Fragrance and Perfume Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

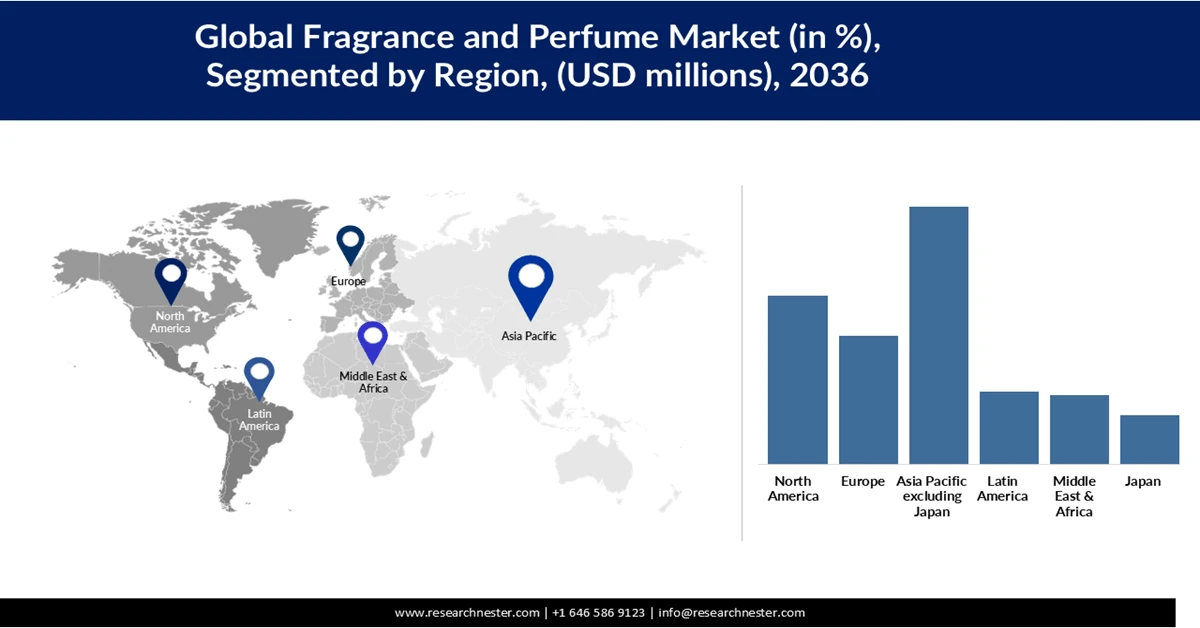

The region accounts for the largest market share of 40.2%, underpinned by rapid urbanization, economic growth, and a large young demographic that is highly fashion-conscious and inclined toward experimenting with fragrances. E-commerce penetration has been a key enabler, with India alone boasting over 270 million online shoppers and expected to emerge as one of the world’s largest online retail markets by the end of this decade, supported by rising internet and smartphone adoption and increasing consumer expenditure across demographics. Brand-owned websites and major platforms help reduce the risk of counterfeit products while enabling secure digital transactions, strengthening consumer trust, and supporting the overall growth of the fragrance and perfume market. E-commerce platforms are particularly advantageous for customers in regions with limited access to offline retail stores.

India is emerging as a leading market for personalized and customized perfume collections tailored to evolving consumer preferences, further fueling market expansion. The strong presence of e-commerce platforms, including Flipkart and Amazon, has enhanced accessibility across both urban and rural areas, reshaping traditional retail behavior and supporting consumption growth in Beauty and Personal Care categories that contribute significantly to online orders. Further, in China, expanding middle-class populations and rising disposable incomes are encouraging greater fragrance adoption, including for premium, sustainable, and organic products. Globally, China continues to lead in online shopper base, further complemented by digital retail growth on platforms such as eBay and JD.com, which support convenient online access and competitive pricing that stimulate broader market uptake.

North America Market Insights

The region is projected to account for 23.59% of the global market share, driven by the rising self-care culture that continues to boost demand for beauty and personal care products, including perfumes and fragrances. Market growth is further supported by increasing male participation, particularly among Gen Z consumers, who show a strong preference for clean-label and vegan formulations. In parallel, major retail brands such as Sephora, Ulta, and Macy’s are expanding both their online and brick-and-mortar presence, accelerating the adoption of premium and high-end fragrance products.

In the U.S., rising disposable income is significantly contributing to market expansion, enabling consumers to spend more on luxury offerings and strengthening the dominance of premium fragrances. Influencer-led product launches and digital storytelling are also playing a critical role, as global niche perfumers increasingly leverage brand narratives to enhance engagement and drive sales. In Canada, perfumes are becoming an everyday essential, broadening the market scope for fragrances. Growing online brand penetration is supporting fragrance discovery and improving accessibility, while increasing consumer awareness around sustainability is encouraging a shift toward eco-friendly perfumes produced through responsible manufacturing practices, further reinforcing market growth.

Europe Market Insights

Europe accounts for 17.43% of the global fragrance and perfume market, supported by its deep-rooted perfumery heritage and strong consumer preference for personalized formulations and high oil concentrations, such as extracts, which enhance scent longevity and quality. The region also benefits from a robust regulatory framework and a growing emphasis on sustainability, ensuring product safety while encouraging the adoption of naturally sourced ingredients. The EU Cosmetics Regulation continues to strengthen consumer confidence and supports the development of clean and responsibly produced fragrances.

In the UK, the perfume and fragrance market is influenced by tourism, with duty-free retail enabling consumers to purchase premium products at competitive prices. The expansion of retail and e-commerce channels is further driving consumer engagement, while rising interest in gender-neutral fragrances and innovative scent profiles is encouraging new users to invest in higher-end offerings. In Germany, consumers increasingly favor organic and natural perfumes, boosting demand for Eau de Parfum (EDP) formulations due to their higher natural oil content and longer-lasting performance. A well-established retail infrastructure continues to propel sales of premium and luxury fragrances, as consumers perceive both online and offline channels to be convenient and price-competitive.