Gaming Console Market Outlook:

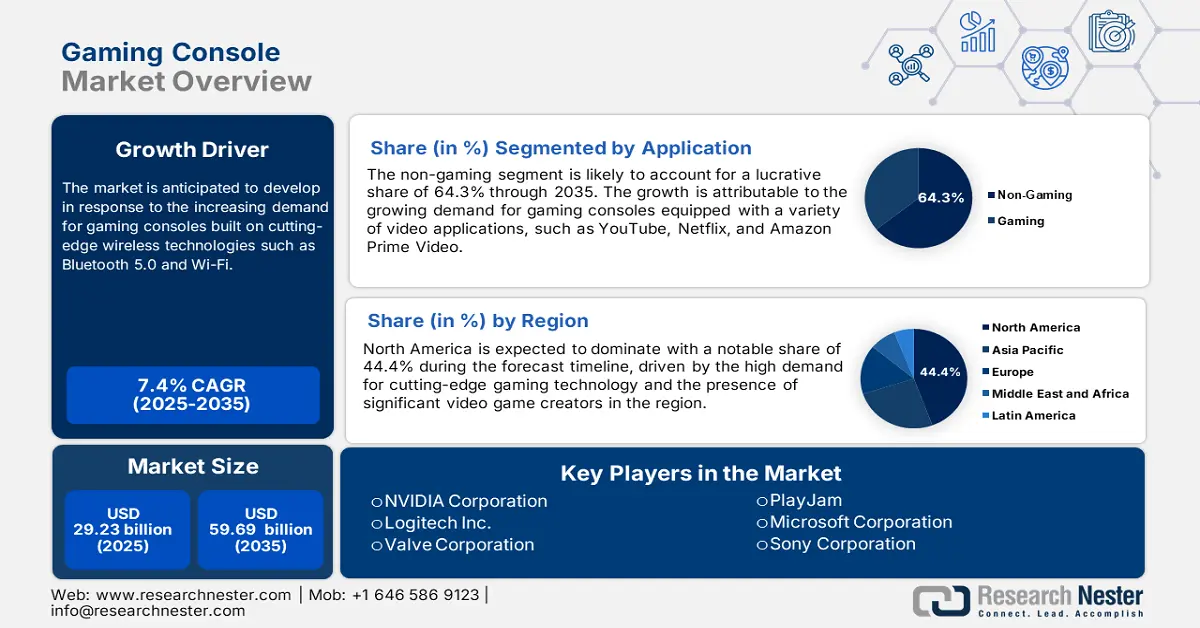

Gaming Console Market size was over USD 29.23 billion in 2025 and is anticipated to cross USD 59.69 billion by 2035, witnessing more than 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gaming console is estimated at USD 31.18 billion.

The gaming console market is fostered by a web of technological advancements, as well as changes in consumer preferences and the broadening appeal of gaming as a global entertainment medium. Online multiplayer gaming and cloud-based services have further enhanced the gaming ecosystem with new business models of subscription services such as Xbox Game Pass, PlayStation Plus, and game streaming platforms.

Such services are increasingly more available, allowing one to access a rich library of games conveniently without requiring significant memory storage capacity or high-end hardware requirements, making the gaming experience more accessible and adaptable. Moreover, social, entertainment and multimedia elements have been incorporated into gaming consoles, thus making them a more appealing electronic device. For instance, in August 2024, Analogue Pocket launched its slim, up-to-date, portable gaming console dedicated to the celebration and research of game-playing history. It featured an entire body made of CNC-machined aluminum.

Furthermore, modern consoles are now cemented as part of the entertainment appliances in your home and further portray their role in the digital world. In conclusion, the gaming console market is thriving owing to a combination of technological innovation, changing consumer demands, digital services, and the mainstreaming of gaming culture. For instance, in September 2023, Lenovo unveiled fresh innovations in gaming, software, visuals, and accessories for holidays such as Lenovo Legion, ThinkVision, Lenovo Wired VOIP Headset, and Lenovo Wired ANC Headset Gen 2. Thus, continued improvements will propel the gaming console market.

Key Gaming Console Market Insights Summary:

Regional Highlights:

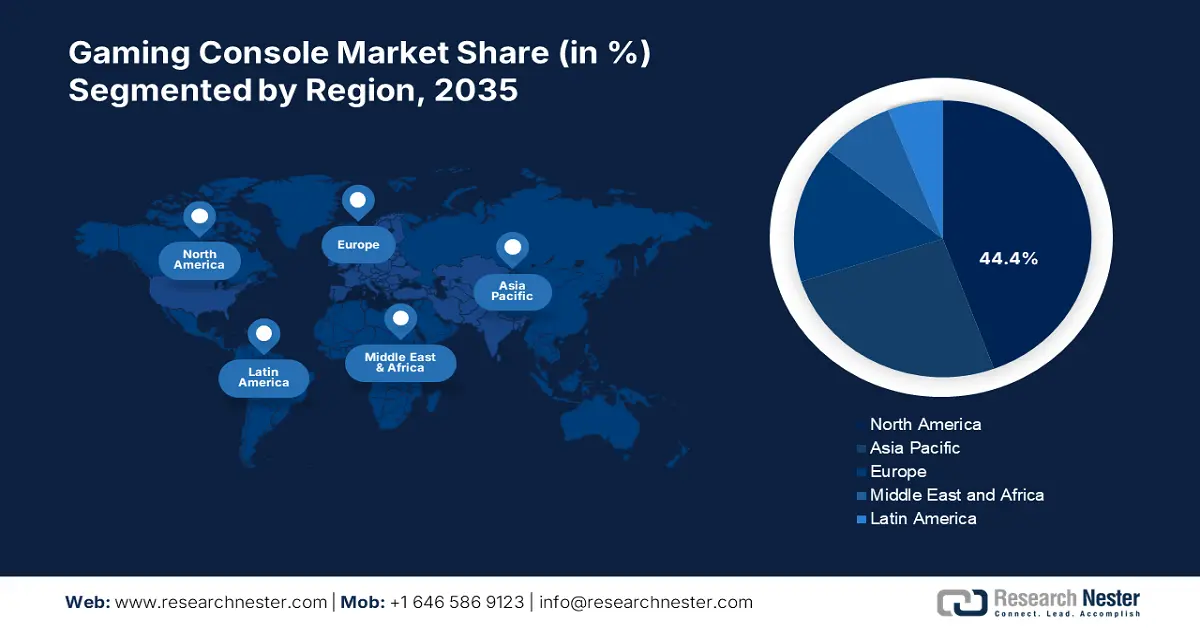

- North America's dominance in the gaming console market, with a 44.4% share, is driven by intense consumer demand for sophisticated gaming experience and a robust gaming culture, fostering strong growth prospects through 2035.

Segment Insights:

- By 2035, the non-gaming application segment is projected to hold a 64.3% share, driven by the multifunctionality of consoles offering access to entertainment services.

Key Growth Trends:

- Growing popularity of online and multiplayer gaming

- Rise in esports and streaming platforms

Major Challenges:

- Digital ownership and monetization issues

- High production cost and component shortage

- Key Players: Logitech Inc., NVIDIA Corporation, Microsoft Corporation, Valve Corporation, PlayJam.

Global Gaming Console Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.23 billion

- 2026 Market Size: USD 31.18 billion

- Projected Market Size: USD 59.69 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, United Kingdom, Germany

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 14 August, 2025

Gaming Console Market Growth Drivers and Challenges:

Growth Drivers

-

Growing popularity of online and multiplayer gaming: The gaming console market is growing substantially on account of the growing demand for social and interactive experiences. With the growth in internet connectivity around the world, more gamers look forward to engaging in competitive or cooperative play and getting steeped into immersive online communities. This move towards social gaming has catalyzed the development of online multiplayer features with games. For instance, in September 2024, BlueStacks unveiled their new feature, Play Together It assists in imagining live streaming the gameplay and playing alongside in real-time. Thus, this feature makes the gameplay even more appealing while driving sustained demand.

- Rise in esports and streaming platforms: The escalation in esports and streaming platforms has heightened commercialization and public popularity for competitive gaming. Esports, has professional tournaments, sponsorships, and media rights that attract tremendous global audiences. This has fueled higher demand for high-performance consoles that support competitive gaming, alongside new avenues of content creation and game exhibition has aided in brand visibility. For instance, in June 2022, Microsoft's Xbox entered Samsung Gaming Hub, to include the Xbox App on Smart TVs. With this association, users will now be able to stream over 100 games of top-notch quality through subscribing to Xbox Game Pass Ultimate. As esports grows, the consoles are becoming increasingly important, thus also triggering market growth.

Challenges

-

Digital ownership and monetization issues: The critical issue regarding the gaming console market is primarily an increase in concern over the low resale value of digital content. In addition, a myth that states physical games could be resold or traded, further reduces consumer flexibility and perceived ownership. This has resulted in quiescent growth among gamers, particularly as the industry increasingly shifts towards subscription models and microtransactions. As consumer demands for greater transparency and fairness in digital transactions continue to grow, pressure mounts upon console manufacturers and game publishers to resolve these issues while keeping monetization profitable.

- High production cost and component shortage: The advanced consoles which are integrated with high-performance processors, graphics cards, and storage solutions result in a higher manufacturing process. In addition, major supply chain disruptions across the world, especially due to the COVID-19 outbreak, have caused significant shortages of key components, which delay production and therefore limit the number of consoles available for the consumer. This would not only negatively impact the pricing strategy of console makers but also impact consumer access and contribute to inflationary pressures and slow growth in the gaming console market as a whole.

