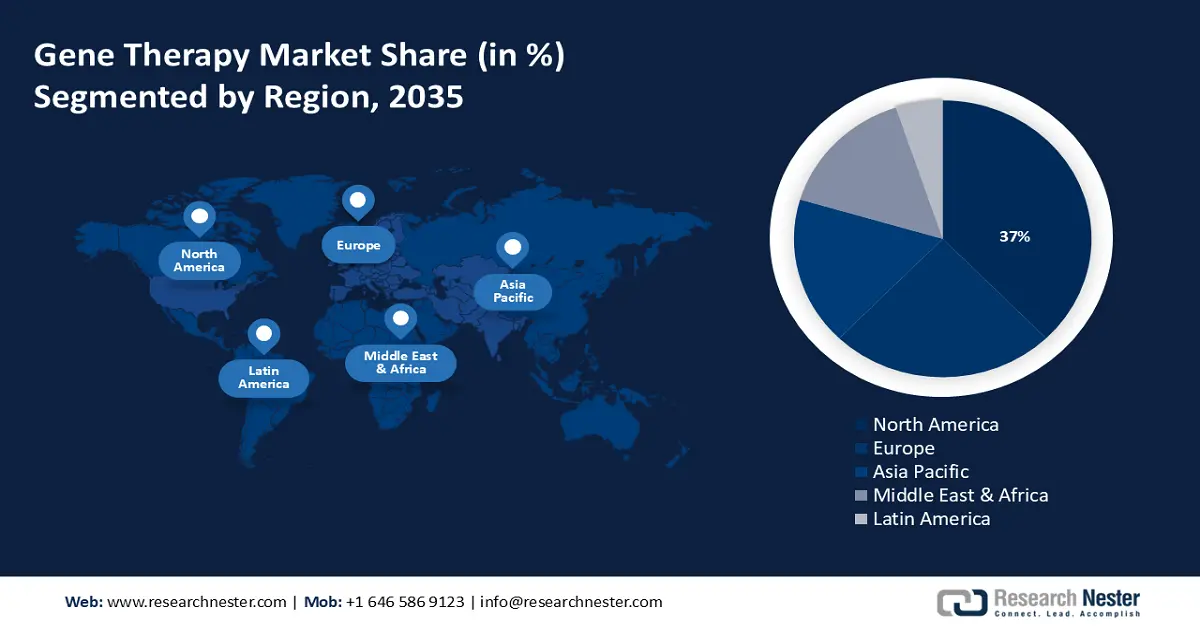

Gene Therapy Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 37% by 2035. The market growth in the region is also expected on account of the presence of extremely sophisticated infrastructure in hospitals, and the availability of cutting–edge technologies, such as the diagnostics needed to determine a patient's eligibility for gene therapy.

The United States has a strong gene therapy pipeline at the moment, with several promising treatments at different phases of research. Numerous of these treatments target uncommon genetic conditions such as hemophilia, choroideremia, Duchenne muscular dystrophy, and spinal muscular atrophy. According to the Centers for Disease Control and Prevention study, up to 33,000 men in the US are expected to have hemophilia A, based on data gathered on patients getting care in federally funded hemophilia treatment centers between 2012 and 2018. Additionally, treatments that can more precisely target particular genetic abnormalities are being developed using gene editing technologies like CRISPR–Cas9.

The market in Canada is being driven by the government's increased investments and the rising incidence of specific diseases. Also, growing investment in healthcare is accelerating the market growth in the region. According to the Canadian Medical Association, it was projected that Canada will spend USD 344 billion on health care, or USD 8,740 per person in 2023.

European Market Insights

Gene therapy market size for Europe region is projected to witness high growth during the forecast period due to the region’s sizable population, unmet medical requirements, and the need for cutting–edge solutions to address uncommon but more common diseases. According to the European Commission report in 2023, the EU's total population increased by 4%, from 429 million to 447 million, between 2001 and 2020. The European Union (EU) was home to 446.7 million people as of January 2022.

The surging investments by various big companies and governments in the United Kingdom are influencing the growth of the market in the region. According to the UK Government, The National Health Service (NHS) offers a research support service to sponsors and contract research organizations (CROs) with an annual investment of USD 1.09 billion. It is home to sixty cell and gene therapy experiments at the moment.

Due to significant expenditures made by both the public and commercial sectors, which have accelerated the growth of the nation's cell and gene therapy market, Germany stands at the forefront of this field. Germany is now engaged in the development and testing of novel cell and gene therapy medications that provide significant advantages to patients.