Gaming Merchandise Market Outlook:

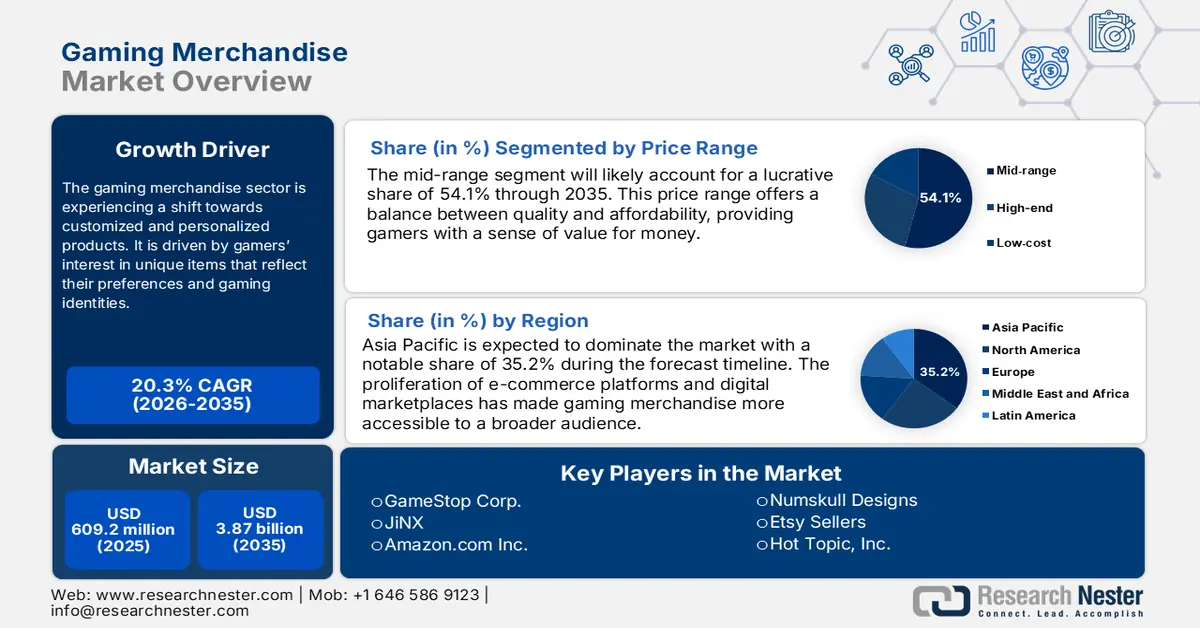

Gaming Merchandise Market size was over USD 609.2 million in 2025 and is poised to exceed USD 3.87 billion by 2035, growing at over 20.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gaming merchandise is estimated at USD 720.5 million.

Merchandising of game items is now becoming an essential part of gaming culture. It reflects the growing influence and popularity of video games in contemporary society. The reasons for the rising demand for gaming merchandise include increased gaming communities, growing esports, and recognition of gaming as a legitimate source of entertainment and art. From collectibles to in-game items, and accessories, merchandise caters to the fan's desire to show affinity for a game and heighten the richness of the gaming experience overall. In addition, the players can use gamertags, favorite characters, or notable in-game moments to personalize items which boost the demand for the gaming merchandise market.

Creative products between game developers and merchandise creators have been born to resonate with gamer psyches, thus opening much deeper connections for them to the gaming merchandise market. This would naturally have a quite considerable effect on the bottom line, increasing revenue streams not only for game developers but also for retailers, and feeding small businesses to customize niche products. According to a report published by the International Trade Administration, in 2024, the global video game industry reached USD 184 billion, having 3.2 billion gamers worldwide. With this future in mind for the industry, merchandise related to shaping gamer identity or engaging gamer communities is liable to extend its role in the near future.

