Fusion Protein and Biosimilars Market Outlook:

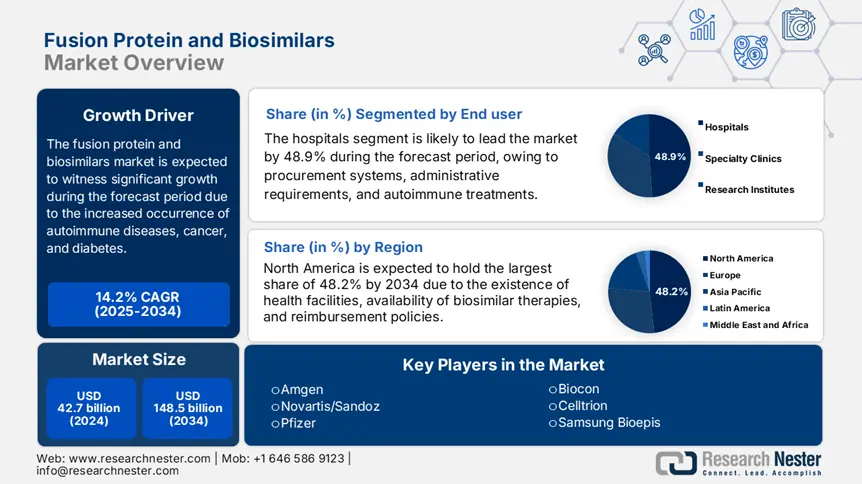

Fusion Protein and Biosimilars Market size was USD 42.7 billion in 2024 and is expected to reach USD 148.5 billion by the end of 2034, increasing at a CAGR of 14.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of fusion protein and biosimilar is evaluated at USD 48.6 billion.

The worldwide patient pool in the market is continuing to expand, highly attributed to a rise in the occurrence of chronic disorders, including autoimmune diseases, diabetes, and cancer. As stated by the 2024 World Health Organization (WHO) report, an estimated 65 million patients from across nations depend on biologic therapies, with biosimilars projected to aid at least 45% of the population by the end of 2030. Besides, as per the 2024 FDA report, the supply chain for these products includes complicated logistics, such as active pharmaceutical ingredient (API), sourced initially from India, the U.S., and Germany, fill-finish manufacturing from Switzerland and South Korea, along with cold-chain distribution, that needs USD 2.9 billion in yearly logistics, thus suitable for the market growth.

Furthermore, international trade in the fusion protein and biosimilars market is highly dominated by the EU and the U.S. exports, combinedly accounting for USD 30 billion as of 2024, while India and China are deliberately leading with API production, which is 50% of the international supply. Besides, the reliance on imports is still high in emerging economies, with Latin America effectively importing at least 85% of biosimilars. Meanwhile, investments in research, development, and deployment have increased to USD 15.5 billion as of 2024, of which 70% is generously allocated to conduct clinical trials, and the remaining 30% caters to automation in manufacturing, thereby positively impacting the overall market.

Fusion Protein and Biosimilars Market - Growth Drivers and Challenges

Growth Drivers

- Enhancement in healthcare and medical quality: Institutional and regulatory efforts are positively enhancing the biosimilar integration in care pathways, which are readily driving the market growth. For instance, in 2023, the U.S. FDA’s biosimilar action plan diminished acceptance duration by 35%, thereby permitting rapid market entry. Besides, hospitals utilizing biosimilars have reported a 13.5% decrease in readmission rates in comparison to originators. Meanwhile, quality-based metrics such as cost-per-dose and patient results are successfully embedding value-driven contracts, with providers incentivizing conversion to biosimilars.

- Tactical sector collaborations: The aspect of partnerships between healthcare systems and pharmaceutical giants is escalating the fusion protein and biosimilars market accessibility. For instance, in 2024, Pfizer entered into a partnership with the Mayo Clinic, with the intention to provide at least 12 million biosimilar doses to developing countries by effectively combining cost-effectiveness with scalability. Besides, in the same year, Novartis made an investment of USD 1.6 billion in cutting-edge fusion proteins for chronic diseases, thus creating a huge opportunity for market expansion.

