Flue-Gas Desulfurization Market Outlook:

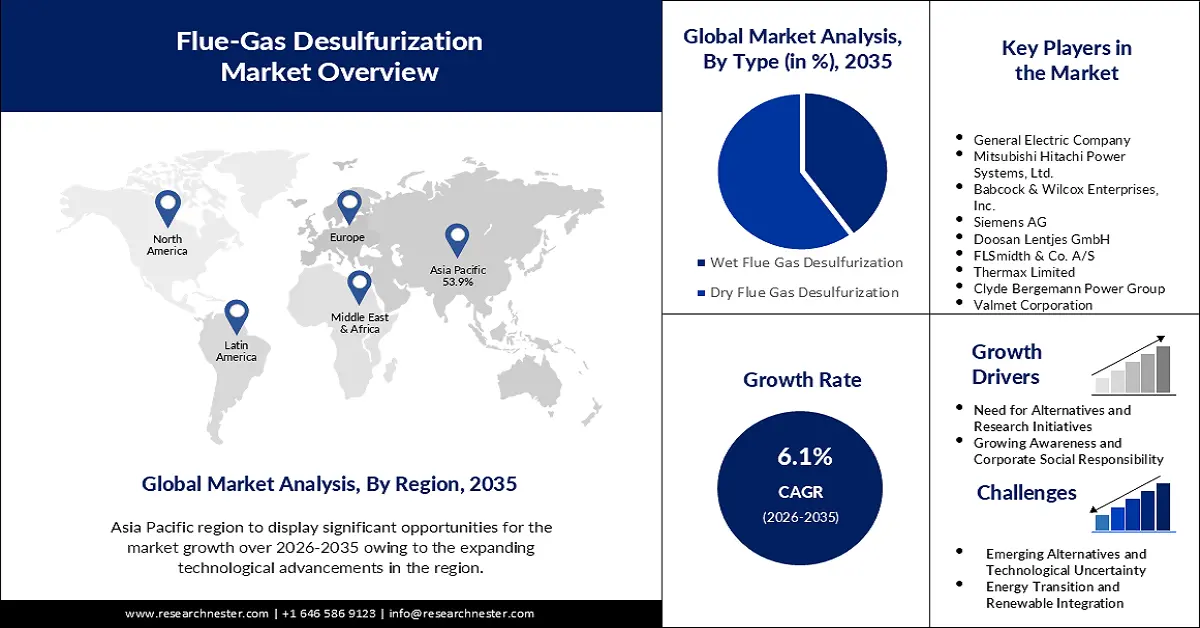

Flue-Gas Desulfurization Market size was valued at USD 25.17 billion in 2025 and is likely to cross USD 45.5 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flue-gas desulfurization is assessed at USD 26.55 billion.

Stringent environmental regulations and emissions standards drive the demand for FGD systems, as industries strive to comply with air quality standards. The growing demand for electricity worldwide, coupled with a rise in coal and gas-based power generation, contributes to the expansion of the FGD system market. The development of alternative, cleaner energy sources and stricter emissions standards may impact the growth of the FGD system market. Major companies in the market include prominent players such as Mitsubishi Hitachi Power Systems, General Electric, Babcock & Wilcox Enterprises, Siemens, and Doosan Lentjes, among others. The installation and maintenance costs of FGD systems can be significant, posing a challenge for some industries.

Flue Gas Desulfurization (FGD) is a technology used to remove sulfur dioxide (SO2) from the exhaust gases produced by burning fossil fuels, particularly in power plants. This process helps in reducing air pollution and mitigating the environmental impact of industrial activities. The flue gas desulfurization system market refers to the industry that provides solutions and technologies for implementing FGD systems. The market is influenced by a complex interplay of environmental policies, energy demand, technological advancements, and economic factors. As the world continues to focus on sustainable development, the demand for FGD systems is expected to persist and evolve.

