Freight Forwarding Market Outlook:

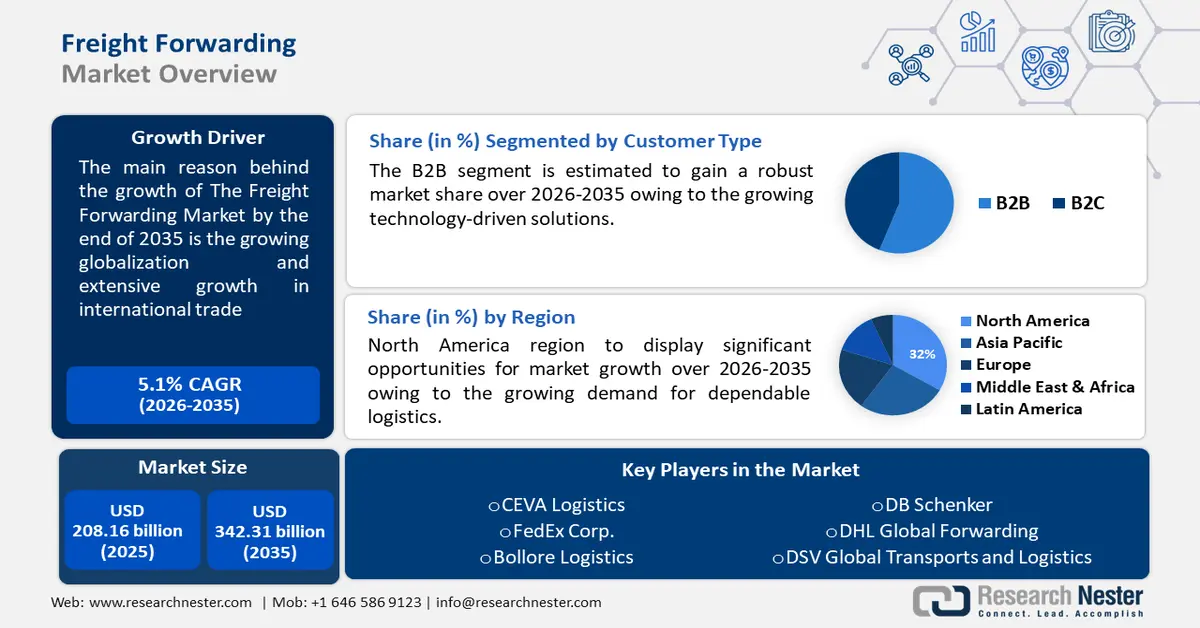

Freight Forwarding Market size was over USD 208.16 billion in 2025 and is poised to exceed USD 342.31 billion by 2035, growing at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of freight forwarding is estimated at USD 217.71 billion.

The freight forwarding market is expanding due to globalization and extensive growth in international trade. According to a report by the World Bank Organization in 2020, the world's exports of goods and services as a percentage of GDP were 28.88%, while imports were 27.94%. As a result, the rise in the value of commodities exported globally reflects technological developments, globalization, and shifts in international trade.

Key Freight Forwarding Market Insights Summary:

Regional Highlights:

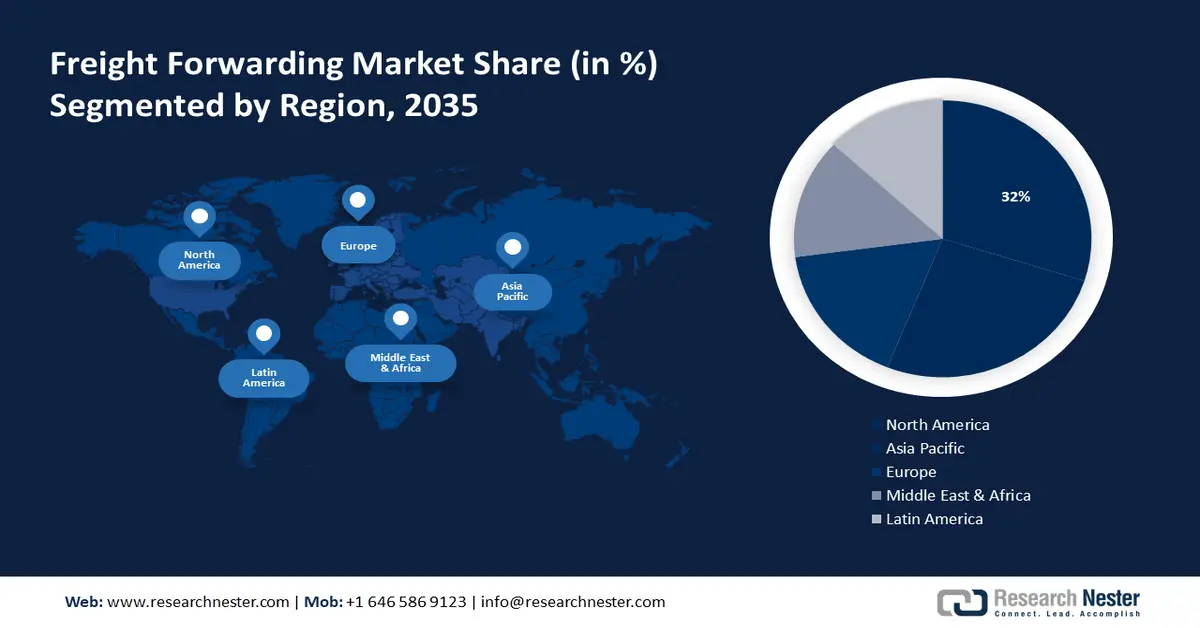

- North America freight forwarding market will dominate around 32% share by 2035, driven by logistics demand from manufacturing and industrial activity.

