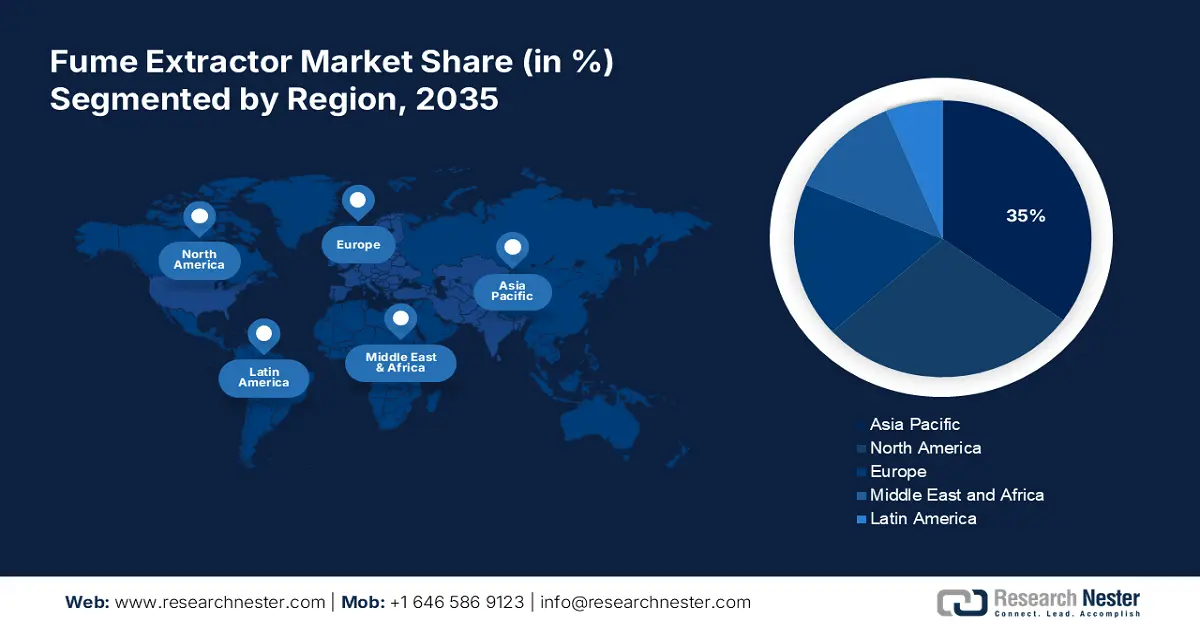

Fume Extractor Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is predicted to hold largest revenue share of 35% by 2035, The enlarging construction and automotive industry in developing countries such as Japan, China, India, and South Korea are driving demand for these systems. The governments are actively taking part in reducing the exposure of welders by issuing several policies and industrial standards. For instance, in January 2024, the Work Health and Safety Ministers of Australia updated the standards of welding fumes for reducing workplace exposure. The new standard strictly mandated an 8-hour time-weighted average to be 1 mg/m3. Such regulations are pushing companies to adopt more effective fume extraction solutions.

India is creating great opportunities for expansion for the market due to its high demand for these safety devices. The extensive use of welding in the enlarging construction industry has positively influenced the sector to grow higher. According to a report published by the India Investment Grid, in October 2024, the construction sector of this country reached USD 126 billion with an annual growth rate of 30%. As the country continues to invest in urban infrastructure development, the volume of welding fumes increases. This further inflates the demand for more efficient extraction-controlling systems.

China presents the potential to generate remarkable revenue for the global leaders of the fume extractor market. The growing population is forcing the country to build more infrastructures, increasing the amount of welding work. This is further creating a surge for more effective solutions to reduce fume exposure. According to the International Trade Administration, in April 2023, China became the world’s largest construction industry. The report further estimates new infrastructures to reach around USD 3725.5 billion during 2021-2025. This subsequently increases the demand for extraction devices.

North America Market Analysis

North America is projected to generate significant revenue in the fume extractor market during the forecast period, 2025-2035. Technological advancement in this region has highly influenced the growth of this sector. Many domestic leaders are now focusing on introducing affordable options for businesses. For instance, in August 2020, Kemper launched a cost-effective welding fume extractor, WallMaster to increase employee safety in metalworking companies. The stationary extraction system consists of a large filter surface of 42 square meters in an entry-level price segment. Such cost-cutting air filtration technologies are diluting the economic barrier, promoting maximum adoption.

The U.S. is creating a great opportunity for global leaders in the market to capture the large consumer base of this country. The heavy investment in building real-estate assets has set a requirement for a sufficient supply of high-performing air filtration systems. This has further dragged the attention of foreign investors to expand their portfolio in this industry. For instance, in July 2022, Nederman acquired RoboVent to strengthen its position in the U.S. in the weld fume extraction segment.

Canada is paving the way for securing a profitable margin in the market for global leaders. The country presents diverse applications of these solutions due to ongoing developments in various industries. This has further created great opportunities for foreign leaders to outstretch their distribution network. For instance, in August 2024, Nederman acquired Duroair Technologies to solidify its position in the Canada extraction and filtration technology division. Nederman aims to capture the strong network of defense, aerospace, and industrial manufacturing industries gained by Duroair.