Challenges

- Gaps in patient cost-effectiveness: The aspect of increased out-of-pocket expenses continues to be a severe gap in the overall fusion protein and biosimilars market. Biosimilar co-pays in the U.S. usually account for an average of USD 1,250 per year, pressurizing the majority of patients to ration-based doses. Likewise, almost 62% of rural patients in India are unable to afford biologics despite the existence of Biocon’s USD 56 per month for an insulin biosimilar. Failure in tiered pricing is the actual reason behind this, while manufacturers only provide discounts across low- and middle-income nations, thus causing a hindrance in the overall market growth.

- Clinical inertia and hesitation among patients: Payer and physician skepticism have slowed the fusion protein and biosimilars market adoption. For instance, an estimated 40% of rheumatologists in the U.S. still continue to prescribe originators, owing to undiscovered efficiency concerns. Besides, hospital tender systems in Europe readily discourage biosimilar utilization by highly favoring the low bidder, despite being regardless of the quality. Therefore, even though biosimilars are cheap and affordable, payers still resist formulary transitions, thus negatively impacting the market upliftment.

Fusion Protein and Biosimilars Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

14.2% |

|

Base Year Market Size (2024) |

USD 42.7 billion |

|

Forecast Year Market Size (2034) |

USD 148.5 billion |

|

Regional Scope |

|

Fusion Protein and Biosimilars Market Segmentation:

End user Segment Analysis

Based on end user, the hospitals segment is anticipated to hold the largest share of 48.9% in the fusion protein and biosimilars market by the end of 2034. The segment’s dominance originates from three major factors, including autoimmune and oncology treatment centers, complicated administrative demands, and centralized procurement systems. For instance, the 2024 FDA reported 73% of biosimilar trastuzumab doses in the U.S., while 345 billion programs in the U.S. and EU tenders have readily prioritized biosimilars for savings in expenses. Besides, cold-chain storage and IV infusions for fusion-based proteins are favoring hospital care treatments, thereby suitable for the segment’s growth.

Application Segment Analysis

Based on the application, the oncology segment in the fusion protein and biosimilars market is projected to account for the second-largest share of 40.7% during the forecast timeline. The segment’s development is effectively driven by an increase in the biosimilar integration for high-cost therapies, along with a surge in cancer occurrences. This headship originates from expanded immune-oncology applications, cost-effectiveness in oncology care, and patent expiration in blockbuster biologics. For instance, fusion proteins such as PD-1 inhibitors have displayed approximately 27% YoY growth, while biologics developed more than a USD 14 billion biosimilar opportunity, thus denoting a positive outlook for the segment.

Our in-depth analysis of the global fusion protein and biosimilars market includes the following segments:

|

Segment |

Subsegment |

|

End user |

|

|

Application |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fusion Protein and Biosimilars Market - Regional Analysis

