Generative AI in Logistics Market Outlook:

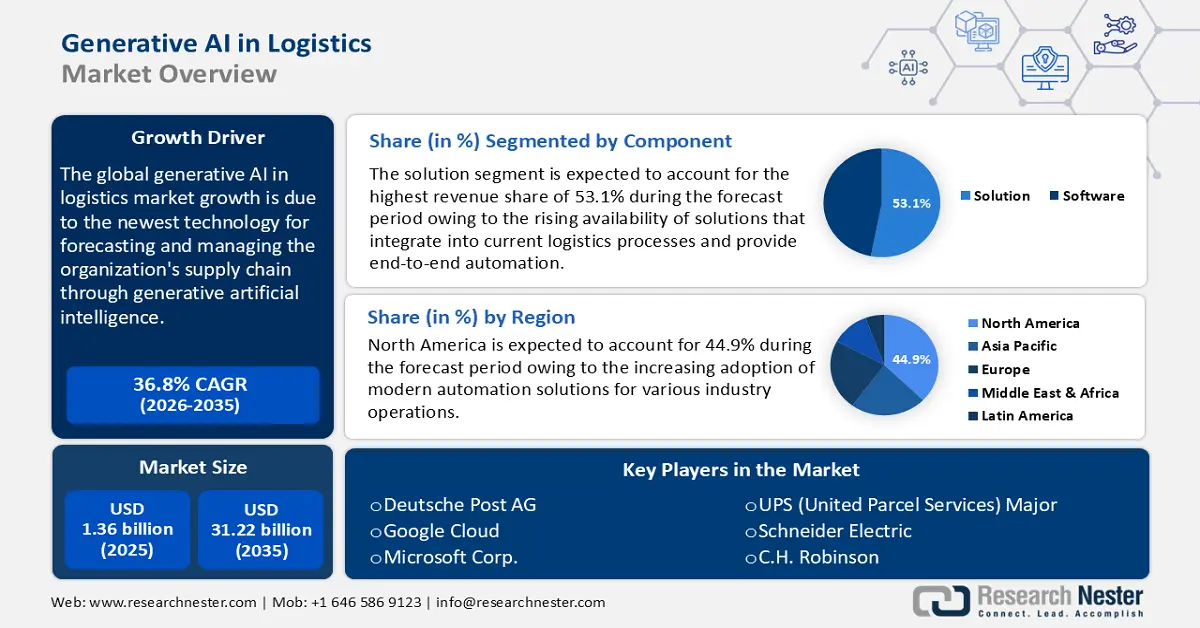

Generative AI in Logistics Market size was valued at USD 1.36 billion in 2025 and is likely to cross USD 31.22 billion by 2035, expanding at more than 36.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of generative AI in logistics is assessed at USD 1.81 billion.

Generative AI in supply chains provides an opportunity to accelerate end-to-end logistics operations and companies have identified this trait and are training models on their own data sets to implement AI for optimized productivity and efficiency. Also, predictive maintenance is another key area where generative AI has helped companies determine the assembly-line machines that are most likely to fail in the future, thus improving equipment effectiveness (OEE)- a vital manufacturing metric. Siemens and Microsoft partnered in October 2023 to strategically adopt cross-industry AI, orchestrating copilots for raw material management, distribution networks, production processes, and customer demands.

Such supply chain responsiveness, resilience, and efficiency dictate an organization’s competitiveness. Conventional supply chain management solutions rely on experience-driven decision-making and established methodologies, where logistic partners navigate the complexities of inventory management, demand forecasting, and distribution scheduling using heuristic algorithms and historical data analysis. These methods often failed to address modern logistics complexities and in turn, aided generative AI in logistics market adoption. The manufacturing and logistic sectors are fertile grounds for generative AI applications, owing to demand fluctuations and the presence of intricate supply chain networks.

The emergence of ChatGPT in the public sphere ignited an interest in the AI chatbot sector. Microsoft's announcement of a USD 10.0 billion investment in OpenAI in January 2023 galvanized this trend, imploring other technology providers to contest the trend. Later in March 2023, Google introduced Bard and Project Magi, while in February 2023 Meta unveiled a language model with 65 billion parameters called LlaMA. Concurrently, OECD data also suggests that AI could readily automate 27% roles in the OECD nations, including inventory management and customer service. Early adopters of AI-powered supply chain management recorded a reduction in logistics costs by 15%, improved service levels by 65%, and inventory levels by 35%.

