Geospatial Analytics Market Outlook:

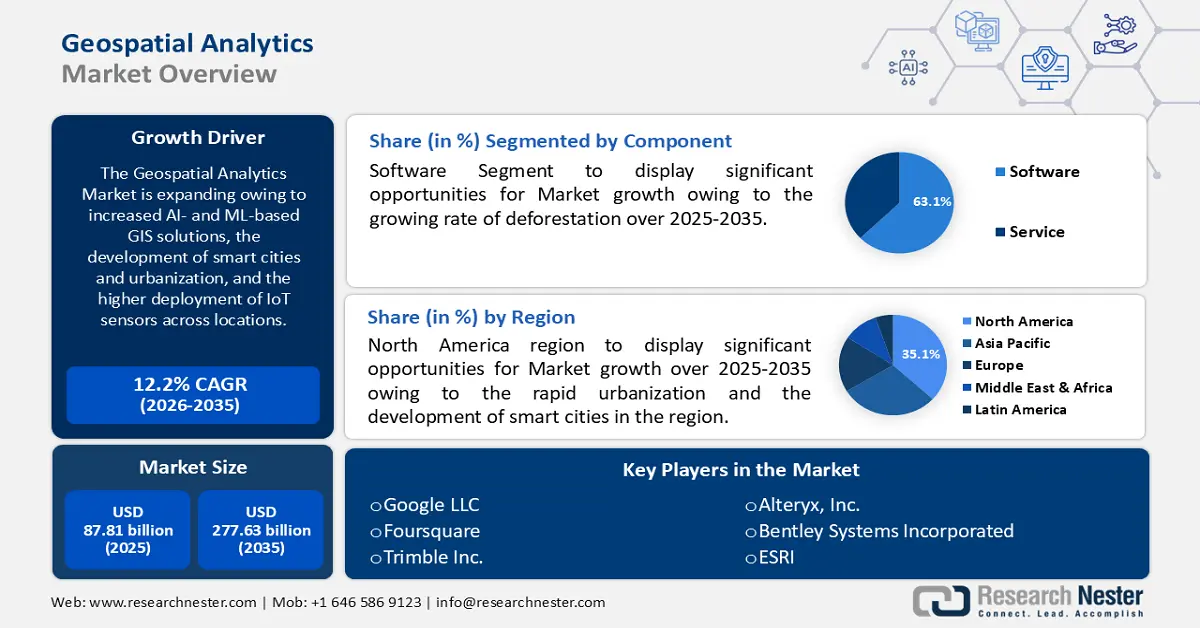

Geospatial Analytics Market size was valued at USD 87.81 billion in 2025 and is likely to cross USD 277.63 billion by 2035, expanding at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of geospatial analytics is assessed at USD 97.45 billion.

Geospatial analytics leverages geographic information, location data, spatial data, and high-resolution imagery, to extract structured data that can be used for various applications. Big data, machine learning, and cloud computing are used to determine patterns in the geospatial datasets to help improve decision-making in businesses. Acquiring data from global navigation satellite systems, space-borne and aerial remote sensing, location-aware mobile data, field surveys, and wireless sensor networks facilitates the development of intelligent healthcare, public safety, and military applications. Geospatial analytics has emerged as a transformative tool for businesses to optimize operations, enhance consumer experience, and gain a competitive edge.

Key Geospatial Analytics Market Insights Summary:

Regional Highlights:

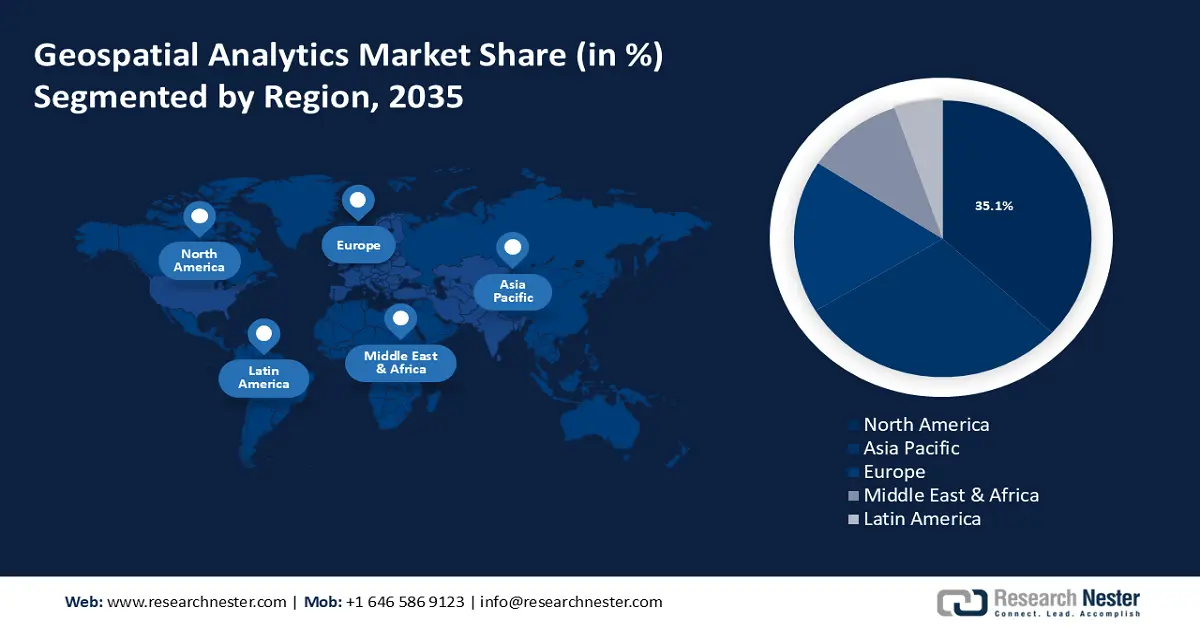

- The North America geospatial analytics market will account for 35% share by 2035, driven by rapid urbanization and the development of smart cities.

- The Asia Pacific market will exhibit tremendous growth with a strong share by 2035, driven by the increasing government initiatives for the protection of the environment.

Segment Insights:

- The software segment in the geospatial analytics market is projected to see substantial growth till 2035, driven by the growing rate of deforestation and increasing usage of GIS software systems.

- The network and location analytics segment in the geospatial analytics market is forecasted to capture a dominant share by 2035, propelled by increased adoption in transportation, telecommunications, retail, and urban planning.

Key Growth Trends:

- Application of geospatial technology in assessing climate change

- Growing defense and intelligence applications

Major Challenges:

- High initial investment and maintenance cost

Key Players: Google LLC, Foursquare, Trimble Inc., Alteryx, Inc., Bentley Systems Incorporated, ESRI, Fugro N.V., General Electric Company, Maxar Technologies Inc.

Global Geospatial Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 87.81 billion

- 2026 Market Size: USD 97.45 billion

- Projected Market Size: USD 277.63 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 17 September, 2025

Geospatial Analytics Market Growth Drivers and Challenges:

Growth Drivers

-

Emergence of GeoAI in healthcare - The integration of geospatial services and artificial intelligence (AI) plays a pivotal role in predicting, tracking, and responding to disease outbreaks and improving overall healthcare outcomes. For instance, the Intelligent Catchment Analysis Tool (iCAT), powered by AI, ML, and the Geographic Information System (GIS), maps disease disparities and identifies healthcare outcomes.

Furthermore, several digital contact-tracing software programs have been developed to mitigate the spread of COVID-19 by tracing areas with high transmission rates and predicting disease evolution. In March 2020, the Singapore government launched the TraceTogether mobile application in response to the COVID-19 pandemic. -

Application of geospatial technology in assessing climate change - Developments in geographic information science (GISc) have transformed the landscape of research in geology and meteorology and play a crucial role in combating climate risks. NASA, the European Space Agency (ESA), and the Centre National d’Études Spatiales (CNES) are collaboratively studying the Sentinel-6 Michael Freilich data to provide insights on rising sea levels and implement climate change models.

-

Growing defense and intelligence applications - Military forces use geospatial analytics to gather intelligence, conduct surveillance and reconnaissance, and maintain situational awareness. This includes tracking troop movements, identifying potential threats, and assessing war conditions.

Challenges

-

Privacy and security concerns - Geospatial data often contains sensitive information about individuals, properties, or infrastructure. Ensuring data privacy and security while leveraging its potential for analysis poses significant challenges.

-

High initial investment and maintenance cost - Although demand for geospatial analytics is expanding across different industries, the high cost of these solutions and data integration remains a significant challenge to market expansion. Due to the high complexity of GIS software development as well as the collection of real-time data, the cost of this software has increased, limiting the expansion of the market.

Geospatial Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 87.81 billion |

|

Forecast Year Market Size (2035) |

USD 277.63 billion |

|

Regional Scope |

|

Geospatial Analytics Market Segmentation:

Component Segment Analysis

Software segment is poised to capture geospatial analytics market share of over 63.1% by 2035. This growth of the segment is set to be encouraged by the growing rate of deforestation. A 2020 report by the Food and Agriculture Organization of the United States stated that between 2015 and 2020, the rate of deforestation was 10 million hectares per year, down from 16 million hectares per year in the 1990s. Since 1990, the world's primary forest area has fallen by more than 80 million hectares.

