Fume Extractor Market Outlook:

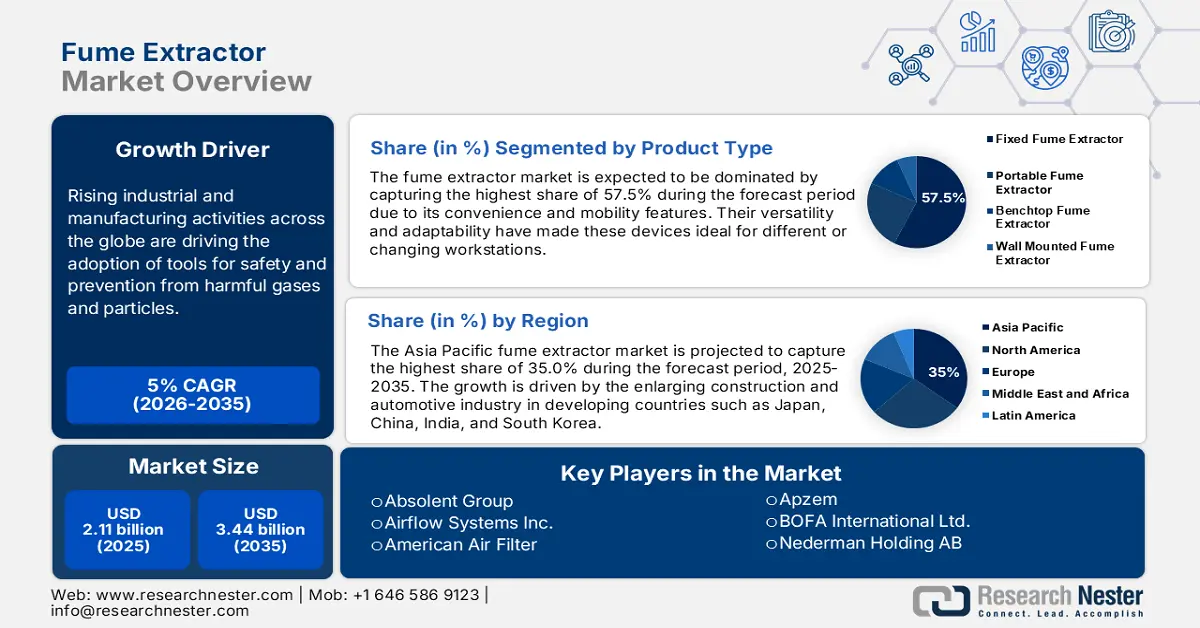

Fume Extractor Market size was valued at USD 2.11 billion in 2025 and is likely to cross USD 3.44 billion by 2035, expanding at more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fume extractor is estimated at USD 2.2 billion.

Rising industrial and manufacturing activities across the globe are driving the adoption of tools for safety and prevention from harmful gases and particles. According to the NLM report published in December 2021, the total number of people exposed to welding fumes worldwide accounted to be 110 million in the same year. The report further states that around 11 million people work as welders, having the possibility of inhaling fumes <5 mg/m3 due to inadequate worker protection.

This has further pushed companies from several sectors related to welding to invest in the market, increasing worker safety. These tools are also capable of reducing emissions from manufacturing facilities, inspiring others to enable such devices to obtain sustainability. The growth in industrialization is achieving record heights, which inflates the volume of welding or other fume-generating works. According to a report published by the UN Industrial Development Organization, in December 2023, the global industrial sectors witnessed a 2.3% increment in the same year. Such growth in these industries including manufacturing and mining is creating a surge for more efficient fume-extracting and controlling systems.

Key Fume Extractor Market Insights Summary:

Regional Highlights:

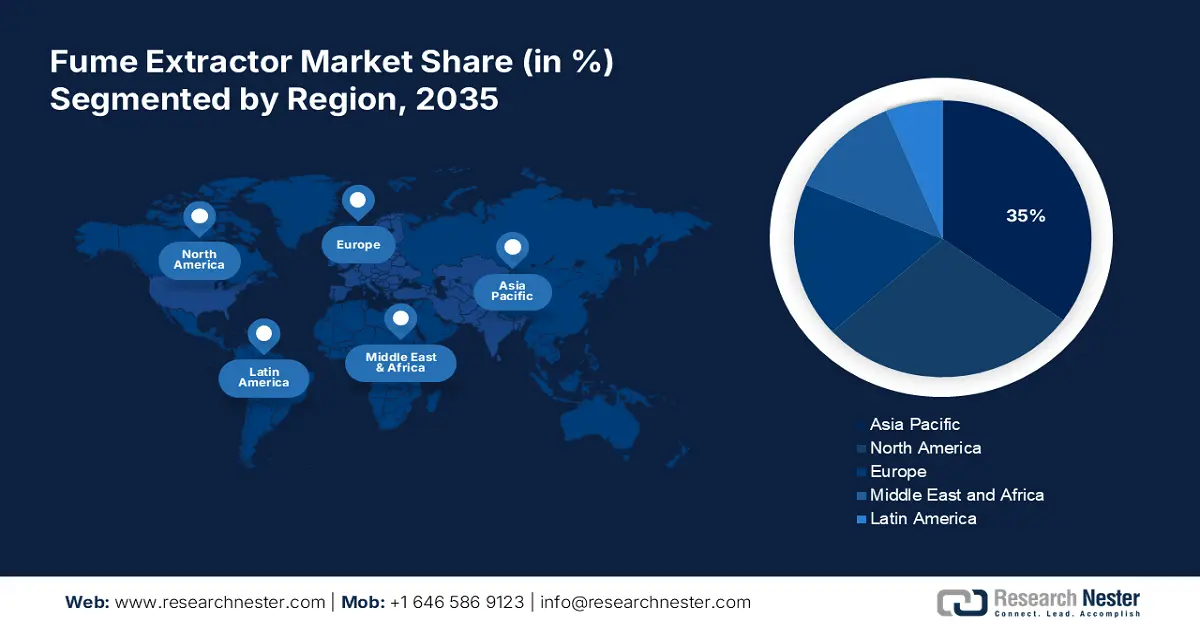

- Asia Pacific holds a 35% share in the Fume Extractor Market, driven by enlarging construction and automotive industries and government regulations reducing exposure to welding fumes through 2026–2035.

Segment Insights:

- The Portable Fume Extractor segment is expected to exceed 57.5% market share by 2035, fueled by its convenience and mobility across varying workstations.

- The Welding Fume Extractor segment is poised for significant share by 2035, driven by heightened health concerns over inhaling welding fumes.

Key Growth Trends:

- Awareness about health impact

- Technological advancements

Major Challenges:

- High initial and operational costs

- Concerns about energy efficiency

- Key Players: Absolent Group, Airflow Systems Inc., American Air Filter, Apzem, BOFA International Ltd., Camfil, Cleantek, DiversitechInc., Donaldson Company, ESTA Apparatebsan GmbH & Co. KG, Fumex Inc., Johnson Controls International plc, Kemper America, Lincoln Electric Holdings, Miller Electric, Nederman Holding AB, Parker Hannifin, Plymovent Group B.V., Weller Tools GmbH.

Global Fume Extractor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.11 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.44 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, Germany, United States, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Fume Extractor Market Growth Drivers and Challenges:

Growth Drivers

- Awareness about health impact: The increasing rate of health hazards due to fume generation has forced both the government and industries to promote adoption in the fume extractor market. The associated risks of inhaling such harmful fumes include respiratory disease and cancers, driving the focus of public health authorities. According to a report published by the UK Health and Safety Executive, in October 2023, around 40-50 welders were being hospitalized every year due to breathing metal fumes at work. Many regulations such as OEL are now being issued to increase safety by limiting fume emissions, inflating the demand for extracting systems.

- Technological advancements: The market is highly benefited by the ongoing development of technologies for better performance. Leaders are now introducing competitive features in the new models for enhanced worker safety and reduced emissions. For instance, in December 2020, ACL Technology partnered with Nederman to launch a new range of LEV systems for the welding industry. The new technology will bring more efficacy in the collection and removal of fumes by capturing them right from the source. The increasing demand for such functionally effective solutions on an affordable budget is further inspiring companies to invest more in innovation in this sector.

Challenges

- High initial and operational costs: Higher upfront costs of purchase and installation can create hurdles for SMEs to invest in the fume extractor market. The economic barriers may also make these enterprises neglect the long-term benefits of such advanced systems. Further, the high capital expenditure can prevent many organizations from adopting upgraded versions of extraction devices, limiting the optimum usage or development of this sector.

- Concerns about energy efficiency: As many traditional systems are energy-intensive, the concerns about efficiency can hinder further adoption in the market. In addition, high energy consumption may also result in additional operational costs and environmental impacts. While balancing effectiveness and performance is still under development, the raised questions may create pressure on companies by hampering the process of developing new technologies.

Fume Extractor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 2.11 billion |

|

Forecast Year Market Size (2035) |

USD 3.44 billion |

|

Regional Scope |

|

Fume Extractor Market Segmentation:

Product Type (Fixed Fume Extractor, Portable Fume Extractor, Benchtop Fume Extractor, Wall Mounted Fume Extractor)

Portable fume extractor segment is projected to hold over 57.5% fume extractor market share by the end of 2035 due to its convenience and mobility features. Their versatility and adaptability have made these devices ideal for different or changing workstations, increasing demand for this segment. Many companies are now focusing on introducing more compact and efficient mobile systems for confined spaces. For instance, in September 2023, Mectal launched the BVX-250 Fume Extraction System with improved ease of use. The new 2-port movable extractor can deliver HEPA filtration with 99.97% efficiency, offering an easy-to-change pre-filter drawer design.