Key Generative AI in Logistics Market Insights Summary:

Regional Highlights:

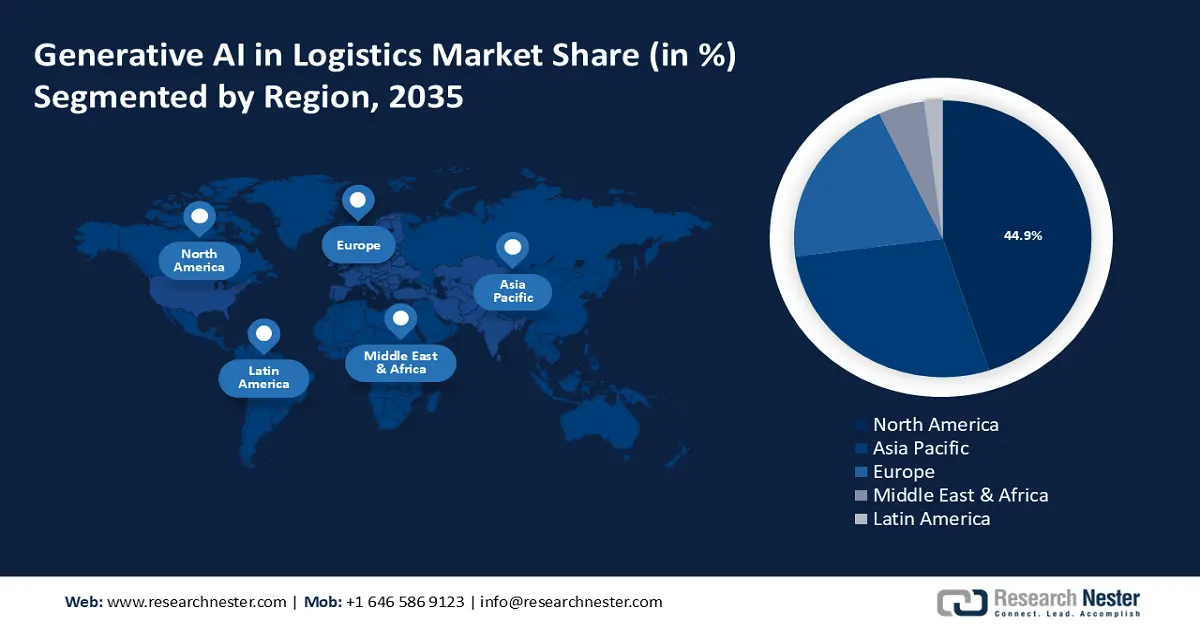

- North America generative AI in logistics market will account for 44.90% share by 2035, driven by increasing adoption of automation solutions and growing demand in supply chain management and logistics.

- Asia Pacific market will register stable CAGR during 2026-2035, driven by rising population and economic growth driving demand for generative AI in logistics.

Segment Insights:

- The cloud segment in the generative ai in logistics market is projected to hold a 63.90% share by 2035, driven by the benefits of real-time data, cost savings, and improved coordination in logistics.

- The solution segment in the generative ai in logistics market is projected to hold a 53.10% share by 2035, fueled by rising demand for comprehensive systems that automate and optimize logistics.

Key Growth Trends:

- Focus on cost reduction, resilience, and sustainability

- Increasing emphasis on sales and marketing analytics tactics

Major Challenges:

- Insufficient visibility

- Integration can be complex

Key Players: Deutsche Post AG, Google Cloud, Microsoft Corp., UPS (United Parcel Services) Major, Schneider Electric, C.H. Robinson, XPO Logistics, FedEx Corp, and A.P. Moller-Maersk AS.

Global Generative AI in Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.36 billion

- 2026 Market Size: USD 1.81 billion

- Projected Market Size: USD 31.22 billion by 2035

- Growth Forecasts: 36.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 18 September, 2025

Generative AI in Logistics Market Growth Drivers and Challenges:

Growth Drivers

-

Focus on cost reduction, resilience, and sustainability: Transportation and logistics amount to immense economic value. According to the UNCTAD Global Trade Update report, global trade peaked at USD 28.5 trillion in 2021- a tenfold surge since 1980, whereas the worldwide intralogistics sector accounted for USD 47.2 billion in 2022 and is projected to value at USD 45.5 billion by the end of 2030, expanding at a 15% CAGR. These figures underscore the widespread transportation networks that have underpinned trading and globalization for years. Efficient logistics and robust supply chains form a crucial component fueling smooth trading operations across all industries.

