Gingival Retraction Cord Market Outlook:

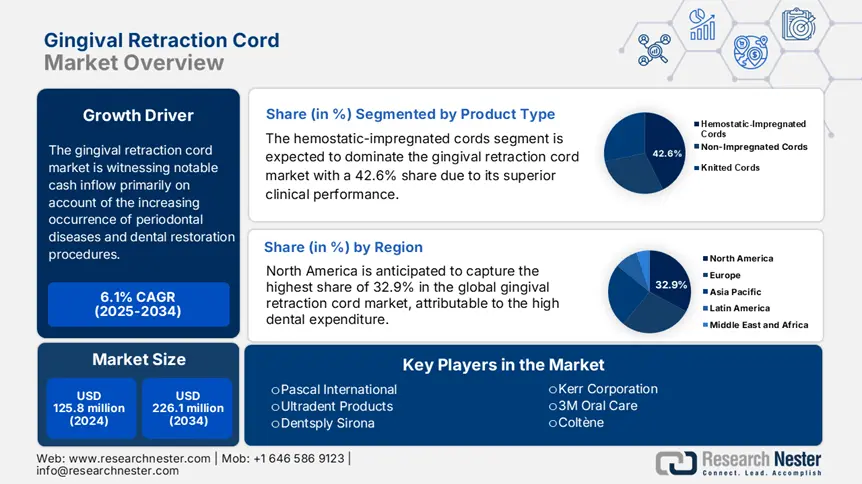

Gingival Retraction Cord Market size was over USD 125.8 million in 2024 and is estimated to reach USD 226.1 million by the end of 2034, expanding at a CAGR of 6.1% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of gingival retraction cord is evaluated at USD 133 million.

The market is witnessing notable cash inflow primarily on account of the increasing occurrence of periodontal diseases and dental restoration procedures. According to the World Health Organization (WHO), more than 1.5 billion cases of severe periodontal disease were recorded in 2023, where treatment needs are expected to grow at an annual rate of 3.8%. It signifies continuous enlargement of the demography, specifically among geriatric populations, which is ultimately fostering a substantial consumer base for this sector. Moreover, with the growing need for advanced tools in modern dentistry to overcome the evolving challenges is fueling demand in this field.

The gingival retraction cord market is experiencing notably amplifying cost pressures due to volatilities in the supply chain and the rising expense of dental services. This can even be testified by a 4.6% year-over-year (YoY) increase in the producer price index (PPI) for dental consumables in 2024, as per the U.S. Bureau of Labor Statistics (BLS). Subsequently, the upstream inflation stimulated the consumer price index (CPI) for dental services with a 5.6% yearly rise, as recorded by the Organization for Economic Co-operation and Development (OECD). This indicates the urgent need for dental practices to successfully pass along pricing trends to attract maximum end users while maintaining consistent service utilization.

Gingival Retraction Cord Market - Growth Drivers and Challenges

Growth Drivers

- Global validation on enabling advantages: Improvements in clinical efficacy and efficiency are attracting more consumers to invest in the market. As evidence, a 2022 study from the Agency for Healthcare Research and Quality (AHRQ) underscored a 28.4% reduction in complications from the use of retraction cords in early-stage gingival displacement. It also highlighted the ability of this treatment approach to save $1.5 billion in healthcare over two years by preventing avoidable hospitalizations. As a result, the Food and Drug Administration (FDA) in the U.S. gave approval to hemostatic cords, such as aluminum chloride-impregnated variants, based on their potential to enhance procedural efficiency by 15.3% through reduced chair time per patient.

- Untapped potential of unmet needs: The gingival retraction cord market is offering lucrative opportunities from the rapid emergence of APAC countries as an enlarging and diversified consumer base. For instance, in 2024, the Ministry of Health in Japan recorded a 40.7% gap in access to advanced retraction treatments, with just 60.3% of eligible residents receiving proper care due to financial disparity. Simultaneously, more than 70.5% of clinics in India still prefer to use outdated methods, creating a surge in affordable options in cords, as per the Indian Dental Association. These underserved markets are driving demand for cost-effective, high-quality products, creating expansion opportunities for manufacturers in this sector.