North America Market Insights

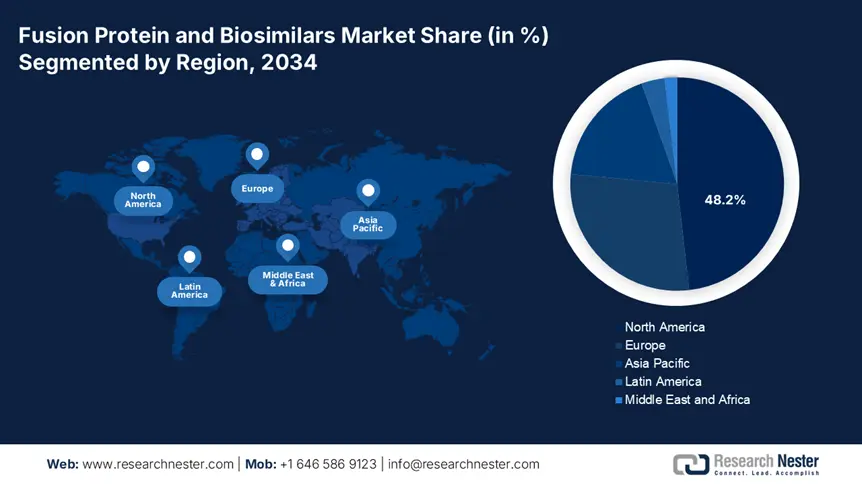

North America in the fusion protein and biosimilars market is considered the dominating region, with a projected share of 48.2% by the end of 2034. The market’s growth in the region is highly driven by an increase in the integration of biologic therapies, suitable reimbursement policies, and innovative healthcare facilities. In addition, the U.S. is dominating the region, which is attributed to the expansion in medical coverage and biosimilars approval by administrative bodies. Besides, Canada is also significantly contributing through provincial biosimilars, along with federal cost initiatives, thereby suitable for market uplifting in the overall region.

The fusion protein and biosimilars market in the U.S. is significantly growing, expected to account for an estimated USD 26 billion by the end of 2034. This is effectively fueled by Medicare Part B coverage expansions, catering to almost 85% of reimbursed biologics as of 2024, along with the 350 billion Drug Pricing Program’s USD 1.3 billion for yearly biosimilar investments. Additionally, the FDA’s Purple Book has listed 48 accepted biosimilars since 2024, with interchangeability designations escalating the implementation, thus denoting an optimistic outlook for the market.

The fusion protein and biosimilars market in Canada is also gaining increased traction, with a projected growth rate of 9.7% by the end of the forecast duration. This is readily driven by provincial transition reforms, with British Columbia achieving 93% biosimilar incorporation for anti-TNFs. Besides, the Pan-Canada-based pharmaceutical alliance’s USD 1.4 billion savings plan has targeted approximately 62% of biosimilar penetration across nations. Meanwhile, Quebec is leading with localized manufacturing with a USD 520 million investment for biologic production, thus uplifting the market growth.

North America Fusion Protein & Biosimilars Supply Chain Facilities (2021-2025)

|

Category |

2021 |

2023 |

2025 |

Key Players |

|

API Production Sites |

U.S.: 14 |

U.S.: 17 (+25.5%) |

U.S.: 19 |

Pfizer (MI), Amgen (CA), |

|

Fill-Finish Facilities |

U.S.: 9 |

U.S.: 11 |

U.S.: 14 (+63.5%) |

Samsung Bioepis (NC), |

|

Cold-Chain Logistics |

U.S.: 27 hubs |

U.S.: 34 hubs |

U.S.: 42 hubs |

AmerisourceBergen (PA), |

|

Trade Volume |

U.S.: USD 4.4 billion |

U.S.: USD 5.9 billion |

U.S.: USD 7.7 billion |

APIs: 62% imported (India/China) |

APAC Market Insights

Asia Pacific in the fusion protein and biosimilars market is considered the fastest-growing region, with an expected revenue share of 18.1% during the forecast timeline. The market’s development in the region is attributed to an expansion in localized manufacturing, government expenses-based containment reforms, and a rise in rare disorder burdens. China is dominating the region with approximately 1.9 million patients, who are yearly treated, along with USD 5.3 billion in administrative spending on biosimilars. Additionally, India is also contributing with affordable production centers, thereby skyrocketing the market exposure in the overall region.

The fusion protein and biosimilars market in China is dominating the market in the region, and is anticipated to garner 47% of the region’s revenue during the projected duration, which is driven by the USD 5.4 billion in yearly government expenditure. Besides, the NMPA readily accepted 13 biosimilars as of 2023, which included at least 5 PD-1 inhibitors, and regional players such as Hengrui and Innovent targeting 72% of local biologic production. Meanwhile, more than 1.6 million patients yearly receive biosimilars, initially for diabetes and cancer, thus denoting the rising market demand in the country.

