Foam Tape Market Outlook:

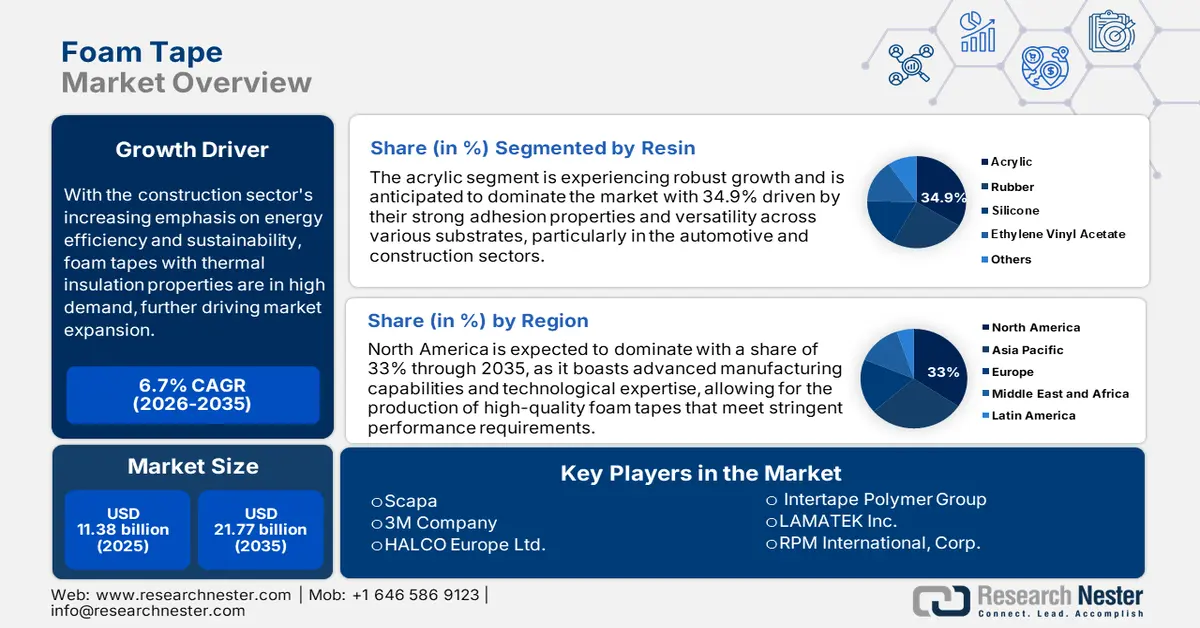

Foam Tape Market size was over USD 11.38 billion in 2025 and is projected to reach USD 21.77 billion by 2035, growing at around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of foam tape is assessed at USD 12.07 billion.

The need for foam tapes is anticipated to increase with the automotive industry's continued growth, especially in emerging economies. In addition, as foam tapes are widely used in mounting fixtures, sealing joints, and bonding facades, the construction industry is driving foam tape market expansion. For instance, in August 2023, Avery Dennison announced a new range of high-performing PSA tape, Cold ToughTM for the construction and building sector. It provides a bonding solution that can endure severe weather conditions.

Furthermore, the demand for foam tapes with thermal insulation qualities is high due to the construction industry's growing emphasis on sustainability and energy efficiency, which is propelling foam tape market growth. For instance, in November 2023, CCL Design announced the release of its new acrylic foam tapes in the 5400 LSE series. The internal creation of foam tape is free from perfluoroalkyl and poly-fluoroalkyl substances (PFAS) which marks a significant turning point in CCL's dedication to sustainability and innovation.

Key Foam Tape Market Insights Summary:

Regional Highlights:

