Gaucher Disease Drugs Market Outlook:

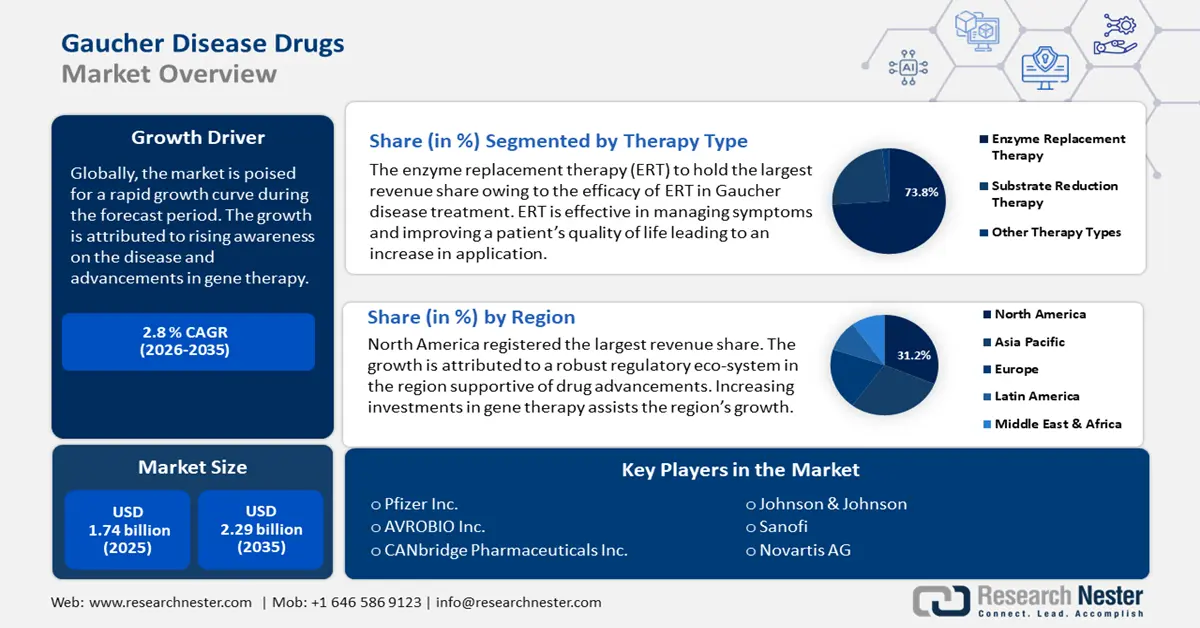

Gaucher Disease Drugs Market size was valued at USD 1.74 billion in 2025 and is set to exceed USD 2.29 billion by 2035, expanding at over 2.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gaucher disease drugs is evaluated at USD 1.78 billion.

The market’s growth is attributed to advancements in enzyme replacement therapies (ERT) and substrate reduction therapies (SRT), that offer life-improvement options for patients diagnosed with gaucher disease.

The disease is rare and life-threatening, and rising awareness globally is leading to more diagnoses, which in turn boosts demands for Gaucher treatment drugs. Additionally, advancements in genetic research have led to more therapies focused on patient outcomes. For instance, in February 2024, a paper published in the Multidisciplinary Digital Publishing Institute highlighted work conducted with different viral vectors and murine models demonstrating promising results for gaucher diseases for gene therapy.

The global gaucher disease drugs market offers lucrative opportunities with rising research on treatments such as chaperone-based and gene therapy. Currently, there is no cure for the disease, which can be a deterrent for the market but advancing therapies in managing symptoms and improving quality of life for patients benefits the sector’s growth. In addition to SRT and ERT, patients diagnosed with Gaucher may require other treatments owing to complications, such as managing anemia and consuming prescription drugs for osteoporosis and bone pain. This opens opportunities for pharmaceutical companies to promote gaucher disease treatment drugs as a bundle with the primary treatment (SRT or ERT) along with medications for managing secondary conditions. This approach can be cost-effective for patients and offer greater convenience.

