Free-to-air Services Market Outlook:

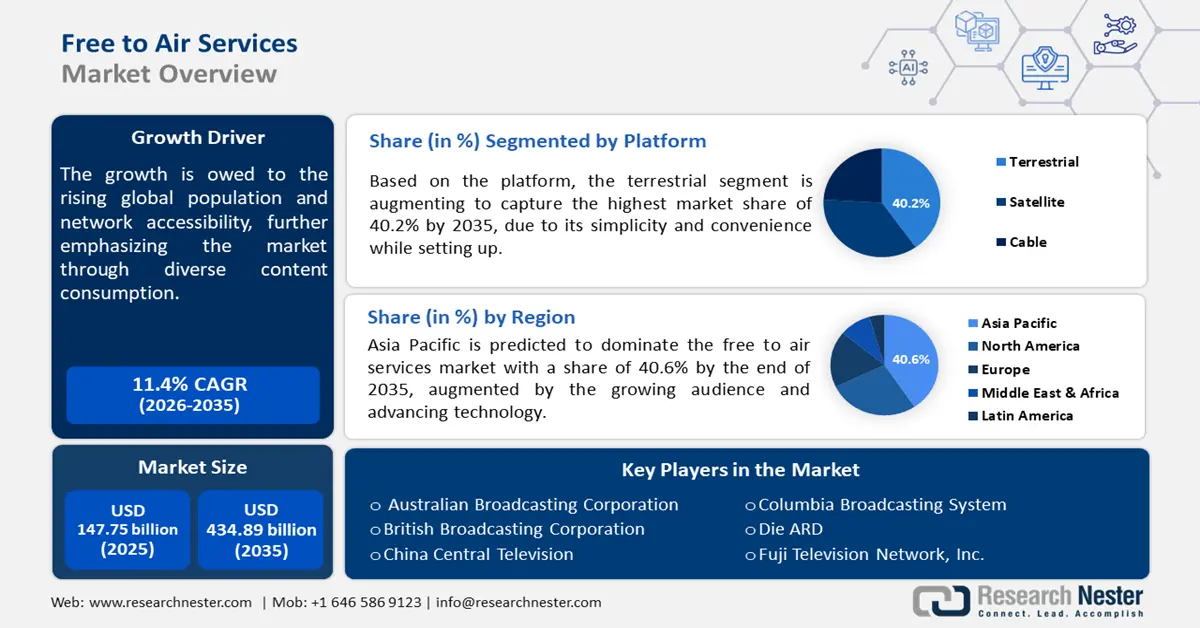

Free-to-air Services Market size was over USD 147.75 billion in 2025 and is projected to reach USD 434.89 billion by 2035, growing at around 11.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of free-to-air services is evaluated at USD 162.91 billion.

The market growth is stimulated by the worldwide rising population and network accessibility. Content creators aim to spread their work globally to create a larger audience base. This is further increasing the demand for stronger on-air networking technologies for easy and affordable access. Several data service providers are investing in development to offer powerful connectivity.

In April 2023, NTT and Cisco enabled mobile private 5G network systems for RWTH Aachen University. Such strong network systems promote the availability of seamless and consumer-specific connectivity with streaming platforms. The adoption of advanced technology in this sector is supporting the service providers to compete with OTTs. New 4K satellite broadcasting is improving the viewer experience, further attracting more audience. The elevated systems can deliver crisp audio-visual quality, fulfilling the demand for HD and UHD resolutions.

Key Free-to-air Services Market Insights Summary:

Regional Highlights:

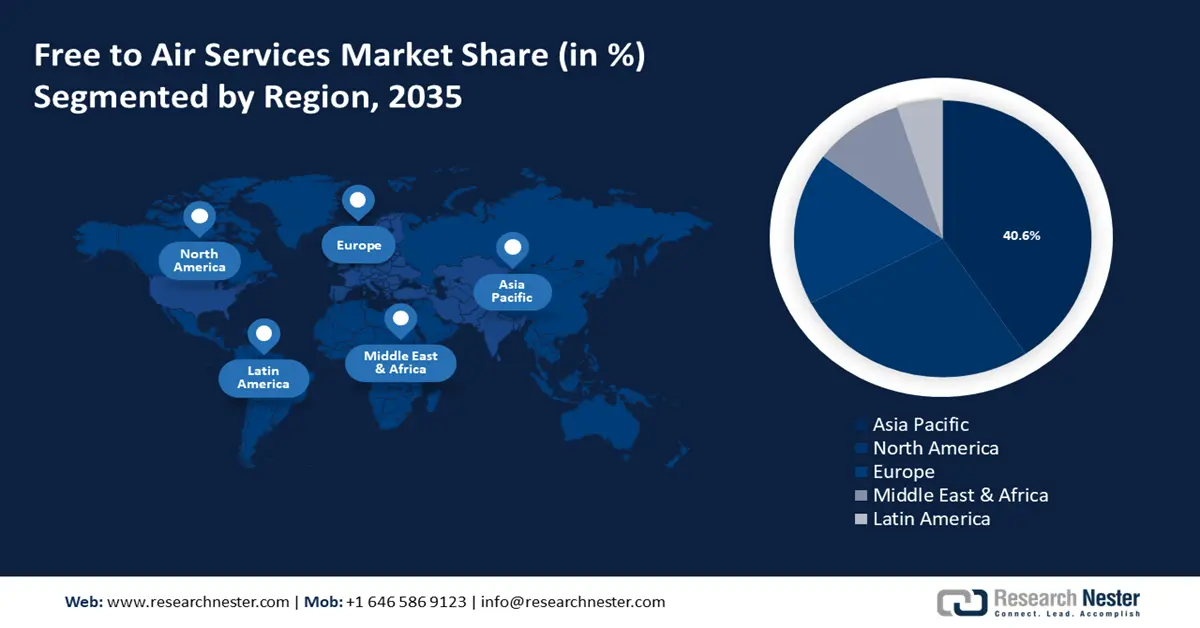

- Asia Pacific free-to-air (FTA) services market will account for 40.60% share by 2035, fueled by a growing audience, advancing technology, and investment opportunities.

Segment Insights:

- Terrestrial segment in the free-to-air services market is projected to achieve 40.20% growth by the forecast year 2035, driven by their wide coverage and cost-free access.

- The television segment in the free-to-air services market is projected to hold the highest market share by 2035, attributed to new features like 8K resolution and affordable yearly packages.

Key Growth Trends:

- Cost-effective accessibility for consumers

- Technological advancement and globalization

Major Challenges:

- Declined revenue from the advertisement

- Limitations in content acquisition

Key Players: British Broadcasting Corporation, Australian Broadcasting Corporation, China Central Television, Columbia Broadcasting System, Die ARD, Nine Entertainment Co. Holdings Limited, Public Broadcasting Service, Seven West Media Limited.

Global Free-to-air Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 147.75 billion

- 2026 Market Size: USD 162.91 billion

- Projected Market Size: USD 434.89 billion by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 18 September, 2025

Free-to-air Services Market Growth Drivers and Challenges:

Growth Drivers

- Cost-effective accessibility for consumers: Free streaming services provide access to a variety of content-creating platforms, further attracting more audiences. The growing number of worldwide internet users are emphasizing the free-to-air services market through diverse content consumption. Ad-supported models are opening an option for viewers, allowing them to access content without investing in subscriptions. These FTA services often reach rural areas, where other satellite and cable networking systems are absent. Further fulfilling the demand for media reach affordably through minimal internet connections. No extensive technological knowledge is required to retrieve FTA services due to their simple and user-friendly interface. Often government funds the broadcasters to ensure the accessibility of essential content to every citizen. Additionally making the FTA services preferable to the majority of the population.

- Technological advancement and globalization: The transition from analog to digital broadcasting has improved the signal quality. In addition, new technologies allow diverse presentations including news, sports, and entertainment with programming options. Integration of smart devices has also enhanced the free-to-air services market through their multi-functionality with streaming apps. Advanced video compression technology allows a wide spectrum of channels over the existing bandwidth. DVB-H (Digital Video Broadcasting Handheld) has empowered the FTH industry by streamlining mobile devices. Such portable and convenient features are encouraging consumers to invest in this sector, further inspiring companies to bring more innovations. International content availability on these platforms has also enabled customizable choices, catering according to need.

Challenges

- Declined revenue from the advertisement: Advertising firms are focusing more on digital ad campaigns rather than FTA platforms. The majority of the revenue of this sector is generated through advertising, which is declining with this shift. The rising popularity of ad-free streaming reduces the budget for such programming. OTT platforms are captivating a large section of the audience, leading to lower ad demand. Changing viewer habits including the tendency to avoid live streaming or skip ads dilute the interest of ad agencies.

- Limitations in content acquisition: Declining revenue is directly impacting the budget for licensing fee payment. As a result, FTA service providers are refraining from acquiring expensive TV shows, movies, and sports events. Substantial investment in talent, production, and marketing is being reduced due to budget cuts. Further failing to offer original content to the consumers, who tend to switch to other streaming services. Escalation of renewal costs for existing shows or series adds a financial burden upon broadcasters, impacting the growth of the free-to-air services market.

Free-to-air Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 147.75 billion |

|

Forecast Year Market Size (2035) |

USD 434.89 billion |

|

Regional Scope |

|

Free-to-air Services Market Segmentation:

Platform Segment Analysis

Based on the platform, the terrestrial segment is poised to hold free-to-air services market share of over 40.2% by the end of 2035, due to their wide coverage and cost-free access. Terrestrial TVs provide high-definition content display, elevating the viewer experience. The simplicity and convenience of setting up terrestrial TV stations require minimal equipment, making it cost-effective. Technologies such as DTT (Digital Terrestrial Television) are attracting consumers to invest in this segment. Companies are also merging different programming for better functionality. In March 2020, Sisvel launched a new patent pool related to the DVB-SIS standard, allowing terrestrial retransmission of signals addressing the DTH satellite receivers program. Integration of HD and UHD is also revolutionizing the Terrestrial FTA services industry. The government is also preserving the installed DTTs due to their reliability. According to an article published by the UK government, in 2023, it has been legislated to secure the continuity of DTT until at least 2035.

Service Segment Analysis

The television segment in free-to-air (FTA) services market is estimated to register the highest revenue during the forecast years. From past years to the present scenario, television has always captured a massive amount of viewer engagement. New additional features such as 8K resolutions in picture quality are encouraging consumers to purchase premium television sets. Manufacturers are incorporating multi-functionality in the devices, making them able to adopt digital broadcasting and streaming. FTA service providers are also launching affordable yearly packages to attract more audiences. Advanced devices such as smart TVs are increasingly in high demand to go along with FTA services.

Our in-depth analysis of the global free-to-air (FTA) services market includes the following segments:

|

Platform |

|

|

Service |

|

|

Distribution Channel |

|

|

Content |

|

|

Transmission Technology |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Free-to-air Services Market Regional Analysis:

APAC Market Insights

Asia Pacific free-to-air services market is poised to hold revenue share of over 40.6% by the end of 2035, due to a growing audience and advancing technology. Rapid digital transformation is shaping the new generation of FTA service providers. The region is filled with opportunities for a remarkable boost in the development of this sector. The investment structure is also creating scopes for future funding. The free trade agreements provide access to external market leaders to capture large Asian markets. Key Players are investing to acquire media and telecommunication companies to expand their portfolio. In June 2023, Asia Satellite Telecommunications Co. Ltd. acquired a 100% share of Lightning International Limited to extend its reach to global audiences through traditional and new distribution platforms.

India is emerging to be one of the largest FTA services market by the end of the forecast year. Governmental support for the re-introduction of advanced FTA broadcasting has greatly influenced the market to grow higher. Authorities are also launching their own FTA service packages to inspire development in the market. According to a notice issued by Prasar Bharati, in August 2024, they are inviting private TV channels to allot them with DD Free Dish. Such an initiative inspires other companies to penetrate more FTA services in their networking systems, further enlarging the market.

The continuous population growth is intriguing the China free-to-air services market. The country holds greater future opportunities for investment in the integration of technologically advanced networking facilities. China government has gradually relaxed the trade regulations for foreign participants in media and broadcasting. Further allowing foreign investment in this region’s FTA services sector. FTA satellite channels such as China Central Television 4, China Global Television Network Francais, CGTN Documentary, and others are also promoting the local FTA services. Their diverse content offerings are becoming audience preference due to originality. With the growing internet penetration, more viewers are accessing FTA channels, expanding the market.

North America Market Insights

North America free-to-air services market encompasses a variety of radio and television broadcasting options, promoting an enlarged audience. The region holds major market players such as ABC, CBS, NBC, and FOX, offering a range of programming. The Federal Communication Commission ensures to delivery of regulation-compliant broadcasting services, bringing diversity to media ownership. In this region, companies are investing in developing FTA technology for improved sound and picture quality. This leads to innovation in content presentation and increased viewer engagement.

The U.S. transitioned to digital broadcasting, which stimulated the free-to-air (FTA) services market to evolution. With enhanced quality and quality of channels, the viewer experience has been improved to grab a larger audience. The programs are now achieving record-high results of engagement. According to an IMDb report published in January 2024, the NFL’s Wild Card matchup streamed on Peacock TV, recorded the biggest live-stream event. The report further states that around 23 million viewers were engaged through the show.

Canada is also accounting for reaching noticeable heights in the growth of the FTA services market. Television broadcasting and radio channels are some of the augmenting segments in the sector, due to their popularity in cost-conscious consumers. Amazing Discoveries TV, Arraata Biyyoolessa Oromiyaa, CTV 2 Vancouver Island, and others are evolving their technologies to hold their market position. Widespread FTA broadcasts in urban and rural areas across the country are leveraging the industry.

Free-to-air Services Market Players:

- British Broadcasting Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Australian Broadcasting Corporation

- China Central Television

- Columbia Broadcasting System

- Die ARD

- Nine Entertainment Co. Holdings Limited

- Public Broadcasting Service

- Seven West Media Limited

Several companies are now establishing their hold on the free-to-air services market through strategic partnerships, robust content offerings, and innovative technologies. Major broadcasters are generating lucrative revenue by providing top-notch free-to-air (FTA) services. According to the BBC annual report published in 2024, World Service grant income for 2023-2024 was USD 0.11 billion, whereas the 2022-23 income was USD 0.1 billion. The report further states, that FCDO has confirmed an investment of around USD 0.1 billion per annum in the BBC World Service until March 2025. Such key player of the growing industry include:

Recent Developments

- In April 2024, BBC launched a new Collective Newsroom, which will be owned by India and will be producing content for six other Indian language services. This reconstruction was made to comply with the country's foreign investment rules.

- In March 2024, the NFL announced to airing of the playoff games on the streaming service Peacock TV during the Annual League Meeting. It was a strategic move of the NFL to reach a greater audience through free-to-air (FTA) services.

- Report ID: 6545

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free-to-air Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.