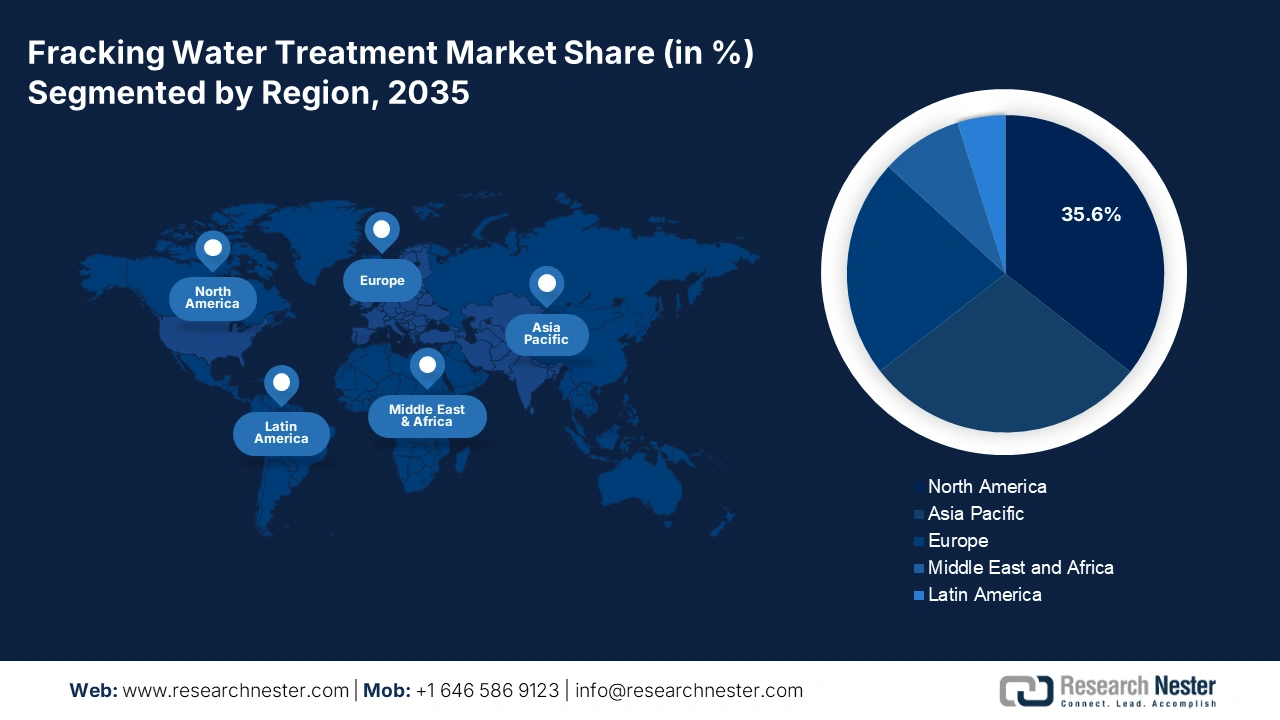

Fracking Water Treatment Market - Regional Analysis

North America Market Insights

By 2035, the North America market is expected to hold 35.6% of the market share, and it is expected to grow from roughly USD 24.62 billion in 2025 to USD 40.51 billion in 2035 with a compound annual growth rate (CAGR) of around 5.8% during the period. The expansion is driven by tougher constraints on the environment, growing fracking operations, and the shift from deep well injection to recycling technologies. The main segments of the fracking water treatment market are ion exchange, reverse osmosis, and microbial treatment processes. It is expected that North America will be the regional leader in the fracking water treatment market share and dominate global market revenues by region for the years ahead, into 2035.

The U.S. is anticipated to dominate the North American fracking water treatment market by 2035. This anticipated growth is primarily due to significant shale gas production in areas such as the Permian Basin and Marcellus Shale, coupled with rigorous regulatory frameworks and a high rate of adoption of advanced treatment technologies. Hydrozonix is a leader in advanced oxidation and mobile water treatment systems tailored for the oilfield, providing chemical-free solutions that utilize ozone and cavitation technologies. The company has successfully deployed its systems at more than 30 oilfield locations, treating millions of barrels of produced water each year.

Canada is expected to rank as the second-largest market for fracking water treatment in North America by 2035. The growth of this market is fueled by heightened shale gas exploration in areas like British Columbia and Alberta, along with strict environmental regulations that encourage water recycling and reuse. Enbridge Inc. plays a crucial role in delivering solutions for water treatment and recycling, thereby supporting Canada's fracking water treatment efforts. The company has established a zero-liquid discharge (ZLD) system at the Indian Oil Corporation's Panipat Refinery, which features a reverse osmosis-based demineralization plant and a condensate polishing unit. This innovative system effectively recycles and reuses water, leading to a significant reduction in freshwater consumption and a decrease in environmental impact.

Asia Pacific Market Insights

Asia Pacific market is expected to hold 28.9% of the market share due to the proliferation of shale exploration and more stringent policies for wastewater reuse. The market is expected to reach USD 1.39 billion by 2035, growing at 7.7% CAGR from 2026 to 2035. China contributes the most to demand in the region, followed by Australia and India. Authorities are implementing stricter water discharge regulations for wastewater as well as investing in produced water treatment infrastructure, such as desalination plants. Increasingly, R&D directed by companies on cost-effective membrane and electrocoagulation technology further bolsters the market for fracking water treatment installations to grow across the region.

China is anticipated to dominate the APAC fracking water treatment market by 2035, with a projected market value surpassing USD 613 million. This expansion is primarily due to vigorous shale gas development in areas such as Sichuan and Inner Mongolia, coupled with wastewater recycling initiatives aimed at enhancing reused water utilization. Companies like. Sinopec has been proactively enhancing water treatment technologies to bolster its hydraulic fracturing activities. A prominent instance of this is its partnership with OriginClear to test the Electro Water Separation™ (EWS) technology at the Fuling shale gas site in Chongqing. This innovative technology efficiently eliminates total petroleum hydrocarbons and suspended solids from wastewater, facilitating its reuse in hydraulic fracturing operations, thus decreasing freshwater usage and mitigating environmental repercussions.

India is anticipated to emerge as the fastest-growing market within the APAC, with a projected market value of USD 106 million by 2035. This growth is fueled by the Indian government's ambitious plan for a gas-based economy and exploration activities in the Cambay and Krishna-Godavari basins. Firms such as Ion Exchange (India) Ltd. has been significantly involved in providing solutions for water pre-treatment, treatment, recycling, and zero liquid discharge, aiding India's fracking water initiatives. The company has established a zero-liquid discharge (ZLD) system at the Indian Oil Corporation's Panipat Refinery, which features a reverse osmosis-based demineralization plant and a condensate polishing unit. This system recycles and reuses water, leading to a substantial reduction in freshwater consumption and a decrease in environmental impact.

Europe Market Insights

Europe’s fracking water treatment market is anticipated to witness consistent growth until 2035, propelled by more stringent environmental regulations, an increase in zero-liquid discharge (ZLD) requirements, and a rising demand for media filtration and water reuse technologies. Various countries within the region are committing resources to sustainable water management practices aimed at minimizing environmental impact and ensuring adherence to EU wastewater directives, thereby prioritizing advanced treatment solutions for operators engaged in hydraulic fracturing activities.

Germany is projected to emerge as a significant revenue contributor in Europe’s fracking water treatment market by 2035, attributed to robust regulatory pressures, investments in shale gas exploration, and a wealth of industrial expertise in water technology. Domestic firms such as EnviroChemie provide approximately 250 decentralized wastewater treatment systems each year throughout Germany and Europe. With over 30,000 plants installed globally, the company reported revenues of around €200.79 million in 2021.

The UK is also expected to capture a considerable market share by 2035, driven by heightened scrutiny regarding water contamination, stricter permits for flowback and discharge, and government incentives promoting sustainable extraction practices. Kolina has treated wastewater (comprising surface runoff and flowback) at a fracking exploration site in Lancashire utilizing a 4-cell plant with a capacity of approximately 20 m³/hr, successfully meeting stringent discharge standards and eliminating the need for up to 12 tanker loads of transport per day.