Increasing partnerships between pharmaceutical companies with expertise in gene editing make it promising to develop a potentially curative treatment in the future. For instance, in October 2024, Editas announced a partnership of its CRISPR platform with Genevant’s LP technology to develop novel gene editing technologies in a deal estimated to be USD 283 million. Increasing regulatory approval for Gaucher drugs benefits the robust growth of the gaucher disease drugs sector by improving the accessibility of treatment to different demographics.

Regulatory advantages can reduce development risks and financial barriers associated with launching drugs, making market entry lucrative for newcomers. Additionally, the global market is positioned to leverage increased government support and research to improve treatments and diagnosis rates. The favorable trends are positioned to fuel the gaucher disease drugs market’s profitable growth curve by the end of the forecast period.

Key Gaucher Disease Drugs Market Insights Summary:

Regional Highlights:

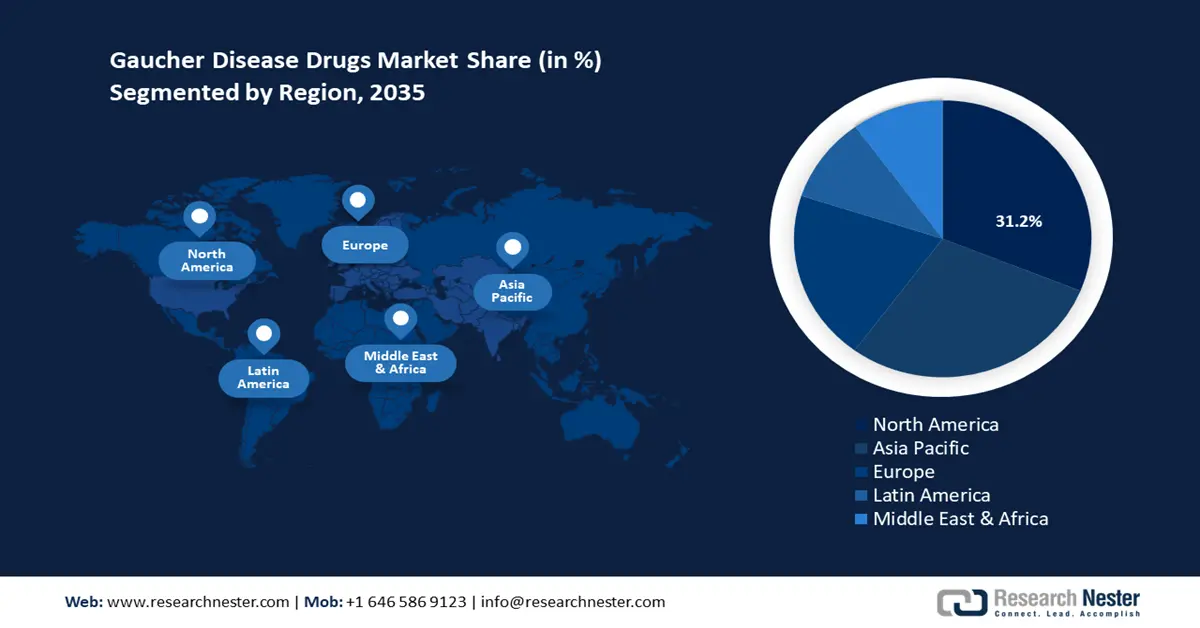

- North America's 31.2% share in the Gaucher Disease Drugs Market is bolstered by a favorable regulatory ecosystem supporting clinical trials and drug approvals, ensuring leadership through 2026–2035.

- Asia Pacific’s Gaucher disease drugs market is poised for rapid growth by 2035, fueled by improved healthcare infrastructure and rising awareness of Gaucher disease.

Segment Insights:

- The Substrate Reduction Therapy segment is forecasted to increase its revenue share from 2026 to 2035, attributed to its suitability for patients unable to undergo infusions, especially children and pregnant women.

- The Type 1 segment is expected to maintain the largest revenue share by 2035, driven by its high prevalence, manageability, and responsiveness to ERT and SRT treatments.