The fusion protein and biosimilars market in India is also gaining increased exposure and is considered the international cost-effective leader, deliberately sourcing 45% of biosimilars to LATAM and Africa. Besides, the aspect of government spending has increased to USD 2.1 billion as of 2024. In addition, Dr. Reddy and Biocon are also driving the market growth with rituximab and insulin biosimilars, which are priced at 55% to 75% lower than originators. Meanwhile, the PLI scheme in the country is expected to incentivize USD 2.5 billion through localized API investments, thus enhancing the market demand.

Europe Market Insights

Europe in the fusion protein and biosimilars market is anticipated to account for a considerable share of 28.3% by the end of the forecast duration. The market’s upliftment in the region is readily fueled by an increase in the aging population, a surge in biosimilar penetration, and cost-containment reforms. Additionally, the region is leading in the biosimilar integration, with almost 60.5% of biologic prescriptions currently available in markets, including France and Germany. Besides, the EU’s €2.6 billion Health Fund, allocated between 2023 and 2027, has escalated research, while regional tender systems have enforced 35% to 55% discounts in price in comparison to originators.

The fusion protein and biosimilars market in Germany is dominating, with an expected revenue share of 32.7% by the end of 2034, effectively fueled by the existence of strict cost-control reforms and an increase in adoption rates. Besides, the AMNOG pricing legal aspect mandates at least 35% discounts on the original post-patent expiry, further contributing to approximately 62% of biosimilar penetration, particularly in hospitals. Besides, in 2024, the country allocated €4.8 billion for biosimilars, of which 12.5% year-over-year (YoY) growth caters to oncology-based biosimilars such as trastuzumab, thus creating a positive impact on the market.

The fusion protein and biosimilars market in France constitutes 22.5% of the region’s market revenue, with an estimated €3.8 billion in yearly spending, of which 7.2% has been allocated to the health care budget as of 2024. Besides, the HAS pricing authority has enforced 45% to 55% in cost savings in comparison to originators, thereby gaining 95% of the adoption for insulin glargine biosimilars. Meanwhile, the country is leading in fusion protein advancement and has invested €525 million in lyophilized formulations to avoid challenges related to cold chains.

Europe-Based Government Investments & Policies in Fusion Protein & Biosimilars (2021–2025)

|

Country |

Policy/Initiative |

Funding (EUR/USD) |

Launch Year |

Key Impact |

|

UK |

NHS Biosimilar Adoption Programme |

£155 million (€177 million) annually |

2021 |

81% biosimilar penetration by 2025 (NHS) |

|

Life Sciences Vision 2025 |

£1.1 billion (€1.2 billion) total |

2022 |

6 new fusion proteins in trials (ABPI) |

|

|

Italy |

AIFA Biosimilar Substitution Policy |

€350 million (2023–2025) |

2023 |

Mandatory biosimilar use in public hospitals |

|

PNRR (EU Recovery Fund Allocation) |

€530 million (2021–2026) |

2021 |

Local API production (+40% capacity) |

|

|

Spain |

National Biosimilar Strategy (AEMPS) |

€215 million (2022–2025) |

2022 |

75% biosimilar adoption in oncology |

|

Regional Tender Reforms (Andalusia) |

€122 million (2023–2025) |

2023 |

44% cost reduction vs. originators |

Key Fusion Protein and Biosimilars Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international fusion protein and biosimilars market is extremely united with key players, such as Samsung Bioepis, Novartis, and Pfizer, effectively and jointly leading through hostile pricing, accounting for 40% to 60% discounts, and first-to-market biosimilars. In addition, Roche and Amgen are highly focused on high-margin fusion proteins, while Celltrion and Biocon readily dominate emerging economies through affordable production processes. Besides, partnerships and collaborations with hospitals, local manufacturing, and EMA and FDA fast-track acceptances are other key strategies that are responsible for uplifting the overall market globally.

