Gasoline Direct Injection Market Outlook:

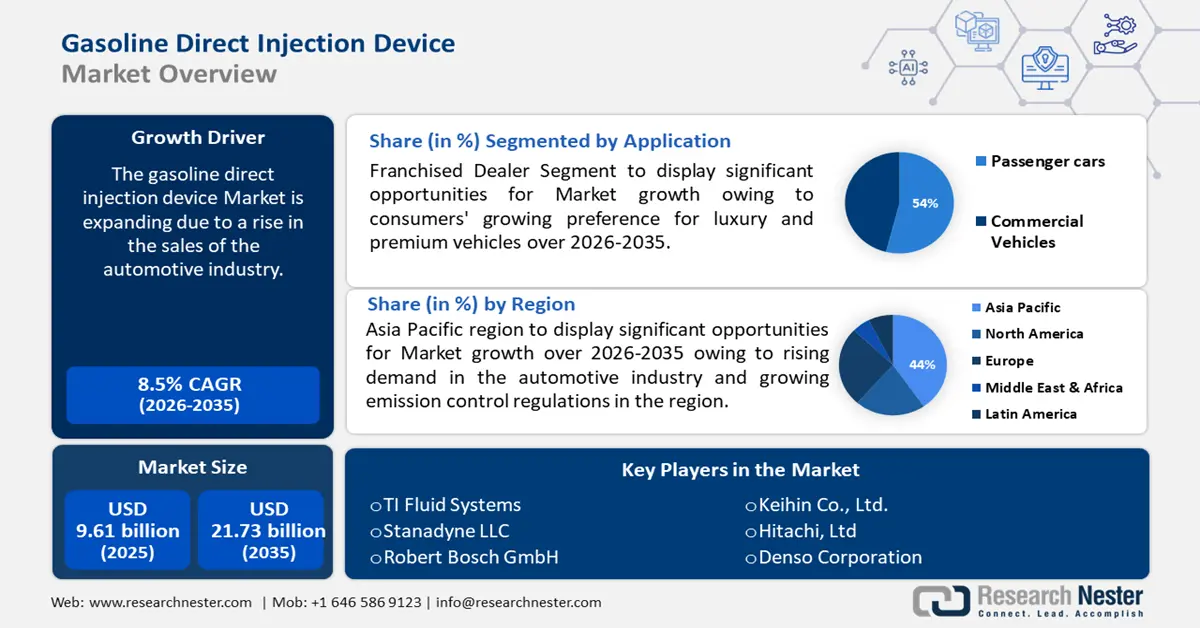

Gasoline Direct Injection Market size was over USD 9.61 billion in 2025 and is poised to exceed USD 21.73 billion by 2035, witnessing over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gasoline direct injection is estimated at USD 10.35 billion.

The automobile industry has significantly propelled the gasoline direct injection (GDI) market by prioritizing fuel efficiency, performance, and compliance with stringent emission regulations. As manufacturers seek to enhance engine efficiency and power output, GDI technology has become a preferred choice, especially for turbocharged engines.

Additionally, the industry’s substantial investments in research and development, coupled with the rising demand for high–performance and eco–friendly vehicles, have accelerated the adoption and advancement of GDI systems globally. For instance, as of in May 2023, 85 million automobiles were produced globally in 2022, up 5.7% from 2021, according to The European Automobile Manufacturers Association (ACEA), a Germany–based association of automobile manufacturers. Thus, the market for gasoline direct injection (GDI) is being driven by the increase in vehicle sales and manufacture.

