Global Gadolinium Market

- An Outline of the Global Gadolinium Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Gadolinium

- Recent News

- Regional Demand

- Global Gadolinium by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Gadolinium Demand Landscape

- Global Gadolinium Demand Trends Driven by Nuclear Energy, MRI, and Electronics (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Gadolinium Porter Five Forces

- PESTLE

- Comparative Positioning

- Gadolinium – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Edgetech Industries LC

- GFS Chemicals

- Goodfellow Cambridge LTD

- HEFA Rare Earth Canada Co.LTD

- Lynas Rare Earth Ltd

- MP Materials

- Otto Chemie Pvt. Ltd

- Solvay

- Star Earth Minerals

- Western Mimetals

- Business Profile of Key Enterprise

- Global Gadolinium Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Gadolinium Analysis (2026-2036)

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Type

- Gadolinium Acetate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Oxide, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Acetylacetonate, Market Value (USD Million), and CAGR, 2026-2036F

- Gadolinium Sulfate, Market Value (USD Million), and CAGR, 2026-2036F

- Pure Gadolinium, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Packaging

- Drum, Market Value (USD Million), and CAGR, 2026-2036F

- Containers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Luxury/Ultra-Premium, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Medical Imaging, Market Value (USD Million), and CAGR, 2026-2036F

- Magnetic Refrigeration, Market Value (USD Million), and CAGR, 2026-2036F

- Catalyst, Market Value (USD Million), and CAGR, 2026-2036F

- Radiation Shielding, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Industry Vertical

- Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace and Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics and Semiconductor, Market Value (USD Million), and CAGR, 2026-2036F

- Mining and Metal, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Gadolinium Market Outlook:

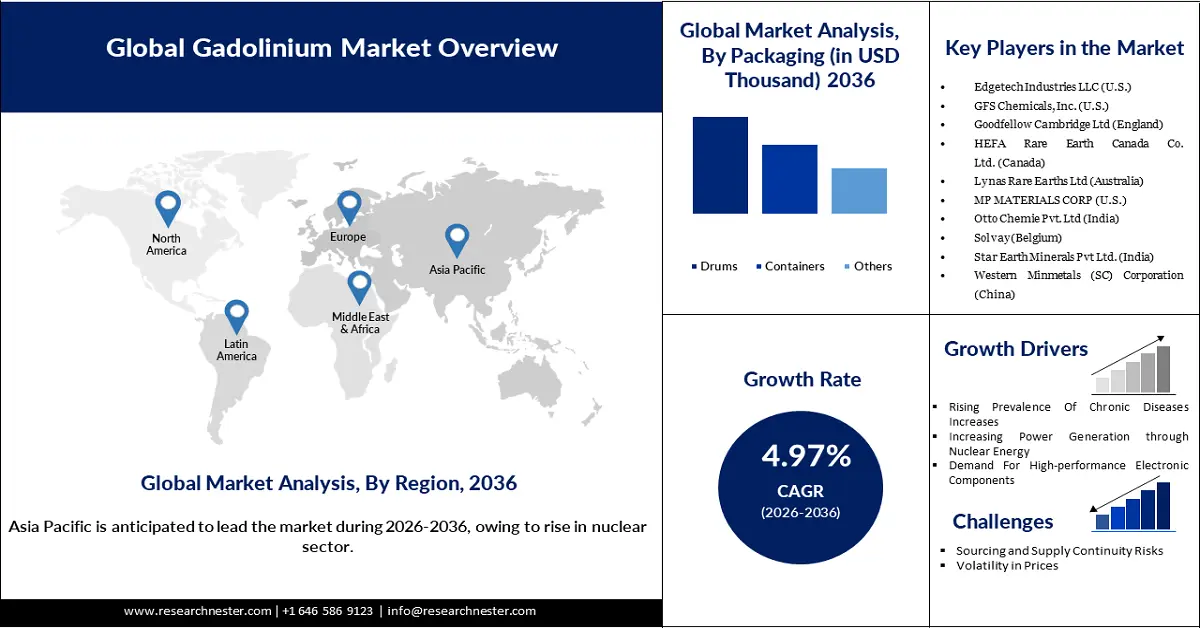

Gadolinium Market size is valued at USD 5.94 billion in 2025 and is expected to grow to USD 10.08 billion by 2036, registering a CAGR of 4.97% during the forecast period, i.e., 2026-2036. In 2026, the industry size of gadolinium is assessed at USD 6.21 billion.