Here is a list of key players operating in the global market:

|

Company Name (Country) |

Industry Focus |

Market Share (2024) |

|

Pfizer (U.S.) |

Leader in monoclonal antibody biosimilars (e.g., trastuzumab, bevacizumab) |

12.8% |

|

Novartis/Sandoz (Switzerland) |

Largest biosimilar portfolio (22+ approved products, including adalimumab) |

11.7% |

|

Amgen (U.S.) |

Pioneer in fusion proteins (e.g., Enbrel) and oncology biosimilars |

9.3% |

|

Samsung Bioepis (South Korea) |

Key player in autoimmune & oncology biosimilars (e.g., Imraldi, Ontruzant) |

8.2% |

|

Celltrion (South Korea) |

Dominates EU biosimilar market with Remsima (infliximab) |

7.2% |

|

Biocon (India) |

Low-cost insulin & trastuzumab biosimilars for emerging markets |

xx% |

|

Roche (Switzerland) |

Focus on originator biologics & biosimilar competition (e.g., Herceptin) |

xx% |

|

Merck KGaA (Germany) |

Investments in fusion proteins for rare diseases |

xx% |

|

Eli Lilly (U.S.) |

Diabetes-focused biosimilars (e.g., insulin glargine) |

xx% |

|

Fresenius Kabi (Germany) |

Biosimilars for oncology & immunology (e.g., Idacio) |

xx% |

|

Dr. Reddy’s (India) |

Affordable biosimilars for LATAM & Africa (e.g., rituximab) |

xx% |

|

Mylan/Viatris (U.S.) |

Broad biosimilar portfolio (e.g., Fulphila |

xx% |

|

Teva Pharmaceuticals (Israel) |

Biosimilars for CNS & autoimmune disorders |

xx% |

|

Stada Arzneimittel (Germany) |

Biosimilars for EU hospitals (e.g., Grasustek) |

xx% |

|

Innovent Biologics (China) |

PD-1 inhibitor biosimilars & fusion proteins for APAC market |

xx% |

Below are the areas covered for each company in the fusion protein and biosimilars market:

Recent Developments

- In June 2024, Pfizer Inc. announced that it achieved the U.S. FDA acceptance for its Trazimera, which is a trastuzumab biosimilar, suitable for gastric cancers as well as HER2-positive breast.

- In June 2024, Novartis AG/Sandoz unveiled Hyrimoz, which is an adalimumab biosimilar, in Canada, with an estimated 62% reduction in the overall price, and further increasing yearly sales by USD 505 million.

- Report ID: 7906

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Get detailed insights on specific segments/region

- Inquire about report customization for your industry

- Learn about our special pricing for startups

- Request a demo of the report’s key findings

- Understand the report’s forecasting methodology

- Inquire about post-purchase support and updates

- Ask About Company-Level Intelligence Additions

Have specific data needs or budget constraints?

Frequently Asked Questions (FAQ)

FREE Sample Copy includes market overview, growth trends, statistical charts & tables, forecast estimates, and much more.

Connect with our Expert

Inquiry Before Buying

Inquiry Before Buying

Afghanistan (+93)

Afghanistan (+93)

Åland Islands (+358)

Åland Islands (+358)

Albania (+355)

Albania (+355)

Algeria (+213)

Algeria (+213)

American Samoa (+1684)

American Samoa (+1684)

Andorra (+376)

Andorra (+376)

Angola (+244)

Angola (+244)

Anguilla (+1264)

Anguilla (+1264)

Antarctica (+672)

Antarctica (+672)

Antigua and Barbuda (+1268)

Antigua and Barbuda (+1268)

Argentina (+54)

Argentina (+54)

Armenia (+374)

Armenia (+374)

Aruba (+297)

Aruba (+297)

