Food Safety Testing Market Outlook:

Food Safety Testing Market size was over USD 26.05 billion in 2025 and is poised to exceed USD 55.72 billion by 2035, witnessing over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food safety testing is estimated at USD 27.9 billion.

The growth of the market can be attributed to the increasing number of people concerned about food quality and safety. A study of around 8500 people in different nations, including Australia, Brazil, China, France, India, Nigeria, Pakistan, Russia, and the United States that around 60% of people were concerned about the sanitary and safety of the food they purchase and they believe that food safety is equal to a healthy life. This is especially true in China, where 80% of respondents associated safe food with being healthy.

In addition to these, factors that are believed to fuel the market growth of food safety testing include the rising cases of foodborne illness and the increasing sensitivity of people towards food. Food safety testing is essential for identifying the allergen component in the product as well as to increase the shelf life of the final product to reduce the attack of the pathogen. Food allergies are becoming more common worldwide and can be exceedingly dangerous, even fatal. Around one in every four persons who are unfortunate enough to develop a food allergy, no matter how mild, are expected to eventually have a serious reaction. Moreover, from around 1,015 admissions in 2013 to nearly 1,746 entries in 2019, the number of hospital admissions for children due to anaphylaxis caused by food increased by approximately 72% in England.

Key Food Safety Testing Market Insights Summary:

Regional Highlights:

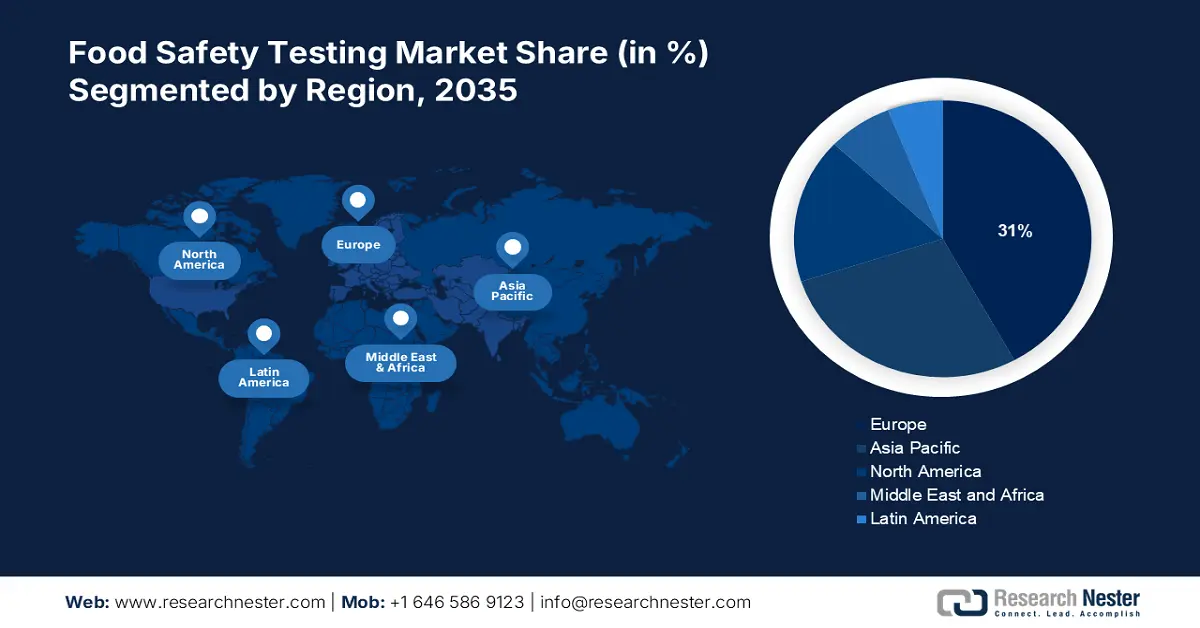

- Europe food safety testing market is predicted to capture 31% share by 2035, fueled by the rising production of milk and seafood consumption in the region, along with increasing food safety testing needs.

- Asia Pacific market will account for 23% share by 2035, driven by the increasing cases of foodborne illness, particularly in China and India.

Segment Insights:

- The pathogens segment in the food safety testing market is expected to hold a significant share by 2035, driven by the increasing importance of food safety testing to prevent foodborne illnesses caused by pathogens.

- The meat & poultry segment in the food safety testing market is projected to achieve the largest share by 2035, driven by rising production and consumption of meat and poultry worldwide.

Key Growth Trends:

- Rising Global Trade of Food

- Higher Cases of Foodborne Illness

Major Challenges:

- Lack of proper facility in food testing infrastructure

- High cost of food safety equipment and their maintenance

Key Players: DTS Food Assurance, AssureQuality, Eurofins Scientific SE, Bureau Veritas, SGS Societe Generale de Surveillance SA, Intertek Group Plc., Covance Inc., Merieux NutriSciences Corporation, Microbac Laboratories, Inc., EMSL Analytical Inc.

Global Food Safety Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.05 billion

- 2026 Market Size: USD 27.9 billion

- Projected Market Size: USD 55.72 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Food Safety Testing Market Growth Drivers and Challenges:

Growth Drivers

- Rising Global Trade of Food – Food testing ensures that food quality matches the global parameters before trading. It is important to be transparent about product validation during international trade. According to a new report released today by the Food and Agriculture Organization of the United Nations, exports from emerging and developing nations are increasing and make up more than one-third of global exports. Moreover, the world's agri-food trade has increased by more than twofold since 1995, reaching USD 1.5 trillion in 2018.

- Higher Cases of Foodborne Illness – Food testing prevents the risk of foodborne illness and any hazards related to it. According to the World Health Organization, every year, 420 000 people worldwide die and an estimated 600 million get sick from eating spoiled food, resulting in 33 million years of healthy life. Moreover, 40% of foodborne disease deaths occur in children under the age of five, which results in 125 000 deaths annually.

- Technological Advancement of Food Safety– New innovation and the introduction of advanced technologies is expected to bring lucrative opportunities for market growth. For instance, in November 2020, the FOSS organization announced the launch of targeted-adulteration models, that enables milk testing facilities to design test equipment to identify the cause of milk adulteration by checking the samples of raw milk. Which further improves food safety in the dairy supply chain.

- Growing Popularity of Processed Food– To identify the accurate time of processed food is difficult, therefore it is important to regulate its shelf life through food testing. Nearly two-thirds of the world's population will reside in urban areas by 2050, which will increase demand for processed foods and meat protein. In Asia, protein intake will have increased by approximately 128%.

- Rising Public Concern for Food Safety – with the rising concern associated with food safety, food testing has become crucial to ensure the safety of the food. A study has observed around a 10% increase in global worry about food safety and future food supply in 2020, which is now at nearly 40%, up from about 30% in 2019. Furthermore, more than 50% of consumers consider increasing food safety to be not only the manufacturers’ responsibility despite the most urgent problem that needs to be addressed.

Challenges

- Lack of proper facility in food testing infrastructure- food safety testing is crucial for the health of the people, and it is important that testing should be performed at competent laboratories which are equipped with standard lab equipment. Moreover, these laboratories should be kept clean in order to obtain correct findings for food tests. There are many food testing facilities that lack the necessary infrastructure, adequate water, the latest technologies, and standardized procedure of testing. These drawbacks are likely to hamper the market growth.

- High cost of food safety equipment and their maintenance

- Shortage of technical expertise among small enterprises

Food Safety Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 26.05 billion |

|

Forecast Year Market Size (2035) |

USD 55.72 billion |

|

Regional Scope |

|

Food Safety Testing Market Segmentation:

Application Segment Analysis

The global food safety testing market is segmented and analyzed for demand and supply by application into dairy products, bakery & confectionary, processed & packages food, infant food, functional food, meat & poultry products, alcoholic & non-alcoholic beverages, and seafood. Out of the eight applications of food safety testing, the meat & poultry segment is estimated to gain the largest market share in 2035. The growth of the segment can be attributed to the rising production of meat and poultry. Food safety testing is consequently essential for meat and poultry owing to their potential for harm if handled poorly, as raw meat, lab-grown meat, and eggs are referred to as high products. Over 86 million eggs were produced in 2021, and 87 million in 2021 across the globe. The volume of eggs produced globally has increased by more than 100% since 1990. In addition to this, according to the OECD-FAO Agricultural forecast the world's meat supply would increase and probably reach 374 Mt by 2030. Increased productivity per animal and extension of the herd and flock are projected to be the majority in the Americas and China.

Target Test Segment Analysis

The global food safety testing market is also segmented and analyzed for demand and supply by target test into pathogens, allergens, residues & contaminants, GMO, chemical & nutritional, shelf life, and others. Amongst these seven segments, the pathogens segment is expected to garner a significant share in the year 2035. Food testing is mainly done to ensure any sort of pathogen attack on the food. Sometimes in contaminated food, pathogens are accidentally consumed along the food as it creates a toxin when sits for a longer period on a food. Moreover, the pathogen can also cause foodborne diseases in the human host. The segment growth is mainly expected on the account of foodborne illness causes by pathogens and its adverse effects on socio-economic conditions. The World Health Organization asserts that foodborne illnesses hinder socioeconomic growth by damaging international trade, tourism, and country economies. Moreover, it also put a strain on the healthcare system. In low- and middle-income nations, unhealthy food costs USD 110 billion annually in lost productivity and medical costs.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Target Test |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Safety Testing Market Regional Analysis:

Europe Market Insights

The European food safety testing market, amongst the market in all the other regions, is projected to hold the largest market share of around 31% by the end of 2035. The growth of the market can be attributed majorly to the rising production of milk in the region. Nutritional labeling is important for the milk, for which food testing is done on the composition of the milk at various stages to guarantee fat management and identity requirements are met. According to Eurostat, in 2021, the European Union generated 161 million tons of raw milk. Additionally, in 2021, the average apparent milk yield per cow in the EU was 7,682 kg. Furthermore, the diet of Europeans includes a significant amount of seafood as a source of their protein. Therefore, market growth is also expected on the account of high consumption of seafood. The average European consumes about 3.3 kg more fish or seafood than the rest of the globe, or about 24 kg each year. Moreover, the most consumed seafood is salmon, tuna, and cod.

APAC Market Insights

The Asia Pacific food safety testing market, amongst the market in all the other regions, is projected to hold the second largest share of nearly 23% during the forecast period. The growth of the market can be attributed majorly to the increasing cases of foodborne illness. In China, poisonous mushrooms continue to be a serious issue, as they were responsible for the majority of outbreaks and fatalities this past year. There was a total of around 7,000 foodborne outbreaks in 2020, which led to nearly 37,000 illnesses and about 143 fatalities. In addition to this, in India, every year around 100 million foodborne illnesses, and nearly 120,000 foodborne illness-related fatalities are reported. Moreover, around 8 million people lose their life after a prolonged disability caused by foodborne illness.

North American Market Insights

Further, the market in North American, amongst the market in all the other regions, is projected to hold a significant share of 19% by the end of 2035. The growth of the market can be attributed majorly to the increasing prevalence of food allergies. By 2021, there were roughly 20 million food-allergic Americans, of which 16 million are adults and the remaining 4% are children. Moreover, in the same year, almost 1 million persons in the United States were identified as being severely allergic to sesame. Besides this, among children, milk stands as the top allergic food followed by peanuts and eggs. Furthermore, the rising consumption of meat and poultry, and processed food is also expected to boost the market growth in the region. In 2021, around 30 billion pounds of beef were consumed in the United States

Food Safety Testing Market Players:

- DTS Food Assurance

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AssureQuality

- Eurofins Scientific SE

- Bureau Veritas

- SGS Societe Generale de Surveillance SA

- Intertek Group Plc.

- Covance Inc.

- Merieux NutriSciences Corporation

- Microbac Laboratories, Inc.

- EMSL Analytical Inc.

Recent Developments

-

Intertek Group Plc. announce the acquisition of Brasil Laboratório de Análises de Alimentos S.A, a leading food testing company. Through this acquisition, Intertek plans to expand its reach into the agri-food & beverage market in Brazil and enable end-to-end Total Quality Assurance (TQA).

-

Eurofins Scientific SE a leading player in the food testing industry has signed a contract to sell its Digital Testing division to Stirling Square Capital Partners ("Stirling Square") for USD 234 million in cash and debt-free terms.

- Report ID: 4741

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Safety Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.