Key Gasoline Direct Injection Market Insights Summary:

Regional Highlights:

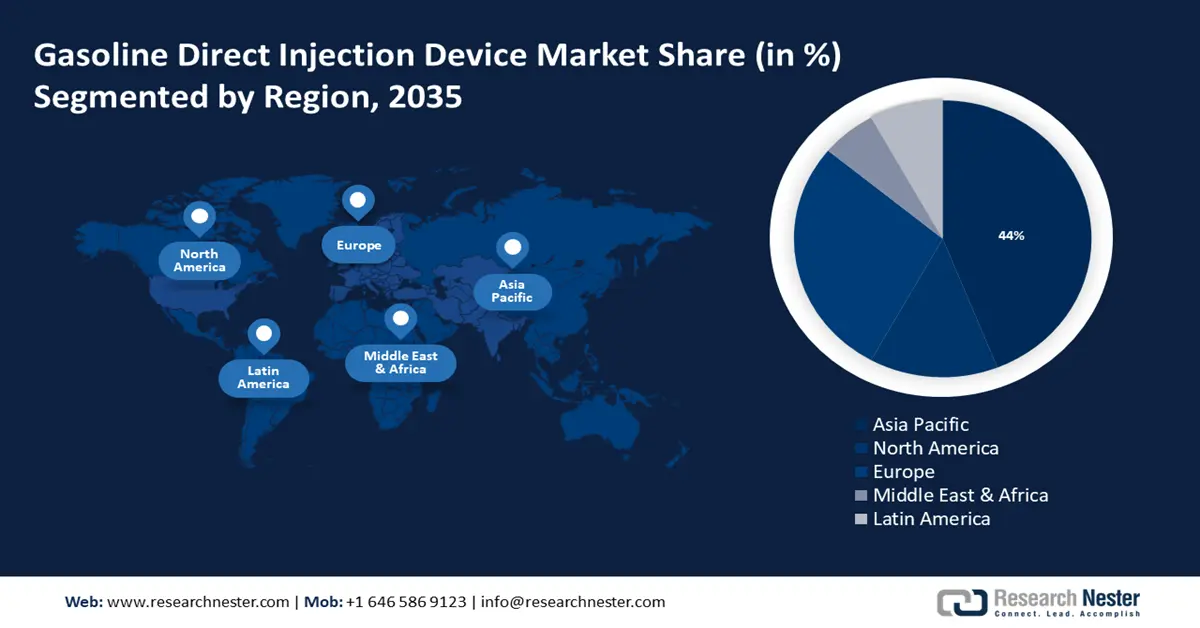

- The Asia Pacific gasoline direct injection market achieves a 44% share by 2035, driven by high vehicle production, demand for fuel efficiency, and stringent emission regulations.

- The Europe market will exhibit huge growth during the forecast timeline, driven by strict fuel efficiency targets and the presence of major automakers.

Segment Insights:

- The passenger cars (pc) segment in the gasoline direct injection market is projected to achieve a 54% share by 2035, influenced by growing consumer preference for luxury vehicles and stricter emission regulations.

- The gasoline turbocharger segment in the gasoline direct injection market anticipates substantial growth, driven by demand for improved engine performance and fuel efficiency via turbocharging technology, over the forecast period 2026-2035.

Key Growth Trends:

- Stringent rules aimed at decreasing CO2 emissions will fuel market expansion

- The growing emphasis on fuel efficiency

Major Challenges:

- Rising high carbon deposits

- High cost of GDI Engines

Key Players: Delphi Automotive LLP, Marelli Europe S.p.A., TI Fluid Systems, Stanadyne LLC, Robert Bosch GmbH, Continental AG, MSR–Jebsen Technologies, Renesas Electronics.

Global Gasoline Direct Injection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.61 billion

- 2026 Market Size: USD 10.35 billion

- Projected Market Size: USD 21.73 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, Japan, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Gasoline Direct Injection Market Growth Drivers and Challenges:

Growth Drivers

- Stringent rules aimed at decreasing CO2 emissions will fuel market expansion – Tightened CO2 emission regulations for carbon capture and storage are boosting the gasoline direct injection market. For instance, the Environmental Protection Agency (EPA) recently finalized new national Greenhouse Gas (GHG) emissions limits for model years 2023–2026 of passenger cars and light trucks. This will lower GHG emissions and other pollutants, saving consumers money on gasoline and improving public health. Gasoline Direct Injection (GDI) technology, used in internal combustion engines, consumes less gasoline compared to traditional engines.