Key Flue Gas Desulfurization System Market Insights Summary:

Regional Highlights:

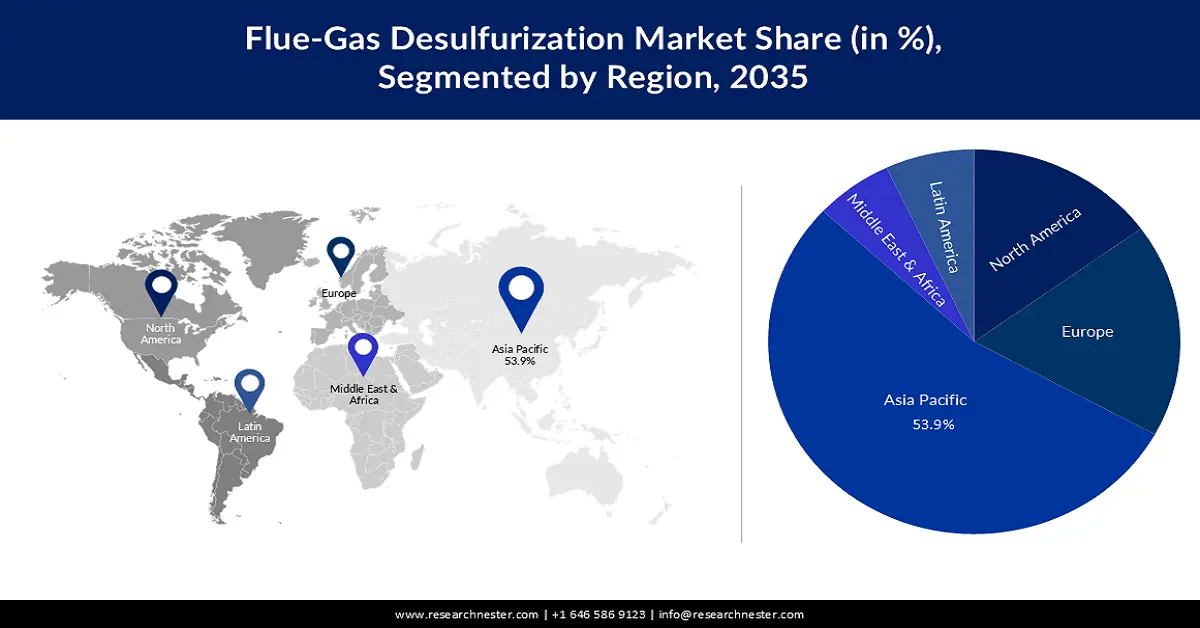

- Asia Pacific flue-gas desulfurization market is anticipated to achieve a 53.9% share by 2035, driven by numerous coal-fired power plants, rising pollution, and rapid industrial growth.

- North America market is expected to hold the second largest share by 2035, driven by stringent emission standards and commitment to environmental sustainability.

Segment Insights:

- The dry flue gas desulfurization segment segment in the flue-gas desulfurization market is anticipated to secure a 60% share by 2035, fueled by stringent environmental regulations and the need for emission reduction technologies.

Key Growth Trends:

- Stringent Environmental Regulations

- Emerging Alternatives and Research Initiatives

Major Challenges:

- Emerging Alternatives and Technological Uncertainty

- Energy Transition and Renewable Integration

Key Players: General Electric Company, Mitsubishi Hitachi Power Systems, Ltd., Babcock & Wilcox Enterprises, Inc., Siemens AG, Doosan Lentjes GmbH, FLSmidth & Co. A/S.

Global Flue Gas Desulfurization System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.17 billion

- 2026 Market Size: USD 26.55 billion

- Projected Market Size: USD 45.5 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (53.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 11 September, 2025

Flue-Gas Desulfurization Market Growth Drivers and Challenges:

Growth Drivers

- Stringent Environmental Regulations: One of the primary drivers fueling the growth of the Flue Gas Desulfurization (FGD) System market is the increasing stringency of environmental regulations globally. Governments and regulatory bodies worldwide are imposing strict emissions standards to combat air pollution and reduce the environmental impact of industrial activities. Sulfur dioxide (SO2) emissions, a major contributor to air pollution and acid rain, are a target for reduction. FGD systems play a crucial role in achieving compliance with these stringent regulations. For instance, in the United States, the Clean Air Act Amendments mandated substantial reductions in SO2 emissions from power plants. Compliance with such regulations has become a key factor driving the adoption of FGD systems in power generation facilities. In China, a country with significant industrial and power generation activities, the government has implemented the Action Plan for Prevention and Control of Air Pollution, emphasizing the reduction of sulfur emissions. This has led to a surge in the installation of FGD systems in coal-fired power plants across the country. The stringent enforcement of environmental regulations is a compelling growth driver for the flue gas desulfurization system market. The imperative to reduce sulfur emissions and achieve compliance with these regulations propels the demand for FGD systems across diverse industries globally.

- Emerging Alternatives and Research Initiatives: While the FGD system market experiences growth, the pursuit of emerging alternatives and ongoing research initiatives is a crucial aspect shaping the industry. Researchers and industry players are exploring new technologies and approaches that could provide cleaner and more sustainable alternatives to traditional FGD systems. One of the emerging alternatives is the development of advanced sorbents with enhanced reactivity and durability. Innovations in sorbent materials, including nanoparticles and composite materials, are being explored to improve the efficiency of sulfur dioxide (SO2) removal and reduce the environmental impact of FGD processes. Additionally, there is a growing interest in dry sorbent injection (DSI) technologies as an alternative to traditional wet scrubbers. DSI involves injecting dry sorbents directly into the flue gas stream, eliminating the need for a liquid slurry. This approach is gaining attention for its potential to reduce water consumption and simplify the FGD process.

- Increasing Awareness and Corporate Social Responsibility (CSR): The growing awareness of environmental issues and the emphasis on Corporate Social Responsibility (CSR) contribute significantly to the expansion of the flue gas desulfurization system market. Stakeholders, including consumers, investors, and regulatory bodies, are increasingly prioritizing sustainable and environmentally responsible business practices. Public awareness of the environmental impact of industrial activities, particularly in terms of air pollution and climate change, has led to a shift in consumer expectations. Companies are now under greater scrutiny to adopt technologies that mitigate their environmental footprint. This shift in consumer sentiment creates a market-driven demand for FGD systems, especially in industries with high emissions.

Challenges

- Cost Considerations and Economic Viability: One of the primary challenges associated with Flue Gas Desulfurization (FGD) systems is the significant upfront capital investment required for installation. The costs include engineering, equipment procurement, construction, and commissioning. For some industries, particularly smaller facilities or those in economically sensitive sectors, these costs can pose a barrier to adopting FGD technologies. Additionally, there are ongoing operational and maintenance costs associated with FGD systems, including the purchase of reagents, disposal of waste byproducts, and regular system maintenance. While the long-term benefits, such as regulatory compliance and reduced environmental impact, often outweigh these costs, some industries may perceive the initial investment as a financial burden.

- Emerging Alternatives and Technological Uncertainty

- Energy Transition and Renewable Integration

Flue-Gas Desulfurization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 25.17 billion |

|

Forecast Year Market Size (2035) |

USD 45.5 billion |

|

Regional Scope |

|

Flue-Gas Desulfurization Market Segmentation:

Type Segment Analysis

The dry flue gas desulfurization system market is estimated to gain the largest revenue share of 60% in the year 2035. The dry flue gas desulfurization (DFGD) segment experiences growth as a result of increasingly stringent environmental regulations and emission standards imposed on industries globally. Governments worldwide are tightening air quality standards to address the impact of industrial activities on public health and the environment. DFGD systems play a crucial role in helping industries meet and exceed these regulatory requirements. A report by the International Energy Agency (IEA) underscores the significance of emission reduction technologies like DFGD systems in achieving air quality goals.

