Fuel Card Market Outlook:

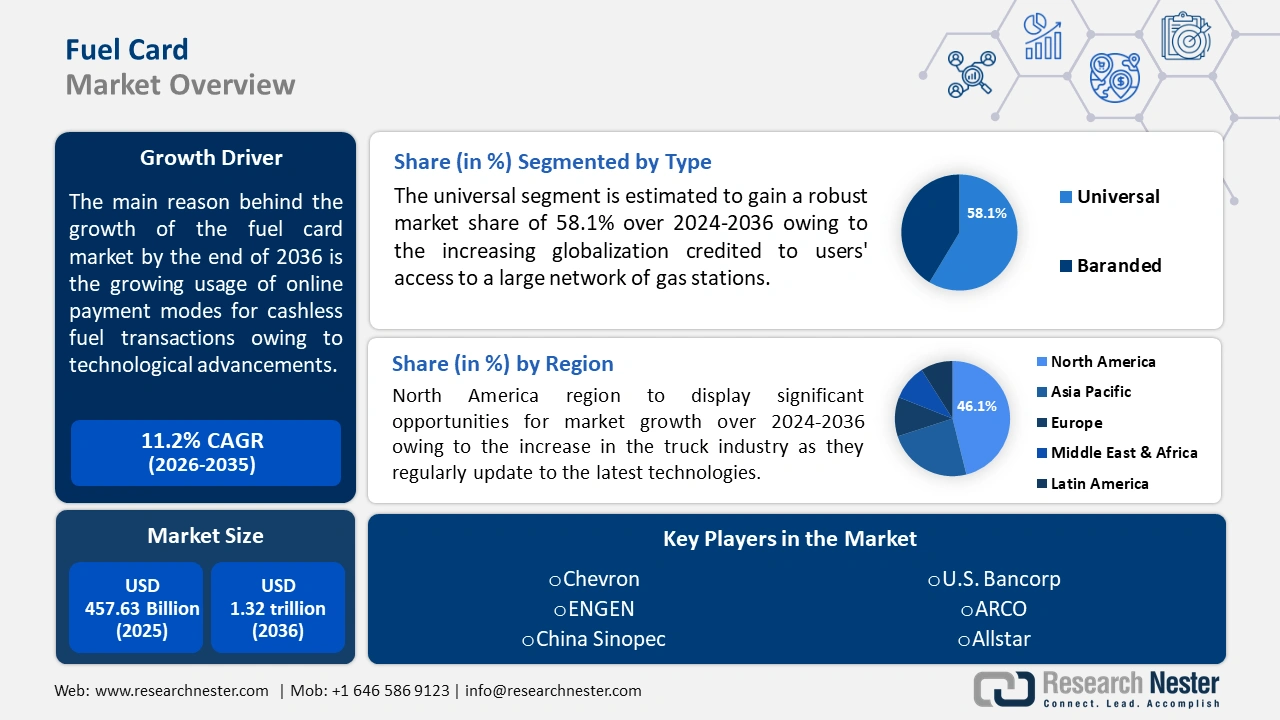

Fuel Card Market size was over USD 457.63 billion in 2025 and is poised to exceed USD 1.32 trillion by 2035, witnessing over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fuel card is estimated at USD 503.76 billion.

The fuel card market is driven by the growing number of small to medium-sized trucking businesses (SMB) and larger fleet companies. Businesses rely on fuel cards to enable drivers and carriers to manage fuel purchases, minimize fraud, and simplify logistics. A fleet card report provides the fuel consumption and mileage for vehicles, allowing fleet managers to set limits on purchases and discourage card misuse. Furthermore, the growing usage of online payment modes for cashless fuel transactions is fostering fuel card market adoption. A May 2024 World Bank survey, estimated that between 2017 and 2020 the cashless transactions per person boosted from 91 to 135 annually, and is expected to show a significant growth rate of 76% from 2025 to 2030.

Key Fuel Card Market Insights Summary:

Regional Highlights:

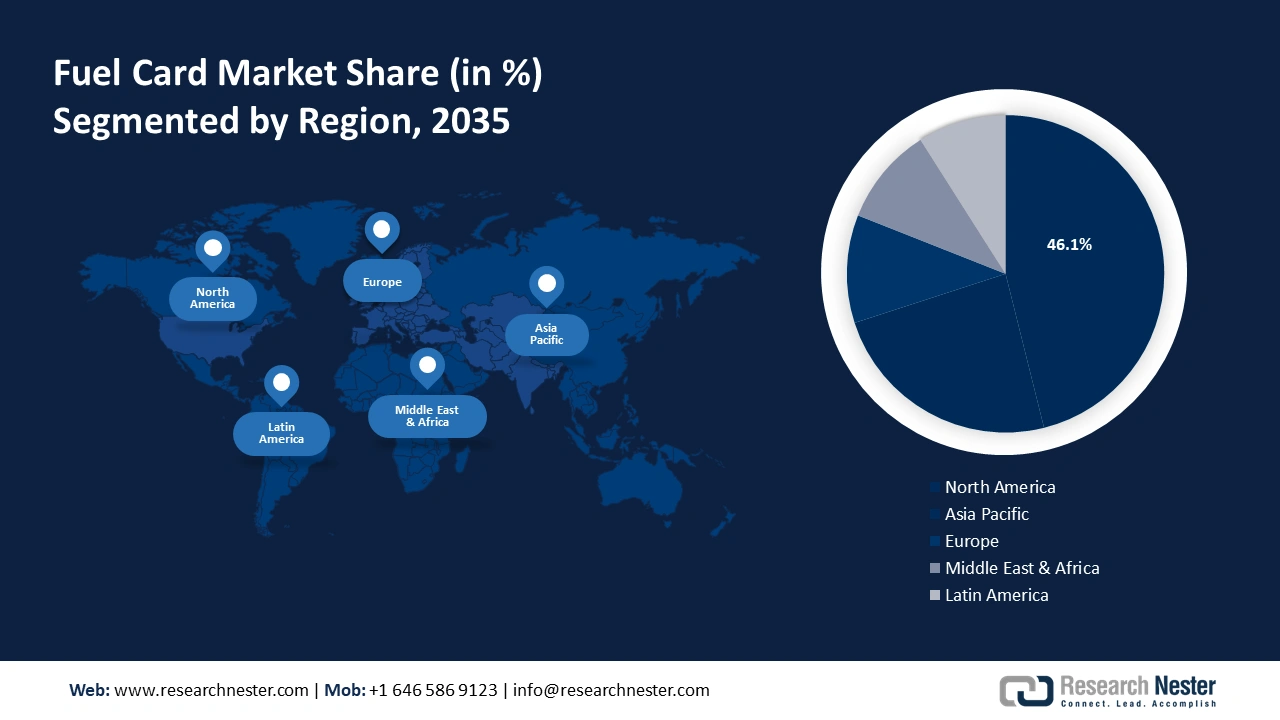

- The North America fuel card market is anticipated to capture 46% share by 2035, driven by the extensive use of commercial vehicles and fleets across the continent.

- The Asia Pacific market will account for 25% share by 2035, driven by the surge in urbanization across the region.

Segment Insights:

- The fuel refill segment in the fuel card market is expected to hold a significant share by 2035, attributed to fuel purchases and vehicle charges by logistics-dependent businesses.

- The universal segment in the fuel card market is projected to hold a 61.50% share by 2035, fueled by increasing globalization and a broad network of gas stations.

Key Growth Trends:

- Increasing demand for efficiency and cost management

- Technological advancements in payment infrastructure

Major Challenges:

- Increasing demand for efficiency and cost management

- Technological advancements in payment infrastructure

Key Players: FleetCor Technologies, Inc., WEX Inc., BP p.l.c., Exxon Mobil Corporation, Royal Dutch Shell plc, U.S. Bancorp (Voyager Fleet Systems), Comdata Inc., Edenred S.A., Fuelman (FleetCor), Radius Payment Solutions Limited.

Global Fuel Card Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 457.63 billion

- 2026 Market Size: USD 503.76 billion

- Projected Market Size: USD 1.32 trillion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Fuel Card Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for efficiency and cost management- Companies that use fleet fuel cards aim to reduce fuel costs by using expense tracking, centralized, volume rebates, and discounts. By monitoring driver behavior these cards help businesses encourage fuel-efficient practices.

International Transport Forum observed that if fuel efficiency is improved by 10%, companies can save about USD 30,000 per vehicle annually. Fuel cards also simplify the administrative work related to fuel purchases, cutting down on paperwork and facilitating the process of resolving expenses. Fuel cards remain the go-to method for handling fuel-related costs as long as companies are focused on being economical and efficient. - Technological advancements in payment infrastructure- To provide better features and services, fuel card companies are utilizing technological advancements like telematics, GPS tracking, and smartphone apps. Businesses can access real-time data on fuel consumption, vehicle location, and maintenance requirements with the integration of expense management software and fleet management systems. A report published in 2022 projected that connected cars will make about 96% in 2030 out of all newly shipped vehicles.

Companies are focused on the launch of advanced products to reduce administrative overhead and promote digital transactions. For instance, in April 2023 Uber and AtoB collaborated to unveil the Uber Freight Carrier Card. It manages fleet finances with lending, banking, and credit tools for fleet operators in the U.S.The evolving needs of businesses of better cash flow management are augmenting technological innovation of automated administrative capabilities. - Surge in internet accessibility- The need for fuel cards has increased as more people get access to digital platforms and high-speed internet. The World Economic Forum published a report in 2023, highlighting that 1/3rd of the global population had internet access in 2022, which was about 5.3 billion people.

