Fuel Cell Market Outlook:

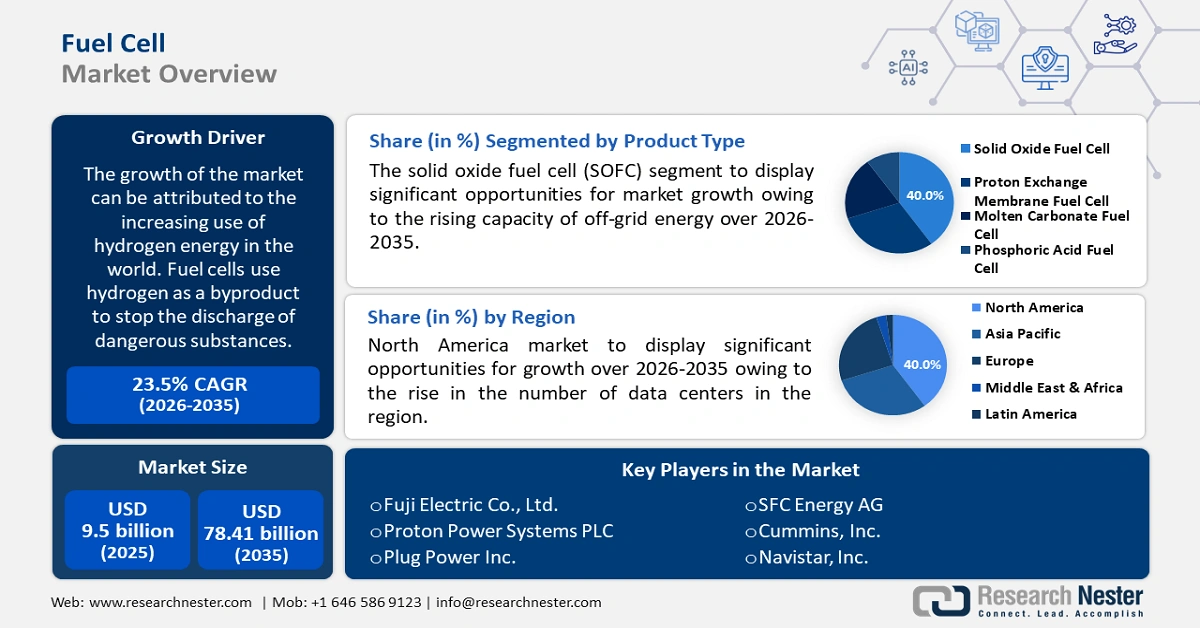

Fuel Cell Market size was over USD 9.5 billion in 2025 and is anticipated to cross USD 78.41 billion by 2035, growing at more than 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fuel cell is estimated at USD 11.51 billion.

The market growth is driven by increasing use of hydrogen energy in the world. Fuel cells use hydrogen as a byproduct to stop the discharge of dangerous substances. Using hydrogen results in only two by-products, heat and water, which lessen combustion reactions and environmental damage. In 2021, the world's demand for hydrogen increased by 5% to 94 Mt, primarily owing to increased activity in the chemical and refining industries.

In addition, the market revenue is propelled by need to reduce the use of fossil fuels and greenhouse gas emissions. Fuel cells use hydrogen and eradicate the chances of emission of carbon, as the final by products are water and heat. The activities in various industries contributed significantly to increasing the greenhouse gas levels in the atmosphere. According to the United States Environmental Protection Agency, the second-largest portion of greenhouse gas emissions is caused by electricity. Our use of fossil fuels, primarily coal and natural gas, accounts for about 60% of our electricity.

Key Fuel Cell Market Insights Summary:

Regional Highlights:

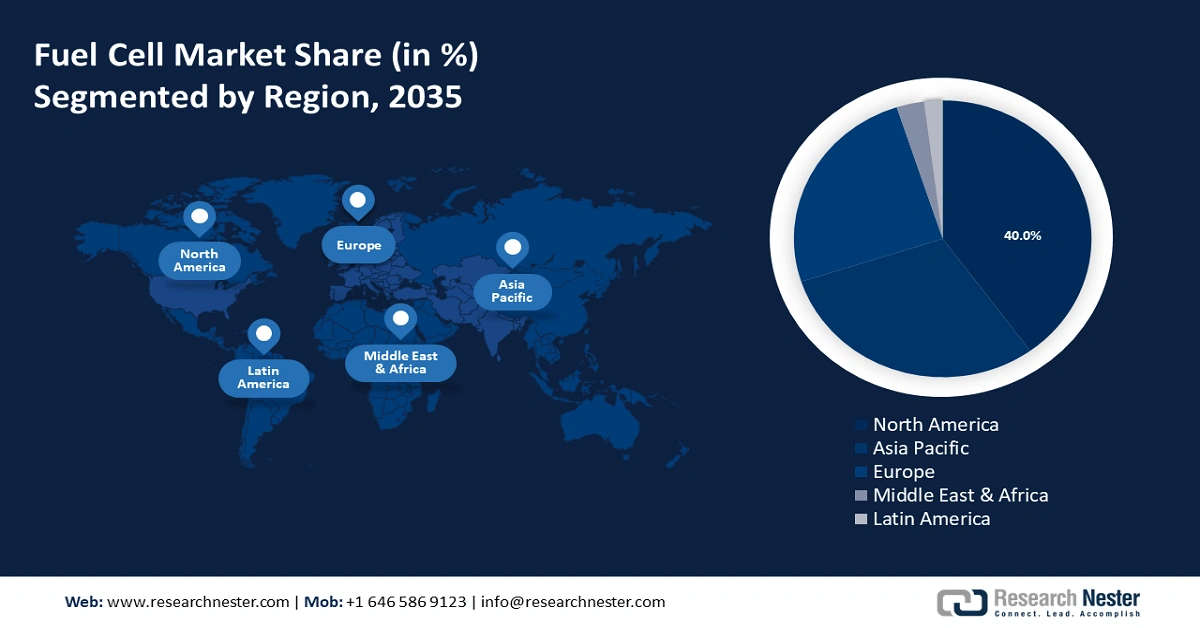

- North America fuel cell market will dominate over 40% share by 2035, driven by growing fuel cell vehicles and rise in data centers.

- Asia Pacific market projects massive growth during the forecast timeline, driven by the rising focus on increasing renewable energy capacity.

Segment Insights:

- The commercial & industrial segment in the fuel cell market is projected to hold a significant share by 2035, fueled by rising energy consumption and power needs in commercial and industrial sectors.

- The solid oxide fuel cell (SOFC) segment in the fuel cell market is anticipated to maintain a dominant share through 2035, fueled by rising off-grid energy capacity and high electrical efficiency.

Key Growth Trends:

- Growing Awareness About Clean Energy

- Rising Need to Reduce the Dependency on Fossil Fuels

Major Challenges:

- High cost of manufacturing of fuel cells

- Inadequate infrastructure to support hydrogen distribution

Key Players: ITM Power PLC, Fuji Electric Co., Ltd., Proton Power Systems PLC, Plug Power Inc., Ballard Power Systems, Mitsubishi Heavy Industries, Ltd., SFC Energy AG, Cummins, Inc., Navistar, Inc., Fuel Cell Energy, Inc.

Global Fuel Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.5 billion

- 2026 Market Size: USD 11.51 billion

- Projected Market Size: USD 78.41 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, United States, China, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 8 September, 2025

Fuel Cell Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Awareness About Clean Energy – Solid oxide fuels operate effectively and are nevertheless regarded as environmentally friendly as they produce little carbon dioxide. According to the United Nations, emissions must be cut by almost half by 2030 and to zero by 2050 in order to prevent the worst effects of climate change. Cleaner energy sources are therefore becoming more popular. Right now, renewable energy sources account for about 29 percent of electricity.

-

Rising Need to Reduce the Dependency on Fossil Fuels– Solid oxide fuel cells may produce electricity using hydrogen, natural gas, and renewable energy sources, which lessens reliance on fossil fuels. As per the report backed by the United Nations, in order to avoid a potentially disastrous rise in global temperatures, countries must reduce their production of fossil fuels by 6% annually between 2020 and 2030.

-

Rise in the Number of Data Centers – Fuel cells are modular and low maintenance, making it simple to integrate, therefore, making it a longer-term dependable solution for data centers. There were around 8,000 data centers worldwide as of January 2021, spread across 110 different nations. Six of these nations are the United States with 33 percent of the total data centers, the United Kingdom with 5.7 percent, and China has a share of 5.2 percent.

