Gel Polymer Electrolyte Market Outlook:

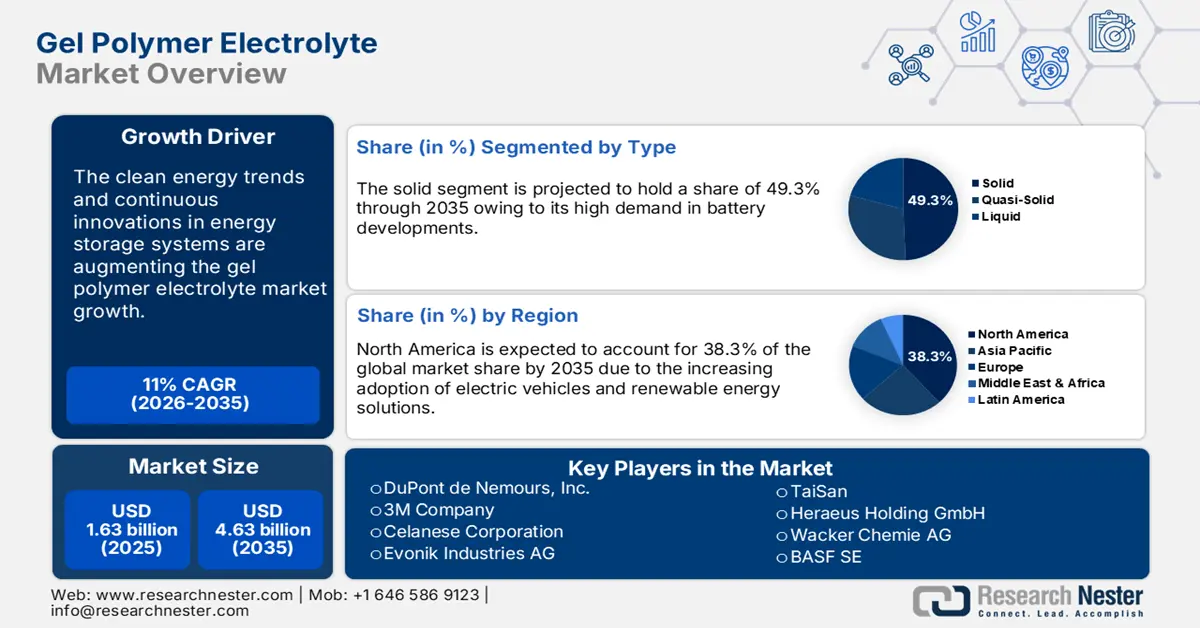

Gel Polymer Electrolyte Market size was valued at USD 1.63 Billion in 2025 and is expected to reach USD 4.63 Billion by 2035, expanding at around 11% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gel polymer electrolyte is evaluated at USD 1.79 Billion.

Gel polymer electrolyte’s (GPE) potential to enhance solid rechargeable batteries’ performance is driving their popularity in the electric vehicle sector. Ongoing innovations are leading to the development of dendrite-free polymer gel electrolytes, 3D printable GPEs, and hybrid solid-state batteries. The increasing adoption of electric vehicles across the world owing to supportive government policies is anticipated to augment the use of gel polymer electrolytes in battery production.

|

Global Electric Car Stock 2023 |

|

|

China BEV |

16.1 million |

|

China PHEV |

5.8 million |

|

Europe BEV |

6.7 million |

|

Europe PHEV |

4.5 million |

|

U.S. BEV |

3.5 million |

|

U.S. PHEV |

1.3 million |

|

Rest of the World BEV |

1.9 million |

|

Rest of the World PHEV |

0.7 million |

Source: IEA

BEV = battery electric vehicle; PHEV = plug-in hybrid vehicle. Includes passenger cars only.

For instance, the International Energy Agency (IEA), revealed that electric vehicle ownership reached around 14.0 million, in 2023. China held a dominating share of 95.0% followed by Europe and the U.S. Currently, the on-road number of electric vehicles has surpassed 40.0 million reflecting the high application of batteries. Furthermore, electric car sales increased by 24.0% in Q1 2024 compared to the previous year. China witnessed half a more commercialization of electric vehicles in 2024 than in 2023. SUV models significantly influenced the sales of batteries in 2023 by holding a dominant share of the global battery electric vehicles.