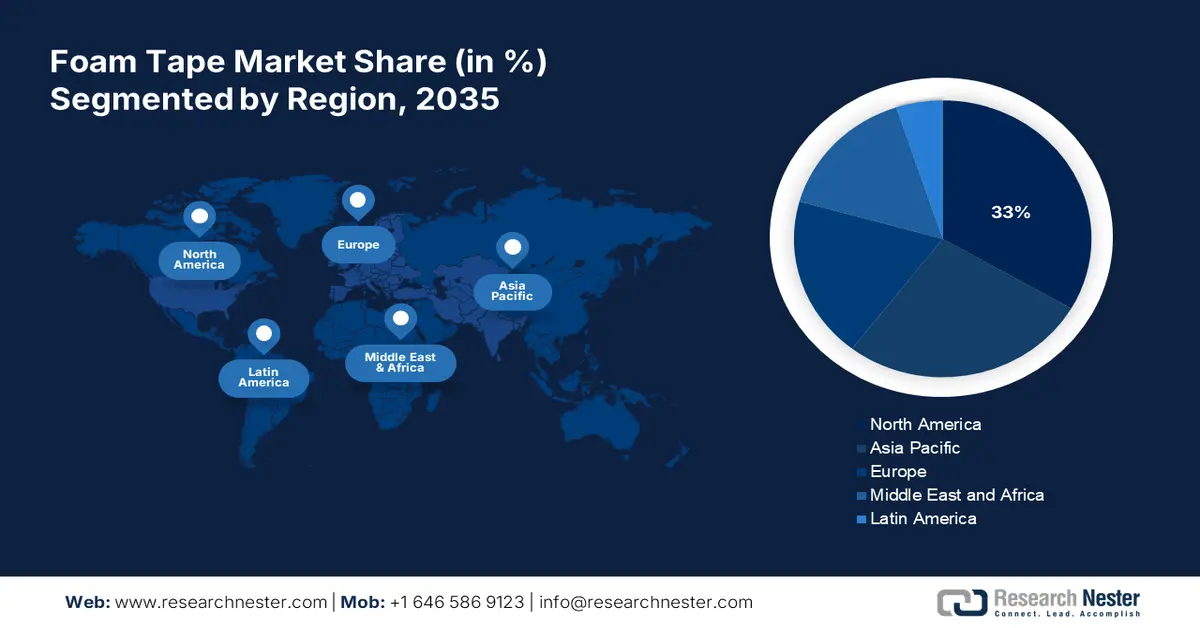

- North America holds a 33% share in the foam tape market, led by technological know-how and innovation in adhesive technology, supporting robust growth through 2026–2035.

- Asia Pacific's Foam Tape Market is experiencing huge growth through 2026–2035, propelled by a robust manufacturing base and rising demand from e-commerce and sustainable materials.

Segment Insights:

- The Acrylic segment is anticipated to hold a significant share by 2035, driven by its superior bonding strength, durability, and versatility.

Key Growth Trends:

- Adoption of lightweight materials

- Growth in the e-commerce industry

Major Challenges:

- Quality control issues

- Raw materials cost fluctuations

- Key Players: 3M Company, Avery Dennison Corporation, HALCO Europe Ltd, Intertape Polymer Group, LAMATEK, Inc., LINTEC Corporation, and more.

Global Foam Tape Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.38 billion

- 2026 Market Size: USD 12.07 billion

- Projected Market Size: USD 21.77 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Foam Tape Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of lightweight materials: Industries in the foam tape market are looking forward to incorporating lightweight material technology. This approach not only supports improved fuel efficiency but also increases battery range that aligns with global sustainability initiatives within automotive and aerospace companies by saving energy. For instance, in August 2022, 3M introduced VHB tape, a new manufacturing bonding solution that offers increased automation, sustainability, and ease of use across automotive and aerospace industries. Thus, it offers numerous benefits and sustainable manufacturing solutions.

- Growth in the e-commerce industry: The surge in e-commerce activities puts a robust force in front of the foam tape market due to the increasing need for quality packaging solutions resulting from an increase in online purchasing activities. Furthermore, the growing interest in DIY projects has driven the demand for foam tape in home decor activities and crafting applications. For instance, in November 2022, Bostik introduced two brand-new, cutting-edge products for the Indian tape and label market, Bostik HM2060 and Bostik HM2070. These are the tape adhesives designed to meet the growing demand for environmentally friendly packaging in India's e-commerce sector, which is projected to generate US$350 billion by 2030.

Challenges

- Quality control issues: The use of foam tape is diversified by many applications and performance specifications required by the industries, which pose quality control as a significant challenge. Moreover, quality inconsistencies could be due to differences in production process, or equipment maintenance leading to differences in strength for adhesion, durability, and general performance. Furthermore, the fact that many industries today use foam tape for critical applications such as in automotive assembly and electronics packaging makes any lapses in quality lead to product failures, more returns, and reputational problems.

- Raw materials cost fluctuations: Polyethylene and polyurethane, with a host of other adhesives, are extremely sensitive to changes in the foam tape market due to interruptions of the supply chain, geopolitics, and general fluctuations of demand in industry sectors. This volatility would lead to inconsistent pricing strategies, hence affecting competitiveness in the market. Raw material prices further increase, making manufacturers pass on the higher costs to their customers, though this may result in losing market share or decreased demand due to customers searching for competitive products.

Foam Tape Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 11.38 billion |

|

Forecast Year Market Size (2035) |

USD 21.77 billion |

|

Regional Scope |

|

Foam Tape Market Segmentation:

Resin (Acrylic, Rubber, Silicone, Ethylene Vinyl Acetate (EVA), Others)

Based on resin, the acrylic segment is set to hold foam tape market share of more than 34.9% by 2035 attributable to its superior bonding strength, durability, and versatility. Moreover, the acrylic tapes are characterized for their high temperature and UV and solvent resistance properties. In November 2022, Henkel introduced Loctite UK 2073-2173, a new solvent-free, elastic adhesive based on two-component polyurethane (2K-PU) technology that is intended to perform exceptionally well on a variety of substrates. Market innovations are changing, and so are formulations of acrylic foam tapes. Their usage is on the rise in a variety of industries which testifies the position of the product in the new manufacturing arena.

