Freight Transport Market Outlook:

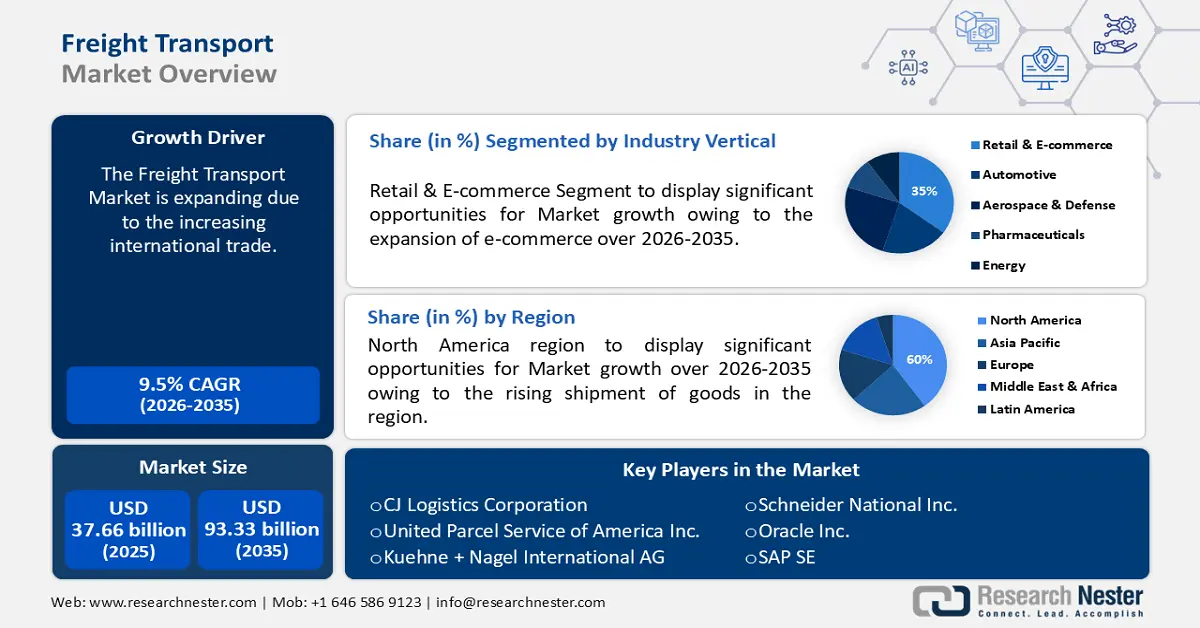

Freight Transport Market size was valued at USD 37.66 billion in 2025 and is likely to cross USD 93.33 billion by 2035, registering more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of freight transport is assessed at USD 40.88 billion.

The increasing international trade is likely to boost the freight transport market demand for freight transport which is essential to moving commodities from ports to their actual destinations. According to the World Trade Organization (WTO), following a 1.2% decline in 2023, the volume of global merchandise trade is projected to rise by 2.6% in 2024 and 3.3% in 2025.

Key Freight Transport Market Insights Summary:

Regional Highlights:

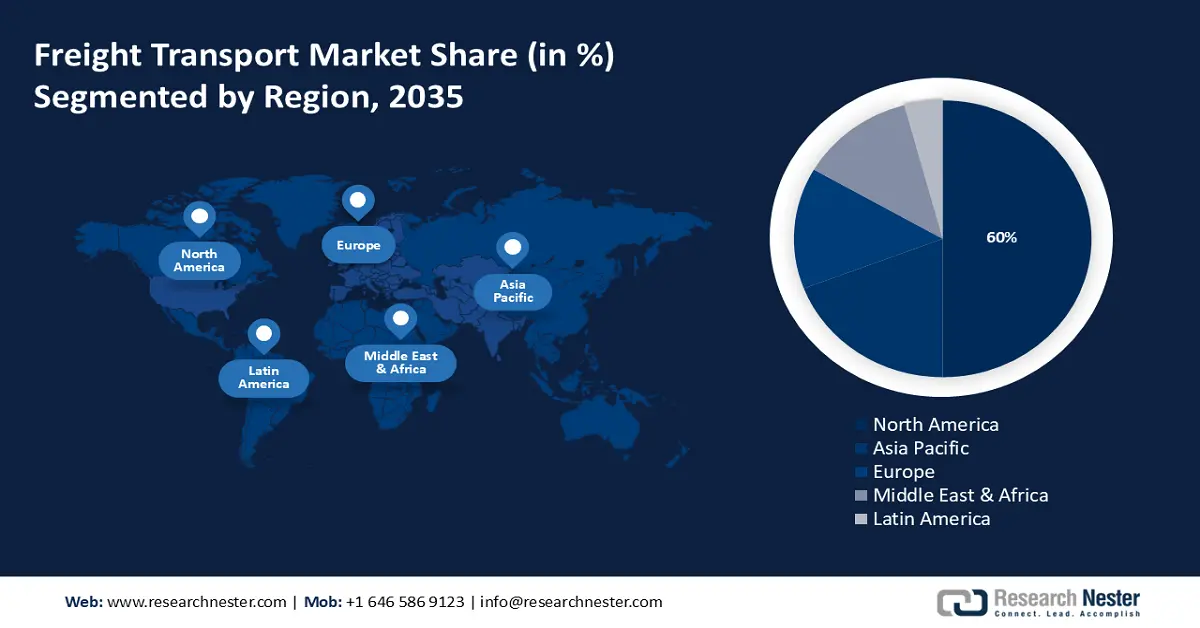

- North America freight transport market achieves a 60% share by 2035, driven by rising shipment of goods and extensive freight transportation network.

Segment Insights:

- The retail & e-commerce segment in the freight transport market is projected to hold a 35% share by 2035, driven by the expansion of online shopping and e-commerce.

Key Growth Trends:

- Growing adoption of artificial intelligence (AI)

- Rising spending on efficient logistics solutions

Major Challenges:

- Varying regulations across different regions

- Environmental concerns

Key Players: CEVA Logistics, CJ Logistics Corporation, United Parcel Service of America Inc., Kuehne + Nagel International AG, Schneider National Inc., Oracle Inc., SAP SE, C.H. Robinson Worldwide Inc., Kerry Logistics Network Limited.

Global Freight Transport Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.66 billion

- 2026 Market Size: USD 40.88 billion

- Projected Market Size: USD 93.33 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Freight Transport Market Growth Drivers and Challenges:

Growth Drivers

-

Growing adoption of artificial intelligence (AI) - The freight industry's supply chain management has been completely transformed by AI-powered predictive analytics, which can mine massive databases for insightful information that can be used to help freight forwarders spot patterns, streamline operations, promote sustainability and increasing the efficiency and competitiveness of logistics.

For instance, professionals in the transportation and logistics industries have responded, and they indicate that more than 45% of businesses employ basic data analytics and around 24% use artificial intelligence. - Rising spending on efficient logistics solutions - Successful supply chain management greatly depends on effective logistics management; therefore both large and small shops are spending on having effective logistics systems in today's fiercely competitive industry to stay in business. This may augment the need for freight transport to ensure the smooth operation of every stage in the supply chain.

The logistics operations account for around 10% of the expenditures incurred by the average online merchant. - Growing shipment of goods via air - When it comes to shipping express shipments around the world, air transport services are the most in demand due to the speed, which is comparable to same-day delivery.

As per IATA, over USD 6 trillion worth of goods are transported by air each year, making up about 35% of all trade in terms of value.

Challenges

-

Varying regulations across different regions - Logistics, and transportation are controlled by a set of rules that have a variety of effects on freight shipping costs, which may impede freight transport market demand.

For instance, to guarantee the protection of all parties concerned, regulations are implemented which have an impact on freight forwarding charges.

Similarly, another area where laws may affect freight forwarding rates is fuel efficiency standards, which may raise the cost of transportation.

Besides this, freight shipping rates can be affected by trade restrictions, which may raise the cost of shipping those items. -

Environmental concerns - One of the main industries contributing to greenhouse gas emissions is freight transport, which also includes particulate matter (PM), nitrogen oxides (NOx), sulfur oxides (SOx), and volatile organic compounds (VOCs), in addition to CO2 emissions due to excessive energy usage. However, regulations have been put in place as a result to lessen its environmental impact, and complying with these regulations can be expensive, leading to higher freight charges.

For instance, more than 45% of freight in the EU is transported by road, which significantly increases greenhouse gas emissions.

