Gabapentin Market Outlook:

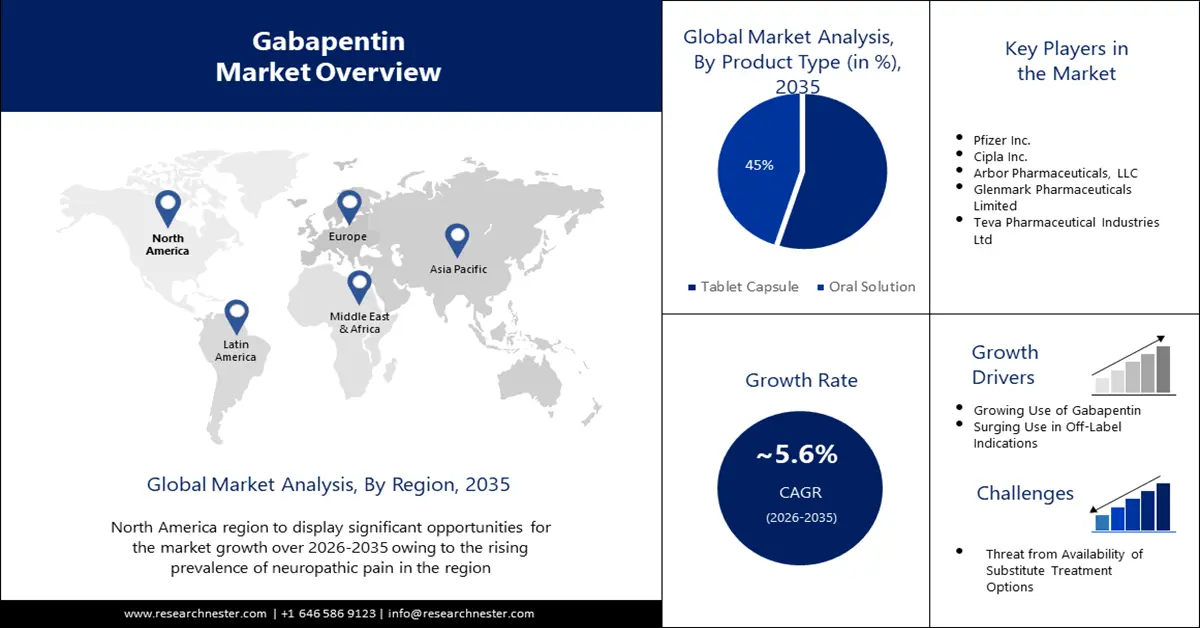

Gabapentin Market size was over USD 2.56 billion in 2025 and is projected to reach USD 4.41 billion by 2035, growing at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gabapentin is evaluated at USD 2.69 billion.

The growth of the market can be propelled by the increasing number of people suffering from epilepsy. Since, gabapentin belongs to the family of anticonvulsants it is prescribed to control seizures in individuals with epilepsy. As per a report by World Health Organization, globally 5 million people suffer from epilepsy with an LMC diagnosis rate in epilepsy 139 per 100,000 people.

Another one of the biggest growth drivers boosting the market expansion is the high utilization of gabapentin as a pain management drug, especially during neuropathic pain. This is largely attributable to an increase in chronic pain for illnesses such as diabetic neuropathy, spinal injuries, and shingles, which are difficult to treat with opioids. In 2021, an estimated 20.9% of U.S. adults experienced chronic pain, and 6.9% of adults experienced high-impact chronic pain.