Key Growth Trends:

- Government support for rare disease treatment

- Rising investments in gene therapy research

Major Challenges:

- Treatment limitation and side effects impacting the quality of life

- Delays in drug approvals

- Key Players: Pfizer Inc., CANbridge Pharmaceuticals Inc., Johnson & Johnson Private Ltd., AVROBIO Inc., Amicus Therapeutics Inc., Novartis AG, Sanofi, Amerigen Pharmaceuticals Ltd., and Dipharma S.A.

Global Gaucher Disease Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.74 billion

- 2026 Market Size: USD 1.78 billion

- Projected Market Size: USD 2.29 billion by 2035

- Growth Forecasts: 2.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: Germany, France, UK, Brazil, Mexico

Last updated on : 14 August, 2025

Gaucher Disease Drugs Market Growth Drivers and Challenges:

Growth Drivers

-

Government support for rare disease treatment: Rising government and non-profit organizations' support for the treatment of rare diseases benefits the growth of the gaucher disease drugs sector. Financial support improves access to treatment to wider demographics. Additionally, recognition of a disease as a rare one benefits in ushering greater research investments to study the disease and formulate effective treatments. For instance, non-profit organizations like the National Gaucher Foundation offer financial support for Gaucher patients, reducing the economic burden of Gaucher care.

Additionally, gaucher disease has been identified as a rare disease in the registries of multiple countries, making patients eligible to apply for financial assistance. The sector also benefits from regulatory approvals of gene therapies. For instance, in October 2020, Prevail Therapeutics received U.S. FDA fast-track designation for PROO1 for the treatment of neuronopathic gaucher disease. - Rising investments in gene therapy research: Growing investments in gene therapy research are poised to benefit the global gaucher disease drugs market. Advancements in gene therapy open the possibility of a curative treatment for gaucher’s.

Pharmaceutical and biotech companies are devising ways to correct the glucocerebrosidase (GBA) gene mutation. For instance, in October 2024, a USD 150 million investment was announced for a state-of-the-art cell and gene therapy hub to be built on Long Island, U.S. Additionally, the increasing support from regulatory bodies globally bodes well for gene therapy research on gaucher disease. For instance, in October 2022, AVROBIO’s AVR-RD-02, i.e., an investigational gene therapy to treat gaucher disease type 1 was granted rare pediatric disease designation by the Food and Drugs Administration (FDA). - Expansion of access to healthcare in emerging markets: Improvements in the healthcare sector in emerging markets benefit the gaucher disease drugs market. Opportunities in emerging economies provide pharmaceutical companies to collaborate and distribute therapeutics boosting revenue share. Emerging economies such as India, Brazil, and Indonesia, are rapidly investing in improving their healthcare sectors. Pharmaceutical companies can partner with local governments to improve the distribution chain of gaucher therapeutics, improving access to people. For instance, in August 2023, a paper published in the National Library of Medicine provided an expert consensus document for the management of type 1 gaucher disease by local experts in South Africa and provided 205 management goals and best practice statements.

Challenges

-

Treatment limitation and side effects impacting the quality of life: gaucher disease is a neurodegenerative lysosomal disorder. The lack of curative treatment can affect patient adherence and side effects can deteriorate quality of life. The challenge of long-term treatment and lifestyle disruption can deter patients from adhering to prescribed treatment protocols. Additionally, lack of awareness can prove to be a challenge for the gaucher disease drugs sector as the rarity of the diseases can lead to limited diagnosis due to a lack of proper healthcare infrastructure in emerging economies.

- Delays in drug approvals: Regulatory complexities in various regions can delay the approval of drugs and clinical trials, affecting the growth of the gaucher disease drugs sector. Countries where the rare disease frameworks are not well established or with a lack of adequate funding in healthcare can stifle the regulatory approval process for therapeutics. Regulatory hurdles can delay the timely access of drugs to patients and be a barrier to small-scale pharmaceutical companies to bear the logistical strain of an unfavorable regulatory ecosystem.