The increasing use of MRI imaging is a major driver of gadolinium market growth, as gadolinium-based contrast agents enable clinicians to obtain higher-resolution images, thereby improving diagnostic accuracy and treatment planning. These contrast agents are particularly effective in chronic disease management, where they help clearly delineate affected tissues and support timely preventive and surgical interventions. The U.S. alone conducts approximately 40 million MRI scans annually, significantly expanding the demand for gadolinium-based contrast media. In parallel, rapid growth in healthcare infrastructure across the country is further supporting market expansion. In 2025, the U.S. is projected to record 2,041,910 new cancer cases, for which MRI imaging is widely recommended to assess disease progression and impacted areas. This underscores the rising need for gadolinium contrast agents in diagnostic imaging. Additionally, the market remains highly competitive and fragmented, with numerous global players dominating regional markets.

Key Gadolinium Market Insights Summary:

Regional Highlights:

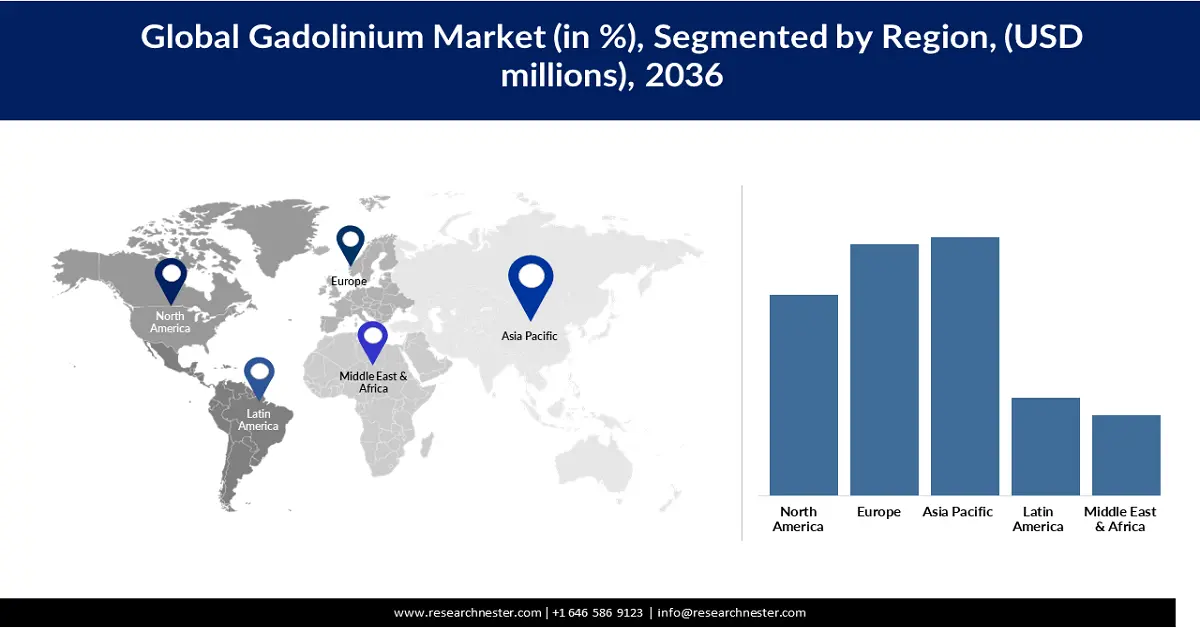

- Asia Pacific in the gadolinium market is projected to secure a 29.1% share by 2036, supported by accelerating adoption in electric vehicles, electronics manufacturing, renewable energy motors, and semiconductor-intensive automotive systems.

- Europe is anticipated to account for a 28.3% share by 2036, reinforced by expanding healthcare diagnostics, rare earth recycling initiatives, electric mobility production, and stringent critical raw material regulations.

Segment Insights:

- The gadolinium oxide segment in the gadolinium market is anticipated to account for a 28.9% share by 2036, supported by its high purity and solubility that elevate its adoption across MRI imaging, optical devices, and magnetic mineral applications.

- The drum packaging segment is projected to capture a 44.95% market share during 2026–2036, attributed to its rigid structure and contamination-resistant design that ensures safe handling and transportation of hazardous gadolinium materials.

