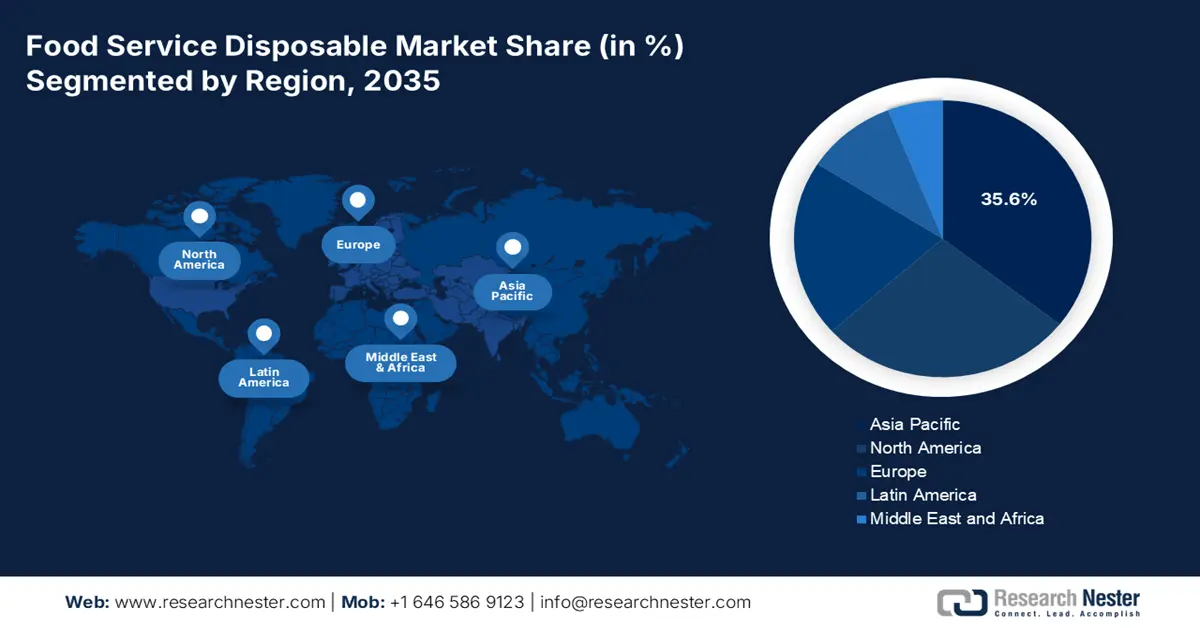

Food Service Disposable Market - Regional Analysis

APAC Market Insights

The Asia Pacific is dominating the food service disposable market and is expected to hold the market share of 35.6% by 2035. The market is driven by the explosive urbanization, massive and expanding population growth, and the unparalleled digital adoption of the online food delivery platforms. While the regional growth is robust, it is highly heterogeneous. The major economies, such as Japan and South Korea, represent mature, high-value markets with stringent regulations similar to Europe, creating a demand for advanced sustainable materials. Further, the high-growth markets such as China and India are primarily volume-driven by the rapid urbanization and the expansion of the quick-service restaurant chains, though they are increasingly implementing their own bans on single-use plastics. The overarching trend is a rapid regulation and consumer-driven pivot away from conventional plastics toward paper, bagasse, and other biodegradable alternatives tailored to local food types and waste management infrastructure.

China’s market is the world's largest and is driven by an unparalleled online food delivery ecosystem and a top-down regulatory mandate to phase out non-degradable plastics. The national development and the Reform Commission’s policy bans specific plastic items in phases, directly reshaping supply chains. While the comprehensive national sales data is not publicly disaggregated, the scale of the underlying demand is clear. The People’s Republic of China, in May 2025, reported that the online food delivery users as of December 2024 reached 592 million, highlighting the urgent need for food service disposable products. Further, the massive recurring demand for disposable packaging from the hundreds of millions of monthly orders now requires compliant, often paper-based alternatives. This regulatory-driven shift is accelerating domestic capacity expansion in paper-based and compostable disposable manufacturing.