In addition, to satisfy the expanding customer need for cross-border operations. The global fuel card market growth has experienced lucrative growth and dynamism due to the surge in effective fleet management, which has been propelled by the widespread availability of the Internet.

Challenges

- Technological compatibility constraints - The market relies heavily on technology for transactions, data processing, and security. Compatibility issues between different technology platforms, such as card readers and payment systems can limit fuel card market growth.

- Security concerns - Fuel cards, despite their enhanced security features, are still susceptible to theft, fraud, and misuse. Some businesses might not use fuel card solutions due to concerns about identity theft, data breaches, and illegal transactions. On the other hand, companies might come under more inquiry and have to comply with regulations.

Fuel Card Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 457.63 billion |

|

Forecast Year Market Size (2035) |

USD 1.32 trillion |

|

Regional Scope |

|

Fuel Card Market Segmentation:

Type Segment Analysis

Universal segment in fuel card market is expected to hold more than 61.5% revenue share by 2035. The segment's tremendous growth rate can be driven by increasing globalization credited to users' access to a large network of gas stations. European Commission 2024 published a report predicting that globalization surpassed 54.7% from 50.6% between 2020 and 2023. Additionally, a large network of gas stations, including independent retailers and several brands, accept these cards. Moreover, certain fuel retailers or oil companies issue branded fuel cards, usually only accepted at their branded fuel stations.

Application Segment Analysis

Fuel refill segment is poised to hold fuel card market share of over 65.2% by the end of 2035, impacting the landscape of fuel card revenue share. This is due to its usage in fuel purchases and vehicle charges by several businesses, including haulage, courier services, transport, relying on motor vehicles for their everyday operations. The International Energy Agency (IEA) reported in 2023 that the global oil demand is expected to expand by 6% from 2022 to 2028, valued at about 105 mb/d per day (million barrels per day).

Our in-depth analysis of the global fuel card market includes the following segments:

|

Type |

|

|

Application |

|

|

Technology |

|

|

Vehicle |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fuel Card Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 46% by 2035. The market expansion in the region is expected on account of the extensive use of commercial vehicles and fleets across the continent. Additionally, the market is growing due to the presence of significant key players, such as financial institutions, fuel retailers, and specialized fleet management companies. These businesses provide a variety of services, such as fleet operator-specific reporting tools, fuel purchase, and expense management.

The United States have a high concentration of trucking companies, delivery services, and logistic firms all of which heavily rely on fuel cards to manage their fleets efficiently. According to the US Department of Transportation, as of June 2022, there were around 2 million registered trucking companies in the US.

Canada showed an increasing demand for delivery services. A report by IBIS World in 2024 propelled that there was an increase of 3.7% every year between 2018 and 2023 in the local delivery and courier services. Furthermore, Canadian commercial vehicle owners are increasingly drawn by the capacity of the fuel card to easily manage costs and track carbon footprints, which will help improve their shift toward sustainability.

APAC Market Insights

By 2035, Asia Pacific fuel card market is estimated to account for around 25% revenue share, credited to the surge in urbanization, as UN-Habitat estimated in 2024 that the share of urban population in Asia Pacific landscape will cross more than 50% by 2050.

The market in China is propelling due to the elevating fuel prices and growing volumes of fuel sold through fuel cards. Moreover, there has been an expansion in economies which will act as a growing factor for the fuel card market in this region. According to a 2024 published report, China’s economy gained 5.2% in their economy as compared to 2023.

There has been a high demand for logistics solutions for efficient transportation as this sector is at the surge in the Japan region. Trading Economics estimated that the transportation industry in Japan witnessed a growth of 153 million in 2023 from 134 million in 2021.

Fuel Card Market Players:

- Shell

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BP

- Absa Group Limited

- FLEETCOR

- Chevron

- ENGEN

- China Sinopec

- U.S. Bancorp

- ARCO

- Allstar

Most of these companies are continuously expanding, collaborating, and adopting joint venture strategies to strengthen their position in the fuel card market.

Some of the key players include:

Recent Developments

- In November 2021, Shell- In an effort to improve the road transport experience for customers, Multi Service Technology Solutions, Inc. (dba TreviPay) sold MSTS Payments, LLC and its Multi Service Fuel Card business to Shell Oil Company.

- In July 2022, BP- The new Bpme Rewards Signature Visa credit card, in partnership with First National Bank of Omaha (FNBO) and Visa, was announced by BP. The power of bpme Rewards is combined with classic credit card benefits like cash-back rewards and flexible redemption options to create a modern take on the classic fuel card.

- Report ID: 6273

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fuel Card Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.