Gaming Console Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 29.23 billion |

|

Forecast Year Market Size (2035) |

USD 59.69 billion |

|

Regional Scope |

|

Gaming Console Market Segmentation:

Application (Non-Gaming, Gaming)

Non-gaming segment is projected to dominate gaming console market share of around 64.3% by the end of 2035. The increasing demand for multifunctional devices offering a wide range of entertainment and multimedia features in the market also lists the non-gaming segment as predominant. The newest models in the gaming console line, including PlayStation 5 and Nintendo Switch, offer access to streaming services such as Netflix, YouTube, and Spotify, pushing them as major home entertainment equipment. For instance, in September 2024, Loco sold a majority stake for USD 65 million to Redwood to boost its global presence. The investment provided the push for Loco's international expansion and aimed at improving the content by partnering with streamers and major gaming organizations.

Interface (Residential, Commercial)

The residential segment is expected to surge in the gaming console market during the forecast timeline mainly due to increasing demand for home entertainment-based solutions for various age groups as well as their interest. The more the gaming content becomes available, diverse, and family-friendly with immersive experiences and multimedia services, including streaming and social features, the more consoles become central at-home entertainment hubs. For instance, in October 2024, SuperGaming announced the launch of its new battle royale mobile game, Indus with a more conventional battle royale game style to be played at one’s convenience.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

|

Interface |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gaming Console Market Regional Analysis:

North America Market Statistics

North America industry is expected to hold largest revenue share of 44.4% by 2035. The main driver behind this continued strong presence is the intense consumer demand for sophisticated gaming experience, spurred by a robust gaming culture, inflicting robust technological structures, and healthy disposable income in the region. This demand spurred constant innovation, frequent console upgrades, and related services growth. This consolidated North America's position as the critical hub for gaming.

The U.S. gaming console market is characterized by a dominance of the U.S. entertainment and media industry. This factor tends to drive console sales with exclusive content, partnerships, and cross-media integration. The integration of gaming with streaming services brings a coherent ecosystem that provides consumers with increased value and strengthens platform loyalty. For instance, in December 2023, Riot Games hosted its debut international esports tournament, VALORANT in India to strengthen the grassroots ecosystem for its first-person shooter (FPS) games in India. This synergy between gaming and broader entertainment trends is a massive differentiator for the U.S. market.

The major characteristic of Canada is significantly driven by its bilingual and multicultural demographic, which plays a key role in determining gaming preferences and demand. For instance, in February 2021, i3 Interactive, a Canada-based company announced to acquire majority of stake (51%) in LivePools, a gaming start-up to create a holistic ecosystem for state-of-the-art experience to gamers. This differentiates their ecosystem, supporting diverse tastes in gaming and thus providing a unique demand within the Canada gaming console market.

Asia Pacific Market Analysis

Asia-Pacific is expected to exhibit lucrative growth during the forecast period of 2025 to 2035 due to the easy availability of 3D gaming hardware and software in the region. In addition, the mobile gaming trend is witnessing tremendous growth with experts estimating more than 1.5 billion active mobile gamers in the region. The future will be accelerated by further investment in online services and infrastructure driven by 5G and advancements in VR, AR, and AI.

China is being driven by trails of innovations brought by key gaming console market players. For instance, in June 2022, a virtual Tencent Games Conference - SPARK 2022 was held. At this conference, a new cloud gaming technology was revealed that revolutionized the future of online gaming. The key focus areas were new technology exploration, new product experience, and more new values. Furthermore, 40 new and innovative projects in the gaming sector were showcased.

A strong gaming culture is one of the major drivers for the gaming console market in India. For example, in March 2024, Indie Games Accelerator (IGA) chose 25 Asia-Pacific indie game developers, marking the largest Asia-Pacific cohort since the Google Play training program began in 2018. In addition, the rising trend of e-sports tournaments is further positively influencing the market in the country.

Key Gaming Console Market Players:

- PlayJam

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NVIDIA Corporation

- Microsoft Corporation

- Logitech Inc.

- Valve Corporation

- BlueStacks

- Atari Inc.

- D-Box Technologies Inc.

- Bay Tek Entertainment Inc.

- IBM

- Tencent

- Paperspace

- Activision

- Ubitus K.K.

- Hatch Ltd.

- Blacknut

The gaming console market is witnessing tremendous growth owing to the presence of techno-savvy players who strive to innovate the gaming landscape through lucrative investments. For instance, in January 2022, Microsoft, the American tech giant, invested in the Call of Duty series by Activision Blizzard, worth USD 68.7 billion. This was the largest-ever acquisition in gaming history, surpassing the company's previous record of a USD 7.5 billion deal.

Here’s the list of some key players:

Recent Developments

- In July 2024, Amazon and Microsoft teamed up, revealing a deal under which the Xbox cloud gaming service would seamlessly be integrated into Amazon's Fire TV devices. The primary owners of the Amazon Fire TV Stick 4K Max (2023) and the Fire TV Stick 4K (2023) would access a slew of acclaimed video game titles. Standouts in the list are Starfield, Fallout 4, and Forza Horizon 5, which can be accessed through Xbox Game Pass Ultimate.

- In October 2022, Electronic Arts and Marvel Entertainment announced that they have entered into a multi-title collaboration to create three new action-adventure games for consoles and PC, each being the companies' original story set in the Marvel universe. Motive Studios is developing a single-player, third-person action-adventure Iron Man game.

- Report ID: 6730

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gaming Console Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.