Gaucher Disease Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.8% |

|

Base Year Market Size (2025) |

USD 1.74 billion |

|

Forecast Year Market Size (2035) |

USD 2.29 billion |

|

Regional Scope |

|

Gaucher Disease Drugs Market Segmentation:

Therapy Type (Enzyme Replacement Therapy, Substrate Reduction Therapy)

By therapy type, the enzyme replacement therapy (ERT) segment is expected to hold over 73.8% gaucher disease drugs market share by the end of 2035 and is projected to maintain a steady growth rate during the forecast period. The growth of the segment is attributed to the efficacy of ERT in managing symptoms and improving patient quality of life. ERT reduces the lipid buildup in patients by supplementing synthetic glucocerebrosidase.

The FDA has approved Cerezyme (imiglucerase), VPRIV (velaglucerase alfa), and Elelyso (taliglucerase alfa) as ERT drugs. The drugs have shown success in stabilizing symptoms such as enlarged liver/spleen (hepatosplenomegaly) leading to increasing adoption in treatment. Additionally, increasing research in ERT and coverage by government-backed plans on ERT drug costs is positioned to maintain a steady growth of the segment in the global gaucher disease drugs market. For instance, in June 2022, Pharmac, the government agency deciding the funding of medicines in Aotearoa, New Zealand, announced the decision to manage funded access to ERT to standard special authority allowing clinicians a streamlined approach to apply for funded access to ERT for patients.

Substrate reduction therapy (SRT) segment of the market is poised to increase its revenue share by the end of 2035. The growth of the segment is attributed to the rising adoption of SRT as an alternative to ERT for patients who cannot undergo regular blood infusions. SRT enables the body to partially block the production of glucocerebroside. The therapy has emerged as ideal for children and pregnant women, boosting its adoption and fueling the growth of the segment.

Cerdelga (eliglustat) and Zavesca (miglustat) are two FDA approved drugs for SRT. The segment benefits from increasing approval by regulatory bodies of SRT drugs benefitting the growth of the market. For instance, Breckenridge Pharmaceuticals Inc. announced that the U.S. Food and Drug Administration granted final approval of its abbreviated new drug application for Zavesca or Miglusat capsules of 100 mg which will be commercialized by a manufacturer based in the U.S.

Disease Type (Type 1, Type 3)

Based on disease type, the type 1 segment registered the largest revenue share in the gaucher disease drugs market. The segment’s growth is attributed to type 1 gaucher disease being the most prevalent and manageable form of the disease. Type 1 is non-neuronopathic because it usually does not affect the spinal cord and the brain. Additionally, type 1 gaucher disease is responsive to ERT and SRT treatments, leading to a high diagnosis rate that expands demands for targeted treatment of the disease. Pharmaceutical companies are leveraging the burgeoning demands of treatment for type 1 gaucher disease by investing in clinical trials and pushing for regulatory approval so that commercialization can be initiated. For instance, in January 2022, Freeline announced FDA clearance of an investigational new drug application for FLT201 for gaucher disease type 1 and it is the first AAV-mediated gene therapy for patients.

Our in-depth analysis of the global market includes the following segments:

|

Therapy Type |

|

|

Disease Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gaucher Disease Drugs Market Regional Analysis:

North America Market Forecast

North America industry is likely to dominate majority revenue share of 31.2% by 2035. The market’s growth is attributed to the presence of a favorable regulatory ecosystem benefiting increasing clinical trials and drug approvals. The market’s profit share is led by the U.S. and Canada. Rising awareness of rare disease management and gaucher benefits the robust growth of the sector in the region. Additionally, access to advanced therapeutics supported by a well-established healthcare sector is positioned to continue the market’s profitable growth. For instance, in January 2020, AVROBIO announced FDA clearance for the new drug application for AVR-RD-02, i.e., an investigational gene therapy for gaucher disease treatment.

The U.S. holds the largest revenue share in the gaucher disease drugs sector. The market’s profitable growth curve is owed to a favorable regulatory environment supporting research on rare diseases. The U.S. Orphan Drug Act incentivizes pharmaceutical companies to develop drugs for rare diseases by offering tax credits and market exclusivity for a 7-year period. This creates a favorable regulatory environment for pharmaceutical and biotech firms to invest in research to find curative treatments for gaucher disease. Additionally, a well-established healthcare sector allows better management of conditions associated with gaucher such as anemia and bone disease. For instance, in March 2024, the FDA approved the first interchangeable biosimilars to Prolia and Xgeva to treat certain forms of osteoporosis that is a common side effect of gaucher disease.

