Food Processing Equipment Market Outlook:

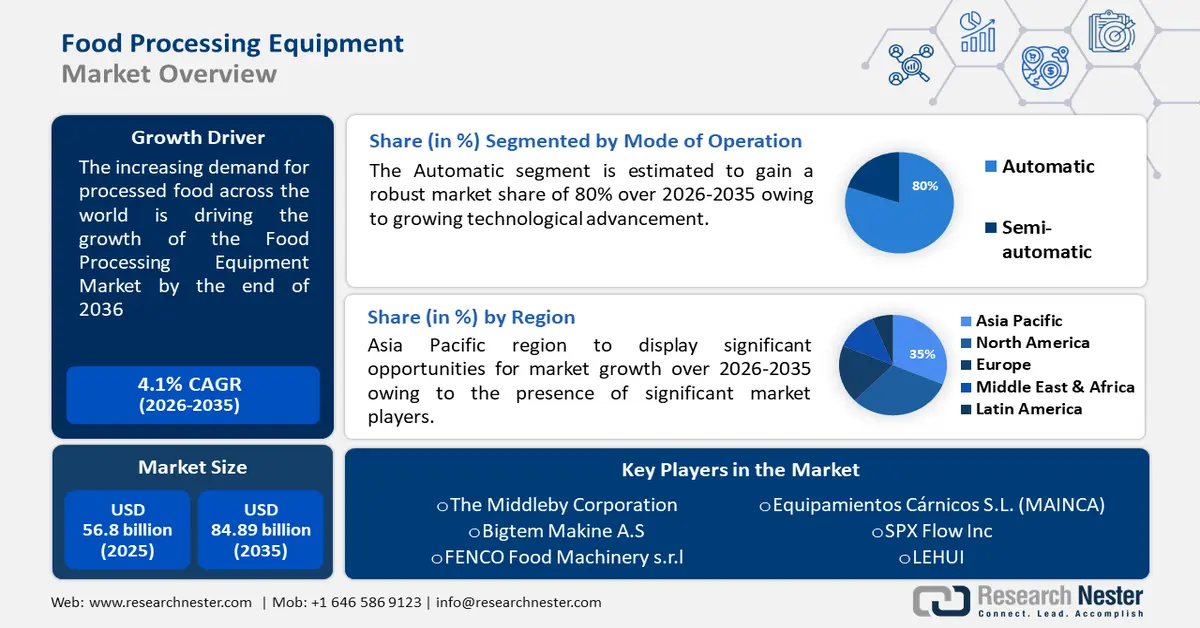

Food Processing Equipment Market size was over USD 56.8 billion in 2025 and is projected to reach USD 84.89 billion by 2035, growing at around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food processing equipment is evaluated at USD 58.9 billion.

The demand for food items is projected to substantially rise by the end of 2050. The global population growth is considered the primary factor behind the growth of this market. The global population reached some 7.8 billion in the year 2020 and by the end of 2050, it is set to reach 9.7 billion as per the data provided by the United Nations. Similarly, as per our research, the food demand is expected to grow by 50% between 2020 to 2050.

Large market participants are making significant investments to develop cutting-edge technology equipment for this sector of the economy. There is ongoing research and development to boost this equipment's output capacity. The output or production capacity of various industries has grown as a result of the employment of this equipment. doesn't raise awareness of the advantages of this technology in emerging countries where increasingly sophisticated, almost human-free, equipment is replacing outdated technology. There is no food product or beverage contamination since there is less human interaction.

Key Food Processing Equipment Market Insights Summary:

Regional Highlights:

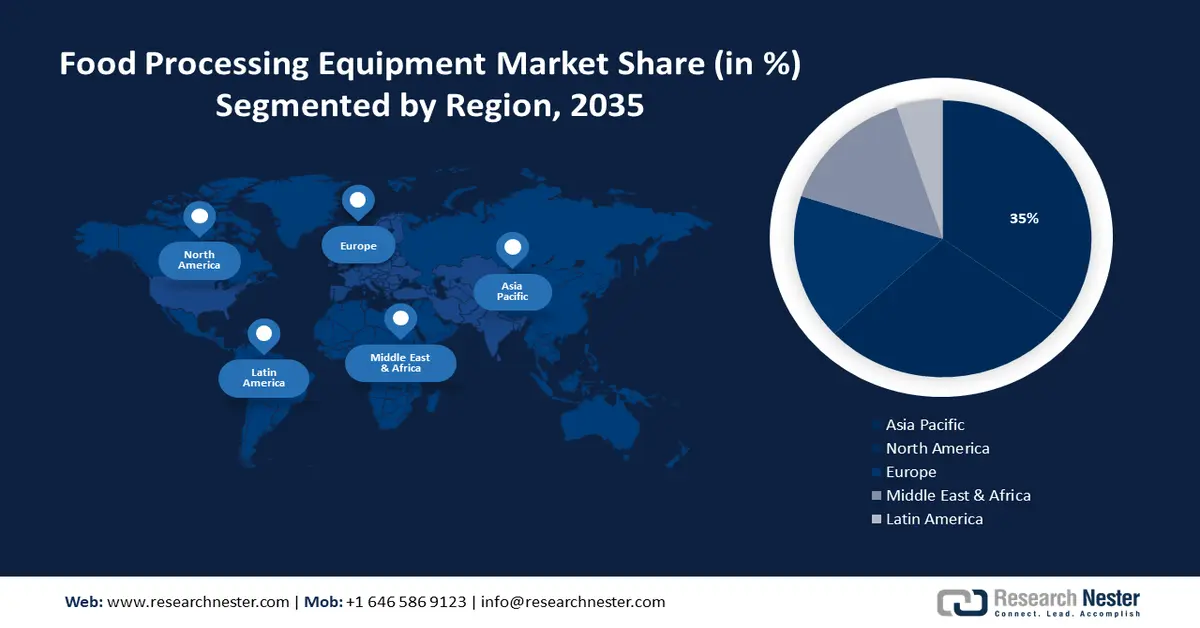

- Asia Pacific food processing equipment market will dominate around 35% share by 2035, driven by presence of key market players and rising demand for processed foods.

- North America market will capture a 28% share by 2035, fueled by urbanization and use of automation in food processing equipment.

Segment Insights:

- The automatic segment in the food processing equipment market is anticipated to achieve significant growth through 2035, driven by the demand for automated systems to increase output and ensure food safety.

- The bakery & confectioneries segment in the food processing equipment market is projected to hold a 25% share by 2035, fueled by high bread consumption in Europe and the efficiency of commercial bakery equipment.

Key Growth Trends:

- Processed fruits and vegetables becoming the talk of the town globally

- Surge in need in the emerging economies

Major Challenges:

- High initial investment cost

- Lack of skilled labor is poised to hinder the market growth in the near future.

Key Players: Tetra Laval International S.A., Alfa Laval, Krones AG, JBT Corporation, SPX Flow Inc., LEHUI, Equipamientos Cárnicos, S.L. (MAINCA), FENCO Food Machinery s.r.l., Bigtem Makine A.S., The Middleby Corporation.

Global Food Processing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.8 billion

- 2026 Market Size: USD 58.9 billion

- Projected Market Size: USD 84.89 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Food Processing Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Processed fruits and vegetables becoming the talk of the town globally - The demand for the equipment required to prepare food has increased as a result of customers' growing need for processed food items in many different countries. The primary driver of the food processing market's widening is rising demand. due to developing countries' rapid industrialization and urbanization. Couples who live in dual-income families or who have demanding work and schedules are more likely to rely on packaged foods and beverages.

Even in underdeveloped countries, there is a significant change in the food habits of many people. Regular meals are replacing packaged and processed food and beverages because they are so handy, both in developed and emerging nations. The processed food industry had a valuation of USD 2 trillion with over 4 million businesses having their presence globally. - Surge in need in the emerging economies - In the upcoming years, growing areas like the Asia Pacific are predicted to dominate the food and beverage industry due to factors including population growth, rising disposable income, increased foreign direct investments, and shifting consumer tastes. Furthermore, it is projected that rising leisure food consumption in China, India, Indonesia, Malaysia, Japan, and other nations would spur industry expansion and, in turn, increase demand for the products in the years to come.

Challenges

- High initial investment cost - Food processing equipment especially those incorporating advanced automation and new technologies can be very expensive. This can be a barrier to entry for smaller companies or those looking to upgrade older equipment.

- Lack of skilled labor is poised to hinder the market growth in the near future.

- Escalating production cost is another important factor hampering the growth of the market.

Food Processing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 56.8 billion |

|

Forecast Year Market Size (2035) |

USD 84.89 billion |

|

Regional Scope |

|

Food Processing Equipment Market Segmentation:

Mode of Operation Segment Analysis

In terms of mode of operation, the automatic segment is anticipated to account for 80% share of the global food processing equipment market by 2035. Automated and autonomous equipment has become an essential component of the food production and processing sector due to advances in computerized food processing technology. As demand and costs continue to rise, automation is helping to shorten production time while increasing output. The value of data-driven insights to maximize the use of raw materials, improve food quality and safety, as well as support continuous improvement is becoming more widely recognized by processors.

One of the more commonly used types of automated equipment is a robot butchery machine, which speeds up the process. In addition, such automatic equipment decreases the influence of personnel who handle potentially harmful tools and apparatus thereby making a facility more secure.

Application Segment Analysis

Based on the application, the bakery & confectioneries segment is set to hold the highest food processing equipment market share of 25% by the end of the forecast period. In countries such as Germany, France, and the United Kingdom, demand for bakery and confectionery products is very high. The market is expected to grow due to the consumption of bread as a staple food throughout Europe. In the European region, approximately 50 kg of bread is consumed on average each year by one person. The equipment used to produce loaves of bread is owned by commercial bakeries. In a shorter period, the equipment available for the production of this bread is capable of producing large quantities.

Our in-depth analysis of the global market includes the following segments:

|

Mode of Operation |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Processing Equipment Market Regional Analysis:

APAC Market Insights

The food processing equipment market in the Asia Pacific region is slated to hold the largest revenue share of 35% during the time period. A notable reason behind the market expansion is the presence of important market players in the Asia Pacific region. Additionally, the development of enhanced equipment would give rise to the production potential of this sector. The market's growth is driven by increasing demand from countries such as Australia, India, China, and New Zealand for processed foods. In order to meet the increasing population's needs, industry is concentrating on the production of technically superior and innovative equipment to produce more output.

North American Market Insights

The food processing equipment market in the North America region is estimated to hold a notable share of 28% by the end of 2035. With the presence of 80% of people in urban regions, the United States is considered one of the most important developed economies of the world. As a result, food preferences have been influenced and the growth of the food processing sector has been stimulated in the region. Given the mature nature of the market, it is anticipated that product demand will grow at a slow pace during the projected timeframe. To increase productivity and production capacity, North America has a significant part of its food processing equipment industry using automation and intelligent technology.

Food Processing Equipment Market Players:

- Tetra Laval International S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alfa Laval

- Krones AG

- JBT Corporation

- SPX Flow Inc.

- LEHUI

- Equipamientos Cárnicos, S.L. (MAINCA)

- FENCO Food Machinery s.r.l.

- Bigtem Makine A.S.

- The Middleby Corporation

Recent Developments

- Middleby Corporation has announced the strategic acquisition of Escher Mixers This will reinforce Middleby's position on the market and allow it to provide comprehensive and efficient integrated solutions, resulting in increased production capacity, cost savings as well as better quality of baked goods.

- Krones Inc, in 2020, announced the launch of the Krones Process Group in North America, to provide a more comprehensive offering to the beverage, dairy, and food sectors in North America, Central America, and the Caribbean.

- Report ID: 6014

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Processing Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.