Key Gabapentin Market Insights Summary:

Regional Highlights:

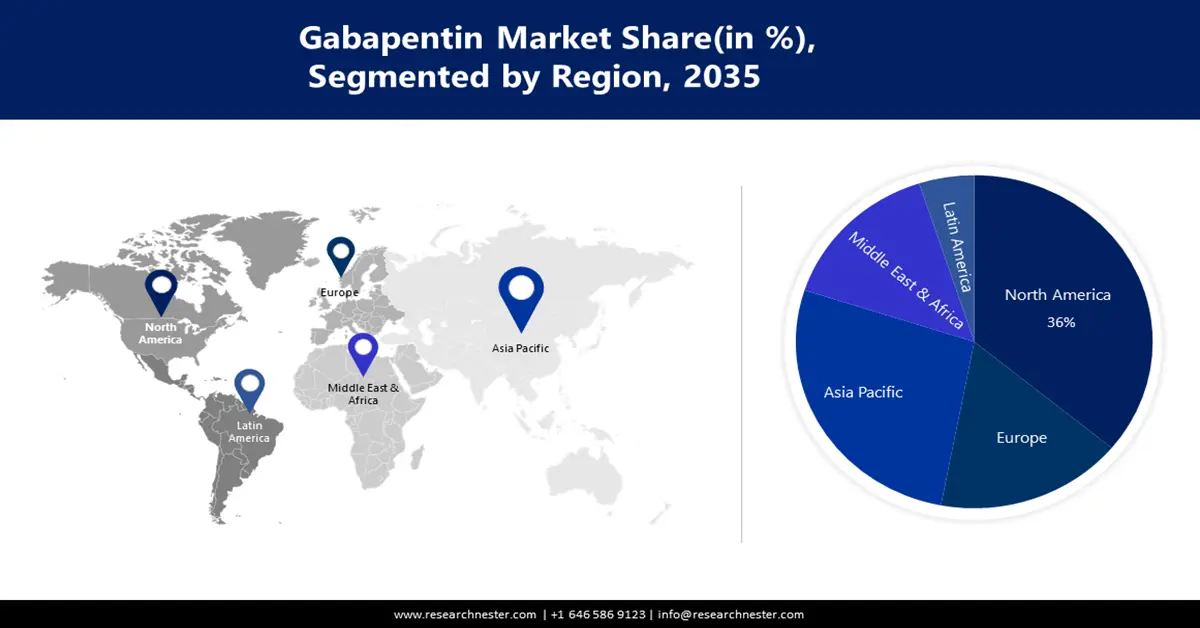

- The North America gabapentin market is expected to achieve a 35% share by 2035, driven by the growing prevalence of chronic pain conditions.

- The Asia Pacific market is poised for a significant revenue share by 2035, fueled by growing awareness about the benefits of gabapentin over opioids and increasing healthcare spending.

Segment Insights:

- The capsule segment in the gabapentin market is projected to hold a 50% share by 2035, driven by the ease of administration, availability, and correct dosing of capsule form medication.

- The hospital pharmacy segment segment in the gabapentin market is expected to achieve a 45% share by 2035, driven by growing demand for advanced healthcare infrastructure and high investment in the sector.

Key Growth Trends:

- Increasing Prevalence of Neuropathic Pain

- Increasing Application in Off-label Indication

Major Challenges:

- Side Effects of Gabapentin

- Availability of Alternative Treatments

Key Players: Sun Pharmaceutical Industries Ltd., Ascend Laboratories, LLC Apotex Inc., Teva Pharmaceutical Industries Ltd., Aurobindo Pharma., Amneal Pharmaceuticals LLC., Cipla USA, Inc., BP Pharmaceuticals Laboratories Company, Assertio Holdings, Inc., Arbor Pharmaceuticals, Inc., Pfizer Inc.

Global Gabapentin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.56 billion

- 2026 Market Size: USD 2.69 billion

- Projected Market Size: USD 4.41 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 May, 2025

Gabapentin Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Prevalence of Neuropathic Pain – Gabapentin is largely used to cure neuropathic pain which is caused by damage or dysfunction in the nervous system. The incidence of neuropathic pain all across the globe is growing with various factors such as the growing geriatric population, high prevalence of chronic disease, and increasing awareness of the situation. As per the estimates, the prevalence of neuropathic pain in the general population is around 7% to 10%, expected to grow to around 20% to 30% in people with diabetes in U.K.

- Increasing Application in Off-label Indication – Besides treating neuropathic and chronic pain, gabapentin is also used in treating off-label indications such as anxiety disorder, bipolar disorder, insomnia, and others.