-

Increasing Use of Hydrogen Energy– The capacity of electrolyzes reached about 8 GW in 2021, a two-fold increase from 2020. The electrolyzers are used in hydrogen generation by splitting water. Additionally, assuming every project in the pipeline is finished by 2030, the installed electrolyze capacity might reach 134-240 GW.

-

Higher Restrictions on Greenhouse Gas Emission– According to the Climate Act proposed by the Dutch government, greenhouse gas emissions must be reduced by 49% by 2030 compared to 1990 levels and by 95% by 2050. The act consists of agreements with various major sectors to curb the greenhouse gas emissions.

Challenges

- High cost of manufacturing of fuel cells- The initial cost of fuel cells can be significantly high since it uses metals such as platinum and iridium that are frequently needed as catalysts in these devices. Moreover, owing to the higher cost of raw materials, it makes the manufacturing of fuel cells expensive, thus imposing a major roadblock to the market’s growth.

- Inadequate infrastructure to support hydrogen distribution

- Available fuel cells are still in the prototype stage

Fuel Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 9.5 billion |

|

Forecast Year Market Size (2035) |

USD 78.41 billion |

|

Regional Scope |

|

Fuel Cell Market Segmentation:

Product Type Segment Analysis

The solid oxide fuel cell (SOFC) segment is predicted to dominate the market share by 2035. The segment growth can be attributed to rising capacity of off-grid energy. China's off-grid renewable energy capacity was 906.23 gigawatts in 2021, up around 5% from the previous year. Solid oxide fuel cells are the best suited for off-grid applications. As solid oxide fuel cells (SOFC) now have an electrical efficiency of more than 60% owing to advancements in technology.

End -User Segment Analysis

The commercial and industrial segment is expected to garner significant share by 2035, on account of higher consumption of energy in the commercial and industrial sectors. Sales of retail power to commercial increased by about 3% in 2021. Additionally, since 2000, the industrial sector's need for power has increased by 3%. Furthermore, the industrial and commercial sectors utilized about 0.14 trillion kWh or about 3% of the total quantity of energy.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fuel Cell Market Regional Analysis:

North American Market Insights

The North American fuel cell market is predicted to hold majority revenue share by the end of 2035, led by rise in the number of data centers and the growing count of fuel cell vehicles in the region. According to reports, more than 2,600 data centers in the United States use more than 1.5% of the country's total energy. Moreover, there are now nearly 328 colocation data centers, around 24 network fabrics, and over 500 service providers in Canada. Besides this, as of February 2019, there were more than 6,500 fuel cell vehicles on American roads.

APAC Market Insights

The Asia Pacific solid oxide fuel cell market is set to register massive CAGR till 2035, on the account of rising efforts to boost the usage of renewable energy. China and India want to increase the installed capacity of renewable energy sources to more than 50% by 2025 and 2030, respectively. India is the world's third-largest generator of renewable energy, and non-fossil fuels account for 40% of the nation's installed electrical capacity.

Moreover, Vietnam's eighth national power development plan (PDP8) for 2021–30, issued by the Ministry of Industry and Commerce includes increasing the capacity of both solar energy and wind energy by 2030 by 18.6 GW and 18 GW, respectively. Additionally, Indonesia aims to build 41 gigawatts of capacity over the next ten years, with renewable energy making up the vast majority of that capacity for the first time.

Fuel Cell Market Players:

- ITM Power PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fuji Electric Co., Ltd.

- Proton Power Systems PLC

- Plug Power Inc.

- Ballard Power Systems

- Mitsubishi Heavy Industries, Ltd.

- SFC Energy AG

- Cummins, Inc.

- Navistar, Inc.

- Fuel Cell Energy, Inc.

Recent Developments

-

Mitsubishi Heavy Industries, Ltd., received a contract of supplying solid oxide fuel cell in Europe. The system is financed by the state of North Rhine-Westphalia and the European Regional Development Fund as part of the research project "KWK.NRW 4.0." (ERDF)

-

Navistar, Inc. announced the collaboration with General Motors and OneH2 to introduce the hydrogen truck ecosystem. It is a solution for a zero-emission transportation system. General Motors is likely to supply hydrotech fuel cell power cubes and OneH2 is to scale hydrogen production

- Report ID: 3310

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fuel Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.