Gas Turbine MRO Market Outlook:

Gas Turbine MRO Market size was over USD 15.54 billion in 2025 and is poised to exceed USD 24.13 billion by 2035, growing at over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas turbine MRO is estimated at USD 16.17 billion.

The reason behind this boost is anticipated by the increasing digitization, as it allows for predictive maintenance to be performed more accurately, leading to reduced operating costs, improved efficiency, and greater uptime. According to the World Bank, the investments in digital solutions from micro firms doubled to 20% in 2022 from 20% in 2020. This, in turn, directly leads to increased gas turbine MRO market growth.

In addition, the fast-paced industrialization leads to huge demands for power and also leads to the construction of more power plants, which in turn leads to the huge demands for gas turbines, as they are necessary for the production of electricity, and therefore the more the level of industrialization increases, leading to new power plants, the higher the demand will be for gas turbines.

Key Gas Turbine MRO Market Insights Summary:

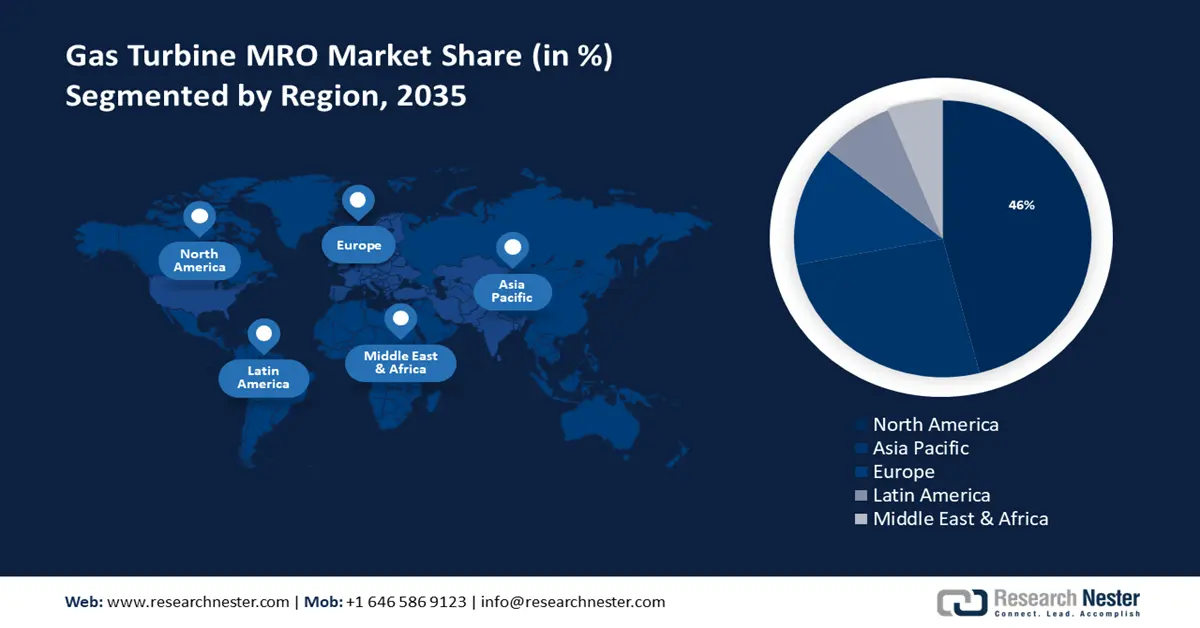

Regional Highlights:

- North America gas turbine MRO market is expected to capture 46% share by 2035, driven by the rising demand for natural gas and government initiatives promoting renewable energy usage.

- Asia Pacific market will achieve significant CAGR during 2026-2035, attributed to increasing industrial and economic growth, rising fossil fuel reserves, and low barriers to investment in power generation.

Segment Insights:

- The maintenance segment in the gas turbine mro market is anticipated to achieve significant growth till 2035, driven by regular inspections and repair preventing breakdowns and ensuring turbine reliability.

