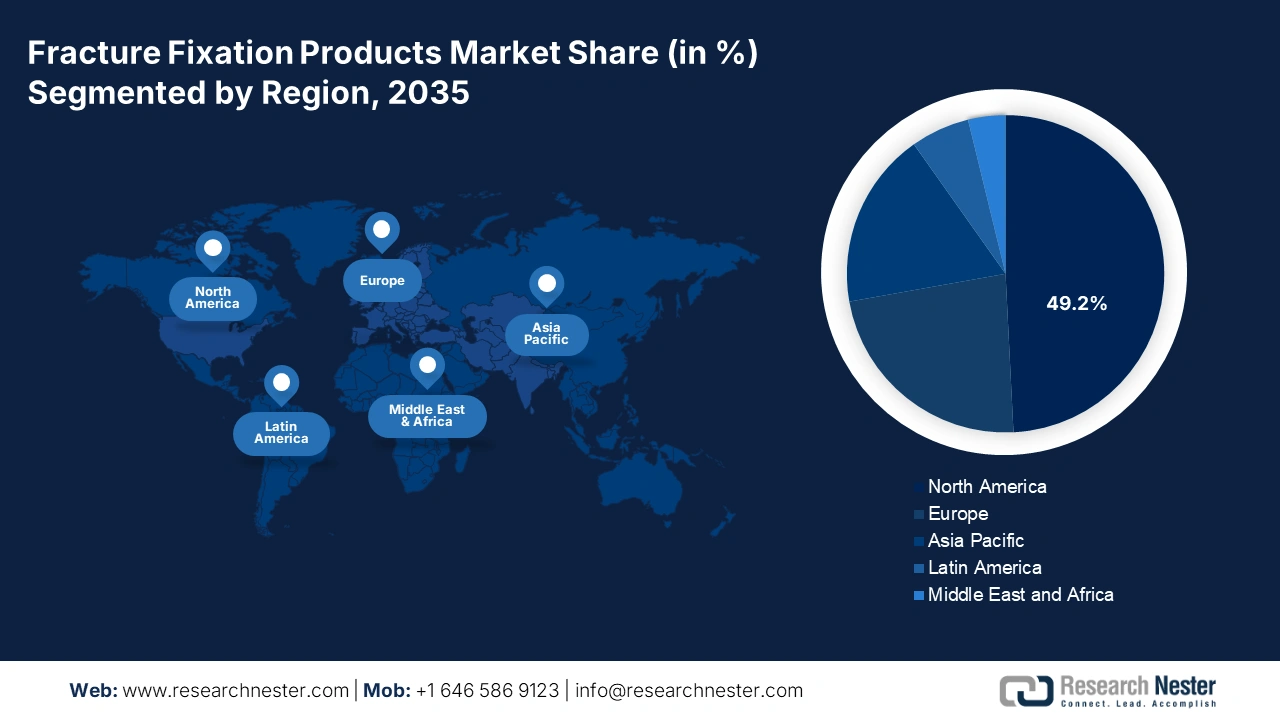

Fracture Fixation Products Market - Regional Analysis

North America Market Insights

North America is expected to hold the dominant share of 49.2% in the global fracture fixation products market over the assessed timeframe. High healthcare spending, coupled with being the epitome of early adoption of advanced surgical technologies, is consolidating the region’s proprietorship in this sector. On the other hand, the enlarging high-risk demography from an aging population, lifestyle-related conditions, and accidental injuries is fostering a substantial demand base for this category. Furthermore, the strong presence of leading MedTech innovators, favorable reimbursement frameworks, and continuous investment in R&D create a potential within the region to show remarkable progress in the upcoming years.

According to a report from the International Journal of Basic & Clinical Pharmacology, the number of individuals having osteoporosis in the U.S. crossed 10 million in 2025 alone. It also underscored the presence of an additional 44 million population with low bone mass, who are highly prone to developing this condition, across the country. This demographic trend signifies a consistent increase in demand in the fracture fixation products market, making the U.S. a dominant contributor to the regional revenue generation. Moreover, the presence of globally leading MedTech manufacturers and wide accessibility to specialized orthopedic care empower the nation’s significance in this sector.

