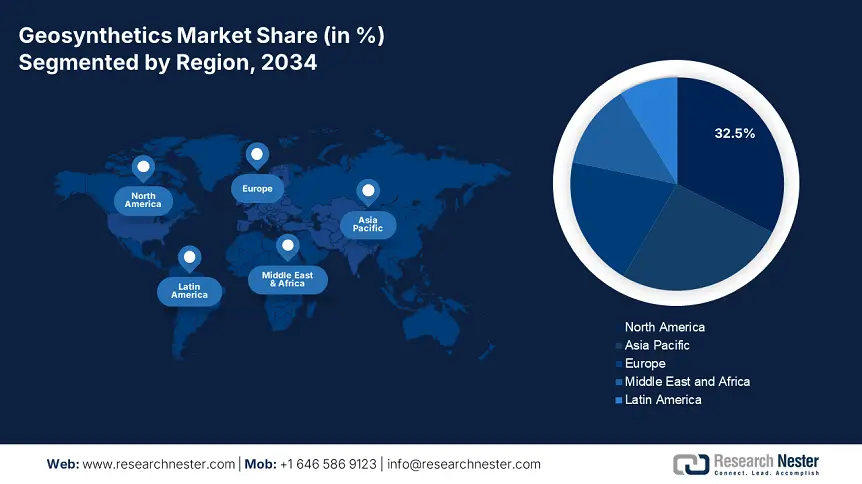

Geosynthetics Market - Regional Analysis

North America Market Insights

By 2034, the North America market is expected to hold 32.5% of the market share and was valued at approximately USD 4.4 billion in 2023, and is projected to reach USD 6.8 billion by 2030, growing at a compound annual growth rate of approximately 6.6% during 2023-2030. These growth drivers are due to factors like infrastructure rehabilitation, erosion control developments, and landfill expansions. The U.S. and Canada each reported 2023 construction values of USD 391 billion and USD 114 billion, respectively, which means that both countries are now spending significant amounts of money on sustainable materials and the environment. This has resulted in demand for geotextiles and geomembranes in soil stabilization, drainage systems, and waste management applications.

The U.S. geosynthetics market accounted for over 86% of North America's revenue in 2023, with its market size exceeding more than USD 3.7 billion. Multiple federal highway investments, the number of landfill upgrades under EPA Subtitle D, and FEMA flood mitigation projects were driving forces behind this success. Many geotextiles and geogrids were utilized for road construction in a recession-resistant industry, costing 11-31% less than traditional road alternatives, while subsequently improving lifecycle performance and soil reinforcement. The increased focus on sustainable infrastructure with the passing of infrastructure deals under the IIJA should further increase the consumption of geosynthetics nationally.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 25.9% of the market share due to the rapid pace of infrastructure development and protection of environmental regulations. The region represented over 41% of global geosynthetics demand in 2024, at USD 6.9 billion, and is expected to grow at a 7.3% CAGR from 2025-2034. China, India, and Southeast Asian countries are heavy investors in geotextiles used in road construction and erosion control, underlining the key drivers of urbanization, land reclamation, and coastal protection projects undertaken by the Asia Pacific economies.

The market for geosynthetics in Asia Pacific is largely dominated by China, with over a 51% regional share in 2024, fueled by the explosion of road, rail, and civil infrastructure projects. The market size in China was USD 3.6 billion in 2024, forecasted to have a 7.6% CAGR from 2025-2034, driven by strong state and local government initiatives in the field of waste management and soil reinforcement. Geography has been assigned to the increase of geosynthetics such as geomembranes and geotextiles within the mining and energy industries, which will likely serve to further support the market growth in China moving forward.

Geosynthetics Market in APAC – Country-wise Insights

|

Country |

Key Applications |

Demand Drivers |

Recent Trends |

|

China |

- Road construction (50% share) |

- $1.8T infrastructure investments (2021–2025) |

- Shift toward high-performance HDPE geomembranes |

|

India |

- Railway ballast stabilization |

- National Infrastructure Pipeline ($1.4T) |

- Rising use of geotextiles in highway projects (NHDP) |

|

Japan |

- Earthquake-resistant infrastructure |

- $300B disaster-proofing budget (2020–2030) |

- Premium-priced geogrids for slope stabilization |

|

Australia |

- Mining sector (60% demand) |

- $120B mining sector output (2023) |

- Strict environmental regulations driving geosynthetic use |

|

Indonesia |

- Peatland restoration |

- $450B new capital city (Nusantara) |

- Growing geocell demand for swampy terrain |

|

Vietnam |

- Coastal dyke reinforcement |

- $120B transport infrastructure plan (2021–2030) |

- Nonwoven geotextiles dominate (70% share) |

|

Thailand |

- Landfill liners |

- Eastern Economic Corridor ($45B investment) |

- Geomembrane demand up 15% yearly (waste management focus) |

Europe Market Insights

The European market is expected to hold 19.9% of the market share due to EU environmental legislation, increasing infrastructure rehabilitation, waste management, and new investments in mining projects. The market size was valued at USD 4.3 billion overall in 2024 and is projected to reach USD 6.9 billion in 2034, growing at a CAGR of 5.1%. Germany, France, and the United Kingdom represent the largest consumption of geosynthetics in Europe and have the most advanced civil engineering standards. Geotextiles and geomembranes dominate applications in roadway construction, landfills, and water management projects throughout Europe.

Geosynthetics Market Insights – Europe (Country-wise)

|

Country |

Primary Application Areas |

Key Trends / Drivers |

Statistical Insights |

|

Germany |

Railways, roads, landfills, and stormwater management |

Strong circular economy policies, Autobahn rehabilitation, and climate-resilient design |

Over 40% of road construction projects now mandate geotextiles; >80% of landfills use geomembranes |

|

France |

Flood control, transportation, and agriculture |

Focus on green infrastructure and Loire River flood protection systems |

Geosynthetics usage in levee reinforcement increased by ~20% from 2021 to 2024 |

|

United Kingdom |

Rail infrastructure (HS2), coastal defences |

Post-Brexit infrastructure reforms, Net Zero targets by 2050 |

HS2 rail project incorporates ~1.3 million m² of geogrids and geotextiles for ground stabilization |

|

Italy |

Coastal protection, tunnelling, waste containment |

Aging infrastructure and EU-backed sustainable construction |

Over 70% of major tunnelling projects now integrate geonets and drainage geocomposites |

|

Netherlands |

Flood defense, land reclamation, green engineering |

Delta Works modernization and sustainability regulations |

>90% of flood barriers use geosynthetics; key projects use geosynthetic clay liners (GCLs) |

|

Spain |

Roadways, erosion control, and agricultural irrigation |

Drought resilience, renewable project growth, and EU water efficiency mandates |

Geotextile use in irrigation canals grew by ~16% between 2022 and 2024 |

|

Poland |

Highway networks, landfill sites, and railway expansion |

EU cohesion fund-backed infrastructure and waste management focus |

~75% of new expressways integrate geosynthetics for subgrade separation and soil reinforcement |

|

Sweden |

Erosion control, mining containment, railroads |

Arctic and sub-arctic soil stability challenges; green infrastructure adoption |

Use of geogrids in mining tailings up by ~12% YoY; growing demand for biodegradable geotextiles |

|

Norway |

Tunnel drainage, road stabilization, and avalanche control |

Infrastructure in mountainous terrain; sustainable civil engineering practices |

Geocomposite drainage layers used in >60% of new road tunnels; adoption of eco-friendly GCLs |