- Benefits and investments in extensive R&D: Technological innovation and increased research activities are driving pipeline expansion in the gingival retraction cord market. For instance, in 2024, 3M published impressive clinical results regarding the evaluation and development of its antimicrobial cord, reducing post-operative infections by 22.5%. This aligns with broader industry trends and regulatory criteria, garnering a favorable atmosphere for new launches. Influenced by such efficiency gains, in 2024, the National Institutes of Health (NIH) increased grants by $27.4 million to dental material creations and findings. This ultimately results in an escalation in product performance and sustainability, driving market adoption.

Challenges

- Limitations in financial backing: The strict price controls from access improvement regulations, implemented by governing bodies, often limit the profitability of advanced and high-quality products available in the gingival retraction cord market. This can be evidenced by the 2023 updates in the G-BA reimbursement policies, capping cord prices at just $0.88 for each unit in Germany. However, in the same year, Dentsply Sirona addressed this constraint by forming a partnership with the health authority of France to enable cost-saving benefits through a 12.5% expansion in coverage.

- Absence of widespread awareness: The market is significantly affected by underutilization. For instance, till 2024, dental professionals in India were failing to use these products in over 40.6% of applicable cases, as per the Indian Dental Association (IDA). This stems largely from a lack of awareness and training on procedures with cord techniques. To resolve the issue, in 2024, Gingi-Pak contributed to government-sponsored workshops that trained more than 5,005 dentists in the country, resulting in a 25.3% demand increase, as reported by the National Health Policy (NHP).

Gingival Retraction Cord Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.1% |

|

Base Year Market Size (2024) |

USD 125.8 million |

|

Forecast Year Market Size (2034) |

USD 226.1 million |

|

Regional Scope |

|

Gingival Retraction Cord Market Segmentation:

Product Type Segment Analysis

Based on product type, the hemostatic-impregnated cords segment is expected to dominate the gingival retraction cord market with a 42.6% share by the end of 2034. The superior clinical performance of these commodities made them the most desired and cultivated resource for modern dentistry across the globe. A majority of these chemically treated cords contain aluminum chloride or epinephrine, enabling 15.5% faster hemostasis compared to alternatives, and hence making them the gold standard for compliance, as established by the 2024 NIH study. This can be exemplified by the 2023 FDA guidance specifically endorsing chemically treated cords for effective bleeding control. This ultimately continues to maintain a robust adoption rate in this segment in this sector.

Application Segment Analysis

Dental clinics are estimated to represent themselves as the major end-user segment with a 55.4% share of total usage in the gingival retraction cord market over the assessed timeframe. This forefront position is supported and consolidated by expanding reimbursement coverage. In this regard, the Centers for Medicare & Medicaid Services (CMS) reported that, in 2024, Medicare enacted a new policy of expansion, covering gingival displacement procedures for 80.5% of restorative treatments. The segment is further bolstered by a consistent 5.7% annual rise in dental surgeries performed in clinics, as per the Centers for Disease Control and Prevention (CDC).

Material Segment Analysis

In terms of materials, the cotton segment is predicted to hold the largest share of 38.6% in the gingival retraction cord market throughout the discussed period. These cords, particularly the non-woven ones, gained remarkable popularity from their superior absorption capacity, soft tissue compatibility, and cost-effectiveness compared to synthetic alternatives. Their widespread utilization displays the shifting preference of dental professionals towards this traditional yet reliable material that provides optimal minimization of trauma during the displacement surgeries. Moreover, the segment's continued relevance in modern dental practice despite competition from newer material innovations is consolidating the leadership.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

Material |

|

|

End user |

|

|

Sterility |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gingival Retraction Cord Market - Regional Analysis