Generative AI systems predict customer demand trends, possible disruptions using historical data, and inventory challenges, which optimizes stock levels and minimizes shortages. A shift of predictive analytics toward prescriptive analytics is anticipated to automate key workflow components in the future. Here, generative AI will take center stage owing to a surge in the volume of data generated. It is estimated that data generated will equate to 200 billion iPhone 14s, which is about 181 zettabytes by 2025. This data, coupled with growing computational power, enables the creation of sophisticated models for complex tasks.

The rise of environmental, social, and corporate governance (ESG) protocols has a strong influence on the overall supply chain.Transparency in terms of emissions of harmful substances, carbon footprint, and compliant labor practices are poised to become more binding and stricter.Despite the high initial costs, gen AI in logistics will become invaluable to companies to meet ESG standards. Investments in warehouse management systems (WMS) streamline fulfilling orders, inventory, and coordinating list-mile delivery. In June 2022, Logiwa received funding of USD 16.4 million as a part of its Series B round for the development of AI-integrated advanced analytics and automation algorithms for its WMS platform. This cloud-based solution increases labor efficiency by 40% and the order processing capacity by 200%. - Increasing emphasis on sales and marketing analytics tactics: More precise sales and marketing data can be obtained with generative AI systems. By leveraging AI-powered solutions, logistics service providers can better predict their clients' next moves by analyzing client behavior and applying predictive analytics. Logistics service companies can gain a competitive edge and enhance their efficiency by using AI-powered solutions to track market trends and make data-driven decisions. Sales and marketing statistics were therefore used to identify potential customers.

- The emergence of innovative solutions: The creation of creative solutions by different industry players is a noteworthy trend in the generative AI in the logistics sector. These cutting-edge initiatives are changing the generative AI landscape in logistics by utilizing alliances with well-established firms to provide distinctive and customized solutions. Demand is being more accurately predicted using generative AI. AI algorithms can estimate demand trends by evaluating large datasets. This allows logistics organizations to reduce stockouts and optimize inventory management.

Challenges

-

Insufficient visibility: Even though generative AI has numerous advantages in the logistics sector. In the logistics industry, generative AI has several disadvantages such as a lack of transparency between suppliers and customers. Without requiring human participation, generative AI provides consumers with direct solutions, yet, this may cause customers to experience visibility concerns. Insufficient communication and lack of openness between the involved stakeholders could potentially impede the expansion of the generative AI in logistics market.

- Integration can be complex: It can be difficult to integrate generative AI into logistical systems. Numerous logistics firms employ outdated systems that might not be compatible with the newest AI innovations. These system replacements or upgrades can be expensive and time-consuming. Specialized knowledge and abilities are needed to implement generative AI. It can be very difficult and expensive to train the workforce to utilize and operate AI technologies.

Generative AI in Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

36.8% |

|

Base Year Market Size (2025) |

USD 1.36 billion |

|

Forecast Year Market Size (2035) |

USD 31.22 billion |

|

Regional Scope |

|

Generative AI in Logistics Market Segmentation:

Component Segment Analysis

Solution segment is projected to account for around 53.1% generative AI in logistics market share by 2035. This market category mostly consists of all-inclusive software programs and systems that are made to smoothly fit into current logistics processes and provide end-to-end automation and optimization features. The market's desire for comprehensive, instantly deployable systems that handle a wide range of logistical difficulties, from inventory management to route optimization, is highlighted by the prominence of solutions over discrete software components. Although crucial, the software subsegment usually consists of standalone programs or instruments that address particular facets of the logistics procedure. While these tools are essential for focused enhancements, they do not provide the extensive range of features found in full solutions.

Deployment Segment Analysis

By the end of 2035, cloud segment is expected to account for more than 63.9% generative AI in logistics market share. The benefits of cloud computing for logistics and its capacity to optimize processes are credited with the segment's rise. Logistics companies' significant data storage needs for operations management and analysis serve as a driving force behind the segment's growth. For instance, 21% of supply chain executives have integrated cloud-based technologies throughout their workflow. 97% of them have approximately 3/4 of their supply chains operating in the cloud.