In India, the market is characterized by rapid growth and a complex regulatory landscape, including central and state-level plastic bans. The cornerstone is the government of India’s plastic waste management rules, which prohibit identified single-use plastic items nationwide. The report from the Central Pollution Control Board states that the enforcement of these rules has led to a significant reduction in the supply of identified SUP items across the country. This further shows the policy’s immediate and substantial impact on the market composition and drives the demand for the compliant substitutes. The report from the PIB May 2025 has indicated that the USD 81.04 billion FDI inflow (FY 2024–25) reflects stronger capital formation across services, manufacturing, logistics, retail, and urban infrastructure, all of which support the expansion of organized foodservice, QSR chains, cloud kitchens, and delivery platforms that rely heavily on disposable packaging.

North America Market Insights

North America is the fastest-growing food service disposable market and is poised to grow at a CAGR of 4.4% during the forecast period 2026 to 2035. The market is driven by the dominance anchored in high per capita consumer spending on the food away from home, a mature food delivery sector, and stringent via fragmented regulatory action against single-use plastics and PFAS chemicals. The primary driver is the legislative push with the multiple U.S. states and a federal ban in Canada, which is pushing a rapid material transition from conventional plastics to paper molded fiber and compliant alternatives. The innovation focuses on the performance within sustainable formats supported by the investments in recycling and composting infrastructure. The market is defined by the consolidation among the major suppliers who can navigate complex compliance and supply chain logistics.

The U.S. market is defined by regulatory fragmentation and compliance-driven material innovation. In the absence of federal law, state-level bans on items such as expanded polystyrene foam and PFAS chemicals are the primary demand drivers. For instance, California’s AB 1200 and similar laws create an immediate need for the PFAS-free fiber-based bowls and containers. The government data confirms the underlying economic activity, with the U.S. Department of Agriculture in September 2025 reporting that the food-away-from-home expenditure reached a record of USD 1.45 trillion in 2023 to USD 1.52 trillion in 2024, sustaining the high volume demand for the packaging across both the regulated and conventional product lines. The U.S. Environmental Protection Agency grants from the Bipartisan Infrastructure Law aim to modernize the domestic recycling infrastructure that is vital for managing new material streams.

In Canada, by 2035, the food service disposable market will undergo a uniform federally mandated transformation. The single-use plastics prohibition regulations prohibit the manufacture, import, and sale of six categories of plastic items, including specific foodservice ware. This creates a clear nationwide shift toward compliant paper fiber and reusable alternatives. The government strategy supports this transition via a direct investment. The Government of Canada, in October 2025, reports that the Zero Plastic Waste Initiative 2018 to 2022 allocated a budget of over USD 5 million for education/awareness and USD 5.2 million for sector solutions. This funding fuels the innovation and infrastructure for compliant material solutions. The market growth is further concentrated in developing products that meet the federal definitions while aligning with the provincial organics collection programs.

Europe Market Insights

The food service disposable market in Europe is fundamentally shaped by the sustainability regulations and is transitioning rapidly. The EU’s single-use plastics directive is the primary catalyst restricting items such as cutlery plates and straws, creating a massive continent-wide demand for compliant alternatives like paper molded fiber and reusable systems. This has driven a significant innovation in sustainable material science. The high consumer awareness of environmental issues further surges this shift, making sustainability a key brand differentiator. The market is advanced but fragmented, with the robust national rules adding complexity. The growth is further concentrated in high-performance sustainable formats mainly for the booming online food delivery sectors that demand functional, eco-friendly packaging solutions such as leak resistant fiber based containers.

The food service disposable market in Germany is driven by the robust enforcement of the EU single-use plastics directive and one of the continent’s most advanced waste management and recycling systems. The country’s packaging act mandates high recycling quotas and holds producers financially responsible, creating a strong incentive for designing recyclable and reusable foodservice items. A key statistical trend is the significant reduction in the plastic packaging waste which is decreased significantly. This indicates a successful early shift in material use away from the conventional plastics, fueling the demand for the certified compostable and mono material solutions that align with Germany’s Dual System for the efficient sorting and recycling. This regulatory environment ensures sustained B2B demand for compliant disposable formats.

In the UK, the food service disposable market has established its own regulatory framework, notably the plastic packaging tax. This tax applies at the rate of £210.82 per ton in April 2023 on plastic packaging with less than 30% of it is recycled content, based on the Government of UK in April 2025, directly altering procurement economies for foodservice operators and suppliers. This policy has stimulated the adoption of recycled content and alternative material packaging. It has also accelerated supplier reformulation efforts to ensure compliance across national distribution networks. Further, the public-sector and contract catering buyers increasingly embed the tax alignment into the tender evaluations. As a result, the long-term sourcing strategies in the UK favor compliant disposable formats over conventional plastics.