Canada is poised to increase its revenue share in the global gaucher disease drugs market owing to expanding network of specialized treatment centers and a favorable healthcare system. The country’s universal healthcare improves access of treatments to wider demographics benefiting the market’s growth. Additionally, the domestic market in Canada benefits from government support to research efforts that have the potential to find new effective treatment for gaucher. For instance, in February 2024, the government invested USD 20 million to improve health outcomes of children diagnosed and living with rare diseases.

Domestic and global players eyeing the market in Canada can benefit from the government’s push to make drugs for rare disease more effective and affordable by leveraging government backed programs and funds. For instance, in March 2023, Canada launched the National Strategy for Rare Diseases to improve access and affordability of drugs effective for rare diseases and invested USD 32 million to advanced rare disease research in the country.

APAC Market Analysis

The APAC gaucher disease drugs market is poised to register the fastest growth in revenue share by the end of the forecast period. The growth is attributed to expanding healthcare infrastructure in the region coupled with rising awareness on the disease. Governments in APAC countries are boosting national frameworks on rare diseases, that is positioned to benefit the market. China, India, Japan, South Korea, and Australia lead the revenue share in APAC. A rising push for increasing government support for gaucher disease treatment is projected to benefit the market. For instance, in October 2024, the Lysosomal Storage Disorders Support Society of India forwarded a petition to the Government of India seeking sustainable treatment support for all patients diagnosed with Gaucher.

China is poised to register the largest share in the gaucher disease drugs market in APAC owing to promising research initiatives in the country led by CANbridge Pharmaceuticals Inc. For instance, in July 2023, CANbridge Pharmaceuticals Inc. announced the completion of the CAN103 phase 2 trial with the final patient completing their visit; CAN103 is a clinical-stage enzyme replacement therapy (ERT) that is showing promise for gaucher treatment.

Gaucher disease awareness is gradually picking steam in the country as efforts of genetic screening improve. The market’s future is promising in China as investments in improving health infrastructure and formulating policies to support rare diseases are positioned to benefit the gaucher disease drugs sector.

India is poised to increase its revenue share in the gaucher disease drugs sector in APAC. The large population in the country provides promising opportunities for pharmaceutical companies but a lack of awareness of gaucher disease leads to misdiagnosis or patients remaining undiagnosed. Recent trends are addressing the challenge and are positioned to benefit the market in India.

A major breakthrough is the inclusion of gaucher in the National Policy of Rare Diseases which is poised to reduce the economic burden of patients suffering from the disease, increasing patient footfall and treatment adoption in the country. For instance, in August 2024, the National Policy of Rural Diseases included gaucher Type 1 and Type 3 as diseases for which definitive treatment is available but face challenges to make optimal patient selection for benefit, very high cost, and lifelong therapy. This is positioned to create a favorable ecosystem in the country within the healthcare sector to support gaucher disease care.

Key Gaucher Disease Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CANbridge Pharmaceuticals Inc.

- Johnson & Johnson Private Ltd.

- AVROBIO Inc.

- Amicus Therapeutics Inc.

- Novartis AG

- Sanofi

- Amerigen Pharmaceuticals Ltd.

- Dipharma S.A

The global gaucher disease drugs market is poised for robust growth during the forecast period. Companies in the sector are investing in acquisitions for better distribution of drugs and investments in research and clinical trials to improve the efficacy of treatment.

Here are some key players in the market:

Recent Developments

- In September 2024, CANbridge Pharmaceuticals Inc., reported that CAN103 (velaglucerase-beta), a recombinant human glucocerebrosidase ERT that is being developed to treat GD Types I and III, has been granted priority review status by the Center for Drug Evaluation (CDE) of the National Medical Products Administration (NMPA) of China.

- In May 2024, CENTOGENE and Evotec announced the discovery of a promising new molecule to treat gaucher disease. The new molecule has the potential to treat patients with type 2 and type 3 gaucher disease.

- Report ID: 6658

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gaucher Disease Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.