Key Gaming Merchandise Market Insights Summary:

Regional Insights:

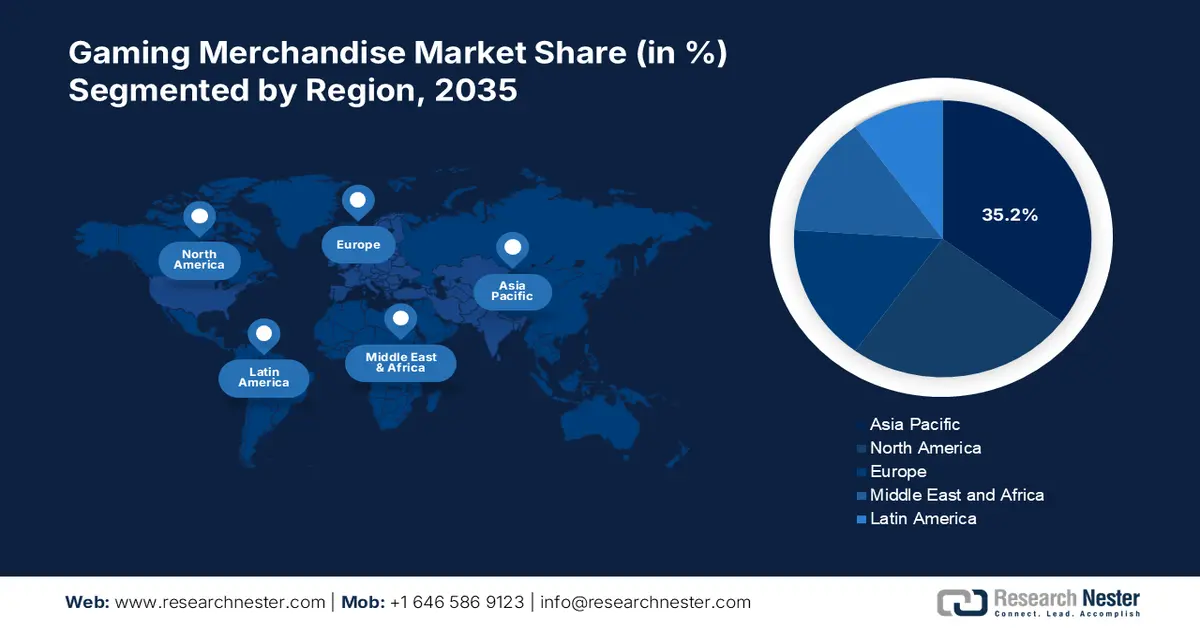

- By 2035, the asia pacific gaming merchandise market is projected to command over 35.2% share, supported by its expanding gamer base and vibrant gaming culture owing to its strong ecosystem of local communities and esports events.

- North America is set to witness notable expansion through 2035 as gaming merchandise diversifies beyond traditional collectibles impelled by rising demand for digital and experiential gaming products.

Segment Insights:

- By 2035, the mid-range segment is estimated to secure more than 54.1% share of the gaming merchandise market propelled by its optimal balance of quality and affordability.

- The online sub-segment is rapidly gaining traction through 2026–2035 supported by increasing consumer dependence on convenient and accessible e-commerce channels.

Key Growth Trends:

- Influence of streaming and content creation

- Brand collaboration and licensing

Major Challenges:

- Intellectual property issues

- Changing consumer preference

Key Players: Etsy Sellers, GameStop Corp., Fanatics, Inc., Hot Topic, Inc., JiNX, Amazon.com Inc., Numskull Designs.