Australia (+61)

Australia (+61)

Austria (+43)

Austria (+43)

Azerbaijan (+994)

Azerbaijan (+994)

Bahamas (+1242)

Bahamas (+1242)

Bahrain (+973)

Bahrain (+973)

Bangladesh (+880)

Bangladesh (+880)

Barbados (+1246)

Barbados (+1246)

Belarus (+375)

Belarus (+375)

Belgium (+32)

Belgium (+32)

Belize (+501)

Belize (+501)

Benin (+229)

Benin (+229)

Bermuda (+1441)

Bermuda (+1441)

Bhutan (+975)

Bhutan (+975)

Bolivia (+591)

Bolivia (+591)

Bosnia and Herzegovina (+387)

Bosnia and Herzegovina (+387)

Botswana (+267)

Botswana (+267)

Bouvet Island (+)

Bouvet Island (+)

Brazil (+55)

Brazil (+55)

British Indian Ocean Territory (+246)

British Indian Ocean Territory (+246)

British Virgin Islands (+1284)

British Virgin Islands (+1284)

Brunei (+673)

Brunei (+673)

Bulgaria (+359)

Bulgaria (+359)

Burkina Faso (+226)

Burkina Faso (+226)

Burundi (+257)

Burundi (+257)

Cambodia (+855)

Cambodia (+855)

Cameroon (+237)

Cameroon (+237)

Canada (+1)

Canada (+1)

Cape Verde (+238)

Cape Verde (+238)

Cayman Islands (+1345)

Cayman Islands (+1345)

Central African Republic (+236)

Central African Republic (+236)

Chad (+235)

Chad (+235)

Chile (+56)

Chile (+56)

China (+86)

China (+86)

Christmas Island (+61)

Christmas Island (+61)

Cocos (Keeling) Islands (+61)

Cocos (Keeling) Islands (+61)

Colombia (+57)

Colombia (+57)

Comoros (+269)

Comoros (+269)

Cook Islands (+682)

Cook Islands (+682)

Costa Rica (+506)

Costa Rica (+506)

Croatia (+385)

Croatia (+385)

Cuba (+53)

Cuba (+53)

Curaçao (+599)

Curaçao (+599)

Cyprus (+357)

Cyprus (+357)

Czechia (+420)

Czechia (+420)

Democratic Republic of the Congo (+243)

Democratic Republic of the Congo (+243)

Denmark (+45)

Denmark (+45)

Djibouti (+253)

Djibouti (+253)

Dominica (+1767)

Dominica (+1767)

Dominican Republic (+1809)

Dominican Republic (+1809)

Timor-Leste (+670)

Timor-Leste (+670)

Ecuador (+593)

Ecuador (+593)

Egypt (+20)

Egypt (+20)

El Salvador (+503)

El Salvador (+503)

Equatorial Guinea (+240)

Equatorial Guinea (+240)

Eritrea (+291)

Eritrea (+291)

Estonia (+372)

Estonia (+372)

Ethiopia (+251)

Ethiopia (+251)

Falkland Islands (+500)

Falkland Islands (+500)

Faroe Islands (+298)

Faroe Islands (+298)

Fiji (+679)

Fiji (+679)

Finland (+358)

Finland (+358)

France (+33)

France (+33)

Gabon (+241)

Gabon (+241)

Gambia (+220)

Gambia (+220)

Georgia (+995)

Georgia (+995)

Germany (+49)

Germany (+49)

Ghana (+233)

Ghana (+233)

Gibraltar (+350)

Gibraltar (+350)

Greece (+30)

Greece (+30)

Greenland (+299)

Greenland (+299)

Grenada (+1473)

Grenada (+1473)

Guadeloupe (+590)

Guadeloupe (+590)

Guam (+1671)

Guam (+1671)

Guatemala (+502)

Guatemala (+502)

Guinea (+224)

Guinea (+224)

