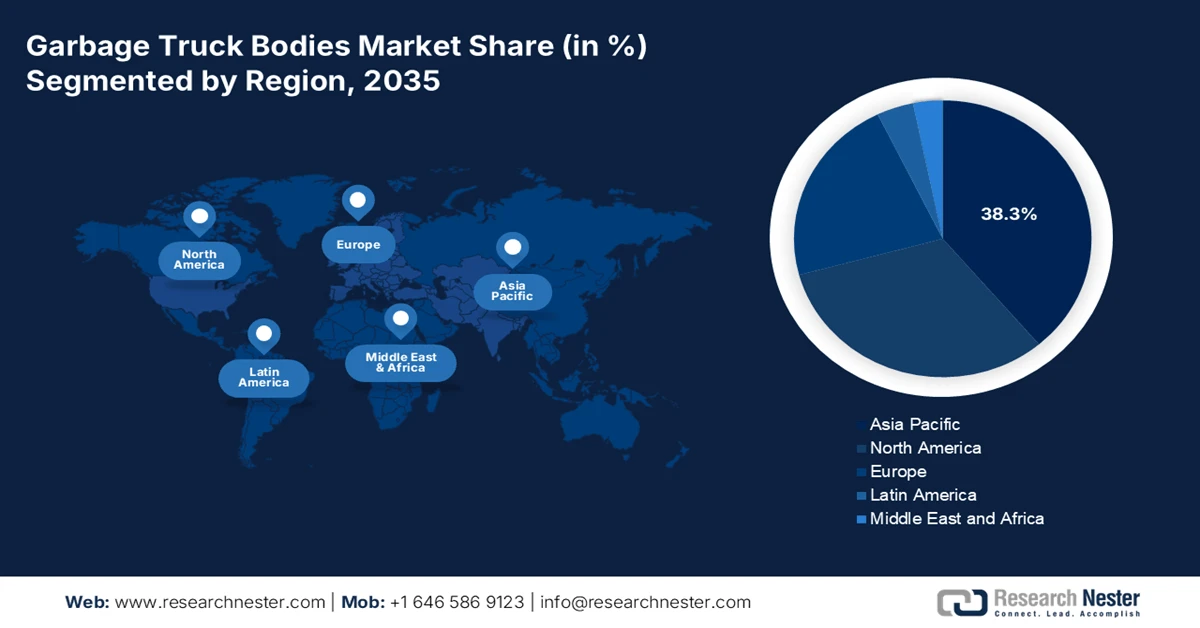

Garbage Truck Bodies Market - Regional Analysis

APAC Market Insights

Asia Pacific is the largest market and is projected to hold the revenue share of 38.3% by 2035. The market is driven by unprecedented urbanization, stringent new environmental policies, and massive government investment in public health infrastructure. The key drivers include national campaigns such as Beautiful China and Waste Free Cities initiative, and India’s Swachh Bharat Mission, which mandate improved waste collection coverage and efficiency. A dominant trend is the rapid electrification of municipal fleets, with China leading the world in the production and deployment of electric vehicles. The market is highly varied, ranging from mature, technology-driven economies like Japan and South Korea to high-growth, volume-driven markets like India and Southeast Asia, creating diverse opportunities for both standard and advanced body solutions.

The China garbage truck bodies market is defined by its integration into a larger state-guided industrial strategy for global dominance in both heavy-duty and new-energy vehicle sectors. The market’s growth is propelled by domestic policy drivers such as the Beautiful China initiative and fueled by the export-oriented Belt and Road strategy. In December 2025, Shacman’s dual success with its New Pearl truck and the export of 30 Zhiyun S500 electric garbage trucks to Uzbekistan demonstrates how Chinese manufacturers use domestic scale to compete internationally. This export of a fully integrated electric vehicle, noted as the largest of its kind in 2025, showcases the market’s move beyond simple body fabrication to supplying complete high-tech municipal solutions. The underlying supply chain focus on new energy, which drove a 251.6% YoY surge in Shacman’s NEV sales in 2025, confirms that the electrification and the global market penetration are the defining interconnected trends of the China industry.

The national Swachh Bharat Mission 2.o is driving the India garbage truck bodies market and is experiencing a transformative growth. The data from the PIB April 2025 indicates that the approval of waste-to-energy and waste-to-biogas projects worth ₹23,549.42 crore, with a central government share of ₹8,662.28 crore and ₹1,970.92 crore released between FY 2020 to 2021 and FY 2025 to 2026, directly strengthens the upstream waste collection infrastructure demand. These projects depend on a consistent, segregated, and high-volume feedstock supply, which increases the municipal investment in specialized garbage truck bodies capable of handling organic wet and segregated waste streams. This government investment creates a direct top-down demand signal for municipal fleets, mandating the procurement of advanced collection vehicles.