- The growing emphasis on fuel efficiency – Gasoline direct injection (GDI) market is driven by fuel efficiency by optimizing fuel delivery directly into the combustion chamber, which enhances combustion efficiency and reduces fuel consumption. This improvement meets consumer demand for cost–effective, fuel–efficient vehicles and helps manufacturers comply with stringent emission regulations, further accelerating the adoption of GDI technology in modern automotive engines.

The fuel efficiency for new 2022 car models is estimated to be 26.4 mpg, a 35.4% increase from 2002 models. Cars from the same model years have seen a 46.1% increase in fuel efficiency, rising to 33.3 mpg in 2022. Truck fuel efficiency has risen 41.8% to 23.4 mpg in 2022.

- Rising trend of engine downsizing – Engine downsizing involves reducing engine size or the number of cylinders to enhance fuel economy and reduce emissions. Many car manufacturers are adopting this strategy to increase fuel efficiency. For instance, Ford has introduced a new 1.0–liter EcoBoost engine for its 2017 vehicles, which achieves a fuel economy of 29–33 MPG, representing a >30% increase over the 2.7–liter engine used in 2015.

This smaller engine utilizes a gasoline turbocharger to improve power and efficiency. The combination of Gasoline Direct Injection (GDI) technology with a turbocharger is particularly effective in countries like the US, China, and Japan, where over 90% of cars are gasoline–powered. This trend is expected to drive up the demand for direct gasoline injections, hence supporting growth of gasoline direct injection market.

Challenges

- Rising high carbon deposits – GDI engines develop high carbon deposits, leading to poor performance and starting issues. This demands regular injector inspection and cleaning, resulting in high maintenance costs. Consumers are deterred from GDI–equipped cars due to these high costs, limiting market growth.

- High cost of GDI Engines – Gasoline direct injection (GDI) systems are costlier and more complex than port fuel injection (PFI) systems. The high cost of GDI engines may limit their growth, with many car buyers preferring PFI–equipped cars due to the price difference.

Gasoline Direct Injection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 9.61 billion |

|

Forecast Year Market Size (2035) |

USD 21.73 billion |

|

Regional Scope |

|

Gasoline Direct Injection Market Segmentation:

Application

Passenger Cars (PC) segment is estimated to capture gasoline direct injection market share of over 54% by 2035. The segment's growth in terms of revenue is due to consumers' growing preference for luxury and premium vehicles, particularly in developed nations, and the installation of direct injection systems in those cars. As observed by Research Nester analysts, Unit sales for luxury cars are forecasted to hit 197,900 vehicles by 2028.

Over the course of the analysis period, increasing demand for passenger cars as well as the implementation of stricter emission regulations for these kinds of vehicles are anticipated to further propel the penetration of passenger cars. The segment is expected to rise in the upcoming years due to consistent advances in passenger vehicles brought about by the addition of new safety and comfort features.

Component

The fuel injectors are expected to see significant expansion during the course of the analysis. Since accurate fuel injection control is necessary to guarantee full fuel combustion. Furthermore, it is anticipated that the demand for efficient management of the air–fuel mixture and gasoline engine exhaust emissions will accelerate the segment's growth throughout the course of the projected period. Additionally, the fuel injector serves to monitor the fuel regulator, which aids in preserving a steady fuel pressure in the delivery pipe.

Technology

Through 2035, gasoline turbocharger segment in the gasoline direct injection market is expected to exhibit substantial growth. By pumping more air into the cylinders of internal combustion engines, gasoline turbochargers are made to make them more efficient. Engine performance and fuel efficiency are enhanced as a result of the compressed air's ability to boost fuel combustion. For the same displacement, naturally aspirated engines cannot match the power output of turbocharged engines. Customers who want their cars to perform better and accelerate more quickly may find this improved power output appealing.

Automotive Turbochargers are seen to be an excellent answer since they convert the exhaust gas that is produced when fuel is consumed into power. Vehicle manufacturers have begun to use turbochargers more frequently in recent years. Revolutionize your engines with turbocharging, which can provide up to 400% more power compared to a naturally aspirated engine.

