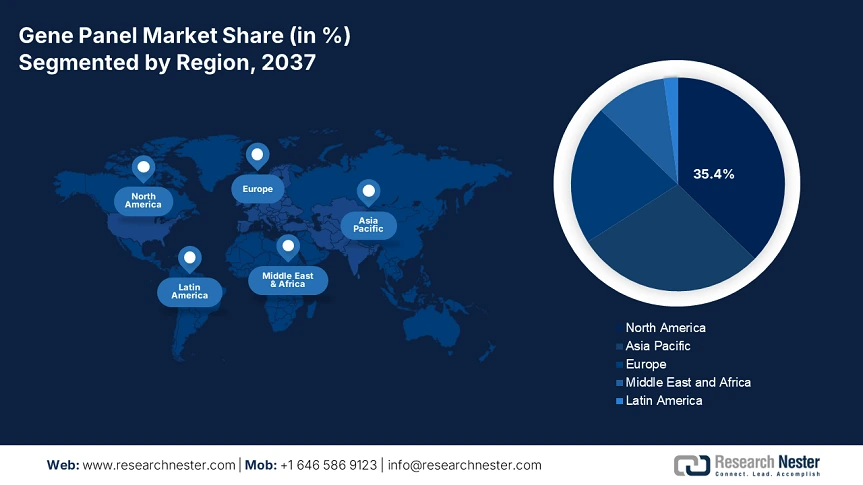

Gene Panel Market - Regional Analysis

North America Market Insights

The gene panel market is anticipated to hold 35.4% of the share of the global market by 2037, driven by sustained development in oncology and newborn screening. The increased federal funding, coupled with the supportive policies under Medicaid and Medicare, is boosting the adoption. The market in the U.S. is witnessing remarkable growth owing to robust federal investment and expanding reimbursement frameworks. In 2023, the genomic sequencing for disease surveillance has received USD 5.1 billion in funding. Also, the technological advancements are the crucial drivers for the machine learning based gene interpretation.

The market in Canada is set to witness staggering growth, anchored by burgeoning investments from the provincial as well as federal governments in the country. The government has infused USD 3.1 billion in 2023 for diagnostics in genomics and diagnostic domains. Hereditary cancer panels are in demand, with 30.2% of breast or ovarian cancer cases associated with mutations in genes. The execution of programs such as Care4Rare uses whole-exome gene panels for various undiagnosed diseases. Companies have launched AI-enabled variant interpretation to upgrade the diagnostic yield.

Asia Pacific Market Insights

The market in Asia Pacific is growing, registering 14% of the CAGR during 2025-2037, owing to a surge in the prevalence of genetic disorders and various genomics initiatives by the government. In China, the National Medical Products Administration (NMPA) is making aggressive regulatory reforms to manage the rising patient pool. The 14th 5-year plan allocated USD 9 billion to precision medicine and genomics. The national GeneBank in the country supports more than 100,000 whole genome sequences every year, bolstering the panel adoption.

India’s gene panel market is witnessing rapid growth owing to rising awareness and advancements in genomic technologies. The Ministry of Health in 2023 stated that Thalassemia and sickle cell anemia cases affect more than 15.1 million people in the country, further propelling the demand for carrier screening panels. Also, Ayushman Bharat & state health schemes are incorporating genetic testing for diagnosing disease in the high-risk populations. Private labs such as MedGenome are widely spreading the cost-efficient gene panel offerings.

Government Investment & Advancements in Gene Panel Market

|

Country |

Gov. Investment in Gene Panel |

Key Advancements (2020–2024) |

|

Japan |

12% of national health budget (~$3B in 2024) |

Nationwide genomic screening under the "Initiative on Rare and Undiagnosed Diseases" (IRUD) |

|

Australia |

$500M invested under Genomics Health Futures Mission (GHFM) through 2024 |

cancer and rare disease screening projects across NSW, VIC |

|

South Korea |

$1.2B allocated to precision medicine and genomics by MOHW by 2023 |

"Korean Genome Project"; over 1.1M NGS tests |

|

Malaysia |

20% increase in gov. funding from 2013–2023 |

Introduction of rare disease and cancer gene panel programs at public hospitals |

Europe Market insights

Europe is anticipated to register a significant market share of the market, driven by the robust government investment and policy harmonization. The expanding cancer and rare disease screening programs and the presence of real-time data infrastructure are fueling the market growth. The EU’s initiatives have enabled broader gene panel access in oncology and the management of infectious diseases. In Germany, the government has invested USD 4.1 billion in gene panel testing and building the infrastructure in 2024. The German Medical Association emphasizes that the gene panels are considered to be standard in diagnostics under the public insurance.

Also, in the UK, the National Health Service (NHS) has infused 8.1% of its healthcare budget in 2023 to upgrade its gene panel technologies. The biobank in the country has genomic data of over 500,100 participants, which is used in conducting clinical trials to refine the level of accuracy. The government has joined hands with Genomic England to extend access to the underserved people, aligning with the equity goals of the NHS. In the post-Brexit era, regulatory flexibility is allowing faster approvals, further propelling the market growth.