Key Gel Polymer Electrolyte Market Insights Summary:

Regional Highlights:

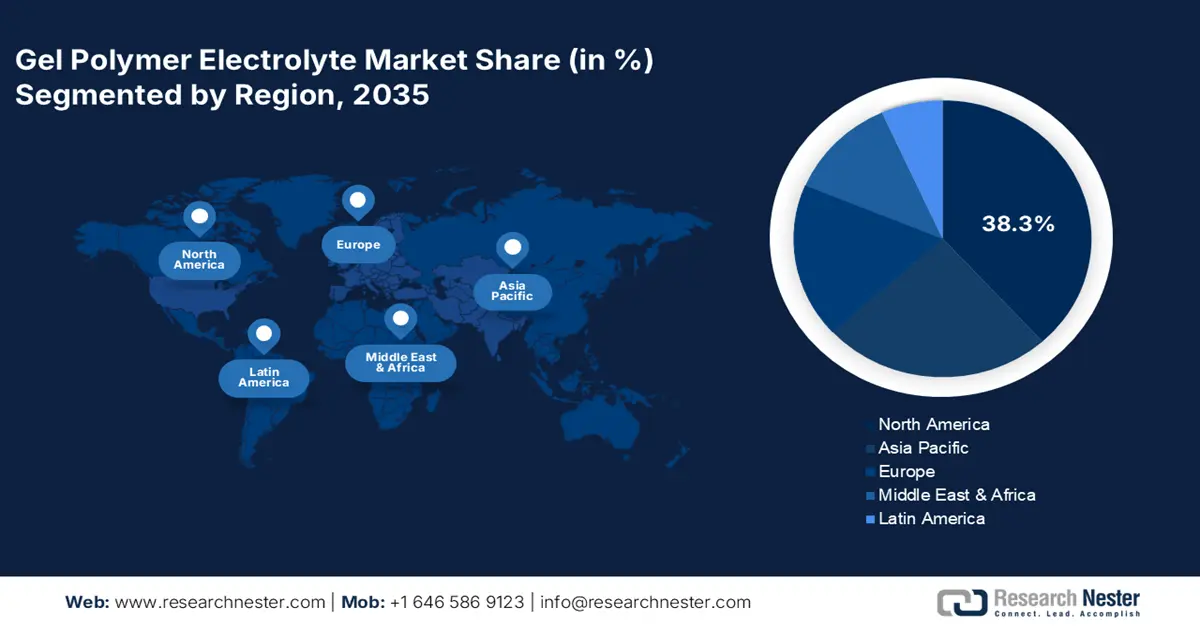

- North America leads the Gel Polymer Electrolyte Market with a 38.3% share, driven by adoption of renewable energy, strict emission regulations, and increasing electric vehicle penetration, ensuring dominance through 2026–2035.

- The Gel Polymer Electrolyte Market in Asia Pacific is set for robust growth through 2026–2035, fueled by government policies promoting renewable energy, growing EV market, and investments in EV charging infrastructure.

Segment Insights:

- The Batteries Segment is expected to dominate by 2035, fueled by trends in renewable energy systems and electric vehicles.

- The Solid Segment is projected to hold a 49.30% share by 2035, fueled by the rising popularity of IoT devices and flexible electronics.

Key Growth Trends:

- High use in consumer electronics

- Clean energy trend

Major Challenges:

- Complex production process

- Gel polymer electrolyte’s limitations

Key Players: DuPont de Nemours, Inc., 3M Company, Celanese Corporation, Evonik Industries AG, and TaiSan.