Technology (Solvent-based, Water-based, Hot melt-based)

Solvent-based adhesives are predominantly preferred in the foam tape market owing to their features that offer better bonding strength as well as more durable applications. They also exhibit excellent resistance to moisture, chemicals, and temperature-related stresses. For instance, in May 2024, H.B. Fuller’s solvent-based portfolio introduced Swiftcol5237 which offers high shear, exceptional aging qualities, and superior heat resistance. It is ideal for high-performance tape manufacturers who need long-lasting bonds to a variety of surfaces and the ability to endure harsh conditions such as high temperatures and media exposure. Concerning high-performance sealing solutions being sought by emerging foam tape markets, solvent-based foam tapes will remain prevalent and relevant in such an industry.

Our in-depth analysis of the global market includes the following segments:

|

Resin |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Foam Tape Market Regional Analysis:

North America Market Statistics

North America industry is expected to dominate majority revenue share of 33% by 2035. The region possesses cutting-edge manufacturing skills and technological know-how, enabling the creation of premium foam tapes that satisfy performance standards. In addition, the focus on product development and innovation in North America propels ongoing improvements in adhesive technology, resulting in the breakthrough of enhanced foam tape solutions that are suited to changing consumer needs.

The U.S., with a strong emphasis on technological advancement and an entrepreneurial culture, the nation consistently propels the foam tape industry's growth and development. For instance, in January 2023, Gorilla Glue launched a varied and exceptional series of adhesives namely Gorilla Contact Adhesive which serves all purposes and is completely waterproof. Foam tape's position in terms of a wide range of product availability and penetration is further cemented by its extensive distribution networks and dependable infrastructure.

Canada has a strong export infrastructure that aids in enhancing the foam tape market ecosystem of foam tapes. For instance, according to Volza's data on adhesive tape exports from Canada, in August 2024, a total of 1,065 adhesive tape suppliers in Canada exported to 1,157 buyers worldwide, 523 suppliers were active between March 2023 and February 2024, with Uline Inc, 3M Company, and Fastenal Company contributing 75% of Canada's total exports of adhesive tape.

Asia Pacific Market Analysis

The Asia-Pacific landscape of the foam tape market is growing with huge magnitude, driven by a robust manufacturing base. Further fueling the market is the increasing trend of lightweight materials in product design for which foam tapes offer better adhesion, cushioning, and thermal insulation. Additionally, the rapidly expanding e-commerce sector is raising the demand for efficient packaging solutions and, thereby the use of foam tapes. Environmental factors are also shaping the market due to growing awareness about eco-friendly products that lead to innovation in sustainable materials.

India has witnessed substantial growth in the foam tape market and is likely to experience an upsurge owing to the rising imports of advanced and innovative tapes. For instance, in August 2024, according to Volza's India Import data, the country bought 170 shipments of acrylic foam double-side tape between March 2023 and February 2024. Moreover, 15 foreign exporters provided these imports to 10 Indian consumers, representing a 91% increase over the previous 12 months. During this time, India bought 16 shipments of acrylic foam double-sided tape in February 2024. This represents a 33% sequential increase from January 2024 and a 33% year-over-year increase from February 2023.

In China, the possible trend of replacing expensive, high-value imported goods with domestic ones is prevailing. Furthermore, low-VOC adhesive tapes have advanced significantly, supporting national strategies for high-quality development and dual carbon goals. For instance, in February 2024, NAIKOS introduced a new range of its product, PE foam tape a premium double-sided mounting made up of an acrylic adhesive-coated release film with a PE foam backing. Moreover, the number of local and international manufacturers in the region increases competitive dynamics and leads to both pricing and product diversification.

Key Foam Tape Market Players:

- 3F GmbH Klebe- & Kaschiertechnik

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Avery Dennison Corporation

- HALCO Europe Ltd

- Intertape Polymer Group

- LAMATEK, Inc.

- LINTEC Corporation

- Lohmann GmbH & Co. KG.

- Lynvale Ltd.

- Nitto Denko Corporation

- RPM International, Inc.

- Scapa

- Tesa Tapes (India) Private Limited

- Wuxi Canaan Adhesive Technology Co., Ltd.

Companies in the foam tape market are focusing on emerging trends of sustainability. They are striving to render cutting-edge solutions by incorporating innovations into the foam tapes to hold competitiveness spirit high. For instance, in November 2022, Tesa introduced a cutting-edge packaging tape. The new Tesa® 60412 comes with a water-based acrylic adhesive system and a backing made of 70% recycled PET (PCR). As a result, the business is adding more high-performance packaging tapes to its lineup. Some key players in this market include:

Recent Developments

- In August 2024, Foam Products Corp (FPC) announced the establishment of a new IXPE manufacturing plant by the end of this year's third quarter. This facility was an investment of USD 15 million and a 100,000-square-foot area.

- In August 2024, Shurtape Technologies, LLC is pleased to present its Shurtape recycled series packaging tapes. Three packaging tapes in the new line are composed of 90% Post-Consumer Recycled (PCR) polyester.

- Report ID: 6629

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Foam Tape Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.