Our in–depth analysis of the global gasoline direct injection market includes the following segments:

|

Application |

|

|

Component |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gasoline Direct Injection Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 44% by 2035. The small passenger cars sector in Asia Pacific is experiencing growth, largely due to increased vehicle production in China, India, and Japan. According to Research Nester analysis and input from primary respondents, Asia Pacific is expected to be the largest market for small passenger cars.

This growth is driven by strong demand in the automotive industry, and the vehicle type segment is expected to have a positive influence on the market. Furthermore, the market is being driven by the increasing demand for fuel–efficient vehicles to meet strict emission regulations. As observed, the CO2 emissions from fuel combustion in the Asia Pacific totaled to around 17178.5 Mt Co2.

Throughout the forecast period, China is anticipated to dominate the Asia Pacific gasoline direct injection market. China is the largest automobile manufacturer in the world. Approximately 80 million cars will be manufactured globally in 2021. During that year, China's production made up around 32.5 percent of the total global car production. As a result, the market for gasoline direct injection in China is predicted to expand quickly. The cost of maintaining diesel automobiles would rise due to the impending emission rules.

Furthermore, South Korea has stringent emission standards to reduce pollution, driving the adoption of fuel–efficient technologies like GDI. South Korea has stringent emission standards to reduce pollution, driving the adoption of fuel–efficient technologies like GDI. In 2015, the Korean government set an average emission standard of 140g/km, which will be strengthened to 97g/km by 2020. The government’s policies incentivize automakers to integrate GDI systems to their vehicles to comply with these regulations. The government’s policies incentivize automakers to integrate GDI systems to their vehicles to comply with these regulations.

European Market Insights

The European region will also encounter huge growth for the gasoline direct injection market during the forecast period. The strict regulations for fuel efficiency and emission targets are projected to drive the highest growth in the Europe region in the coming years. To meet compliance standards, OEMs are increasingly embracing GDI systems. The presence of major automotive companies such as BMW AG, Daimler AG, and Audi AG in the region is expected to have a positive influence on the growth of GDI systems during the analysis period.

Germany is expected to dominate the gasoline direct injection system industry in Europe by growing at a CAGR of 9.6% during the forecast period. As a leading center for automotive production in the European Union, Germany is a major contributor to the gasoline direct injection market. Efforts towards reducing carbon emissions, while improving fuel economy are key factors that are supporting the adoption of gasoline direct injection systems in the country.

Additionally, France’s strong automotive industry is investing heavily in advanced technologies, including GDI systems, to enhance vehicle performance and efficiency. Leading automotive companies and suppliers are focusing on integrating GDI technology into new vehicle models.

Furthermore, the United Kingdom’s commitment to reducing carbon emissions has led to stricter regulations, The UK plans to cut emissions by 68% by 2030, encouraging the adoption of GDI systems for their efficiency in lowering emissions compared to traditional fuel injection systems.

Gasoline Direct Injection Market Players:

- Eaton Corporation plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Delphi Automotive LLP

- Marelli Europe S.p.A.

- TI Fluid Systems

- Stanadyne LLC

- Robert Bosch GmbH

- Continental AG

- MSR–Jebsen Technologies

- Renesas Electronics Corporation.

The key participants in the market are primarily concentrated on securing long–term contracts to supply particular vehicle models and creating tailor–made solutions for both commercial and passenger vehicles. This approach will ultimately enhance their presence in the worldwide market.

Recent Developments

- Eaton Corporation plc, a provider of intelligent power management systems, has announced the release of its next–generation fuel tank isolation valve (FTIV) designed for hybrid automobiles. Compared to its predecessor, the new FTIV® is easier to install, 27% lighter, 39% smaller, and has 24% fewer components. In a hybrid car, the gas engine is not running all the time. Therefore, extra precautions are needed for hybrid fuel systems to deal with evaporative pollutants that build up when the gas engine is not running.

- Stanadyne LLC launched the patented Goliath 350–bar gasoline direct injection (GDI) durability fuel injector to broaden its performance and specialist product offering. With Stanadyne's most recent Goliath high–flow, 12mm bore, 350–bar performance gasoline direct injection (GDI) fuel pump, this new injector functions as a system or can be used alone.

- Report ID: 6243

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gasoline Direct Injection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.