Key Growth Trends:

- Rising investments in power infrastructure

- Increasing energy demand

Major Challenges:

- Complexity and technical requirements for maintenance

- The lack of land and infrastructure

Key Players: General Electric (GE), Ansaldo Energia, Solar Turbines, Baker Hughes, Evonik Industries Flour Corp., OPRA Turbines, Caterpillar Inc., Metalock Engineering Group.

Global Gas Turbine MRO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.54 billion

- 2026 Market Size: USD 16.17 billion

- Projected Market Size: USD 24.13 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Gas Turbine MRO Market Growth Drivers and Challenges:

Growth Drivers

- Rising investments in power infrastructure - The increasing investments in power infrastructure, and power generation in the form of building new power plants, upgrading the existing ones, and the need for maintaining the new infrastructure leads to huge demands for gas turbines. According to a report, a total of about 2.8 trillion USD was invested in energy in 2023, out of this, 1.7 trillion USD is for clean energy. The increasing investments in the power infrastructure require gas turbines and therefore the demand for gas turbines for power production increases, hence the gas turbine MRO market revenue increases in size.

- Increasing Industrialization - The electricity demand is propelling due to increased industrialization, which has led to a situation where the power plants are in a constant state of upgrade or improvement. This leads to continuous pressure on the turbines to meet higher workloads which require more frequent maintenance and repairs. According to the International Yearbook of Industrial Statistics 2023- 29th edition by UNIDO, there was an increase of about 2.3% worldwide in the industrial sector.

- Increasing energy demand - The surge in energy demand that is driven by several factors such as economic development, population growth, and many more, has led to an increase in the demand for gas turbines. Gas turbines are highly essential for meeting the increasing energy demands which has led to an increase in the production of gas turbines, this in turn results in the increasing availability and demand for spare parts, repairs, and maintenance services which are essential to ensure their operation continuously. According to a report, due to the increasing population, the global energy demand increased to 69.22% in 2022 led by the increasing world population from 47.67% in 1990.

- Rise in renewable Global Gas Turbine MRO source of the energy sector - The demand for renewable sources of energy is surging, and this is increasing the renewable energy sector. Additionally, the rise in investment in renewable sources of energy, such as wind turbines and solar PV is fueling the revenue share. According to the International Energy Agency, the renewable energy supply from wind, hydro, ocean, geothermal, and solar increased by 8% in 2022.

Challenges

- Complexity and technical requirements for maintenance - Gas turbines are complex machines that require specialized skills and expertise for their efficient maintenance and repair. The components of gas turbines, such as the compressor, turbine, and generator, require special precautions and expertise for their maintenance. Repair work may often involve specialized tools and processes, and even small mistakes can lead to huge losses and downtime. As a result, maintaining and repairing gas turbines requires substantial investments in training, hiring specialized resources, and equipping facilities with the necessary tools and equipment. This can put a significant financial strain on the operators, acting as a restraining factor for the influence of the gas turbine MRO Market.

- The lack of land and infrastructure- to install renewable energy could limit Global Gas Turbine MRO Market value. Furthermore, the high development and maintenance costs of renewable energy projects could also limit sector drive. The availability of cheaper alternatives, such as renewable energy, can limit the predicted growth rate of the gas turbine MRO market.

Gas Turbine MRO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 15.54 billion |

|

Forecast Year Market Size (2035) |

USD 24.13 billion |

|

Regional Scope |

|

Gas Turbine MRO Market Segmentation:

Service Type Segment Analysis

Maintenance segment is poised to account for more than 48% gas turbine MRO market share by the end of 2035. The segment's lucrative growth can be attributed to regular maintenance, as this type of maintenance involves the periodic inspection of the gas turbine, its components, and the power plant. It ensures that the gas turbine is always running properly by addressing any signs of wear and tear.

According to a report in 2023, the lack of maintenance would decrease the reliability and availability to 60% and 20% respectively. Moreover, this type of maintenance involves fixing or replacing the parts that have gone faulty and also involves preventing breakdowns by monitoring and analyzing the gas turbine's performance data. It ensures the gas turbine is in a functional condition at all times.

