glass containers with narrow necks such as vials and jars. They offer amazing grip over the shape and thickness of the boxes. Manufacturers are increasingly investing in automated press & blow machines to enhance production efficiency and reduce labor costs. Furthermore, manufacturers are also developing press and blow machines that are lighter, stronger, and more durable.

Our in-depth analysis of the global glass forming machine market includes the following segments:

|

Method Type |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glass Forming Machine Market Regional Analysis:

APAC Market Insights

The glass forming machine market in Asia Pacific is set to dominate the market by registering a share of 33% during the forecast period. Asia Pacific consists of the countries that are the most important contributors to glass production For instance, about 8.22 million weight cases of plate glass were produced in China as of July 2023. Demand for glass-forming machines in China is led by the food, beverage, chemical, and laboratory sectors. In addition, the region is expected to see high demand for production machinery as demand for glass molded products will continue during the forecast period.

European Market Insights

The glass forming machine market in the Europe region is set to hold a substantial revenue share by the end of 2035. The EU holds a significant share of the world's glass exports, which has continued to be an important driver of demand for glass-making machines. In spite of the challenges created by COVID-19, EU production and exports continued to grow steadily in 2020. The main players in Europe's region are Germany, Italy, and France which provide a number of opportunities for suppliers of raw materials and machinery.

Glass Forming Machine Market Players:

- BDF Industries SPA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jetter AG

- Sklostroj Turnov CZ, s.r.o.

- LiSEC GmbH

- JCL Engineering Pte Ltd.

- Ishizuka Glass Group

- BOTTERO S.p.A

- C&M Machinery

- Chongqing Life Furnace Technology Co., Ltd.

- GPS Glasproduktions-Service GmbH

- Bucher Emhart Glass

Recent Developments

- Glasproduktions-Service GmbH (GPS) and Siemens welcomed a partner who can help develop new standards for IS machine control systems. GPS is available with proven, advanced and compact hardware and monitoring systems for IS machines. The innovative collaboration between GPS software and Siemens hardware results in a system that not only works together efficiently.

- Bucher Emhart Glass, the world's leading supplier of machinery and equipment for the glass industry, has completed its portfolio of servo-driven glass forming machines with the latest and improved BIS machines.

- Report ID: 5457

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glass Forming Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.