Guinea-Bissau (+245)

Guinea-Bissau (+245)

Guyana (+592)

Guyana (+592)

Haiti (+509)

Haiti (+509)

Honduras (+504)

Honduras (+504)

Hong Kong (+852)

Hong Kong (+852)

Hungary (+36)

Hungary (+36)

Iceland (+354)

Iceland (+354)

India (+91)

India (+91)

Indonesia (+62)

Indonesia (+62)

Iran (+98)

Iran (+98)

Iraq (+964)

Iraq (+964)

Ireland (+353)

Ireland (+353)

Isle of Man (+44)

Isle of Man (+44)

Israel (+972)

Israel (+972)

Italy (+39)

Italy (+39)

Jamaica (+1876)

Jamaica (+1876)

Japan (+81)

Japan (+81)

Jersey (+44)

Jersey (+44)

Jordan (+962)

Jordan (+962)

Kazakhstan (+7)

Kazakhstan (+7)

Kenya (+254)

Kenya (+254)

Kiribati (+686)

Kiribati (+686)

Kuwait (+965)

Kuwait (+965)

Kyrgyzstan (+996)

Kyrgyzstan (+996)

Laos (+856)

Laos (+856)

Latvia (+371)

Latvia (+371)

Lebanon (+961)

Lebanon (+961)

Lesotho (+266)

Lesotho (+266)

Liberia (+231)

Liberia (+231)

Libya (+218)

Libya (+218)

Liechtenstein (+423)

Liechtenstein (+423)

Lithuania (+370)

Lithuania (+370)

Luxembourg (+352)

Luxembourg (+352)

Macao (+853)

Macao (+853)

Madagascar (+261)

Madagascar (+261)

Malawi (+265)

Malawi (+265)

Malaysia (+60)

Malaysia (+60)

Maldives (+960)

Maldives (+960)

Mali (+223)

Mali (+223)

Malta (+356)

Malta (+356)

Marshall Islands (+692)

Marshall Islands (+692)

Mauritania (+222)

Mauritania (+222)

Mauritius (+230)

Mauritius (+230)

Mayotte (+262)

Mayotte (+262)

Mexico (+52)

Mexico (+52)

Micronesia (+691)

Micronesia (+691)

Moldova (+373)

Moldova (+373)

Monaco (+377)

Monaco (+377)

Mongolia (+976)

Mongolia (+976)

Montenegro (+382)

Montenegro (+382)

Montserrat (+1664)

Montserrat (+1664)

Morocco (+212)

Morocco (+212)

Mozambique (+258)

Mozambique (+258)

Myanmar (+95)

Myanmar (+95)

Namibia (+264)

Namibia (+264)

Nauru (+674)

Nauru (+674)

Nepal (+977)

Nepal (+977)

Netherlands (+31)

Netherlands (+31)

New Caledonia (+687)

New Caledonia (+687)

New Zealand (+64)

New Zealand (+64)

Nicaragua (+505)

Nicaragua (+505)

Niger (+227)

Niger (+227)

Nigeria (+234)

Nigeria (+234)

Niue (+683)

Niue (+683)

Norfolk Island (+672)

Norfolk Island (+672)

North Korea (+850)

North Korea (+850)

Northern Mariana Islands (+1670)

Northern Mariana Islands (+1670)

Norway (+47)

Norway (+47)

Oman (+968)

Oman (+968)

Pakistan (+92)

Pakistan (+92)

Palau (+680)

Palau (+680)

Palestine (+970)

Palestine (+970)

Panama (+507)

Panama (+507)

Papua New Guinea (+675)

Papua New Guinea (+675)

Paraguay (+595)

Paraguay (+595)

Peru (+51)

Peru (+51)

Philippines (+63)

Philippines (+63)

Poland (+48)

Poland (+48)

Portugal (+351)

Portugal (+351)

Puerto Rico (+1787)

Puerto Rico (+1787)