North America Market Insights

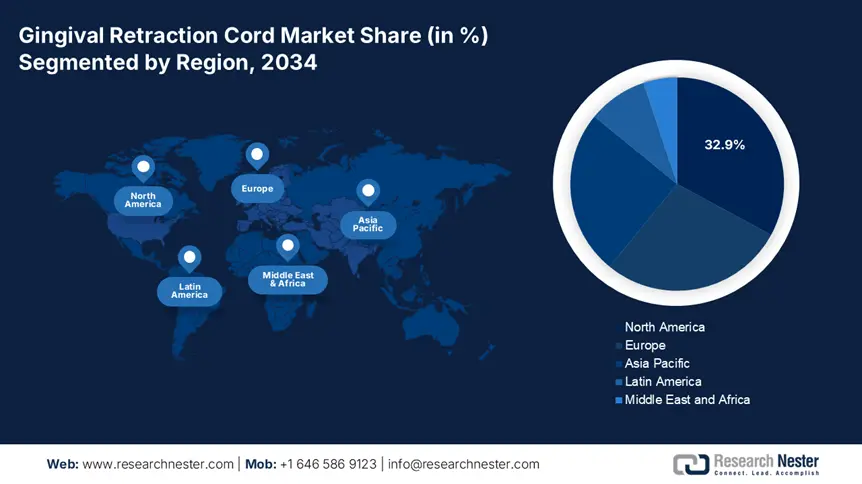

North America is anticipated to capture the highest share of 32.9% in the global gingival retraction cord market by the end of 2034. The region's proprietorship is evidenced by a 12.5% surge in periodontitis cases in 2024, surpassing 45.7 million, as unveiled by the CDC report. The aging population, high dental expenditure, and advanced healthcare infrastructure are also cumulatively strengthening its significance as a large patient pool and tech-based innovation hub for this sector. Moreover, comprehensive insurance coverage, combined with these factors, is helping North America maintain its strong emphasis on widespread adoption and innovation of retraction cord technologies.

The U.S. market is experiencing robust expansion both regionally and globally. This is primarily fueled by the 2024 Medicare coverage expansion, providing financial backing for 45.4% more dental procedures, as reported by the CMS. Besides, ongoing technological advancements, such as the AI-assisted cord placement that can reduce chair time by 20.4%, are driving rapid clinical adoption, according to the NIH findings. However, with Medicaid currently reimbursing only 35.3% of procedures using cords, the landscape is facing a lack of access to advanced retraction technologies among patients with weaker economic backgrounds.

The gingival retraction cord market in Canada is primarily augmented by a strong capital influx, directed by its universal healthcare policies. According to the Canadian Institute for Health Information (CIHI), the country's single-payer system ensured 80.5% reimbursement for cords, evidently proving the country's contribution to this sector. Provincial allocations, including an 18.3% spending increase by the government of Ontario from 2021 to 2024, are also enhancing accessibility in this category. Furthermore, the improving capacity of Canada in domestic manufacturing reduced overall costs by 15.4%, attracting participation from both domestic and foreign dental health industries.

APAC Market Insights

Asia Pacific is expected to be the fastest-growing region in the global gingival retraction cord market during the analyzed timeline, while exhibiting a 7.4% CAGR. The booming dental tourism industry, government healthcare investments, and rising periodontal disease rates are concomitantly stimulating the region's pace of progress in this sector. For instance, in 2024, the aging population in Japan secured a $720.5 million spending on cords, as revealed by the MHLW. On the other hand, South Korea is maintaining a strong emphasis on technological adoption and has already achieved a 25.4% increase in AI-assisted cord usage in 2024. Whereas, the 20.3% rise in funding created a strong position for Malaysia as a dental tourism hub, serving more than 2.3 million patients every year, as per the Ministry of Health (MOH).

China acquires the largest revenue share of 40.3% in the APAC gingival retraction cord market. This proprietorship is backed by the $2.2 billion annual allocation of dental consumables budget till 2024, as determined by the National Medical Products Administration (NMPA). The nation is also utilizing the advantage of having a globally leading manufacturing capability, where local production satisfies more than 70.5% of domestic demand, reducing reliance on imported products and associated expenses. This combination of robust government investment and increasing self-sufficiency solidifies the nation's position as the regional leader.

India is representing itself as the growth engine of the APAC gingival retraction cord market with a 9.4% CAGR. The country's propagation in this sector is propelled by expanded Pradhan Mantri Jan Arogya Yojana (PMJAY) insurance coverage, offering backing for more than 500.4 million beneficiaries, as revealed by the Ministry of Health and Family Welfare (MoHFW). However, the landscape was still depending on imports for 45.4% of dental consumables till 2024, according to the Ministry of Commerce. Thus, manufacturers are heavily engaging their resources in the localization of production, particularly through joint ventures.