Logistics service providers can track and manage supplies, shipments, and delivery in real-time due to cloud-based logistics management systems. Logistics service providers can save costs and boost efficiency by leveraging this real-time data to better correctly estimate inventory levels, delivery timetables, and route optimization. Cloud computing also facilitates better customer and supplier collaboration for logistics service providers. Logistics organizations can improve coordination and collaboration by sharing information and data in real-time with their suppliers and customers through the use of cloud-based communication technology.

Our in-depth analysis of the generative AI in logistics market includes the following segments

|

Component |

|

|

Deployment |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Generative AI in Logistics Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 44.9% by 2035. The increasing adoption of modern automation solutions for various industry operations and the growing use of technology in every sector is credited with the region's success. The major sectors' growing demand for supply chain management and logistics, along with the expanding industrial infrastructure, are driving up the need for generative AI in logistics throughout the region. By investing USD 40 billion in new machinery, United Parcel Service, Inc. was able to increase its daily processing capacity from 60 million packages in 2022 to 70 million packages in 2023.

The U.S.' supremacy in the logistics industry can be ascribed to its substantial investments in AI research and development, the country's robust tech giant presence, and its innovative culture. Furthermore, the sophisticated infrastructure in the area facilitates the smooth integration of IoT and AI technologies, augmenting operational effectiveness.

Asia Pacific Market Insights

Asia Pacific in generative AI in logistics market is expected to experience a stable CAGR during the forecast period due to the rise in the region’s population. Every other industry experiences a surge in demand for inventory owing to the growing need for lifestyle products ranging from everyday necessities to technical necessities. There will be a greater need for generative AI in the logistics business as supply chain and logistics management become more sophisticated.

Driven by rising disposable incomes and economic growth, China is gradually emerging as a center for generative AI in the logistics sector. China is leading the way in AI investment which propels advances in generative AI for logistics, including predictive maintenance and AI-driven route optimization.

The varied supply chain environment in India encourages the use of generative AI to improve supply chain visibility, expedite logistical procedures, and reduce risks. The country adopts cutting-edge technologies like blockchain and IoT and combines them with generative AI to build reliable logistics solutions that save costs and increase productivity. For instance, in June 2023, the logistics technology company Pidge, which has already offered its services in numerous large and medium-sized Indian cities, proclaimed the arrival of digital parity in the mostly unorganized logistics industry. With its first industry low-code and self-serve logistics (Software-as-a-services) technology platform, the launch will completely alter the logistics business.

Generative AI in Logistics Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Deutsche Post AG

- Google Cloud

- Microsoft Corp.

- UPS (United Parcel Services) Major

- Schneider Electric

- C.H. Robinson

- XPO Logistics

- FedEx Corp

- A.P. Moller - Maersk AS

With generative AI in logistics market shares of more than 15%, Google Cloud and IBM are the leaders in the generative AI space in the logistics sector. TensorFlow and AutoML, two of Google Cloud's AI and ML tools, enable logistics firms to create complex generative AI models. Because of the flexibility and agility of its cloud architecture, real-time data processing and analysis for logistics optimization is made possible. Logistics organizations benefit from Google's proficiency in data analytics and AI-driven insights, which enhance supply-chain visibility, demand forecasting, and route optimization.

With products like Watson AI and IBM Cloud Pak for Data, IBM offers cutting-edge generative AI capabilities specifically designed for the logistics sector. Predictive analytics, anomaly detection, and intelligent decision-making in logistics processes are made possible by its AI-driven solutions. Low latency and data protection are ensured by IBM's expertise in edge computing and hybrid cloud, which makes AI adoption across distributed logistics networks easier.

Here are some leading players in the generative AI in logistics market

Recent Developments

- In June 2024, Microsoft Corp. and Hitachi Ltd. announced a multibillion-dollar partnership expected to take place over the next three years and accelerate social innovation through generative AI. With a projected revenue of 18.9 billion USD in FY2024, Hitachi will drive the expansion of the Lumada business through this strategic agreement. It will also encourage operational efficiency and productivity improvements for the 270,000 employees of the Hitachi Group.

- In September 2024, IBM stated that it has increased the scope of its consulting services and solutions to assist customers in getting more out of Oracle's cloud apps and technology and extending generative AI through an open, coordinated approach. According to recent data from the IBM Institute for Business Value, the average cost of compute consumption is predicted to climb by 89% between 2023 and 2025.

- Report ID: 6478

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Generative AI in Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.