Gas Meter Market Outlook:

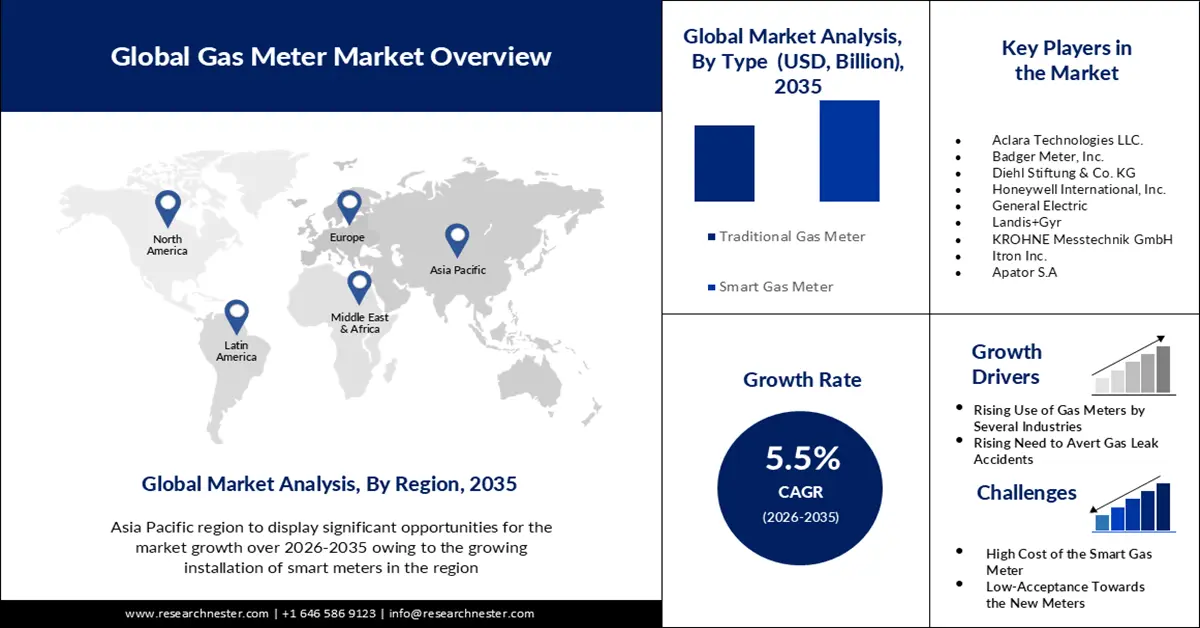

Gas Meter Market size was over USD 5.74 billion in 2025 and is poised to exceed USD 9.8 billion by 2035, witnessing over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas meter is estimated at USD 6.02 billion.

The growth of the market can be attributed to the several advancements in the technology of gas meters. In the last few years, the gas meter has undergone several innovations in the technology, this includes the integration of the Internet of Things (IoT) in the meters to make it even smarter. Several manufacturers in the market are investing heavily in the research and development of new innovative gas metering equipment. For instance, Nicor Gas and Sensus, a Xylem brand has installed the two-way Sensus FlexNet communication network and SmartPoint and with this, they commence their journey of urbanization.

In addition to these, factors that are believed to fuel the growth of gas meter market include the rising need to reduce gas leak accidents and helps avert huge gas accidents. The need to avoid accidents and make the gas chambers a safe place to work and live around is increasing the demand for gas meters. Modern gas meters are built to detect any form of gas seeping from the piping. They accurately gauge consumption, pinpoint excess usage that may indicate leakage, and warn the supplier of unusual consumption trends. Petrol meters have a number of sensors that monitor changes in pressure, temperature, and flow rate. These sensors assess the amount of petrol consumed and compare it to the projected rate of consumption. A leak could be indicated by unusually high usage. The meter will then transmit an alert to the supplier, who will be able to further investigate.

Key Gas Meter Market Insights Summary:

Regional Highlights:

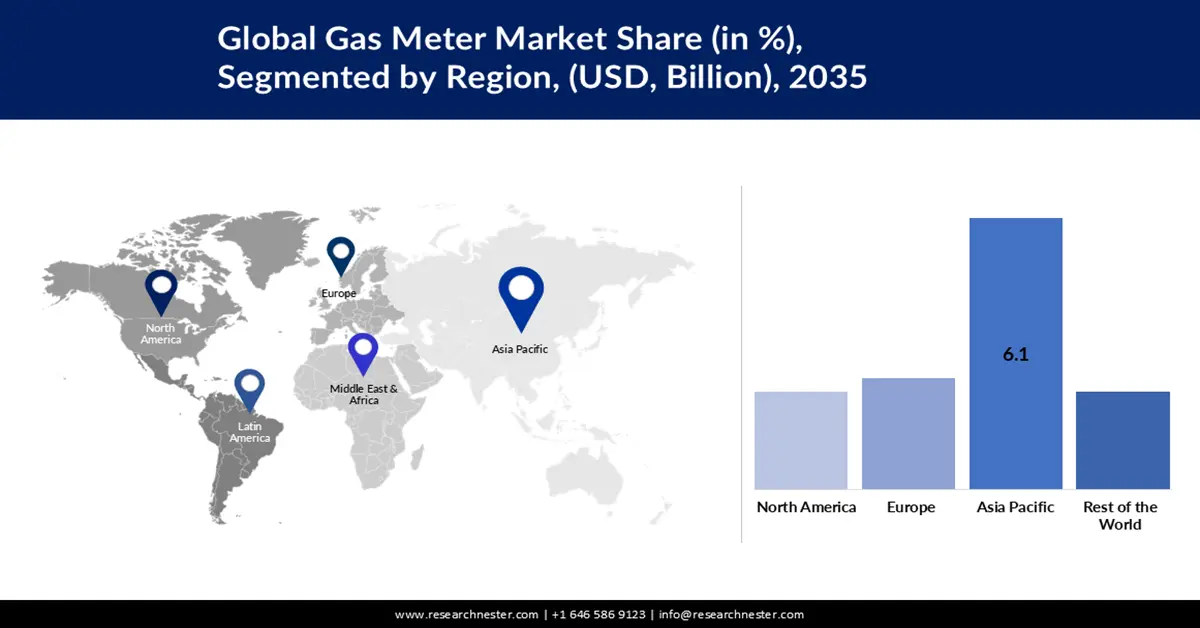

- Asia Pacific’s gas meter market will secure around 46% share by 2035, driven by government initiatives to expand gas infrastructure.

- Europe’s market will achieve a 19% share by 2035, fueled by the growing installation of smart meters.

Segment Insights:

- The residential segment in the gas meter market is expected to achieve a 58% share by 2035, driven by growing gas consumption in the residential sector and the need to reduce energy bills.

- The smart gas meter segment in the gas meter market is anticipated to achieve strong growth through 2035, driven by industries efficiently using smart meters to reduce energy costs and consumption.

Key Growth Trends:

- Growing Government Initiatives Towards Energy Efficiency

- Growing Popularity of Prepaid Gas Meters

Major Challenges:

- Hesitancy Among People to Switch to Pre-Payment Meters

- Unavailability of smart gas meters in rural regions

Key Players: ABB Group, Aclara Technologies LLC., Badger Meter, Inc., Diehl Stiftung & Co. KG, Honeywell International, Inc., General Electric, Landis+Gyr, KROHNE Messtechnik GmbH, Itron Inc., Apator S.A, Aichi Tokei Denki Co., Ltd., OSAKI ELECTRIC CO., LTD., Azbil Kimmon Co., Ltd., and TOYOKEIKI CO., LTD.

Global Gas Meter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.74 billion

- 2026 Market Size: USD 6.02 billion

- Projected Market Size: USD 9.8 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Gas Meter Market Growth Drivers and Challenges:

Growth Drivers

- Growing Government Initiatives Towards Energy Efficiency- Governments around the world are setting high energy efficiency goals in order to reduce waste and greenhouse gas emissions. Natural gas meters, notably smart meters, are critical to achieving these goals because they give accurate information in real-time that enables customers and utilities to measure and monitor gas usage. Furthermore, safety rules demand that gas distribution systems satisfy severe requirements, highlighting the importance of dependable and licensed gas meters. Government incentive programs and subsidies to encourage the use of digital petrol meters also help to drive industry expansion. Because of these incentives, utilities, and customers can afford to invest in sophisticated metering equipment.

- Growing Popularity of Prepaid Gas Meters- The installation of pre-paid gas meters is expected to have many critical uses. It minimized system losses by lowering gas wastage and alerting consumers of the proper use of the gas. It also improves the financial health of gas distribution companies by generating pre-paid revenues and reducing billing, collection, and monitoring costs.

- Growing Development of Smart Cities- With increased urbanization, numerous smart cities have sprouted up. Increased integration of smart petrol meters has accelerated market growth as smart grid network, smart gas, smart homes, and towns with real-time monitoring, remote management, and data analysis become more popular. As urbanization rises, so will the development of many businesses such as construction, automotive, and healthcare, which will eventually provide growth chances for various uses of petrol meters in such industries. The World Bank recently released data. With cities accounting for more than 80% of global GDP, urbanization has a chance to drive long-term growth through increased productivity and innovation, if properly managed. Cities now house about half of the world's population which is 4.4 billion people, and this figure is anticipated to rise further. The urban population is predicted to more than double by 2050, with cities housing approximately 7 out of 10 people.