Global Gel Polymer Electrolyte Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.63 Billion

- 2026 Market Size: USD 1.79 Billion

- Projected Market Size: USD 4.63 Billion by 2035

- Growth Forecasts: 11% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 13 August, 2025

Gel Polymer Electrolyte Market Growth Drivers and Challenges:

Growth Drivers

-

High use in consumer electronics: The increasing demand for miniature, lightweight, and high-capacity batteries in consumer electronics is propelling the sales of gel polymer electrolytes. The advanced and flexible battery designs are gaining traction in electronic products such as smartphones and wearables.

-

Clean energy trend: The growing adoption and popularity of renewable energy systems are estimated to offer lucrative opportunities for gel polymer electrolyte manufacturers. The increasing demand for reliable energy storage solutions to manage the intermittent nature of the energy sources is fueling gel polymer electrolyte use in battery production. GPEs offer long life and high energy densities vital for renewable energy applications. Furthermore, the American Clean Power Association states that the battery storage in the U.S. increased from 47 MW to 17380 MW in 2023. The net-zero emission (NZE) goals are also contributing to the gel polymer electrolyte market growth. Considering this goal, the use of battery energy storage systems is increasing substantially.

|

Globally Installed Energy Storage Capacity by Scenario, 2030 NZE |

|

|

Utility-scale Batteries |

1001 GW |

|

Behind-the-meter Batteries |

203 GW |

|

Pumped Hydro |

293 GW |

|

Other Storage |

6 GW |

Source: IEA

Challenges

-

Complex production process: The manufacturing process of gel polymer electrolytes from polymerization to uniformity of final products is highly complex. This complexity often slows the production cycle hampering the overall sales growth. In such cases, many alternative technology providers witness high-earning opportunities, hindering the gel polymer electrolyte market growth to some extent.

-

Gel polymer electrolyte’s limitations: The poor mechanical strength of the gel polymer electrolytes leads to the leakage of liquid electrolytes hampering the production of lithium-ion batteries. This drawback leads to the recalling of products hindering the goodwill of the companies as well as their revenue shares. The low ionic conductivity in some specific applications is also lowering gel polymer electrolyte demand.

Gel Polymer Electrolyte Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 1.63 Billion |

|

Forecast Year Market Size (2035) |

USD 4.63 Billion |

|

Regional Scope |

|

Gel Polymer Electrolyte Market Segmentation:

Type (Solid, Quasi-Solid, Liquid)

In gel polymer electrolyte market, solid segment is expected to capture over 49.3% revenue share by 2035. The high potential of solid-state gel polymer electrolytes is majorly contributing to its sales growth. This type of gel polymer electrolyte is used in the processing of gallium nitride wafers, which are used in enhancing the performance of zinc-ion batteries. The increasing popularity of flexible electronics and the Internet of Things (IoT) devices is set to augment the demand for solid gel polymer electrolytes. Manufacturers are also investing in technological innovations to develop next-gen gel polymer electrolytes.

Application (Batteries, Supercapacitors, Fuel Cells, Sensors)

The batteries segment is foreseen to account for a dominating gel polymer electrolyte market share by 2035. The renewable energy system and EV trends are fueling the sales of gel polymer electrolytes. The increasing demand for advanced electronics is augmenting the use of gel polymer electrolytes in the production process for long battery spans. The Observatory for Economic Complexity (OEC) report reveals that the global batteries trade stood at USD 9.26 billion in 2022, with 401st rank as the most traded product. The same source also states that the global electric batteries trade totaled USD 130.0 billion in 2022, with 24th rank as the most traded product. China exported around USD 68.7 billion worth of electric batteries in 2022, whereas the U.S. imported USD 23.2 billion of electric batteries. The global electric battery export compound annual growth accounted for 35.5% in 2022.

Our in-depth analysis of the global gel polymer electrolyte market includes the following segments:

|

Type |

|

|

Application |

|

|

Polymer Matrix

|

|

|

Ionic Conductor

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gel Polymer Electrolyte Market Regional Analysis:

North America Market Forecast

By 2035, North America gel polymer electrolyte market is predicted to dominate over 38.3% revenue share. The high adoption of renewable energy systems, strict regulation on emissions, and innovations in battery designs and performance are propelling the sales of gel polymer electrolytes in North America. The high trend of electric vehicles in both the U.S. and Canada is pushing the demand for gel polymer electrolytes in battery production.