As countries implement stricter emission standards to curb sulfur dioxide (SO2) and other pollutants, industries are compelled to invest in advanced pollution control technologies to ensure compliance. The growth of the DFGD segment is supported by concrete numerical data, showcasing the global push for regulatory compliance and the significant market size projections driven by continuous technological advancements. As industries invest in DFGD technologies to meet emission standards and benefit from operational efficiencies, the segment remains a pivotal player in the landscape of sustainable and effective pollution control solutions.

End User Segment Analysis

Flue gas desulfurization system market from the refineries segment is expected to garner a significant share in the year 2035. Growing public awareness of environmental issues and an increased emphasis on Corporate Social Responsibility (CSR) contribute to the growth of FGD system adoption in refineries. Communities surrounding refineries are becoming more vocal about air quality concerns and the environmental impact of industrial operations. Refineries, recognizing the importance of community relations, are motivated to invest in FGD systems to demonstrate their commitment to sustainable and responsible practices. According to a survey, 73% of consumers are willing to pay more for products and services from companies committed to positive environmental and social impact.

Refineries, as major industrial players, are aligning their CSR initiatives with environmental responsibility, including the implementation of FGD systems to mitigate air pollution. Moreover, the Global Reporting Initiative (GRI) standards, widely adopted for CSR reporting, encourage companies to disclose their environmental impact and measures taken to address it. Refineries incorporating FGD system installations into their sustainability reports demonstrate a proactive approach to addressing air quality concerns and reducing their environmental impact.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flue-Gas Desulfurization Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 53.9% market share by 2035, driven by numerous coal-fired power plants, rising pollution, and rapid industrial growth. Technological advancements and significant investments in research and development are driving innovation in FGD systems in the Asia Pacific region. Countries like Japan, South Korea, and China are at the forefront of research initiatives aimed at improving the efficiency and cost-effectiveness of FGD technologies.

Ongoing projects focus on developing advanced sorbent materials, enhancing process controls, and exploring novel approaches to flue gas desulfurization. The Asia Pacific region is witnessing increased collaboration between government bodies, research institutions, and industry players. For example, China has been investing in research programs to develop and deploy advanced pollution control technologies, including FGD systems. These technological advancements contribute to the attractiveness of FGD systems in the market. Flue gas desulfurization system market in the Asia Pacific region is driven by the rapid industrialization, stringent emission regulations, the increasing focus on renewable energy, and ongoing technological advancements.

North American Market Insights

The flue gas desulfurization system market in the North America region is projected to hold the second largest share during the forecast period. One of the primary drivers for the Flue Gas Desulfurization (FGD) System market in North America is the region's commitment to environmental sustainability through stringent emission standards. The United States, in particular, has been actively enforcing regulations to reduce sulfur dioxide (SO2) emissions from industrial sources. The Clean Air Act Amendments, along with the Acid Rain Program, have set ambitious targets to mitigate the environmental impact of SO2 emissions. According to the U.S. Environmental Protection Agency (EPA), the Acid Rain Program achieved a remarkable 91% reduction in SO2 emissions from power plants between 1990 and 2019. This exemplifies the region's dedication to regulatory compliance and the pivotal role that FGD systems play in achieving and surpassing emission standards. The transition towards cleaner energy sources is another significant driver for the FGD system market in North America. While there is a growing focus on renewable energy, coal-fired power plants continue to be a substantial part of the energy mix. The challenge is to balance the demand for energy security with the need for environmental responsibility.

Flue-Gas Desulfurization Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Hitachi Power Systems, Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Siemens AG

- Doosan Lentjes GmbH

- FLSmidth & Co. A/S

- Thermax Limited

- Hamon & Cie International SA

- Clyde Bergemann Power Group

- Valmet Corporation

Recent Developments

- Siemens merged its wholly owned subsidiary Smart Grid Solutions LLC, a US-based smart grid technology company, with Siemens Digital Industries LLC, a US-based digital industries company. The merger was aimed at streamlining operations and improving efficiency.

- Siemens merged its wholly owned subsidiary Verra Mobility LLC, a US-based transportation infrastructure company, with Siemens Mobility LLC, a US-based mobility company. The merger was aimed at streamlining operations and improving efficiency.

- Report ID: 5405

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.