Particularly, more than 8 million hectares of land are affected by climate change each year, making it the primary cause of the rise in deforestation. This has led to the increasing usage of GIS software systems, which gives forestry departments precise data for improved decision-making and aids them in monitoring the loss of forest cover, assessing the health and growth of recently planted trees, and evaluating the land cover over time.

Application Segment Analysis

The surveying segment in geospatial analytics market is estimated to gather substantial CAGR by the end of 2035. The segment expansion is due to the thriving agriculture sector across the world. According to a 2024 published report by the World Bank Group, agriculture accounts for 4% of global gross domestic product (GDP), and in some least developing countries, it can account for more than 25% of GDP. in Farmers can undertake geospatial analysis with GIS for mapping and surveying plantation crops to increase agricultural output, lower labor expenses, and guarantee crop quality and yield.

Type Segment Analysis

By the end of 2035, the network and location analytics segment is expected to dominate the global geospatial analytics market as it leverages geospatial data to gain insights, optimize operations, and enhance decision-making across various industries. The increased adoption of network and location analytics solutions in transportation, telecommunications, utilities, retail, insurance, and urban planning is propelling market expansion.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Type |

|

|

Application |

|

|

Technology |

|

|

Offering |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geospatial Analytics Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 35% by 2035 The market growth in the region is expected on account of rapid urbanization and the development of smart cities. As an intriguing phenomenon in contemporary urban development, smart city efforts seem to be thriving which relies on geospatial analytics for efficient resource management. According to the United Nations, with 82% of its people living in cities, Northern America is the most urbanized region in the world.

The market in Canada has been steadily growing, driven by advancements in technology and increasing applications across various sectors. Canadian companies specializing in geospatial analytics, along with global players, are actively expanding their presence on the market through partnerships, acquisitions, and technological innovations. For instance, in 2022 Carl Data Solutions Inc., a leader in predictive analytics that uses artificial intelligence and machine learning for compliance-driven environmental monitoring as a service ("EMaaS") and smart city applications, has formed a strategic partnership with Montreal-based K2 Geospatial ("K2").

GIS technology is frequently utilized by the United States federal government's independent National Aeronautics and Space Administration (NASA) to improve user experiences by enabling strong capabilities for managing, viewing, analyzing, serving, and disseminating crucial data and insights.

APAC Market Insights

The Asia Pacific region will also register tremendous revenue share in the geospatial analytics market owing to the increasing government initiative for the protection of the environment. The preservation of natural heritage in the region has faced numerous difficulties lately, which is likely to boost market demand since the governments have implemented several initiatives to promote green economic restructuring, livelihoods, and economic growth.

Tourism in China requires the assistance of GIS (geographic information system) technology for landscape planning including mapping, spatial analysis, communications with tourists, and visualization of the landscape.

Japan is among the nation’s most vulnerable to natural disasters such as worldwide, which necessitates planning for natural disasters as a crucial aspect of urban development. The country has made significant investments in cutting-edge methods of natural disaster mitigation, which helps individuals comprehend natural disasters better and increases awareness of potential natural disasters including earthquakes.

The market in South Korea is expected to grow at a high rate, as it is being utilized by enterprises, governments, and researchers in a wide range of applications. The Korean Land and Housing Corporation, as well as the Ministry of Land Infrastructure and Transport, have made major investments in geospatial technology and policies.

Geospatial Analytics Market Players:

- SAP SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google LLC

- Foursquare

- Trimble Inc.

- Alteryx, Inc.

- Bentley Systems Incorporated

- ESRI

- Fugro N.V.

- General Electric Company

- Maxar Technologies Inc.

The geospatial analytics market consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- In October 2023, Maxar Technologies announced the introduction of the Maxar Geospatial Platform (MGP) which will allow for quick and simple access to the most sophisticated Earth intelligence available and will make it possible for technical developers, seasoned analysts, and sporadic geospatial data users to all utilize Maxar data in their workflows for mapping, monitoring, and analysis.

- In June 2023, General Electric Company along with Larsen & Toubro for supplying GIS substations for Saudi Arabia's largest green hydrogen facility, to guarantee a steady and dependable power supply for the hydrogen plant and its auxiliary solar and wind power plants.

- Report ID: 6272

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Geospatial Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.