Qatar (+974)

Qatar (+974)

Romania (+40)

Romania (+40)

Russia (+7)

Russia (+7)

Rwanda (+250)

Rwanda (+250)

Saint Barthélemy (+590)

Saint Barthélemy (+590)

Saint Helena, Ascension and Tristan da Cunha (+290)

Saint Helena, Ascension and Tristan da Cunha (+290)

Saint Kitts and Nevis (+1869)

Saint Kitts and Nevis (+1869)

Saint Lucia (+1758)

Saint Lucia (+1758)

Saint Martin (French part) (+590)

Saint Martin (French part) (+590)

Saint Pierre and Miquelon (+508)

Saint Pierre and Miquelon (+508)

Saint Vincent and the Grenadines (+1784)

Saint Vincent and the Grenadines (+1784)

Samoa (+685)

Samoa (+685)

San Marino (+378)

San Marino (+378)

Sao Tome and Principe (+239)

Sao Tome and Principe (+239)

Saudi Arabia (+966)

Saudi Arabia (+966)

Senegal (+221)

Senegal (+221)

Serbia (+381)

Serbia (+381)

Seychelles (+248)

Seychelles (+248)

Sierra Leone (+232)

Sierra Leone (+232)

Singapore (+65)

Singapore (+65)

Sint Maarten (Dutch part) (+1721)

Sint Maarten (Dutch part) (+1721)

Slovakia (+421)

Slovakia (+421)

Slovenia (+386)

Slovenia (+386)

Solomon Islands (+677)

Solomon Islands (+677)

Somalia (+252)

Somalia (+252)

South Africa (+27)

South Africa (+27)

South Georgia and the South Sandwich Islands (+0)

South Georgia and the South Sandwich Islands (+0)

South Korea (+82)

South Korea (+82)

South Sudan (+211)

South Sudan (+211)

Spain (+34)

Spain (+34)

Sri Lanka (+94)

Sri Lanka (+94)

Sudan (+249)

Sudan (+249)

Suriname (+597)

Suriname (+597)

Svalbard and Jan Mayen (+47)

Svalbard and Jan Mayen (+47)

Eswatini (+268)

Eswatini (+268)

Sweden (+46)

Sweden (+46)

Switzerland (+41)

Switzerland (+41)

Syria (+963)

Syria (+963)

Taiwan (+886)

Taiwan (+886)

Tajikistan (+992)

Tajikistan (+992)

Tanzania (+255)

Tanzania (+255)

Thailand (+66)

Thailand (+66)

Togo (+228)

Togo (+228)

Tokelau (+690)

Tokelau (+690)

Tonga (+676)

Tonga (+676)

Trinidad and Tobago (+1868)

Trinidad and Tobago (+1868)

Tunisia (+216)

Tunisia (+216)

Turkey (+90)

Turkey (+90)

Turkmenistan (+993)

Turkmenistan (+993)

Turks and Caicos Islands (+1649)

Turks and Caicos Islands (+1649)

Tuvalu (+688)

Tuvalu (+688)

Uganda (+256)

Uganda (+256)

Ukraine (+380)

Ukraine (+380)

United Arab Emirates (+971)

United Arab Emirates (+971)

United Kingdom (+44)

United Kingdom (+44)

Uruguay (+598)

Uruguay (+598)

Uzbekistan (+998)

Uzbekistan (+998)

Vanuatu (+678)

Vanuatu (+678)

Vatican City (+39)

Vatican City (+39)

Venezuela (Bolivarian Republic of) (+58)

Venezuela (Bolivarian Republic of) (+58)

Vietnam (+84)

Vietnam (+84)

Wallis and Futuna (+681)

Wallis and Futuna (+681)

Western Sahara (+212)

Western Sahara (+212)

Yemen (+967)

Yemen (+967)

Zambia (+260)

Zambia (+260)

Zimbabwe (+263)

Zimbabwe (+263)