Maintenance services can increase the reliability of the gas turbine, reducing downtime and increasing efficiency. They can also help ensure the safety of the power plant, as they identify potential faults and address them in a timely manner. These features, along with the regular inspections of the power plant, lead to lower operating risks and lower operating costs, which are beneficial for the operators of gas turbines.

Technology Segment Analysis

The aero-derivative segment is set to garner a notable share shortly and is likely to remain the second largest segment in the technology of the gas turbine MRO market revenue share and is projected to grow at a noteworthy CAGR propelled by the increasing demand for clean energy from the rising industrial and increasing population. According to the International Energy Agency, there is an increase in electricity demand of about 2.2% in 2023.

Aircraft engine technologies in the design of gas turbines. Gas turbines based on aero-derivative technology are optimized for the specific needs of power generation, compared to the turbines that are designed for jet engines or marine applications. Furthermore, aero-derivative technologies provide gas turbines with benefits such as increased efficiency, decreased emissions, and lower maintenance requirements. This leads to better financial viability and lower operating costs for the power plants that use gas turbines. It also leads to greater marketability of gas turbines, which contributes to the growing gas turbine MRO industry.

Application Segment Analysis

The power generation segment is estimated to be the highest-growing segment in near future. In the coming years in the application of the gas turbine MRO market, as it ensures reliable and continuous electricity production. According to a report by International Energy Agency 2020, worldwide energy production increased by about 2% from 2018 and reached 617EJ in 2019.

Our in-depth analysis of the gas turbine MRO market includes the following segments:

|

Service Type |

|

|

Technology |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Turbine MRO Market Regional Analysis:

North America Market Insights

North American in gas turbine MRO market is poised to account for more than 46% revenue share by the end of 2035. The market expansion in the region is expected on account of the growing demand for natural gas such as compressed natural gas, as there is a rise in population, which is shifting more towards the usage of clean energy. According to a report by the U.S. Energy Information Administration, in 2022 the usage of natural gas was about 33% of the whole energy consumption.

There have been rising government initiatives in the United States in the form of investment and campaigns to spread awareness regarding the usage of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power.

Moreover, Canada is predicted to have the presence of key players in the field of power generation and electricity demand which is further encouraging collaboration with the energy & power sector. Hence, this factor is estimated to impact the overall growth of the gas turbine MRO industry in Canada.

APAC Market Insights

Asia Pacific region is likely to observe significant growth till 2035 and will hold the second position owing to the presence of high fossil fuel reserves, and low barriers to investment for power generation infrastructure. According to a report, in 2023 APAC holds about 43% of the global coal reserves. Furthermore, a large part of the Asia Pacific region has favorable geographical conditions for the development of gas turbine power plants. In addition to this, the Asia Pacific region has witnessed rapid industrial and economic growth in recent years, leading to increasing demands for power generation.

There is a high presence of gas-filled power stations in Japan which reduces the risk of outages. According to a report by the Energy Information Administration in 2024, renewable generation in Japan increased to 26% in 2022 from 21% in 2018.

Gas Turbine MRO Market Players:

- Bharat Heavy Electrical Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric (GE)

- Ansaldo Energia

- Solar Turbines

- Baker Hughes

- Evonik Industries Flour Corp.

- OPRA Turbines

- Caterpillar Inc.

- Metalock Engineering Group

Most of the key players are continuously collaborating, expanding, making agreements, and joining ventures for the growth of the gas turbine MRO market and are estimated to be the major key players in this landscape.

Recent Developments

- General Electric- accelerated the maintenance of its industry-leading HA gas turbines with the first shipment of HA component repairs to Global Repair Solutions Singapore Center's (GRAS) newly opened ART Centre in Singapore.

- Evonik Industries- This is a specialty chemical company, that has chosen Siemens to build a turnkey merged cycle power plant within the Marl Chemical Park in North Rhine-Westphalia, Germany.

- Report ID: 6090

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Turbine MRO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.