Application (Welding Fume Extractor, Laboratory Wield Extractor, Chemicals Wield Extractor, Pharmaceutical Wield Extractor)

In terms of applications, the welding fume extractor is poised to hold a significant share of the fume extractor market by the end of 2035. These systems are specially designed to remove hazardous fumes, dust, smoke, and other airborne contaminants generated from welding in the manufacturing industry. The growth in this sector is majorly driven by the health impact on welders due to inhaling poisonous fumes. Leaders are now introducing systems specially engineered to save these workers. For instance, in June 2024, Nederman launched a compact plug-and-play welding fume extractor, MCP-G0. The smart filter technology of this system enables simple and quick operations with a reliable clean air solution.

Our in-depth analysis of the global market includes the following segments

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fume Extractor Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is predicted to hold largest revenue share of 35% by 2035, The enlarging construction and automotive industry in developing countries such as Japan, China, India, and South Korea are driving demand for these systems. The governments are actively taking part in reducing the exposure of welders by issuing several policies and industrial standards. For instance, in January 2024, the Work Health and Safety Ministers of Australia updated the standards of welding fumes for reducing workplace exposure. The new standard strictly mandated an 8-hour time-weighted average to be 1 mg/m3. Such regulations are pushing companies to adopt more effective fume extraction solutions.

India is creating great opportunities for expansion for the market due to its high demand for these safety devices. The extensive use of welding in the enlarging construction industry has positively influenced the sector to grow higher. According to a report published by the India Investment Grid, in October 2024, the construction sector of this country reached USD 126 billion with an annual growth rate of 30%. As the country continues to invest in urban infrastructure development, the volume of welding fumes increases. This further inflates the demand for more efficient extraction-controlling systems.

China presents the potential to generate remarkable revenue for the global leaders of the fume extractor market. The growing population is forcing the country to build more infrastructures, increasing the amount of welding work. This is further creating a surge for more effective solutions to reduce fume exposure. According to the International Trade Administration, in April 2023, China became the world’s largest construction industry. The report further estimates new infrastructures to reach around USD 3725.5 billion during 2021-2025. This subsequently increases the demand for extraction devices.

North America Market Analysis

North America is projected to generate significant revenue in the fume extractor market during the forecast period, 2025-2035. Technological advancement in this region has highly influenced the growth of this sector. Many domestic leaders are now focusing on introducing affordable options for businesses. For instance, in August 2020, Kemper launched a cost-effective welding fume extractor, WallMaster to increase employee safety in metalworking companies. The stationary extraction system consists of a large filter surface of 42 square meters in an entry-level price segment. Such cost-cutting air filtration technologies are diluting the economic barrier, promoting maximum adoption.

The U.S. is creating a great opportunity for global leaders in the market to capture the large consumer base of this country. The heavy investment in building real-estate assets has set a requirement for a sufficient supply of high-performing air filtration systems. This has further dragged the attention of foreign investors to expand their portfolio in this industry. For instance, in July 2022, Nederman acquired RoboVent to strengthen its position in the U.S. in the weld fume extraction segment.

Canada is paving the way for securing a profitable margin in the market for global leaders. The country presents diverse applications of these solutions due to ongoing developments in various industries. This has further created great opportunities for foreign leaders to outstretch their distribution network. For instance, in August 2024, Nederman acquired Duroair Technologies to solidify its position in the Canada extraction and filtration technology division. Nederman aims to capture the strong network of defense, aerospace, and industrial manufacturing industries gained by Duroair.

Key Fume Extractor Market Players:

- Absolent Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Airflow Systems Inc.

- American Air Filter

- Apzem

- BOFA International Ltd.

- Camfil

- Cleantek

- DiversitechInc.

- Donaldson Company

- ESTA Apparatebsan GmbH & Co. KG

- Fumex Inc.

- Johnson Controls International plc

- Kemper America

- Lincoln Electric Holdings

- Miller Electric

- Nederman Holding AB

- Parker Hannifin

- Plymovent Group B.V.

- Weller Tools GmbH

The fume extractor market is now focusing on gaining sustainability through controlled energy consumption. Many leaders are developing new technologies to implement eco-friendly features in the devices. For instance, in March 2024, ULT launched a new line of modular extraction and filtration systems ULT 400.1 series. The new range offers advanced features such as energy-efficient and quiet operation for the removal of laser fumes, soldering fumes, odors, gases, vapors, and smoke. Such innovations are propelling the adoption of these devices by solving the high-energy consumption issues of traditional extractors. In addition, this inspires other participants to introduce more advancements in this sector. Such key players include:

Recent Developments

- In November 2024, Nederman acquired Olicem A/S to expand its existing range of extraction, transport, and filtration across Europe. By utilizing Olicem’s measurement and emissions reporting technology, the company aims to supply optimized fume extraction tools worldwide.

- In March 2023, BOFA partnered with Photocentric to enhance customer experience in the 3D printing industry. By offering a range of suitable fume extraction systems to Photocentric’s global consumer base, BOFA solidified its position with the massive adoption of extraction units in all 3D printing projects.

- Report ID: 6734

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fume Extractor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.