Food Acidulants Market Outlook:

Food Acidulants Market size was valued at USD 5.7 billion in 2025 and is set to exceed USD 8.85 billion by 2035, expanding at over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food acidulants is estimated at USD 5.93 billion.

The reason behind this growth is anticipated by the increasing investments in food manufacturing and technologies led by the boosted demand for Food Acidulants as these acidulants play a vital role in preserving the freshness of food items, they are used in food and beverages to prevent bacterial growth and in several other industries including cosmetics, pharmaceuticals, dairy, and many others. According to the National Institutes of Health, the food manufacturing landscape contributes about 2.1% of the GDP in developing countries.

Key Food Acidulants Market Insights Summary:

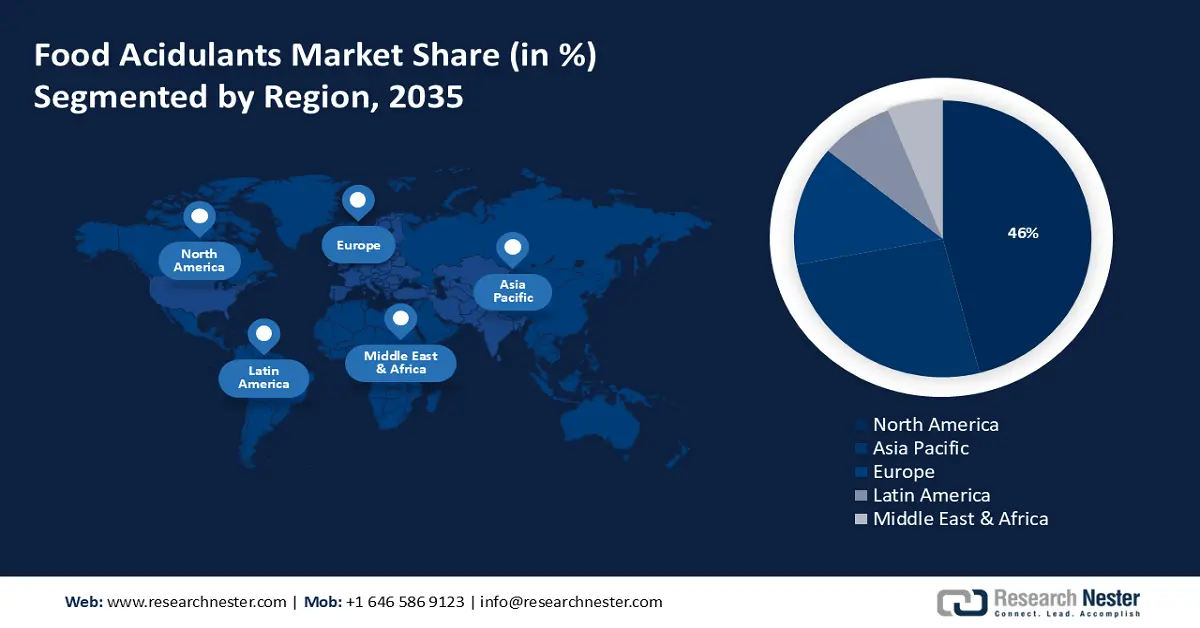

Regional Highlights:

- North America food acidulants market will secure over 46% share by 2035, driven by growing demand for convenient foods and processed fruits and vegetables.

Segment Insights:

- The citric acid segment in the food acidulants market is expected to capture a 26% share by 2035, fueled by its strong preservative and emulsifying properties.

Key Growth Trends:

- Rising concerns over food health and safety

- Technological advancements in food preservation techniques

Major Challenges:

- Increasing concern over the environmental effects of food acidulants

Key Players: Kemin Industries, Inc., Jungbunzlauer Suisse AG, Bartek Ingredients Inc., FBC Industries, Inc., Prinova Group LLC, Corbion NV, ADM WILD Europe GmbH & Co. KG, Fuerst Day Lawson Ltd., Batory Foods, Inc..

Global Food Acidulants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 5.93 billion

- Projected Market Size: USD 8.85 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Food Acidulants Market Growth Drivers and Challenges:

Growth Drivers

- Rising concerns over food health and safety - The increasing awareness among consumers over the safety and hygiene conditions for their food, as in recent years, there have been several instances of food contamination and food poisoning mainly due to the unhygienic and unsafe food processing and storing conditions. This has led to a growing concern among consumers over the safety and cleanliness of their food. According to a report, the percentage of foodborne illnesses increased to 16% in 2007 from 2% in 1990.

- Risk of food contamination - There are about 76 million foodborne illnesses estimates from the Centers for Disease Control and Prevention (CDC), along with 325,000 hospitalizations, and about 5,000 deaths that occur in the U.S. each year. As a result, such demands have anticipated the demand for food acidulants, as they can effectively reduce the risk of food contamination and increase safety.

- Increasing demand for natural and organic foods - Additionally, organic and natural foods are seen as healthier and safer alternatives than processed fruits and vegetables, this rising demand has resulted in an increase in the demand for natural preservation techniques, such as food acidulants, these natural vegetables and fruit preservatives techniques are seen as safer and healthier than artificial ones, which have also driven by the demand for food acidulants industry. According to USDA ERS, in 2021 the U.S. ranches and farms sold about USD 11 billion in organic products.

- Technological advancements in food preservation techniques - As consumers are highly conscious regarding the freshness and quality of the food that they consume, food manufacturers are also highly investing in technological advancements that can help them to preserve food that they consume for longer periods without compromising on the taste and texture. Such technological advancements have been crucial to the development of new and improved food acidulants that can effectively preserve food for longer periods without affecting the taste or quality. These advancements have led to the gain of the sector and have enabled manufacturers to develop more effective solutions.