- Asia Pacific market will exhibit huge CAGR during 2026-2035, driven by rapid urbanization and investments in transportation networks.

Segment Insights:

- The b2b segment in the freight forwarding market is projected to experience robust growth till 2035, driven by the need for visibility and control in complex supply chains.

- The ocean segment in the freight forwarding market is projected to achieve a 23% share by 2035, driven by the growing transportation of bulky and voluminous goods.

Key Growth Trends:

- Growing shift towards industrialization in emerging nations

- Increase in e-commerce industry

Major Challenges:

- Volatile transportation prices

- Growing trends of reshoring

Key Players: CEVA Logistics, FedEx Corp., Bollore Logistics, DB Schenker, DHL Global Forwarding, DSV Global Transports and Logistics, Expeditors International, United Parcel Service, Kuehne + Nagel International AG, CJ Logistics Corporation.

Global Freight Forwarding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 208.16 billion

- 2026 Market Size: USD 217.71 billion

- Projected Market Size: USD 342.31 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Freight Forwarding Market Growth Drivers and Challenges:

Growth Drivers

- Growing shift towards industrialization in emerging nations - For the freight forwarding sector, the growth of new markets offers a strong opportunity. These economies are becoming increasingly industrialized, driving up demand for effective logistics services.

Furthermore, strong local ties allow freight forwarders to exploit the growing trade flows and link these markets to worldwide supply networks. Freight forwarding businesses may establish themselves as an essential channel for trade and commerce in these emerging areas by providing dependable transportation, customs expertise, and specialized solutions.

- Increase in e-commerce industry - The e-commerce industry uses logistics services to oversee and manage online merchants' supply chains, freeing up their owners to focus on marketing and other business-related duties. E-commerce is a well-liked method of purchasing a variety of goods due to its accessibility, enjoyable browsing experiences, and significant discounts & offers. According to the most recent projections, in 2024, e-commerce sales are expected to account for 20.6% of global retail sales.

- In addition, the emergence of e-commerce has compelled freight forwarders to embrace digital technology to meet the growing demands of their clientele. To guarantee that clients receive their orders of goods or products on time, they have also begun to deploy artificial intelligence, the Internet of Things, and other technologies.

- Increased focus on reducing carbon emissions - The majority of advances, particularly in the freight and transportation sectors, are concentrated on carbon emission-reducing sustainable development. Many businesses are acting morally by using techniques that are both practical and economical.

Furthermore, this can speed up shipments without endangering the environment. By employing a few strategies, transportation, and logistics firms can transition to more environmentally friendly solutions more quickly. They ought to use contemporary methods to foster this freight forwarding trend.

Challenges

- Volatile transportation prices - Fuel price volatility can hinder the expansion of the freight forwarding industry by adding unpredictability and uncertainty to cost structures. Variations in fuel prices have an immediate effect on transportation costs, which impacts freight forwarders' and their clients' profit margins.

This may result in difficulties with budgeting, pricing, and general financial planning. Frequent pricing changes can also discourage enterprises from entering into long-term shipping agreements, interfere with operational effectiveness, and force them to look for alternatives, all of which can slow down the freight forwarding market's growth trajectory.

- Growing trends of reshoring - It is anticipated that the increase of nearshoring manufacturing practices globally, which will come to an end in the absence of trade activity acceptability, will hinder market expansion. The freight forwarding business is expected to face challenges between 2023 and 2030 due to the increasing trend of reshoring and nearshoring manufacturing.

Freight Forwarding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 208.16 billion |

|

Forecast Year Market Size (2035) |

USD 342.31 billion |

|

Regional Scope |

|

Freight Forwarding Market Segmentation:

Customer Type Segment Analysis

The B2B segment is estimated to capture freight forwarding market share of around 56% by the end of 2035. B2B clients use their participation in complex supply chain networks to maintain their market supremacy. When items are traded between businesses, they frequently travel through a convoluted process that involves several steps, such as obtaining raw materials, production, and distribution.

Furthermore, technology-driven solutions to improve supply chain visibility and control are actively sought after by B2B customers. This involves implementing real-time tracking, transportation management systems (TMS), and sophisticated analytics tools to optimize routes, cut expenses, and boost overall productivity.