- Availability of Generic Versions – The generic version of gabapentin has become easily accessible in recent times, and this has made the medication more affordable and attainable for patients.

- Supportive Reimbursement Policies – In many countries, healthcare authorities and government initiatives have offered supportive reimbursement policies that have covered gabapentin which makes the medication more affordable and accessible to patients.

- Increasing Awareness about Gabapentin – Patients and healthcare professionals are becoming more educated about gabapentin as a viable therapy option as more clinical evidence points to the drug's effectiveness for some conditions.

- Development of New Formulations – In recent times, new formulations have been developed in the gabapentin domain which enhances efficacy and is easy to use.

Challenges

-

Side Effects of Gabapentin – Gabapentin medication gives relief but it also has a few side effects associated with it such as drowsiness, dizziness, and nausea. Besides this, a few serious and harmful side effects are also associated with this medication such as suicidal thoughts, or abnormal behavior. These side effects might pose a limitation on the growth of the market in the upcoming times.

- Availability of Alternative Treatments

- Patent Expiration

Gabapentin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 2.56 billion |

|

Forecast Year Market Size (2035) |

USD 4.41 billion |

|

Regional Scope |

|

Gabapentin Market Segmentation:

Distribution Channel

The hospital pharmacy segment is anticipated to account for 45% share of the global gabapentin market during the projected period. The hospital pharmacies also have exposure to patients' medical records which leads to high accuracy in medication provision. Besides, the growing demand for advanced healthcare infrastructure, especially in developing countries along with high investment in new technologies and the healthcare sector is expected to influence the segment growth in the upcoming times. Given the risk of misuse, most medicines are provided by hospitals or the healthcare industry. According to a US national survey, 6.6% of persons reported misusing gabapentin at some point in their lives, with therapeutic and non-therapeutic uses split fairly evenly.

Dosage Form

The capsule segment in the gabapentin market is predicted to witness the largest revenue of 50 % by the end of 2035. The gabapentin medication is available in the market in various forms but the most popular and demanding form is the capsule form, owing to its easy availability, ease of administration, and correct dosing. One of the significant advantages of capsules is that they are easy to swallow which means old people or kids can take them easily and most doctors prescribe capsules over other forms owing to their huge properties.

Our in-depth analysis of the global gabapentin market includes the following segments:

|

Dosage Form |

|

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gabapentin Market Regional Analysis:

North American Market Insights

The gabapentin market in the North America industry is estimated to dominate majority revenue share of 35% by 2035. The growth can be ascribed to the growing prevalence of chronic pain conditions in the region. As the medication is used to treat anxiety, bipolar disorder, nausea, and other off-label indications. It is high in demand in the United States and Canada from this region. As per the data, gabapentin is highly prescribed and is one of the top 30 medications in the United States.

APAC Market Insights

The Asia Pacific gabapentin market is poised to account for a significant market value during the forecast timeframe. The growing awareness about the benefits of gabapentin over opioids and increasing healthcare spending in the region is the primary factor boosting the market expansion in the region. Moreover, various other factors such as the growing geriatric population, rise in government initiatives, research and development by pharmaceutical industries, and increasing product approvals are expected to elevate the growth of the gabapentin market in the region.

Gabapentin Market Players:

- Sun Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ascend Laboratories

- LLC Apotex Inc.

- Teva Pharmaceutical Industries Ltd.

- Aurobindo Pharma.

- Amneal Pharmaceuticals LLC.

- Cipla USA, Inc.

- BP Pharmaceuticals Laboratories Company

- Assertio Holdings, Inc.

- Arbor Pharmaceuticals, Inc.

- Pfizer Inc.

Recent Developments

· Pfizer Inc. announced the availability of its rheumatoid arthritis biosimilar, RUXIENCE, in July 2021.

· Pfizer Inc. disclosed in September 2021 that it would acquire Amplyx Pharmaceuticals, a privately held business that specializes in creating medications for life-threatening infections.

- Report ID: 5130

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gabapentin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.