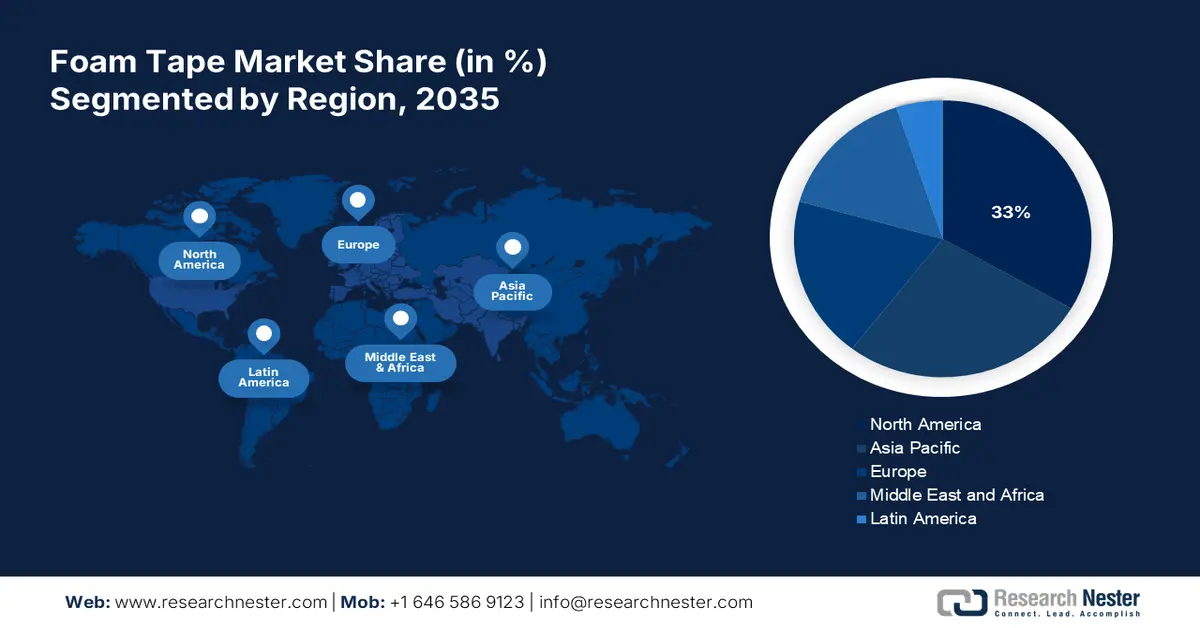

Foam Tape Market Regional Analysis:

North America Market Statistics

North America industry is expected to dominate majority revenue share of 33% by 2035. The region possesses cutting-edge manufacturing skills and technological know-how, enabling the creation of premium foam tapes that satisfy performance standards. In addition, the focus on product development and innovation in North America propels ongoing improvements in adhesive technology, resulting in the breakthrough of enhanced foam tape solutions that are suited to changing consumer needs.

The U.S., with a strong emphasis on technological advancement and an entrepreneurial culture, the nation consistently propels the foam tape industry's growth and development. For instance, in January 2023, Gorilla Glue launched a varied and exceptional series of adhesives namely Gorilla Contact Adhesive which serves all purposes and is completely waterproof. Foam tape's position in terms of a wide range of product availability and penetration is further cemented by its extensive distribution networks and dependable infrastructure.

Canada has a strong export infrastructure that aids in enhancing the foam tape market ecosystem of foam tapes. For instance, according to Volza's data on adhesive tape exports from Canada, in August 2024, a total of 1,065 adhesive tape suppliers in Canada exported to 1,157 buyers worldwide, 523 suppliers were active between March 2023 and February 2024, with Uline Inc, 3M Company, and Fastenal Company contributing 75% of Canada's total exports of adhesive tape.

Asia Pacific Market Analysis

The Asia-Pacific landscape of the foam tape market is growing with huge magnitude, driven by a robust manufacturing base. Further fueling the market is the increasing trend of lightweight materials in product design for which foam tapes offer better adhesion, cushioning, and thermal insulation. Additionally, the rapidly expanding e-commerce sector is raising the demand for efficient packaging solutions and, thereby the use of foam tapes. Environmental factors are also shaping the market due to growing awareness about eco-friendly products that lead to innovation in sustainable materials.

India has witnessed substantial growth in the foam tape market and is likely to experience an upsurge owing to the rising imports of advanced and innovative tapes. For instance, in August 2024, according to Volza's India Import data, the country bought 170 shipments of acrylic foam double-side tape between March 2023 and February 2024. Moreover, 15 foreign exporters provided these imports to 10 Indian consumers, representing a 91% increase over the previous 12 months. During this time, India bought 16 shipments of acrylic foam double-sided tape in February 2024. This represents a 33% sequential increase from January 2024 and a 33% year-over-year increase from February 2023.

In China, the possible trend of replacing expensive, high-value imported goods with domestic ones is prevailing. Furthermore, low-VOC adhesive tapes have advanced significantly, supporting national strategies for high-quality development and dual carbon goals. For instance, in February 2024, NAIKOS introduced a new range of its product, PE foam tape a premium double-sided mounting made up of an acrylic adhesive-coated release film with a PE foam backing. Moreover, the number of local and international manufacturers in the region increases competitive dynamics and leads to both pricing and product diversification.