Formic Acid Market Outlook:

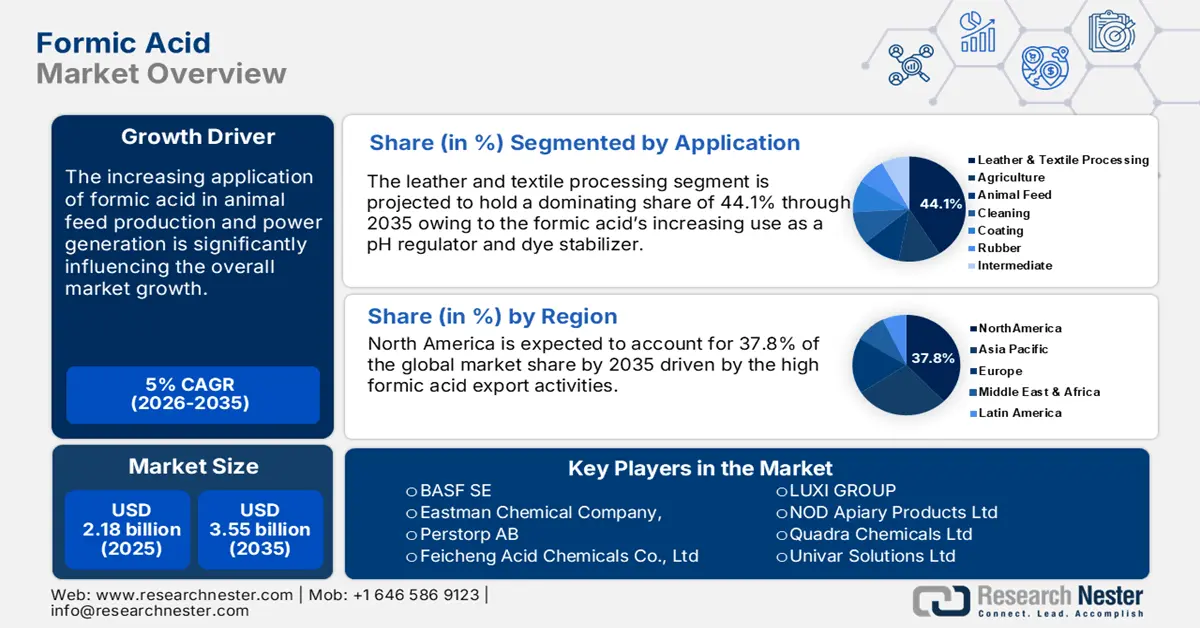

Formic Acid Market size was over USD 2.18 billion in 2025 and is poised to exceed USD 3.55 billion by 2035, growing at over 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of formic acid is evaluated at USD 2.28 billion.

Insects such as stingless bees and ants produce formic acid naturally, but its industrial production is significant, around 870 kt of formic acid was produced industrially in 2021. Formic acid is being increasingly studied for its use as a carrier in power generation. This trend is estimated to offer lucrative opportunities to formic acid producers in the coming years. Energy consumption is booming across the world, for instance, according to the International Energy Agency (IEA), the electricity’s share in the final energy consumption accounted for 20% in 2023. By 2026, sectors such as artificial intelligence (AI), cryptocurrency, and data centers are expected to exhibit double electricity consumption. Data centers alone are forecast to account for total electricity consumption of over 1000TWh by 2026.

The use of formic acid as a liquid hydrogen carrier for power generation is set to be an effective fossil fuel transition move. For instance, In October 2023, Kawanami Hajime, Chief Senior Researcher from the Interdisciplinary Research Center for Catalytic Chemistry, AIST in collaboration with the University of Tsukuba generated power using formic acid. Such achievements are enhancing the application areas of formic acid. Overall, by aligning with sustainability practices and driving innovations in the manufacturing processes, the producers of formic acid are projected to earn high profits.

Key Formic Acid Market Insights Summary:

Regional Highlights:

