Gene Therapy Market Outlook:

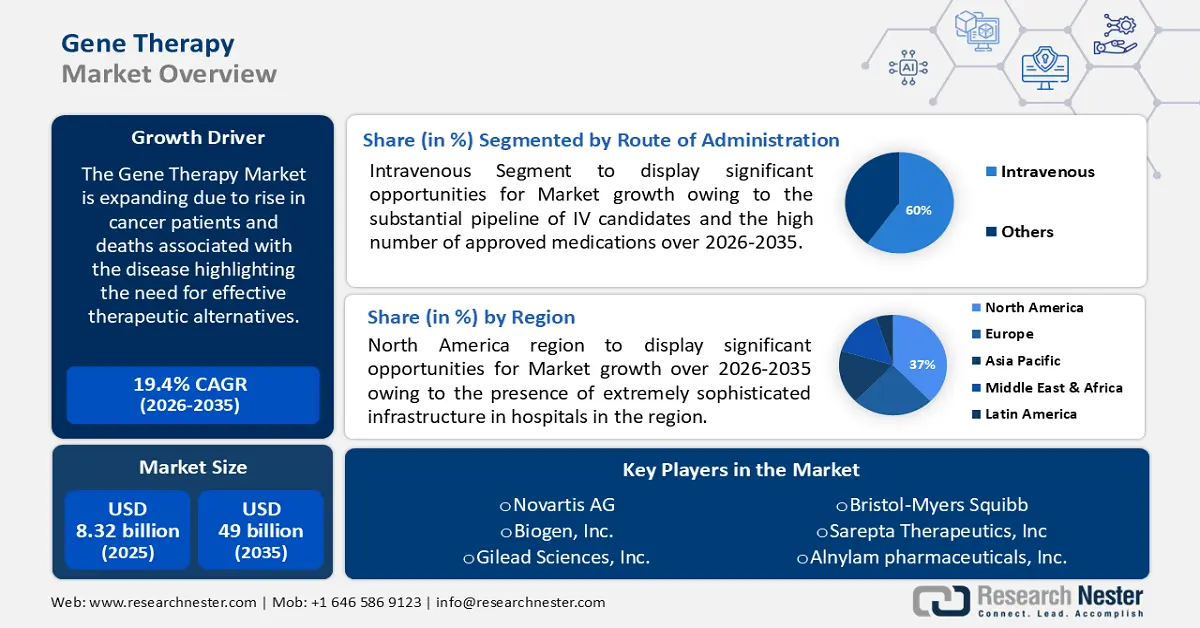

Gene Therapy Market size was over USD 8.32 billion in 2025 and is projected to reach USD 49 billion by 2035, witnessing around 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gene therapy is evaluated at USD 9.77 billion.

The market is expanding due to the rise in cancer patients and deaths associated with the disease highlighting the need for effective therapeutic alternatives. The World Health Organization predicts that there will be over 35 million new cases of cancer in 2050, up 77% over the 20 million cases expected in 2022. Furthermore, WHO anticipated that high HDI nations will see the most absolute increases in incidence, with an extra 4.8 million new cases estimated in 2050 compared to estimates for 2022.

Key Gene Therapy Market Insights Summary:

Regional Highlights:

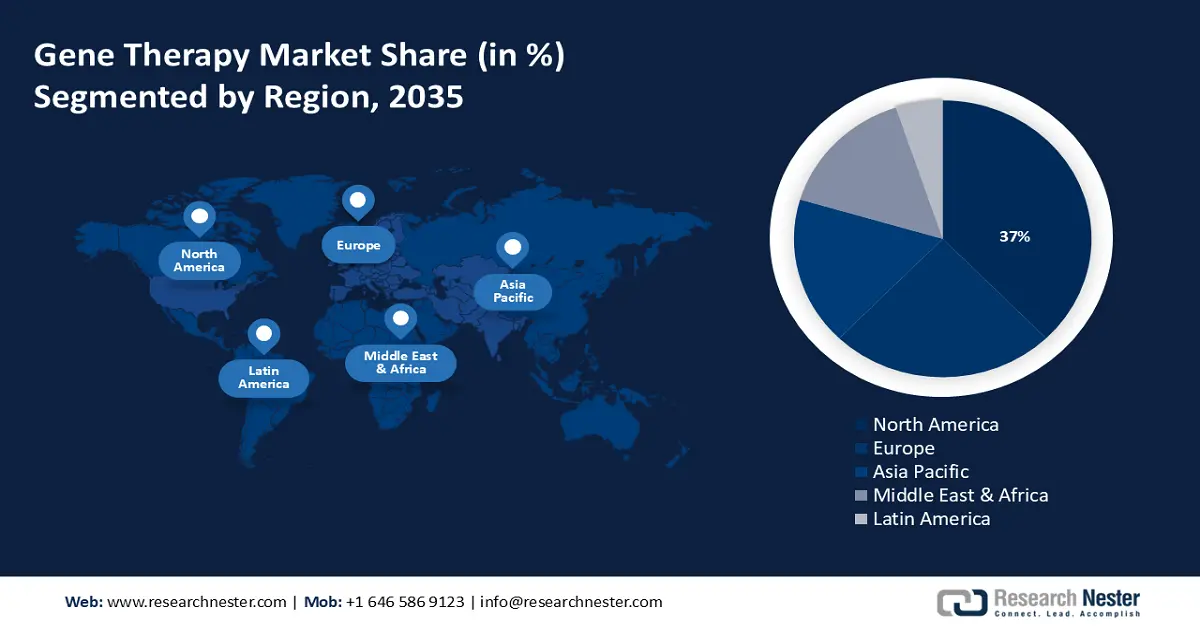

- The North America gene therapy market is anticipated to capture 37% share by 2035, driven by the presence of sophisticated infrastructure and availability of cutting-edge technologies.

Segment Insights:

- The intravenous segment in the gene therapy market is expected to expand significantly by 2035, fueled by a substantial pipeline of IV candidates and a high number of approved medications.

Key Growth Trends:

- Surge in the approval for gene therapy products

- Growing R&D activities in genetic therapies

Major Challenges:

- Higher costs of gene therapy products

- Shorter shelf life

Key Players: Novartis AG, Biogen Inc., Gilead Sciences, Inc., Bristol–Myers Squibb, Alnylam Pharmaceuticals, Sarepta Therapeutics, Orchard Therapeutics, Celgene Corporation.

Global Gene Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.32 billion

- 2026 Market Size: USD 9.77 billion

- Projected Market Size: USD 49 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Gene Therapy Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the approval for gene therapy products – Gene therapy products are subject to stringent regulatory review before approval. They produce longer–lasting and more powerful therapeutic effects than conventional methods by acting at the genetic level. Because of this significant benefit, it has been seen that the number of approvals for gene therapy products has increased.

According to the National Institute of Health, gene therapy products have been approved for use in the European Union and seven other nations. It is projected that by 2030, there will be more than 60 new certified products in the market. Furthermore, a sizable number of clinical pipeline drugs are anticipated to obtain final approval during the projected period.

- Growing R&D activities in genetic therapies – The study of cell and gene therapies has seen an increase in research and development efforts. This is because gene and cell treatments can treat a variety of conditions, particularly neurological indications for which there is now no proven cure.

Pharmaceutical and biotechnology businesses have the chance to invest in the research and marketing of innovative cell and gene therapies in this field. Additionally, specific therapeutic effects are produced by gene and cell therapies. As a result, their adoption has been primarily motivated by the desire to lower ongoing medical expenses.

- Surge in technological advancements in recombinant DNA technology – The continued advancements in recombinant DNA technology will increase the number of active gene therapy clinical trials. These developments are mostly being made in relation to different expression systems and gene–editing instruments to support product R&D. The development of ZFN, TALEN, and CRISPR/Cas9 nuclease has made genome editing simple and accurate. Because of this, there have been a lot of research projects in the gene–editing field recently, which is anticipated to have an impact on the gene therapy market.

Challenges

- Higher costs of gene therapy products – Extensive research and development efforts are being made to create cutting–edge remedies like gene therapy. As such, they require a substantial time and financial commitment. Clinical trials, regulatory approval, preclinical testing, and laboratory research are all included in the expenditures. Products use vectors, which must be created and separately engineered under specifications. This adds to the entire manufacturing process' complexity. Production expenses are increased by the need for extremely controlled manufacturing processes and strict adherence to quality standards.

- Shorter shelf life – Products used in cell and gene therapy have drastically differing shelf lives. The brief shelf life of viral vectors raises their price and restricts their availability. Because short–lived viral vectors must be produced in small batches, the entire procedure is costly and time–consuming.

Furthermore, cell and gene therapy products, as well as some biological samples, require extremely cold temperatures, ranging from –4°C and –20°C to –80°C, –120°C, –150°C, and beyond. This contrasts standard biological therapies, which also require temperature management.

Gene Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 8.32 billion |

|

Forecast Year Market Size (2035) |

USD 49 billion |

|

Regional Scope |

|

Gene Therapy Market Segmentation:

Type Segment Analysis

Gene silencing segment in the gene therapy market is estimated to grow substantially through 2035. The segment growth can be credited to the presence of several gene therapy products that use a method of gene silencing. Silencing genes has also been shown to be a useful strategy, particularly against neurological disorders like neuromuscular illnesses.

The effectiveness and specificity of gene silencing techniques have been greatly improved by ongoing developments in gene editing technologies, including CRISPR–Cas9, RNA interference (RNAi), and antisense oligonucleotides, which often reduce a gene’s expression by at least 70% without completely eliminating it.