Freight Transport Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 37.66 billion |

|

Forecast Year Market Size (2035) |

USD 93.33 billion |

|

Regional Scope |

|

Freight Transport Market Segmentation:

Industry Vertical Segment Analysis

Retail & e-commerce segment is poised to dominate over 35% freight transport market share by 2035. The segment growth can be ascribed to the expansion of e-commerce. The worldwide freight transport industry has been affected by e-commerce in recent years as more and more individuals purchase goods and services online, which has substantially increased the volume of items being sent across the nation.

In addition, the requirement for quicker delivery times is one way that online retail has affected freight transport activities, as a result, many freight transport businesses have had to make investments in new procedures and technology to keep up with demand. For instance, global retail e-commerce revenues reached over USD 5 trillion in 2023.

Mode of Transport Segment Analysis

The roadways segment is set to garner robust market revenue shortly. The volume of freight carried by roads is anticipated to rise between 2020 and 2050, presenting potential as a result of expanding e-commerce deliveries, a greater emphasis on multi-modal connectivity, and increased volume from the fast-moving consumer goods (FMCG) industry.

As per recent data, from around 6 trillion ton-kilometers in 2010 to over 25 trillion ton-kilometers in 2050, there will likely be an even greater growth in road freight transit worldwide.

Our in-depth analysis of the freight transport market includes the following segments:

|

Offering |

|

|

Mode of Transport |

|

|

Industry Vertical |

|

|

Logistics Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Freight Transport Market Regional Analysis:

North American Market Insights

North America in freight transport market is poised to account for around 60% revenue share by 2035. The market growth in the region is also expected on account of the rising shipment of goods. An incredible number of commodities are moved annually by the freight transportation network in the region either locally, within a specified area, or even throughout the entire nation.

By weight, trucks move about 72% of American freight. Moreover, the world's largest and most coveted freight rail network is found in the United States, which is an integral part of the extensive, multimodal freight transportation network in the region. As per the Association of American Railroads, U.S. freight railroads move around 1.6 billion tons across 140,000 miles of track in a typical year.

Besides this, in Canada, the majority of commodities are moved by road, since there is a vast rail network spanning more than 35,000 kilometers.

APAC Market Insights

The Asia Pacific region will also encounter tremendous revenue for the freight transport landscape in the coming years and will hold the second position owing to the presence of eco-friendly freight transportation systems. The freight transport ecosystem in the region plays a pivotal role in mitigating the nation's greenhouse gas emissions through the launch of numerous initiatives to foster intermodal transport solutions.

For instance, the IKI project Green Freight strives to aid partners at the federal and state levels in transforming the Indian freight and logistics industry into a climate-friendly industry by improving productivity and lessening the automotive logistics industry's carbon footprint.

Additionally, trains are a popular means of passenger transportation in Japan because they are easy to use and very efficient. As a result, the nation's freight transport market is growing and is predicted to experience profitable expansion shortly. Japan's railway freight was around 38 million metric tons in 2022.

Furthermore, one of the main drivers of the rise in global oil consumption has been China's quickly increasing need for freight transportation, and this trend is predicted to continue to drive up world oil demand for transportation in the decades to come.

Freight Transport Market Players:

- CEVA Logistics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CJ Logistics Corporation

- United Parcel Service of America Inc.

- Kuehne + Nagel International AG

- Schneider National Inc.

- Oracle Inc.

- SAP SE

- C.H. Robinson Worldwide Inc.

- Kerry Logistics Network Limited

There are several freight transport service providers operating in the market, resulting in a highly fragmented industry. Prominent companies engage in mergers and acquisitions to enhance their market position, diversify their range of products, extend their reach geographically, and use cutting-edge technologies to lower freight expenses. The main goal of the players is to provide secure, quick, and affordable freight transport services. These businesses are working together with local and regional businesses as well as e-commerce enterprises to obtain a competitive advantage over their rivals and a sizeable market share.

Recent Developments

- CEVA Logistics acquired Stellar Value Chain to increase its current footprint in India and enable the company to provide comprehensive supply chain services to clients throughout the Asia Pacific area and beyond.

- Schneider National Inc. declared that it has acquired M&M Transport Services to provide more value to its stakeholders and clients to foster ongoing expansion and dependable, continuous service by capitalizing on Schneider's extensive talents and resources while using the strengths of M&M Transport Services.

- Report ID: 6060

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Freight Transport Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.