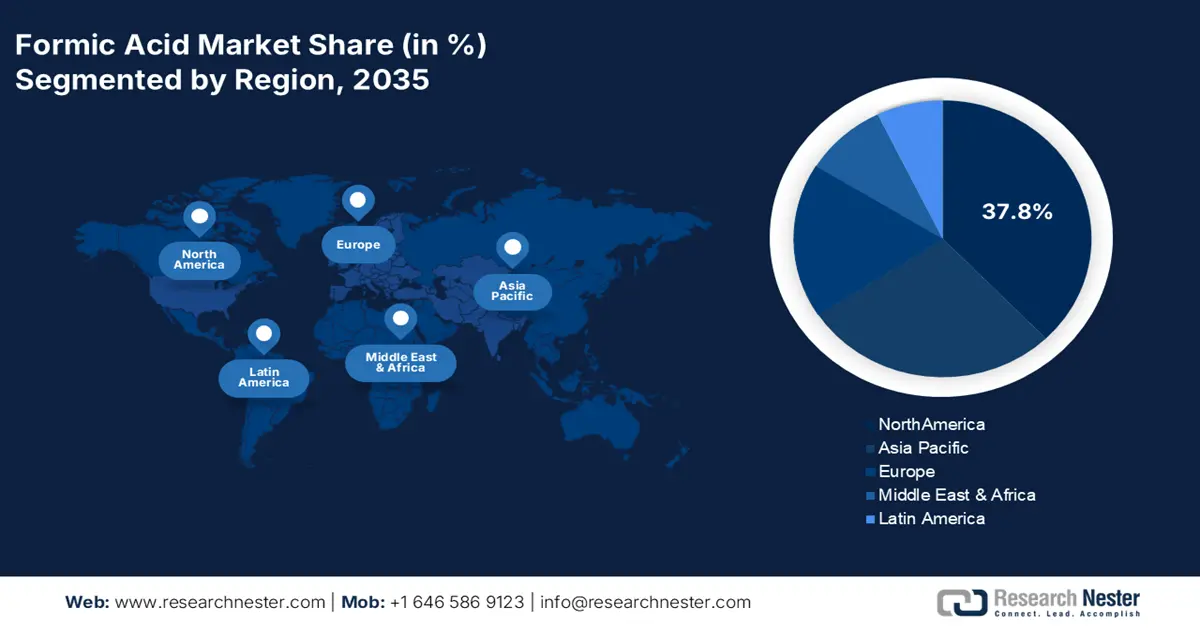

- North America leads the formic acid market with a 37.8% share, propelled by the presence of industry giants, chemical research organizations, and high livestock feed demand, ensuring robust growth through 2035.

Segment Insights:

- The Leather and Textile Processing segment is expected to hold more than 44.1% market share by 2035, fueled by rising demand for textiles and synthetic fibers.

- 99% Formic Acid segment is projected to hold more than a 16.2% share by 2035, fueled by increased use in animal feed due to its antibacterial properties.

Key Growth Trends:

- Increasing use as animal feed and silage preservation

- Increasing oil and gas demand

Major Challenges:

- Easy availability of alternatives

- Side effects of formic acid

Key Players: BASF SE, Eastman Chemical Company, Perstorp AB, and Feicheng Acid Chemicals Co., Ltd.

Global Formic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.18 billion

- 2026 Market Size: USD 2.28 billion

- Projected Market Size: USD 3.55 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, Thailand, Brazil

Last updated on : 14 August, 2025

Formic Acid Market Growth Drivers and Challenges:

Growth Drivers

- Increasing use as animal feed and silage preservation: Formic acid’s vital role in animal feed and silage preservation is one of the high-earning scopes for key formic acid market players. For instance, as per the analysis by the International Feed Industry Federation (IFIF), annually more than 1 billion tonnes of compound feed is produced globally and the yearly turnover exceeds USD 400 billion. Furthermore, the Food and Agriculture Organization estimates that the global population is foreseen to increase by 2.3 billion people by 2050 and subsequently the food demand will uplift by 70%. Thus, the rising food demand including meat, dairy, and aqua products is set to augment the use of formic acid in livestock feed products to enhance their shelf life and quality.

- Increasing oil and gas demand: In recent years, formic acid has gained high applications in the oil and gas industry. This is primarily due to its ability to enhance well productivity and reservoir performance. The rising industrial and urbanization activities across the world are fueling oil and gas consumption. For instance, the International Energy Agency revealed that the worldwide upstream oil and gas (O & G) investment increased by 11% to USD 528 billion in 2023. Also, the U.S. Energy Information Administration estimates that global liquid fuel consumption is anticipated to increase from 1.0 million b/d in 2024 to 1.2 million b/d by 2025. Such statistics highlight that the increasing production of oil and gas to meet the global demand is pushing the use of formic acid in acidizing and corrosion resistance of high-temperature and pressure o & g wells.

Challenges

- Easy availability of alternatives: The presence of alternatives often hampers the sales of the primary product. In the case of formic acid, the easy availability of substitutes such as acetic acid, sulfuric acid, and phosphoric acid limits their sales growth to some extent. These alternatives are cost-effective and are less hazardous compared to formic acid, and their similar application areas are creating challenges for formic acid manufacturers.

- Side effects of formic acid: Formic acid is a hazardous chemical compound and high exposure to it can cause severe skin burns and irritation to the eyes. Also, some may witness dizziness, vomiting, headache, and nausea if come in direct contact with formic acid. Such side effects can limit the use of formic acid, affecting their overall sales growth.