Canada is also steadily growing in the fracture fixation products market in support of its publicly funded healthcare system and increasing focus on improving elderly care. Besides, as the country experiences a notable rise in fracture cases, particularly among its aging population, the surge in effective surgical interventions amplifies. Testifying to this epidemiology, the Bone and Joint Canada (BJC) estimated the annual costs to care for patients with hip fractures in Canada to surpass USD 2.4 billion by 2041. Thus, the country is highly focused on in-hospital infrastructure development, availability enhancement of orthopedic specialists, and widening of minimally invasive procedure adoption, contributing to the sector’s expansion.

APAC Market Insights

Asia Pacific is estimated to become the fastest-growing region in the global fracture fixation products market during the analyzed tenure. The region’s pace of progress is primarily propelled by the rapidly aging populations, rising incidence of trauma and osteoporotic fractures, and rapidly improving healthcare infrastructure. As evidence, an NLM study predicted more than 50% of hip fractures to occur in Asia by 2050. Particularly, in developing countries, including China, India, and Japan, the urge for advanced orthopedic treatments is witnessing a notable increase on account of the heightening spending on advanced surgical options. Besides, government-backed subsidies for surgeries performed in public settings are boosting access to adequate fracture care, raising adoption in this sector.

China plays a crucial role in expanding the Asia Pacific fracture fixation products market, which is backed by its massive population, rapid urbanization, and rising rates of road accidents and age-related bone disorders. Additionally, as the country faces a growing burden of osteoporosis and traumatic injuries, the demand for surgical fixation solutions is increasing steadily. Government efforts to expand healthcare coverage and centralize the medical system also make the products available in this sector more accessible.

India is emerging as a growth engine for the APAC fracture fixation products market. The country is augmenting the sector with its large patient population and a rising number of road traffic accidents and bone-related conditions. The rising awareness of orthopedic health, increasing access to healthcare facilities, and expansion of medical insurance are fueling demand for surgical components for fracture treatments. This can be testified by the growing trade of orthopedic appliances in India, which accounted for USD 355 million and USD 956 million in exports and imports, respectively, in 2023, as reported by the OEC.

Opportunities Presented by the Key Landscapes

|

Country |

Form & Characteristics of the Opportunity |

Timeline |

|

Japan |

The launch of the Bone Health Promotion Project by the alliance of Fujitsu and iSurgery |

2023-2025 |

|

China |

5,790,636 radius and/or ulna fractures occurred in 2021; the incidence is expected to rise from 427 to 502 per 100,000 by 2036 |

2021-2036 |

|

India |

4,61,312 road crashes killed 1,68,491 people, with 4,43,366 injured |

2022 |

Source: Company Press Release, Frontiers, and MoRTH

Europe Market Insights

Europe is anticipated to hold the second-largest share in the global fracture fixation products market between 2026 and 2035. The aging population, high prevalence of osteoporosis, and well-developed healthcare systems are the major growth factors behind the region’s consistent propagation in this sector. Evidencing such as a favorable demography, a report published by the International Journal of Basic & Clinical Pharmacology revealed that more than 22 million women and 5.5 million men in Europe were suffering from osteoporosis till 2025. It also mentioned that the region-wide annual expenditure on osteoporosis-related fractures can potentially rise from USD 43.0 billion to USD 89.2 billion by 2050.

The UK is a prominent landscape in the Europe fracture fixation products market, which is backed by a high incidence of fractures among its aging population and a strong public healthcare system. Osteoporosis-related fractures, especially hip and wrist, are becoming a national medical crisis, prompting service providers to accommodate reliable surgical fixation solutions for their enlarging patient populations. The nation’s focus on improving trauma care services, alongside investments in advanced orthopedic technologies, also supports substantial growth in this sector.

Germany is a leading supplier of associated devices for the fracture fixation products market in Europe. The strong presence of MedTech innovators and manufacturers empowers the country’s significance in this landscape. Its large geriatric population also results in a steady rise in osteoporosis-related fractures and trauma cases, hence benefiting the merchandise. Moreover, the hospitals, due to being well-equipped with cutting-edge orthopedic technologies and surgeons, are acting as the major influential factor behind the country’s impressive progress in this category.

Country-wise Export-Import Data for Orthopedic Appliances

(incl. Instruments for Fracture) (2023)

|

Country |

Trade Type |

Value (in USD, Billion) |

|

Germany |

Import |

5.0 |

|

Switzerland |

Export |

7.9 |

|

Netherlands |

Import |

8.9 |

|

Ireland |

Export |

7.6 |

Source: OEC