Global Gaming Merchandise Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 609.2 million

- 2026 Market Size: USD 720.5 million

- Projected Market Size: USD 3.87 billion by 2035

- Growth Forecasts: 20.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Kingdom

Last updated on : 2 December, 2025

Gaming Merchandise Market - Growth Drivers and Challenges

Growth Drivers

- Influence of streaming and content creation: In the gaming merchandise market, the influence of streaming and content creation is fundamentally reshaping consumer engagement and purchasing behavior. With gaming becoming increasingly prominent, content creators have become crucial influences, showing off merchandise to their audiences and creating a community around specific games and brands. For instance, in August 2023, HSN teamed up with Fanatics to offer sports merchandise, bringing the fans a much broader assortment of products from major sports leagues. Thus, it follows the mutually beneficial relationship between content creators and gaming merchandise promotes the visibility of products and loyalty, thus fueling further growth.

- Brand collaboration and licensing: This interplay of collaborative branding with licensing increases perceived value and ensures high involvement in the gaming merchandise market that eventually leads to sales, driving brand loyalty in the market. These strategic collaborations between game developers and manufacturers allow for the creation of new merchandise items that are specific to a given popular franchise, hence making brands more authentic and consumers trusting. For instance, in October 2024, Unilever announced that it has partnerships with platforms including EAFC, Fortnite, and Roblox to help its personal care brands engage new consumers where they play.

Challenges

- Intellectual property issues: The most prominent challenge facing the gaming merchandise market is intellectual property issues, primarily caused by counterfeit products that devalue brand integrity and consumer trust. The reproduction of unauthorized merchandise not only dilutes the value of official merchandise but also leads to severe financial losses for legitimate creators and developers, thus hindering innovation and investment in new merchandise lines. Increased focus by consumers on authenticity and quality is a threat to their purchasing official, legitimate branded products which lowers sales and progresses slowly for original brands because this causes reduced consumer confidence.

- Changing consumer preference: A significant challenge in the gaming merchandise market, is dynamic consumer choices, being driven by rapid developments in gaming technology and the diversification of gaming experiences. Increasingly, consumers are finding immersive experiences offered by virtual reality (VR) and augmented reality (AR) because they increasingly prefer VR and AR gaming. These displace the demand for traditional merchandise, which ranges from physical collectibles to apparel. The preference for digital content and in-game purchases, which is faster gratification and makes a user feel more engaged, is what mainly drives this shift.

Gaming Merchandise Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.3% |

|

Base Year Market Size (2025) |

USD 609.2 million |

|

Forecast Year Market Size (2035) |

USD 3.87 billion |

|

Regional Scope |

|

Gaming Merchandise Market Segmentation:

Price Range Segment Analysis

By 2035, mid-range segment is estimated to capture over 54.1% gaming merchandise market share. The mid-range is well-suited to strike the proper balance between quality and price, thus attracting a diverse consumer base. This price range typically offers items that are superiorly crafted with unique designs, appealing to both casual gamers and dedicated collectors. Since consumers are keen on extracting value out of their investment, middle-of-the-line merchandise comes in as a more enticing product since it allows quality merchandise without the cost attributed to premium collectibles. It shows the trend where accessible but desirable gaming products create an upward demand in this industry and position mid-range as the key in the market structure.

Distribution Channel Segment Analysis

The online sub-segment is taking over the gaming merchandise market rapidly because of the convenience and accessibility that it provides to consumers. The growing reliance on e-commerce portals and digital shopping gives easy access for gamers, browsing through a number of available products. For instance, in August 2023, DAZN combined the Fanatics e-commerce platform to boost in-app merch sales. The two companies have agreed to a partnership that will initially feature a substantial product range available from within the DAZN app. This experience will include personalized recommendations, single billing relationships, and one-click purchasing. This shift in the network of distribution meets the desire for instant gratification and also allows retailers to target a larger market across the globe.

Our in-depth analysis of the global gaming merchandise market includes the following segments:

|

Price Range |

|

|

Distribution Channel |

|

|

Purchase Motivation |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gaming Merchandise Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific gaming merchandise market is expected to dominate revenue share of over 35.2% by 2035. This is mainly attributed to its expansive and diversified games culture and increasing gamer population. Furthermore, the mix of traditional and modern gaming experiences in this region provides a strong bond between game players and their favorite franchises. Moreover, local gaming communities and events such as conventions and esports tournaments shape the culture of fandom furthering the market for gaming merchandise.