Formic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 2.18 billion |

|

Forecast Year Market Size (2035) |

USD 3.55 billion |

|

Regional Scope |

|

Formic Acid Market Segmentation:

Application (Leather & Textile Processing, Agriculture, Animal Feed, Cleaning, Coating, Rubber, Intermediate)

Leather and textile processing segment is anticipated to account for more than 44.1% formic acid market share by the end of 2035. This high-purity formic acid is widely used for dyeing, finishing processes, and the production of synthetic fibers. Leather and textile producers make high use of formic acid to control the pH level and enhance the dye stability. For instance, the Observatory for Economic Complexity revealed that the textiles held 7th position as the most traded product, with a global trade of USD 941 billion in 2022. This explains that, as the demand for textiles increases the consumption of formic acid is set to uplift.

Grade (20%, 25%, 40%, 60%, 70%, 75%, 85%, 90%, 94%, 99%)

By 2035, 99% formic acid segment is predicted to hold more than 16.2% formic acid market share. The abundance of 99% formic acid and more environment friendliness are majorly contributing to its high sales. These high-purity grade-type formic acids are utilized as preservatives and antibacterial agents in feed production for animals.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Formic Acid Market Regional Analysis:

North America Market Forecast

North America industry is predicted to dominate majority revenue share of 37.8% by 2035. The strong presence of industry giants, chemical research organizations and high livestock feed demand is fuelling the consumption of formic acid in the region. The United States holds a dominating position in the North America market and the formic acid demand in Canada is estimated to expand at the fastest CAGR through 2035.

The U.S. is one of the major exporters of formic acid to the world, and according to the World Integrated Trade Solution report the country exported around 18,450,00 kg of formic acid worldwide, in 2022. Furthermore, the Observatory of Economic Complexity reveals that the U.S. accounted for USD 5.05 million in formic acid exports in 2022. These statistics highlight the major role of the U.S. in the global formic acid market growth.

Canada is significantly contributing to the formic acid trade, through both import and export activities. For instance, the World Integrated Trade Solution study reveals that the country exported around 1,435,330 kg of formic acid salts to the world, in 2022. Furthermore, the report by the Innovation, Science, and Economic Development Canada estimates that Agro-Bio Contrôle Inc., Brenntag Canada, Inc., ClearTech Industries, Inc., NOD Apiary Products Ltd, Quadra Chemicals Ltd, and Univar Solutions Ltd are major importers of formic acid in Canada and accounts for around cumulative 78.57% of imports.

Asia Pacific Market Statistics

Formic acid manufacturers are projected to grab high-earning opportunities in Asia Pacific due to the supportive government investments in advancing the chemical sector and the presence of labor and technologies at cost-effective prices. China and India are the most lucrative marketplaces followed by Japan and South Korea.

China has a strong presence of chemical producers, which have the potential to positively influence the sales of formic acid. For instance, according to the World Integrated Trade Solution, formic acid exports from China to the globe reached USD 168.340 billion in 2023. Formic acid companies focusing on investing in China are expected to earn high profits in the coming years.

In India, textile, homecare, agriculture, and cosmetics are major end users of formic acid. The rapid expansion of these markets is substantially influencing the consumption of formic acid. The India Brand Equity Foundation estimates that by 2025-end the country is expected to witness an investment of USD 107.38 billion in the chemicals and petrochemicals sector. Such investments are anticipated to positively influence formic acid sales in the country.

Key Formic Acid Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company,

- Perstorp AB

- Feicheng Acid Chemicals Co., Ltd

- Chongqing Chuandong Chemical (Group) Co., Ltd

- Agro-Bio Contrôle Inc.

- Brenntag Canada, Inc.

- ClearTech Industries, Inc.Gujarat Narmada Valley Fertilizers & Chemicals Limited ,

- LUXI GROUP

- NOD Apiary Products Ltd

- Quadra Chemicals Ltd

- Univar Solutions Ltd

- Qingdao Hisea Chem Co., Ltd

- Shandong Aojin Chemical Technology Co., Ltd

- OCOchem

Key players in the formic acid market are employing strategies such as technological innovations, advanced solution launches, strategic collaborations and partnerships, mergers & acquisitions, and regional expansions. Industry giants are forming strategic partnerships with other players and collaborating with research organizations and universities to increase the applications areas of formic areas. In recent years, many market players collaborated with researchers from top universities to expand the use of formic acid. Furthermore, mergers, acquisitions, and regional expansion strategies are aiding them to boost their formic acid market reach.

Some of the key players include:

Recent Developments

- In June 2024, Kemin Industries announced the launch of FORMY, an advanced feed acidifier for Swine health, in the U.S. This is a non-antibiotic solution of formic acid effective in reducing the Enterobacteriaceae challenges and Escherichia coli

- In June 2024, Yield Engineering Systems, Inc. revealed that it supplied multiple VeroTherm Formic Acid Reflow (FAR) systems to logic and memory producers. These systems are used to empower the 3D stacking of memory and logic chips essential for the development of high-performance AI accelerators.

- Report ID: 6743

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Formic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.