Mode of Transportation Segment Analysis

By 2035, ocean segment share in the freight forwarding market is poised to reach 23%. The segment growth can be credited to the growing transportation of bulky and voluminous goods. According to a report by the World Bank Group, over 80% of commodities are transported by sea, making maritime transport the backbone of global trade. Developing nations rely heavily on shipping, which makes up around 55% of seaborne exports and 61% of imports.

Industries handling enormous items tend to favor ocean freight due to its ability to efficiently handle huge weights and larger quantities. The movement of heavy machinery, raw materials, and other big cargo via ocean freight is cost-effective and logistically convenient, which benefits industries like mining, building, and manufacturing and contributes to its dominance in the global supply chain.

Services Segment Analysis

Till 2035, transportation & warehousing segment in the freight forwarding market is expected to witness significant growth rate. E-commerce has been a major driving force in the transportation and logistics sector. Efficient freight forwarding solutions for the management of inventories, order fulfillment, and timely customer delivery are needed by retailers on the Internet.

Furthermore, last-mile delivery is an essential component of e-commerce freight transport, and companies are increasingly investing in innovative solutions to optimize this end part of the shipment process.

Our in-depth analysis of the global freight forwarding market includes the following segments:

|

Mode of Transportation |

|

|

Customer Type |

|

|

Services |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Freight Forwarding Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 32% by 2035. The industrial and manufacturing industries of North America are the backbone of the region's economy. These businesses require the seamless transportation of components, finished items, and raw materials over large distances.

Because of the wide variety of goods and industries that are encompassed by manufacturing and industrial activities, there is a constant demand for dependable logistics, which makes freight forwarding a crucial component of the region's economic growth and competitiveness.

There has been an increasing government initiative and infrastructure spending to assist land-based (road and rail) transportation in the United States. For instance, the most recent iteration of several federal discretionary grant programs for transportation is the 2022 RAISE program. While the initiative will focus on requiring grantees to show how they plan to integrate transportation and land-use planning, it will also advance many other aims concurrently.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the freight forwarding market during the forecast period and will hold the second position owing to the growing population. The rapid urbanization process has led to significant investments in freight forwarding hubs, smart warehouses, and contemporary transportation networks, all of which have improved the competitiveness and efficiency of the freight forwarding sector. Asia Pacific nations have been actively engaged in cross-border trade, which has been made possible by several trade agreements and economic alliances.

The market in China is to be supported by increasing production, imports, and exports of semiconductor chips. For instance, only about USD 3.7 billion worth of semiconductor equipment is exported from China, whereas the country imports over USD 34.6 billion worth of machinery. To increase semiconductor manufacturing, China is giving priority to sophisticated manufacturing clusters.

Real-time tracking of shipments, route optimization, and better management of the truck fleet is enabled by the growing adoption of technologies such as global positioning system (GPS) trackers, telematics & fleet management systems in Korea. The freight forwarding market is expanding because of the growing emphasis on improving and expanding road networks, such as expressways and highways, to streamline cargo transportation and boost the effectiveness of trucking operations.

In response to the surge in crude oil prices worldwide, the Japanese government implemented various subsidies which is augmenting the market growth in the region. For instance, in January 2022, the Japanese government initiated a fuel oil, gasoline, kerosene, and gasoil subsidy scheme to lessen the impact of elevated oil costs on the economy while it recovered from the epidemic. Gasoil and kerosene prices were lowered by Yen 20.20/l and Yen 20.10/l, respectively, as a result of the subsidies.

Freight Forwarding Market Players:

- CEVA Logistics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FedEx Corp.

- Bollore Logistics

- DB Schenker

- DHL Global Forwarding

- DSV Global Transports and Logistics

- Expeditors International

- United Parcel Service

- Kuehne + Nagel International AG

- CJ Logistics Corporation

The top businesses in the freight forwarding industry are listed below. Together, these businesses control the largest share of the freight forwarding market and set the direction of industry trends. To map the supply network, these freight forwarding companies' financials, strategy plans, and goods are examined.

Recent Developments

- CEVA Logistics announced that it has signed an agreement to acquire 96 percent of Mumbai-based Stellar Value Chain Solutions from an affiliate of private equity firm Warburg Pincus and other shareholders. Started in 2016 by Anshuman Singh, Stellar Value Chain Solutions has grown into a key local player in contract logistics with omnichannel fulfillment services in the eCommerce, automotive, food products, consumer, fashion and retail, healthcare, and pharmaceuticals market segments. Anshuman Singh will continue driving this business following the acquisition.

- FedEx Corp. and Microsoft Corp. revealed their next solution in their multi-year partnership to revolutionize logistics, supply chains, and commerce. FedEx and Microsoft plan to integrate Microsoft Dynamics 365 capabilities with FedEx network intelligence to launch a cross-platform "logistics as a service" for retailers, merchants, and brands. The organizations have a common goal of redefining the commerce experiences for companies to provide them with faster, more effective delivery as well as more integrated shopping options for their customers.

- Report ID: 6074

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Freight Forwarding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.