Key Growth Trends:

- Rise in global mine production

- Rising chronic diseases

Major Challenges:

- Supply chain constraints

- Price volatility

Key Players: Edgetech Industries LLC (U.S.), GFS Chemicals, Inc. (U.S.), Goodfellow Cambridge Ltd (England), HEFA Rare Earth Canada Co. Ltd. (Canada), Lynas Rare Earths Ltd (Australia), MP Materials Corp (U.S.), Otto Chemie Pvt. Ltd. (India), Solvay (Belgium), Star Earth Minerals Pvt Ltd. (India), Western Minmetals (SC) Corporation (China)

Global Gadolinium Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.94 billion

- 2026 Market Size: USD 6.21 billion

- Projected Market Size: USD 10.08 billion by 2036

- Growth Forecasts: 4.97% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (29.1% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Canada

- Emerging Countries: India, South Korea, France, United Kingdom, Australia

Last updated on : 7 January, 2026

Gadolinium Market - Growth Drivers and Challenges

Growth Drivers

- Rise in global mine production: The mining production across the globe has increased significantly, which is expanding the market of gadolinium and its uses for various purposes. In 2022, global gadolinium production rose to 18.70 metric tons, and in 2024, the figures reached 19.41 billion, reflecting the growing demand across electricity, healthcare, and nuclear sectors. The rising growth has eliminated the reliance on single suppliers as players are emerging in the gadolinium market, intensifying the competition and increasing the adoption of gadolinium. In 2025, the U.S and Japan signed an agreement that secured the supply chain of critical minerals by focusing on stockpiling, recycling, and coordination in order to stabilize the markets and enhance the global delivery of the mineral.

- Rising chronic diseases: Chronic diseases belonging to cardiovascular and neurological disorders demand MRI, where gadolinium is widely used as contrast fluid. Clinicians rely on precision imaging to assess the impacted areas and begin diagnostics accordingly. In 2025, the World Health Organization of Europe claimed to lose 1.8million people to non-communicable diseases, highlighting the rising dependency on diagnostic systems. Out of all, 60% of cases were preventable through accurate diagnosis, which shows a continuous reliance of patients on MRI systems to obtain accurate health information. This has had a significant impact on the adoption of gadolinium as a contrast agent in imaging, providing patients with accurate data on affected organs to prevent potential risks and challenges in the future.

- Demand in electrical components: Gadolinium has exceptional dielectric properties, which make it suitable for use in high-performance electrical components. Semiconductors and microelectronic devices need high-purity gadolinium to improve performance and reliability. In January 2024, arXiv claimed that gadolinium scandate films were deposited on silicon utilizing high-pressure sputtering and plasma oxidation. The films generated were of high quality and showed minimal interfacial layer formation. Gadolinium scandate enhanced device efficiency and reliability. The high-purity properties of gadolinium have boosted the adoption and ensured better gadolinium market expansion.

Challenges

- Supply chain constraints: Gadolinium adoption remains limited in several regions due to export restrictions and licensing challenges, which continue to disrupt the global supply chain. In April 2025, China’s Ministry of Commerce and the General Administration of Customs implemented export controls on gadolinium, including its oxide and metal forms, citing licensing non-compliance and improper declaration of dual-use applications by importers. While these measures are intended to strengthen regulatory oversight and enhance supply chain security amid market uncertainty, they have tightened global availability. In response, importers are increasingly stockpiling gadolinium metals and oxides to mitigate supply disruptions and manage procurement risks.

- Price volatility: Supply chain constraints have subsequently impacted the price volatility of gadolinium, creating uncertainty for buyers. The fluctuations create challenges in long-term contracts and increase the risk of additional costs in procuring the mineral. In February 2025, gadolinium experienced a minor price variation where the oxide form was costing USD 25,550/ton, which was higher for buyers with an intention of purchasing large quantities. This price volatility often leads them to consider alternatives such as feromoxytol.

Gadolinium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

4.97% |

|

Base Year Market Size (2025) |

USD 5.94 billion |

|

Forecast Year Market Size (2036) |

USD 10.08 billion |

|

Regional Scope |

|

Gadolinium Market Segmentation:

Type Segment Analysis

The gadolinium oxide shows promising growth in the future and is expected to hold a gadolinium market share of 28.9% by the end of 2036. The Gadolinium oxide is used in magnetic minerals and optical devices, which makes the mineral a high-value component and ensures its greater use. In June 2024, Lynas Rare Earth, a leading producer of rare earth mineral, expanded its strategic plan to produce heavy rare earth materials at its Malaysian facility by 2025. The strategic plans of the business has enhanced the global gadolinium market by ensuring the availability of the mineral. Furthermore, the purity and the solubility of the mineral is high, making it a suitable option in MRI imaging and catalysis of magnetic minerals.