North America Market Insights

The North America garbage truck bodies market is the fastest growing and is expected to grow at a CAGR of 4.5% during the forecast period 2026 to 2035. The market is defined by the stringent regulatory mandates, high fleet replacement rates, and a strong push toward electrification and automation. The primary driver is the government policy, notably the U.S. EPA’s Clean Trucks Plan and Canada’s national zero-emission vehicle strategy, which create a direct legislated demand for cleaner vehicles. Substantial federal and municipal spending on solid waste management at the state or local level in the U.S> provides a stable demand base. The shift to automated side loader bodies to reduce the high injury rates among the workers is a dominant trend supported by the OSHA ergonomic guidelines. Concurrently, the smart city investments are integrating telematics for route optimization, turning refuse trucks into data collection assets.

The U.S. garbage truck bodies market is currently defined by the large-scale publicly funded electrification projects that integrate vehicle deployment with the critical charging infrastructure. The delivery of the Mack LR Electric, a subsidiary of Volvo Group, to Royal Waste Services in July 2025 in New York, supported by a USD 10 million NYSERDA prize, highlights the dominant procurement model. These projects validate the commercial readiness of electric refuse vehicles for municipal and private fleets, directly driving the demand for the new specialized bodies compatible with zero-emission chassis. The concurrent development of the 32-charger freight depot by MN8 Energy and the order of 35 battery-electric trucks from Volvo by the International Waste Management Company in April 2025 underscores that infrastructure access is a prerequisite for scaling adoption, making public-private partnerships a key enabler for market growth and a primary source of new orders for body manufacturers.

The provincial climate mandates such as British Columbia’s Clean BC Program drive the municipal and private fleet electrification via aligned procurement and are defining the Canada market. The recent advancement, such as in June 2024, the deployment of eight Mack LR Electric trucks by Emterra for the Comox Valley noted as the largest fleet and is a direct result of this policy-driven demand. Further, each electric chassis is fitted with an automated side loader body from Labrie Environmental Group, confirming that the shift to zero emission vehicles is a primary driver for the new body sales. This transition is supported by the partnerships with the utilities, such as BC Hydro, for charging infrastructure, creating a complete ecosystem for adoption. Such projects validate the business case for electrification, signaling to other municipalities and waste operators across Canada that investing in new electric-compatible truck bodies is both feasible and increasingly necessary to meet the legislated emissions targets.

Europe Market Insights

The Europe garbage truck bodies market is primarily driven by the stringent EU-wide environmental regulations, notably the European Green Deal and Circular Economy Action Plan, which mandate higher recycling rates and cleaner urban transport. A key trend is the stimulated transition from the diesel to electric refuse collection vehicles supported by the municipal low-emission zone policies and direct funding programs like the EU’s Alternative Fuels Infrastructure Facility. In 2023, according to the IEA report, the sales of electric trucks increased by 35%. This shift is compounded by the need for fleet modernization to handle increasing waste volumes and complex separate collection streams, pushing the demand for the specialized automated body designs that improve operational efficiency and worker safety.

The Germany garbage truck bodies market is undergoing a significant transformation and is being driven by the dual track approach to fleet decarbonization. The established alternatives, such as compressed natural gas, remain in active deployment. The Abfallwirtschaftsbetrieb München's order for 34 new Scania CNG trucks in May 2022 has demonstrated that the market is simultaneously entering a new phase with the introduction of hydrogen fuel cell vehicles. On the other hand, in July 2025, Hyundai’s launch of the hydrogen electric hook lift and refuse collection vehicles based on its proven XCIENT Fuel Cell platform represents a pivotal moment. This development signals to body builders such as Faun that future designs must be compatible with the zero-emissions drivetrains from multiple energy sources, such as CNG, battery, electric, and hydrogen, to meet the diverse sustainability strategies of Germany’s leading municipal operators like AWM.

The UK garbage truck bodies market is defined by the regulatory mandates driving a rapid transition to cleaner vehicles and increased operational efficiency. The primary catalyst is the Environment Act 2021, which requires all English local authorities to implement separate weekly food waste collection. This legislation has created a time-bound massive demand for new collection vehicles fitted with specialized bodies, mainly multi-compartment designs for co-collection. This regulatory push aligns with the broader government targets, such as the Government of the UK, which in April 2021 stated that the country has committed to a 78% of reduction of greenhouse gas emissions by 2035. Supporting this transition, the Department of Transport reported a significant increase in grant funding, with the Zero Emission Road Freight Trial demonstrating a rise every year in applications for heavy vehicle electrification support. This policy-driven demand ensures the market remains focused on technologically advanced, often electric or low-emission body solutions compatible with modern chassis.