Government Investments/Policies (2024-2025)

|

Country |

Investments/Policies |

Key Policy Focus |

|

Australia |

AUD 18.4 million (Preventive Care Initiative) |

Bulk billing for dental procedures |

|

South Korea |

₩35.6 billion (Senior Oral Health Project) |

Digital dentistry adoption |

|

Malaysia |

RM 12.3 million (Dental Tourism Boost) |

Public-private partnerships |

Source: DoH Australia, MOHW South Korea, and MOH Malaysia

Europe Market Insights

The Europe gingival retraction cord market is predicted to grow steadily over the timeline between 2025 and 2034. The aging demographics and comprehensive universal healthcare systems are the pillars of the region's augmentation in this sector. As evidence, in 2024, the WHO revealed that 25.5% of adults in Europe, aged over 50, require retraction cords for restorative work. France attained a 22.4% share in the region by investing 7.3% of its healthcare budget in the development and deployment of products available in this sector. On the other hand, Italy and Spain demonstrate strong 5.4% growth, which is aided by regulatory efficiencies, including fast-track approvals from the Italian Medicines Agency (AIFA).

Germany dominates the Europe gingival retraction cord market with a 30.5% share, and is supported by its substantial €4.3 billion dental consumables budget. The country's advanced manufacturing capabilities, including automated cord production that reduced costs by 10.4%, enhance its regional leadership, as reported by the Fraunhofer Institute. Besides, substantial public healthcare investments, such as the €480.5 million allocation in 2024 to advanced dental restoration materials, further strengthen the nation's position as both a production hub, as displayed by the Federal Ministry of Health.

The UK is strongly supporting the Europe gingival retraction cord market with remarkable public and private spending on advanced dental procedures. For instance, from 2020 to 2024, the National Health Service (NHS) expanded its coverage to 80.4% of restorative procedures and increased its dental budget by 8.4%. This universal healthcare system reflects the growing demand for cost-effective, NHS-compliant cord solutions in the country, creating a stable consumer base for value-oriented products. Moreover, the country is maintaining its consistency in this sector by encouraging tech-based domestic innovations.

Country-wise Government Provinces (2024-2025)

|

Country |

Investment/Policies |

Key Policy Focus |

|

Spain |

€20.4 million (Digital Dentistry Fund) |

Expanding coverage under SNS |

|

Italy |

€16.3 million (Aging Population Dental Plan) |

Focus on geriatric & prosthodontic care |

|

Russia |

₽2.1 billion (Regional Clinic Upgrades) |

Local production incentives |

Source: MISAN, MDS, and Minzdrav

Key Gingival Retraction Cord Market Players:

- Ultradent Products

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dentsply Sirona

- Kerr Corporation

- 3M Oral Care

- Coltène

- Pascal International

- Gingi-Pak

- Premier Dental

- VOCO GmbH

- Septodont

- DentaMed

- Hager & Werken

- SmithCare

- Ivoclar Vivadent

- Dental Technologies of America

- Angelus Indústria

- Prime Dental

- DPI Dental

The gingival retraction cord market consists of a fragmented yet competitive atmosphere, where Ultradent and Dentsply Sirona are leading in technological innovations and strategic payer partnerships. On the other hand, regional pioneers are employing distinct strategies to garner maximum revenue, where the U.S. players dominate the premium antimicrobial segment. Furthermore, manufacturers in Asia, such as GC Corporation and Prime Dental, are concentrating their focus on cost-competitive solutions to enhance the relevance of their pipelines in price-sensitive regions. This diverse ecosystem is ultimately fueling localized production, sustainable material development, and distribution through tele-dentistry models.

Such key players are:

Recent Developments

- In March 2024, Ultradent launched a hemostatic cord, HemostraMAX, pre-loaded with 25.3% aluminum chloride for rapid bleeding control. The product captured 12.4% additional market share in North America within Q2 2024. With 20.4% higher adoption in Medicare-covered procedures, it's projected to generate $50.5 million annually.

- In January 2024, Dentsply Sirona revolutionized gingival retraction with the introduction of AI CordPlacer, an AI-guided placementthat reduces procedure time by 25.5%. The system has been adopted by over 1,204 U.S. clinics, decreasing average chair time from 15 to just 11 minutes.

- Report ID: 7952

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gingival Retraction Cord Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert