Formulation Development Outsourcing Market Outlook:

Formulation Development Outsourcing Market size was valued at USD 31.34 billion in 2025 and is expected to reach USD 59.94 billion by 2035, expanding at around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of formulation development outsourcing is evaluated at USD 33.23 billion.

The major driver behind the rising tendency of pharma companies to lend expertise and specialization from the market is cost savings. The significant reduction in operational and R&D expenses due to hiring such professional teams to support new therapeutic launches has earned a huge consumer base. Particularly, contractual services are gaining traction by offering high-end technologies and research capabilities without adding any internal cost, which is propelling maturation in this field.

Besides the cost-effectiveness feature, the market also pledged to provide time efficiency during drug discoveries. The quick transition from concept design to final formulation helps the customers get accelerated regulatory compliance, attracting more investments and participation. Moreover, the growing demand for such assistance in attaining international standards is signified by the rising globalization of pharmaceutical products. According to OEC data, the value of pharmaceutical exports worldwide reached USD 835.0 billion in 2022, increasing by 3.8% from 2021. The whole pipeline included chemical products, packaged & unpackaged medicaments, and vaccines, which ranked as the 7th most traded asset in the world.

Statistics of Top Importers & Exporters:

|

Country |

Import Value (in billion) |

Export Value (in billion) |

|

Germany |

USD 71.1 |

USD 125.0 |

|

The U.S. |

USD 168.0 |

USD 90.0 |

|

Switzerland |

USD 48.5 |

USD 93.8 |

|

Belgium |

USD 46.9 |

USD 73.5 |

Source: OEC 2022

Key Formulation Development Outsourcing Market Insights Summary:

Regional Highlights:

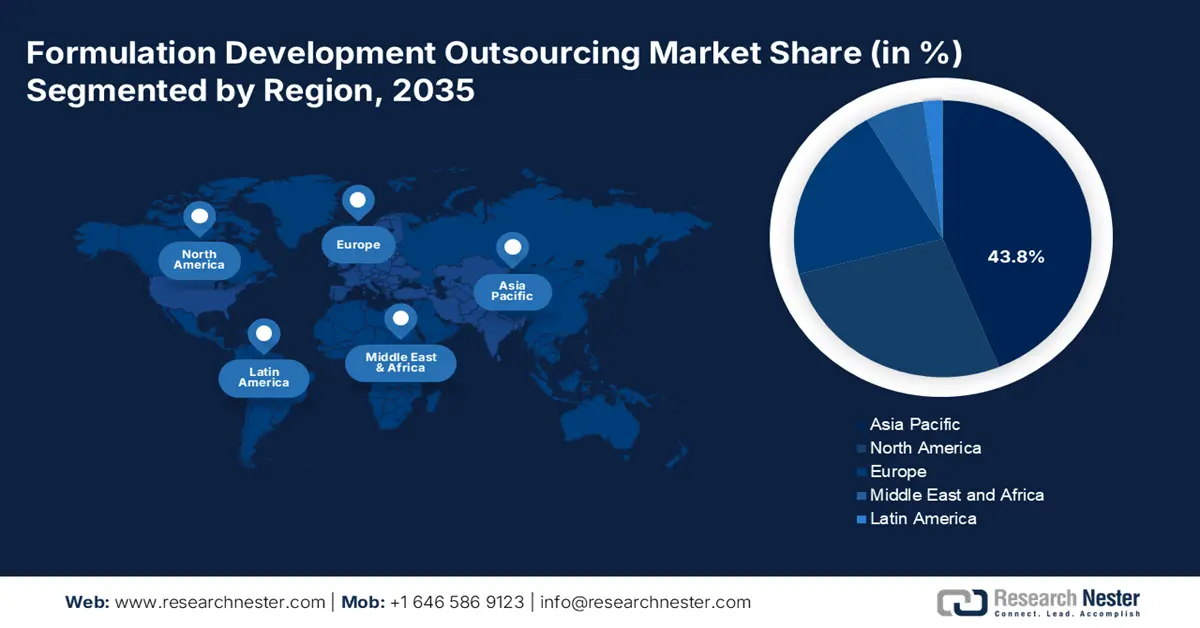

- Asia Pacific formulation development outsourcing market will account for 43.80% share by 2035, attributed to progressive clinical assessments and strong manufacturing capabilities.

- North America market will account for significant share by 2035, driven by North America dominance in contractual biologics production.

Segment Insights:

- The formulation development segment in the formulation development outsourcing market is expected to see substantial growth till 2035, fueled by rising demand for comprehensive biologic drug development services.

- The oncology segment in the formulation development outsourcing market is projected to achieve the largest share by 2035, attributed to the increasing cancer burden and need for cost-effective anticancer therapeutics.

Key Growth Trends:

- Increasing pharmaceutical R&D activities

- Growing demand for advanced drug delivery systems

Major Challenges:

- Uncertainty in intellectual property preservation

- Third-party supply chain management

Key Players: Lonza, Charles River Laboratories International, Inc., Eurofins Scientific SE, Thermo Fisher Scientific, Inc. (Patheon).

Global Formulation Development Outsourcing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.34 billion

- 2026 Market Size: USD 33.23 billion

- Projected Market Size: USD 59.94 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Formulation Development Outsourcing Market Growth Drivers and Challenges:

Growth Drivers

- Increasing pharmaceutical R&D activities: The robust demand for specialized treatments such as targeted therapies and precision medicine is pushing the pharma pioneers to engage in rigorous research and innovation. This is further creating a surge in the formulation development outsourcing market. The increased frequency of investments in medicinal R&D, specifically for designing more effective biologics has escalated the profit margin in this sector. According to a collaborative report from RAND Europe, published in February 2022, the global pharmaceutical R&D expenditure held USD 300.0 billion in 2020. It further calculated the average out-of-pocket costs for companies, which ranged USD 280.0-380.0 million.

- Growing demand for advanced drug delivery systems: The conjugated efforts from both government and private authorities to increase the accessibility of therapeutics have propelled demand in the market. They are continuously working on curating the most affordable yet efficient route of administration for these drugs to serve the purpose. The frequent innovations in this category are also evidence of this sector’s growth. For instance, in October 2024, Samsung Biologics launched a new high-concentration formulation platform, S-HiCon for high-dose biopharma.

Challenges

- Uncertainty in intellectual property preservation: The formulation development outsourcing market often faces issues regarding the authenticity of intellectual property (IP). There is a possibility of creating a dispute between service providers and customers based on proprietary protection. The risk of theft or misuse of sharing sensitive information may prevent drug developers from engaging in such trading relationships. These boundaries, which are built with conservative consumer behaviors, have the potential to disrupt a good flow of adoption in this sector.

- Third-party supply chain management: The reliance on the manufacturers from the formulation development outsourcing market becomes complex in cases of time-constraint distribution. Timely completion of the contract highly depends on these third-party outsources, which may involve supply chain disruptions and logistical delays. This is capable of hindering product availability in the market and loosening consumer trust. It further drags inefficiency in proper communication and coordination among partners, leading to setbacks and errors.

Formulation Development Outsourcing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 31.34 billion |

|

Forecast Year Market Size (2035) |

USD 59.94 billion |

|

Regional Scope |

|

Formulation Development Outsourcing Market Segmentation:

Service Segment Analysis

Based on service, the formulation development segment is expected to account for more than 78.3% formulation development outsourcing market share by the end of 2035. Companies with exceptional biologics manufacturing capabilities are stepping forward with a tailored suite of services to cope with inflating demand. Particularly the magnifying need for all-in-one solutions to foster a wide range of administrations and functions in medicines has boosted this segment, inspiring participation. For instance, in December 2024, Ascendia introduced its new line of CDMO services, Ascendia Pharmaceutical Solutions, offering formulation development.

Therapeutic Area Segment Analysis

In terms of therapeutic areas, the oncology segment is predicted to capture the largest share in the formulation development outsourcing market by the end of 2035. The outraging widespread of cancer incidences around the world is pushing companies to get involved in verse exploration to find the most effective treatment. In addition, the broad spectrum of malignancies has widened the applications of anticancer regimens, resulting in an emergent surge. According to the NLM database, the global expenditure on oncology medicines was valued at USD 180.0 billion during the period 2019-2020. There is plenty of evidence to prove the exponential rise in expense burden, which dragged the attention toward introducing more accessible and affordable products. This is further igniting engagement in this field.

Our in-depth analysis of the global market includes the following segments:

|

Service |

|

|

Formulation |

|

|

Therapeutic Area |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Formulation Development Outsourcing Market Regional Analysis:

APAC Market Insights

Asia Pacific in formulation development outsourcing market is expected to hold over 43.8% revenue share by the end of 2035. The progressive nature of this region’s clinical assessments is a major driver in this sector. Its ambitious manufacturing powerhouses such as China and India are garnering a profitable trading practice for both domestic and international service providers. For instance, in May 2024, Biocon Limited released its financial report, highlighting revenues of USD 104.9 million (23%) from research services and USD 82.2 million (18%) from APIs & generic formulations. Their innovative approach to producing the most effective regimens allows them to escalate scalability and quality.

The rapid enlargement of the pharmaceutical industry in India has founded many global leaders in the market. Besides, the investment scope of this country has levitated with the subsidiary policies from the governing body. The efforts to prioritize and emphasize domestic production have influenced companies to be involved in this category. According to an IBEF report published in October 2024, the annual turnover of the pharma industry in India obtained USD 49.7 billion in 2023, acquiring a 20.0% share in the accumulated global supply. The report further mentioned that 75.0% of its total exports consist of drug formulations and biologics.

China is propagating the market with its strong emphasis on distribution channels and manufacturing capabilities. The presence of leaders in this category has become more prominent with the country’s significant contribution to pre-clinical and clinical findings and achievements. These further fuel this marketplace with a proactive association in curating eligible therapies and medications. For instance, in November 2022, WuXi STA unveiled a new parental line of formulation production in Wuxi, China. With an additional manufacturing capacity of 10.0 million units, the new site complies perfectly with the company’s aim to enhance its injectable drug product platform.

North America Market Insights

The North America formulation development outsourcing market is anticipated to capture a significant share throughout the assessed timeframe. The region is augmenting with meticulous R&D activities for pioneering new remedies. Its dominance over biotechnology and outsourcing originated from its strong presence in biologics. North America is poised to captivate the largest portion of 50.0% of global contractual biologics evolution and production revenue, as per Research Nester’s estimation. Another report from the Information Technology & Innovation Foundation, published in May 2024, revealed that over 40.0% of the worldwide biopharmaceutical output is contributed by the U.S. landscape.

The U.S. is fostering a beneficial scope of progress in the market with its large pool of revolutionizing and established biotech startups. The existing specialized service providers in this country are well-equipped with advanced technologies and workforces to ensure compliance with stringent regulatory frameworks such as the FDA. Besides, the balanced management of budgets has also cultivated investments in the in-house infrastructure and expertise. For instance, in December 2023, Agno Pharma acquired Lubrizol Particle Sciences Inc. to extend its drug product formulation pipeline. The company earned the groundbreaking clinical and preclinical expertise of Particle Sciences.

Efforts from the government to strengthen the national R&D network have made Canada one of the prime profit-generating landscapes in the market. According to the government of Canada, the total R&D expenditure by local manufacturers, who were selling patented therapeutics, accounted for USD 922.9 million in 2021. The report further mentioned the 2022 domestic export value to be at USD 12.7 billion. The figures signify the importance of this marketplace. The nation is now highly focused on improving treatment availability across all patient demographics. Furthermore, the enhanced healthcare infrastructure is accumulating a prefecture of business in this field.

Formulation Development Outsourcing Market Players:

- SGS S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eurofins Scientific SE

- Element

- Labcorp

- Thermo Fisher Scientific, Inc. (Patheon)

- Intertek Group plc

- Recipharm

- Lonza

- Charles River Laboratories International, Inc.

- Catalent Inc.

- Etherna Immunotherapies NV

Expansion of footprint has become the first priority of key players in the formulation development outsourcing market. Their active engagement is encouraging other pharma producers to introduce compatible and flexible pipelines of services to offer convenience and time-to-market eligibility to consumers. For instance, in October 2024, Ardena acquired Catalent’s production site in Somerset, New Jersey to improve its abilities in downstream late-stage and small-scale commercial fabricating of oral drug products. This addition was intended to benefit the company with global extension in its CDMO portfolio, providing integrated and comprehensive solutions across the lifecycle. The list of such key players includes:

Recent Developments

- In January 2025, Etherna Immunotherapies engaged in a strategic collaboration with Dropshot Therapeutics to leverage its RNA-based therapeutics development capabilities. It brought a total earning of USD 950.0 million for the company, based on its patented lipid nanoparticle formulations.

- In September 2024, Lonza unveiled its innovation and formulation center, Innovaform Accelerator in Colmar (FR). The new site serves pharma customers with the development and innovation of capsule-based manufacturing and delivery solutions for oral and pulmonary administration.

- Report ID: 7130

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Formulation Development Outsourcing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.