In the U.S., the strict regulations on carbon emission and supportive policies on sustainable vehicle adoption are augmenting the sales of gel polymer electrolytes. For instance, as per the analysis by the Alliance for Automotive Innovation, nearly 386,000 electric vehicles were sold in Q2 2024, in the U.S. The hybrid EV share accounted for 2.15% in Q2 FY24. The battery electric vehicles comprising cars, utility vehicles, vans, and pick-ups held a dominant share of the total EV sales in Q2 FY24. California is leading the country with around 27.0% of the new lightweight vehicle registrations in 2nd quarter of 2024. Thus, the rise in EV vehicle registration in the country is creating a win-win pool for gel polymer electrolyte manufacturers.

Canada is the world’s largest producer of renewable energy, which creates a high demand for storage solutions such as batteries. The Canadian Centre for Energy Information estimates that in 2022 the country consumed 70.0% of its electricity from renewable sources. The same source also reveals that electric vehicle registration accounted for 10.8% of the total vehicle registrations, in 2023. Thus, the renewable energy system trend is set to double the profits of gel polymer electrolyte manufacturers in the coming years.

Asia Pacific Market Statistics

The Asia Pacific gel polymer electrolyte market is poised to register a robust CAGR between 2026 to 2035. Supportive government policies in the form of schemes, tax benefits, or subsidies on renewable energy system adoption, the increasing popularity of electric vehicles, investments in EV charging infrastructure, and rapid industrialization are all collectively contributing to the Asia Pacific gel polymer electrolyte market growth. China and India are high-earning marketplaces, while Japan and South Korea are more focused on innovations.

China is set to dominate the production of next-generation battery technologies, according to the report by the Carnegie Endowment for International Peace. The high production of consumer electronics, military equipment, power grid storage solutions, and clean energy vehicles is uplifting the position of China in the global landscape. The boom in the production of these technologies is directly fueling the demand for gel polymer electrolytes.

India is anticipated to witness a healthy demand for gel polymer electrolytes in the coming years owing to the growing adoption of electric vehicles and renewable energy solutions. The prime reason contributing to the clean energy trend is the increasing awareness of environmental protection among individuals and supportive policies from the government end. The India Brand Equity Foundation (IBEF) report reveals that the EV market in the country is set to reach USD 18.31 billion by 2029. The same source also states that the market for EV batteries is poised to expand from USD 16.77 billion in 2023 to USD 27.70 billion by 2028. The Electric Mobility Promotion Scheme worth USD 60.18 million is focused on the enhancement of green mobility and EV production is expected to open profitable doors for gel polymer electrolyte manufacturers in the country.

Key Gel Polymer Electrolyte Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Celanese Corporation

- Evonik Industries AG

- TaiSan

- Heraeus Holding GmbH

- Wacker Chemie AG

- BASF SE

- Entegris, Inc.

- Clariant AG

The gel polymer electrolyte market is anticipated to expand at a high pace during the study period and offer lucrative opportunities to key players. Market growth is mainly characterized by the clean energy trend and the increasing demand for consumer electronics. The leading companies are adopting several organic and inorganic market strategies to earn high profits. New product launches, technological innovations, collaborations with universities, partnerships with other players, mergers & acquisitions, and global expansions are some of the tactics aiding the key players to boost their market reach and revenue shares.

Some of the key players in gel polymer electrolyte market:

Recent Developments

- In July 2024, TaiSan a leading producer of quasi-solid-state sodium batteries for automobiles announced that it raised USD 1.5 million investment to boost the production of its gamechanger BEV technology. By this investment, the company is benefitting the progress of its quasi-solid-state sodium battery technology manufacturing.

- In June 2024, Pohang University of Science and Technology (POSTECH) revealed that a team led by Professor Soojin Park, Seoha Nam, and Dr. Hye Bin Son from the Department of Chemistry achieved a breakthrough in creating a gel electrolyte-based battery. This is effective for both stable and commercial use.

- Report ID: 6992

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gel Polymer Electrolyte Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.