Geosynthetics Market Outlook:

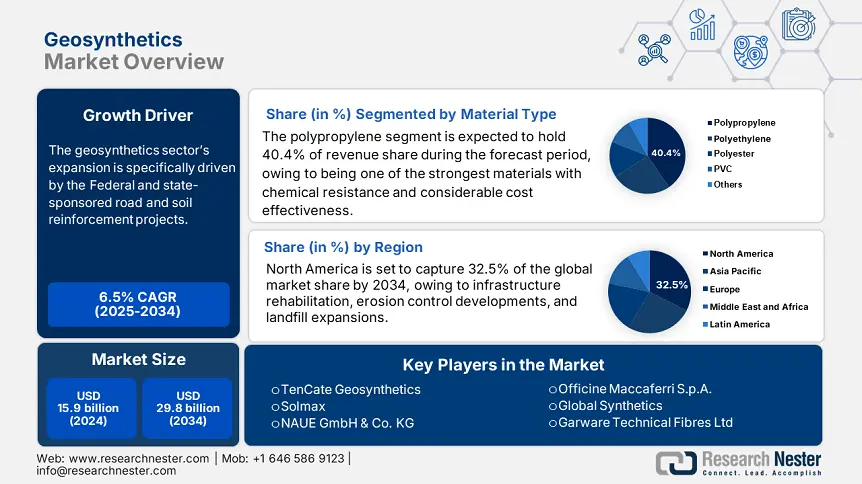

Geosynthetics Market size was estimated at USD 15.9 billion in 2024 and is expected to surpass USD 29.8 billion by the end of 2034, rising at a CAGR of 6.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of geosynthetics is evaluated at USD 16.9 billion.

The geosynthetics sector’s expansion is specifically driven by the Federal and state-sponsored road and soil reinforcement projects. Citing increased design requirements and training programs to boost acceptance, the Federal Highway Administration notes planned inclusion of geosynthetics across Federal Lands Highway projects. At the same time, the U.S. Bureau of Reclamation requires geomembrane manufacturers to show "adequate production capability," therefore signaling government confidence in rising demand. Rising procurement volumes supported by these policy-driven mandates underpin market expansion with public sector-backed project investment data.

According to the Bureau of Reclamation's quality assurance rules, the supply chain spine relies on polymer resin from recognized vendors. Prequalification ensures that raw materials are consistent, as confirmed by Federal Highway requirements. With some putting up assembly lines in the United States, Chinese manufacturers such as BOSTD added 34.1 million SY yearly (2014), TMP at 119.7 million SY, and Taiwan at 358.9 million SY, increasing global production capacity. In 2014, US imports from China totaled $9.26 million, accounting for 15.7 million SY, and are still classified under HTS code 3926. 90. 9995. Though continuous R&D initiatives at federal labs and transportation agencies demonstrate continued innovation investment, official producer/consumer pricing indices are not publicly available.