In India, the demographic shift and increase in mobile and online platforms have created fertile ground for the growth of the gaming merchandise market. For instance, in November 2020, Flipkart announced the acquisition of the intellectual property (IP) of gaming startup Mech Mocha. This acquisition aimed at boosting Flipkart’s newer formats to push user engagement on its own GameZone platform. In addition, Mech Mocha's gaming team announced to join the Walmart-owned e-commerce marketplace to showcase its gaming merchandise.

In China, the growing popularity of mobile and PC gaming demands more merchandise related to collectibles, apparel, and in-game items. This flourishing gaming culture, clubbed with the incorporation of gaming into mainstream entertainment, puts China in an excellent strategic position. According to a report published by the Ministry of Foreign Affairs of the Netherlands, in 2022, the gaming market in China was estimated to be USD 45.8 billion in 2022. The report further states that the player base in the country reached around 666 million in 2021.

North America Market Insights

North America is experiencing remarkable growth in the gaming merchandise market during the projected timeline. The gaming merchandise has evolved beyond collectibles to encompass a wide range of products that enhance the gaming experience and reflect individual fandom. This trend not only expands the reach of gaming merchandise beyond traditional physical products but also taps into the burgeoning market of digital collectibles and virtual economies within gaming communities.

In the U.S., the popularity of esports events and tournaments has grown, while gaming has become more popular than ever and has given birth to a highly lucrative merchandise market in team apparel, collectibles, and gaming accessories. This is further fueled by an energetic fan following that aims at expressing support for favorite teams and players, driving a demand for a whole myriad of products related to the game. Moreover, the U.S. gaming merchandise market is booming because of the nation's strong entertainment industry and the high demand for gaming as a mass culture.

The growth in the gaming merchandise market in Canada is augmented by incorporating gaming into popular culture. Major franchise tie-ins and the increasing impact of streaming platforms in a comprehensive manner advance consumer participation and develop an energetic demand for gaming-themed merchandise. In addition, to the robust gaming development community and studios based in Canada, the constant flow of popular titles that resonate with local and international audiences continues to increase. For instance, in August 2024, TELUS Esports Series powered by TELUS Arena, partnered with Android for opening the tournament to gamers across North America for the first time with Apex Legends, Rocket League, and Valorant.

Gaming Merchandise Market Players:

- Etsy Sellers

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GameStop Corp.

- Fanatics, Inc.

- Hot Topic, Inc.

- JiNX

- Amazon.com Inc.

- Numskull Designs

Today's scenario shows how the majority of gaming companies now use online media to directly sell their merchandise to fans. These companies are bypassing traditional retailing. This approach not only provides better control over branding and customer engagement but also helps companies respond promptly to market trends and consumer preferences. For instance, in November 2024, Nike launched a line of four digital virtual sneakers and apparel exclusively for 'Fortnite' players. This partnership allowed consumers to purchase branded in-game items. Therefore, companies can build a loyal customer base while maximizing profit margins by positioning themselves appropriately within the rapidly changing gaming merchandise industry. Here's the list of some key players:

Recent Developments

- In January 2024, Fanatics Betting and Gaming, a subsidiary of Fanatics Holdings Inc. the global digital sports platform unveiled its Fanatics Sportsbook and Casino in Pennsylvania commonwealth. Launch to be conducted as two days of soft launch with the Pennsylvania Gaming Control Board allowing customers unlimited signups and playtime.

- In May 2022, Valve Corporation, a US-based gaming online platform provider, launched its Steam VR 1.22 home, which boasts a new photogrammetry feature that transforms the photographs of the real world into a VR environment and allows the player to enjoy it in a virtual world.

- Report ID: 6863

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gaming Merchandise Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.