Challenges

- Hesitancy Among People to Switch to Pre-Payment Meters- The disadvantage of smart prepayment meters is that they do not let customers simply switch suppliers. It restricts the payment of cutting off the energy supply if a prepayment customer with a first-generation SMETS1 smart meter switches to different providers. Smart prepayment requires credit to be loaded onto the customer's gas and electricity meters by the customer's provider, who must be able to connect with them electronically. If the consumer does so while using an SMETS1 meter, the meter may become dead and fail to communicate with any other provider, preventing the consumer from topping up. This means that until the smart meter is upgraded or transferred to the new data network, the consumer may be obliged to stay with his present supplier. Such a flaw could be an impediment to the proliferation of petrol meters in the next years.

- Unavailability of smart gas meters in rural regions

- Smart meters can be fairly expensive

Gas Meter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 5.74 billion |

|

Forecast Year Market Size (2035) |

USD 9.8 billion |

|

Regional Scope |

|

Gas Meter Market Segmentation:

Type Segment Analysis

The smart gas meter segment share in the gas meter market is estimated to cross 56% in the year 2035. The growth of the segment can be attributed to the rising use of smear meters by industries. industries are employing it efficiently carrying out the distribution and transmission of energy while reducing the cost and minimizing the energy consumption. Smart meters provide fantastic insights into how much energy is being used at any one time and how to reduce its usage. With narrow confidence intervals, smart meters save an average of 3.4% of power consumption and 3.0% of petrol used. Both estimations have a statistically significant level of significance.

End User Segment Analysis

Gas meter market from the residential segment is projected to garner significant revenue share of 58% in the year 2035. Growing consumption of gas from the residential sector is expected to boost the segment growth in the market. According to the Energy Information Administration, in 2015, around 58% of households used natural gas, in 2021, around 42% of households used natural gas. In addition to this, the rising need for reducing bill expenses is also expected to boost the growth of the segment. A smart meter saves a typical home 2% on their annual energy expenditures or 354kWh. That may not seem like much, but it's sufficient power to take 115 hot baths or listen to your favorite song on a tablet for the next 35 years.

Our in-depth analysis of the global gas meter market includes the following segments:

|

Type |

|

|

Component |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Meter Market Regional Analysis:

APAC Market Insights

The gas meter market share in Asia Pacific is projected to surpass 46% by the end of 2035. The growth of the market can be attributed majorly to the growing government initiatives from China, India, and Japan to connect the entire nations, with gas meters. According to the Government of India's plans and objectives, around 230 cities will have gas infrastructure by 2025. Pipeline infrastructure is predicted to quadruple by 2025, while CNG stations are expected to triple by 2025 as new geographies are penetrated.

European Market Insights

The European gas meter market is estimated to register a revenue share of 19% by 2035. The growth of the market can be attributed majorly to the growing installation of smart meters. Smart meters have taken the place of traditional gas and electricity meters across the UK, making the energy system more efficient and adaptable, allowing the UK to use more renewable energy, and bringing the country closer to net zero. As of 30 March 2023, the United Kingdom had 32.4 million smart and advanced meters, accounting for 57% of all meters.

Gas Meter Market Players:

- ABB Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aclara Technologies LLC.

- Badger Meter, Inc.

- Diehl Stiftung & Co. KG

- Honeywell International, Inc.

- General Electric

- Landis+Gyr

- KROHNE Messtechnik GmbH

- Itron Inc.

- Apator S.A

- Aichi Tokei Denki Co., Ltd.

- OSAKI ELECTRIC CO., LTD.

- Azbil Kimmon Co., Ltd.

- TOYOKEIKI CO., LTD.

Recent Developments

- Honeywell International, Inc. unveiled its Next Generation Cellular Module (NXCM), which allows for Advanced Metering Infrastructure (AMI). This revolutionary technique converts traditional gas and water meters into smart meters without requiring any additional infrastructure. This groundbreaking module improves monitoring, security, and analytics capabilities for utility companies and their consumers by allowing meters to connect wirelessly to pre-existing public cellular networks. AMI collector maintenance and crew operations, being free of proprietary technology can save utilities between USD 3 and 3.5 million in installation and maintenance expenditures.

- Itron, Inc. has introduced the Itron Intelis gFlex prepaid petrol meter. The next-generation meter combines cutting-edge ultrasonic solid-state measurement technology with Itron's 30-year track record in prepayment metering solutions. Consumers prepay for petrol with the Intelis gFlex, ensuring upfront money for utility companies. According to the Prepay Energy Working Group, when paired with other payment programs, prepayment programs can assist in collecting more than 90% of unpaid bills.

- Report ID: 5417

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Meter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.