- Continually changing lifestyle - The food sector has experienced significant growth rate in recent years, credited to changing lifestyles, growing disposable incomes, and the increasing adoption of processed food and beverages, all of which have increased the demand for food acidulants. According to a report, in Agri-exports, the share of food exports has increased to 25.6% in 2022-23 from 13.7% in 2014-15.

Challenges

- Increasing concern over the environmental effects of food acidulants - Food acidulants are derived mainly from acids, and they produce CO2 gas as a by-product during their manufacturing and disposal. In instances where they are not properly handled or disposed of, many acids can leak into the environment, which can contaminate water bodies, soil, and several other natural sources as well. This has led to concerns over the growing usage of food acidulants, and this has prevented the landscape from growing further.

Additionally, the increasing environmental awareness and regulations have also made food manufacturers more mindful about the packaging of their products and services and have prompted them to take measures to reduce their environmental impact. - Regular potency checks for food acidulants propelled by the increasing competition from alternative preservation techniques, such as sterilization and other natural preservation techniques, there has been an increase in the cost of labor and raw materials needed to produce food acidulants, which has made them less cost-effective and has hindered growth.

Food Acidulants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.85 billion |

|

Regional Scope |

|

Food Acidulants Market Segmentation:

Type Segment Analysis

Citric acid segment is expected to account for more than 26% food acidulants market share by the end of 2035. The segment growth can be attributed to its high preservative and emulsifying properties, as it is derived from citric fruits and is mainly used in a variety of foods and beverage chemicals. It is a powerful preservative that can effectively reduce the risk related to bacterial growth and can prevent food spoilage.

Moreover, it is also highly effective in maintaining the color, texture, and flavor of foods. Additionally, it is often used in combination with other preservatives such as sorbic acid or sodium benzoate to achieve a better preservative effect. According to a report, one-third of all the food which is produced globally is wasted or lost, which held for about more than 35 billion USD per year.

Additionally, citric acid is also considered a safer alternative to several other preservatives, such as sodium benzoate, potassium sorbate, potassium dichromate, and many more. It is also considered one of the safer alternatives because it is not highly toxic and does not leave any toxic residue behind in the final product. This has made citric acid a more attractive preservative for food manufacturers and has also been a key growth driver for the food acidulants market value.

Application Segment Analysis

The beverages segment in food acidulants market is set to garner a notable share shortly and is likely to remain the second largest segment in the application of the Food Acidulants due to its high usage in a variety of beverages, such as fruit juices, teas, sodas, beers, and many more. In these beverages, food acidulants are also used to prevent the growth of bacteria mainly to extend the shelf life of the product. According to research by WRAP, an increase in the shelf life by one day can reduce about 0.2 million tonnes of food waste in households.

Furthermore, as consumers have become increasingly health-conscious, there has been a shift towards natural and organic beverages, such as juice drinks, tea, and sodas. Additionally, food acidulants are also used in beer-making, as they can effectively prevent bacterial growth and spoilage.

Our in-depth analysis of the food acidulants market includes the following segments:

|

Type |

|

|

Application |

|

|

Form |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Acidulants Market Regional Analysis:

North American Market Insights

North America industry is estimated to account for largest revenue share of 46% by 2035. The region's market growth is expected due to the growing demand for convenient foods and processed fruits and vegetables to have them on the go. While this industry runs on an extended shelf-life, it also challenges the companies to maintain the taste and flavors. The beverages along with the food are used extensively in this sector.

According to USDA Foreign Agricultural Services, the demand for processed food products is expected to grow by 11% and is expected to fuel export opportunities as well. This tremendous boost indicates that they are developing to provide natural ingredients to fulfill the nutrients required coupled with the desired taste, and these demands are expected to influence the demand for the Food Acidulants sector in the region.

Increasing demand for convenience food coupled with ready-to-go foods drives the food acidulants market demand in the United States. According to the USDA, about 12% less ready-to-eat food is purchased in households where all adults are employed, and more than 70% of foods from full-service restaurants.

In Canada, there is an increase in health-oriented customers for low-calorie and organic products. According to a report, more than 45% of Canadians are eager to find new ways to improve their health.

APAC Market Insights

By 2035, Asia Pacific food acidulants market is anticipated to capture over 24% revenue share and will hold the second position on account of an increase in the adoption of Western dietary habits, hence the requirement for processed and packed food items and beverages. This count in the steps of urbanization, the ready-to-eat meals: their texture, taste, flavor, and nutrition for a healthy diet. According to a report, the revenue share of ready-to-eat meals is slated to witness a CAGR of about 6.8% by 2028.

In addition, this is also the need of countries to meet the demand of the population, certain organic and natural ingredients are used nowadays which fuels the food acidulants market and adds to its growth of demand and supply.

According to the OEC World, China exported more than USD 2.18 billion of citric acid, which makes it the world’s largest exporter in 2022.

Food Acidulants Market Players:

- JMD Food Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kemin Industries, Inc.

- Jungbunzlauer Suisse AG

- Bartek Ingredients Inc.

- FBC Industries, Inc.

- Prinova Group LLC

- Corbion NV

- ADM WILD Europe GmbH & Co. KG

- Fuerst Day Lawson Ltd.

- Batory Foods, Inc.

Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- JDM Food Group- announced its collaboration with the US-based Henry Broch Foods (HBF) to create a new parent company, Jardin and Broch.

- Kemin Industries, Inc.- announced its expansion in Central America and Mexico by opening several new distribution centers and offices in Mexico, based in Jalisco, Guadalajara.

- Report ID: 6086

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Acidulants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.