Therapeutic Area Segment Analysis

Neurology segment in the gene therapy market is estimated to register lucrative growth till 2035. The segment is growing due to the technological advancements in gene therapy. Highly specific viral vector designs, plasmid transfection, nanoparticles, polymer–mediated gene delivery, engineered microRNA, and in vivo clustered regulatory interspaced short palindromic repeats (CRISPR)–based therapeutics have been the focus of recent technological advancements for improved gene sequence delivery.

Highly common neurological and neurodevelopmental disorders, such as Parkinson's disease, Alzheimer's disease, and autism spectrum disorder, can be effectively treated with these cutting–edge techniques. According to Alzheimer’s Disease International Organization, in 2020, there were about 55 million dementia patients worldwide. By 2050, there will be 139 million people on the planet, having nearly doubled every 20 years to 78 million in 2030. Therefore, the growing cases of such diseases are propelling the growth of the segment.

Route of Administration Segment Analysis

By the end of 2035, intravenous segment is estimated to capture gene therapy market share of around 60%. The primary driver of the segment's dominance is the substantial pipeline of IV candidates and the high number of approved medications. The least complex and intrusive technique for cardiac gene transfer that is currently available is intravenous injection. Injection into the tail vein of rodents successfully expresses the cardiac gene. Throughout the projected period, this segment is likewise anticipated to become the most lucrative.

Our in–depth analysis of the market includes the following segments:

|

Type |

|

|

Vector |

|

|

Therapeutic Area |

|

|

Delivery Method |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gene Therapy Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 37% by 2035. The market growth in the region is also expected on account of the presence of extremely sophisticated infrastructure in hospitals, and the availability of cutting–edge technologies, such as the diagnostics needed to determine a patient's eligibility for gene therapy.

The United States has a strong gene therapy pipeline at the moment, with several promising treatments at different phases of research. Numerous of these treatments target uncommon genetic conditions such as hemophilia, choroideremia, Duchenne muscular dystrophy, and spinal muscular atrophy. According to the Centers for Disease Control and Prevention study, up to 33,000 men in the US are expected to have hemophilia A, based on data gathered on patients getting care in federally funded hemophilia treatment centers between 2012 and 2018. Additionally, treatments that can more precisely target particular genetic abnormalities are being developed using gene editing technologies like CRISPR–Cas9.

The market in Canada is being driven by the government's increased investments and the rising incidence of specific diseases. Also, growing investment in healthcare is accelerating the market growth in the region. According to the Canadian Medical Association, it was projected that Canada will spend USD 344 billion on health care, or USD 8,740 per person in 2023.

European Market Insights

Gene therapy market size for Europe region is projected to witness high growth during the forecast period due to the region’s sizable population, unmet medical requirements, and the need for cutting–edge solutions to address uncommon but more common diseases. According to the European Commission report in 2023, the EU's total population increased by 4%, from 429 million to 447 million, between 2001 and 2020. The European Union (EU) was home to 446.7 million people as of January 2022.

The surging investments by various big companies and governments in the United Kingdom are influencing the growth of the market in the region. According to the UK Government, The National Health Service (NHS) offers a research support service to sponsors and contract research organizations (CROs) with an annual investment of USD 1.09 billion. It is home to sixty cell and gene therapy experiments at the moment.

Due to significant expenditures made by both the public and commercial sectors, which have accelerated the growth of the nation's cell and gene therapy market, Germany stands at the forefront of this field. Germany is now engaged in the development and testing of novel cell and gene therapy medications that provide significant advantages to patients.

Gene Therapy Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biogen Inc.

- Gilead Sciences, Inc.

- Bristol–Myers Squibb

- Alnylam Pharmaceuticals, Inc.

- Sarepta Therapeutics, Inc.

- Orchard Therapeutics Limited

- Celgene Corporation

- Spark Therapeutics, Inc.

- Sibino GeneTech Co., Ltd.

The introduction of new medicines, technologically sophisticated product launches, regulatory approvals, acquisitions, and joint ventures with other businesses are the activities of major players in the global market. These tactics are probably going to encourage the worldwide market's expansion.

Recent Developments

- Novartis presented new research demonstrating the transformational and long–term benefits of Zolgensma, a one–time gene therapy for the treatment of spinal muscular atrophy (SMA). The most recent findings from two Long–Term Follow–Up (LTFU) trials, LT–001 and LT–002, reveal that Zolgensma continues to be efficacious and durable across a wide variety of patient demographics, with a positive overall benefit–risk profile.

- Biogen Inc. announced that the European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP) has issued a positive opinion recommending a marketing authorization under exceptional circumstances for QALSODY® for the treatment of adults with amyotrophic lateral sclerosis (ALS) caused by a mutation in the superoxide dismutase 1 gene.

- Report ID: 6234

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gene Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.