Packaging Segment Analysis

The drum segment is expected to hold a market share of 44.95% during the forecast period 2026-2036, owing to its rigidity and high strength. The contrast agents are stored in cylindrical drums that ensure safe transportation and handling. Gadolinium oxide, metal and nitrates are hazardous in nature and often require safe packaging. The drugs are concealed through air pressure, ensuring minimal contamination and safe logistics. In January 2025, Mauser Packaging Solutions expanded to China and opened a new facility to boost the manufacturing of drums and UN-certified intermediate bulk containers as demand from specialty chemicals increased over time, including gadolinium. The firm holds an FSSC 22000 license and ensures suitability for high-purity filling. Drums remain high in demand as safe packaging of rare earth minerals such as gadolinium requires non-contaminated transportation that drums can successfully perform.

Application Segment Analysis

The medical imaging segment is projected to grow with a gadolinium market share of 29% by 2036, owing to the rise in neurological and oncological cases across the globe. MRI contrast agents are widely used to increase tissue visibility and ensure accurate diagnostics. Ultra-low dose GBCA has significantly enhanced the segment value as contrast agents, such as gadoquatrane increases patient safety and accuracy. The medical imaging segment will further propel because of the rise in healthcare systems that employ contrast agents made of gadolinium, which is the most effective and safe form of dye used to enhance the organ visibility. In August 2025, Bayer submitted a New Drug Application (NDA) to the U.S. FDA for the investigation of the gadolinium contrast agent, which was primarily targeted for MRI imaging of the central nervous system. The new gadolinium-based contrast agent has been proven to ensure high clarity during imaging and ensure safety for patients.

Our in-depth analysis of the global gadolinium market includes the following segments:

| Segment | Sub-segment |

|

Type |

|

|

Packaging |

|

|

Application |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gadolinium Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to hold 29.1% of the global gadolinium market share owing to the rising demand in automotive and electronics. The region is rich in electronic manufacturing with special preference to electric vehicle batteries, which is amplifying the growth of the gadolinium market. The rising emergence of renewable energy and alternative sources is demanding the use of high-performance magnets used in motors, further propelling the gadolinium market in the Asia Pacific. The automotive sector also brings in a significant demand for gadolinium as brands across the region are focusing on electric vehicles, which are integrated with semiconductors.

China is a leader in electronic manufacturing, which enforces global reliance on the country for components. The country also excels in the manufacturing of semiconductors and high-performance magnets that are used in electric vehicles. China is rapidly enhancing its wind and solar energy, which will need the use of gadolinium in order to make energy-efficient batteries and motors to power the sources.

The demand for gadolinium in India is increasing rapidly, fueled by the growing nuclear sector under the Vikasit Bharat Program, which holds 24 nuclear reactors with a capacity of 7943 Mwe and 7 reactors with a capacity of 5398 Mwe as of 2025. The effectiveness of the neutron present in the gadolinium makes it suitable for use in the shutdown process of the reactors. Due to its neutron absorption capabilities, it is widely used in control rods. The growing emphasis of India on the nuclear sector and the utilization of the mineral in the reactors is amplifying the gadolinium market of India.

Europe Market Insights

The gadolinium market in Europe is expected to hold a share of 28.3% by 2036 as the healthcare, automotive, and nuclear sectors grow at a strong rate. Europe is strong in recycling rare earth minerals, paving the way for strong adoption across industries. In April 2025, Solvay increased its rare earth production in LaRochelle in order to reduce its reliance on China. The facility is expected to produce rare earth minerals, including gadolinium, for electric vehicles and wind turbines. The firm further aims to meet 30% of Europe’s demand by increasing production and reducing reliance on non-Chinese materials. Strong regulations of the government in terms of critical raw materials are further fueling the expansion of the market.

A significant share of demand in the UK is driven by the healthcare sector, largely due to the rising prevalence of oncological conditions such as cancer. According to Macmillan Cancer Support, more than 3.5 million people are currently living with cancer in the UK, a figure expected to increase in the coming years. MRI serves as a critical diagnostic tool for early disease detection and clinical assessment, particularly in oncology. The growing burden of cancer, coupled with rising healthcare expenditure, is creating substantial market opportunities across the UK. Additionally, the widespread acceptance and commercialization of mineral recycling further support the gadolinium market, as recycled materials help ensure supply availability and cost efficiency.

Germany has large-scale research and development centers that focus on material study and observation. Their growing emphasis on magnetic minerals used in wind turbines and electric vehicles is advancing the quality and performance of semiconductors, enabling their wider adoption in the country. Germany also demands gadolinium for their automotive sector, which is penetrated by global brands in terms of electric and hybrid vehicles. Electric vehicles use semiconductors where permanent high-performance magnets composed of gadolinium are embedded to maximize power efficiency.

