Forklift Battery Market Regional Analysis:

North America Market Insights

North America region is poised to witness substantial growth through 2035. Growth is supported by the broad-based electrification of warehouse and logistics operations in industry segments such as retail, manufacturing, and e-commerce. Organizations are upgrading from diesel and lead-acid forklifts to lithium-ion alternatives with improved performance and eco-friendly gains. Automating and electrifying the fleet is now the norm in large-scale logistics centers of distribution. Stringent climate regulation and carbon-emissions reduction obligations also encourage industry to turn towards zero-emission solutions, and that aligns with financial offerings to upgrade batteries. Being based in regions with a highly developed industry base helps the region to dominate long term.

The U.S. forklift battery market is picking up speed with incentives at the state and federal levels in the direction of clean energy and vehicle electrification. Under Section 45W Commercial Clean Vehicle Credit by the IRS, businesses can claim incentives of up to USD 40,000 per electric industrial vehicle, which includes forklifts. This has been stimulating the acquisition of lithium-ion-powered forklifts in manufacturing and logistics facilities. In March of 2025, Grid On Demand initiated a pilot mobile battery storage product focused on electrified fleets of forklifts. The system provides scalable energy assistance to high-load operations. American companies are also investing in the local production of batteries to de-risk the supply chain. Collectively, these measures are stimulating steady demand in the market.

Canada forklift battery market is being driven by corporate electrification and a supportive regulatory landscape. In March 2025, Walmart Canada ordered the purchase of CAD 7 million in battery systems from Electrovaya to be supplied to two of its distribution centers. This project reveals increasing corporate demand for low-emission warehouse equipment that is reliable. Canada’s policy to become Net-Zero Emissions by 2050 has encouraged industries to shift to carbon-cutting technologies. Industrial electric vehicle adoption is supported by provincial rebate schemes. Logistics operators are adopting lithium-ion forklifts to achieve internal ESG commitments. All those efforts and policies combined place Canada firmly in North America market.

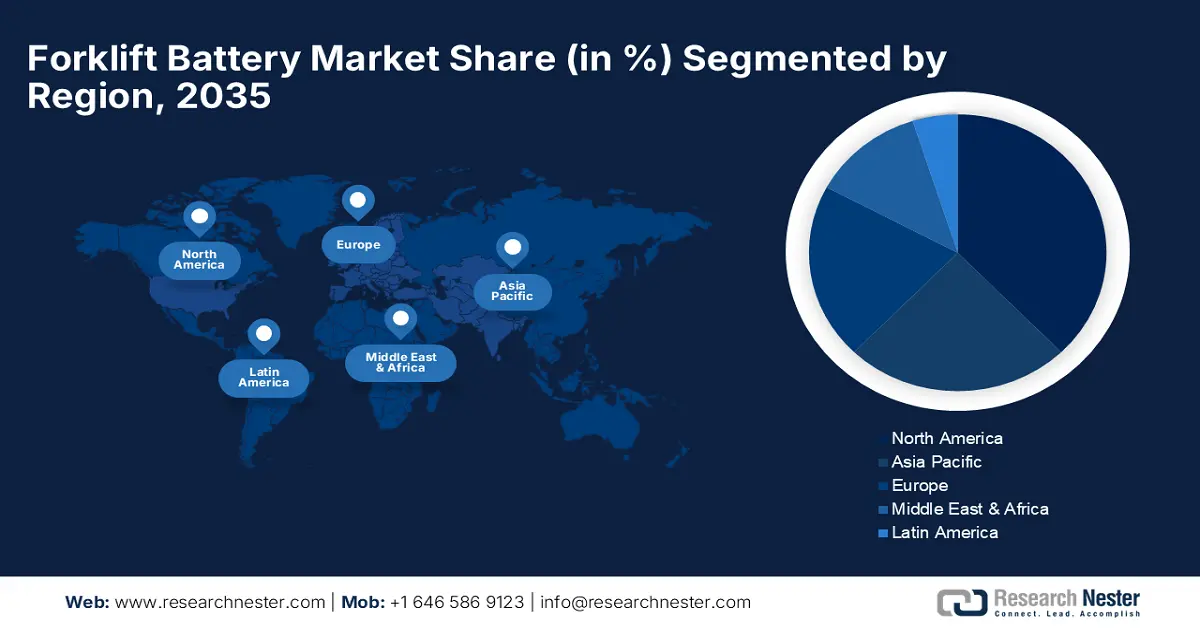

APAC Market Insights

Asia Pacific is set to dominate the forklift battery market with a share of 47% by 2035. Industrialization and the construction of infrastructure in emerging economies are generating tremendous demand for efficient material handling equipment. Asia Pacific's huge warehousing demand and growth driven by e-commerce and city growth is promoting the use of electric forklifts. Lithium-ion batteries are garnering forklift battery market share due to their charging speed advantage and long-term cost savings. Southeast Asia and India are placing great emphasis on upgrading fleets in order to meet the growth in manufacturing. Incentives from the government to support clean energy use by corporate players in the private sector are further pushing the implementation of high volumes of batteries in the region.

China forklift battery market is witnessing growth driven by large-scale production and government-initiated electrification. In March 2025, a USD 67 million investment was reported in South Carolina to produce critical components of lithium-ion batteries shipped to China. Locally, domestic authorities are implementing tighter emission regulations on industrial trucks in urban areas. This is hastening internal combustion forklift replacement. While major industry players such as BYD are increasing their production of lithium-ion forklifts, the nation is both a major producer and consumer. Scale and policy incentives in China put it at the forefront of the global demand for batteries.

India forklift battery market is gaining traction with the improvement of the country's logistics and warehousing network. Demand is increasing in pharmaceuticals, e-commerce, and manufacturing sectors, where downtime and maintenance costs arise as major areas of concern. Policies of the government, such as the National Electric Mobility Mission, pave the way towards a favorable environment. Import duty cuts on the components of batteries also decreased entry barriers. Local production and growing demand in India together indicate good prospects of growth.