North America Market Insights

North America is projected to account for 22.6% of the global market share by 2036, driven by strong adoption in medical imaging and expanding applications in the energy sector. The region’s well-established circular supply chain further strengthens domestic reliance on critical minerals. In July 2025, North America commissioned its first gadolinium and samarium refining facility in Ontario, aimed at reducing dependence on Chinese supply chains, highlighting the region’s strategic focus on securing gadolinium resources. Additionally, the rapid expansion of electric vehicles and the presence of numerous market participants are intensifying competition and accelerating market growth. State-level funding for critical minerals is further enabling domestic production and supply security.

The U.S. is experiencing a rising prevalence of oncological and cardiovascular diseases, for which contrast-enhanced MRI is widely recommended. Gadolinium-based contrast agents provide enhanced visualization of affected tissues, supporting accurate diagnosis and timely clinical intervention. The country’s advanced healthcare infrastructure strengthens preventive care and enables minimally invasive diagnostic procedures. Moreover, ongoing technological advancements in gadolinium-based applications are increasing global reliance on the U.S. gadolinium market.

Canada, as a global leader in renewable energy, has significantly expanded the use of wind power across its cities and territories. Wind turbines utilize high-performance magnets containing gadolinium, which enhance motor efficiency and durability. The sustained use of gadolinium in energy applications is broadening market opportunities across the country. Furthermore, Canada’s commitment to achieving net-zero emissions by 2050, with a targeted 50% reduction in greenhouse gas emissions, signals strong long-term growth in renewable energy investments, thereby further propelling demand for gadolinium.

Key Gadolinium Market Players:

- Edgetech Industries LLC (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GFS Chemicals, Inc. (U.S.)

- Goodfellow Cambridge Ltd (England)

- HEFA Rare Earth Canada Co. Ltd. (Canada)

- Lynas Rare Earths Ltd (Australia)

- MP MATERIALS CORP (U.S.)

- Otto Chemie Pvt. Ltd (India)

- Solvay (Belgium)

- Star Earth Minerals Pvt Ltd. (India)

- Western Minmetals (SC) Corporation (China)

- Otto Chemie Pvt. Ltd, an Indian manufacturer of specialty, organic, and inorganic chemicals. The business also extracts rare earth minerals such as cerium and lanthanum. The business also serves industries through gadolinium oxides and salts, and powders. The business is also a popular supplier and distributor of rare earth to pharmaceuticals and electronics.

- Solvay, a Belgian multinational company, is a leading producer of specialty chemicals, which operates in more than 40 countries. The firm focuses on mining and processing of rare earth minerals to produce high-performance magnets. The global footprint of the business has earned it the reputation of being a strategic supplier of processed chemicals.

- Star Earth Minerals Pvt Ltd, an Indian rare earth mineral mining and processing firm that supplies high-purity zirconium compounds and inorganic compounds. The materials are supplied to industries and pharmaceutical companies across the globe because of the large-scale manufacturing capabilities

- Western Minerals (SC) Corporation, a material technology company based in China that deals in supplying high-purity elements and compounds and advanced materials. The business also supplies semiconductor products such as crystal silicon and germanium used in microelectronics.

Below is the list of the key players operating in the global gadolinium market:

Players operating in the global gadolinium market are expected to face intense competition throughout the forecast period. The market comprises a mix of well-established companies and emerging entrants, resulting in a moderately fragmented competitive landscape. New participants are intensifying competition, limiting the ability of existing players to capture a dominant share of market revenue. Specialized manufacturers continue to shape market dynamics by focusing on niche applications and technological differentiation. Furthermore, key players benefit from strong government support for research, development, and innovation, which further influences competitive positioning within the gadolinium market.

Competitive Landscape of the Global Gadolinium Market Key Players

Recent Developments

- In April 2025, Edgetech Industries LLC collaborated with Ashtead Technology to enhance the eBoss sonar system as a rental unit, enabling navigational and safety in maritime and enhancing sea scanning technology. The system is capable of identifying smaller as well as larger objects, enhancing the safety and security of seafarers.

- In September 2024, GFS Chemical announced a partnership with Analytichem to enhance the distribution of CONOSTAN line reference materials complying with U.S. standards. The initiative will significantly improve the delivery and broader accessibility for industrial customers.

- Report ID: 7226

- Published Date: Jan 07, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gadolinium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.