Florist POS System Market Outlook:

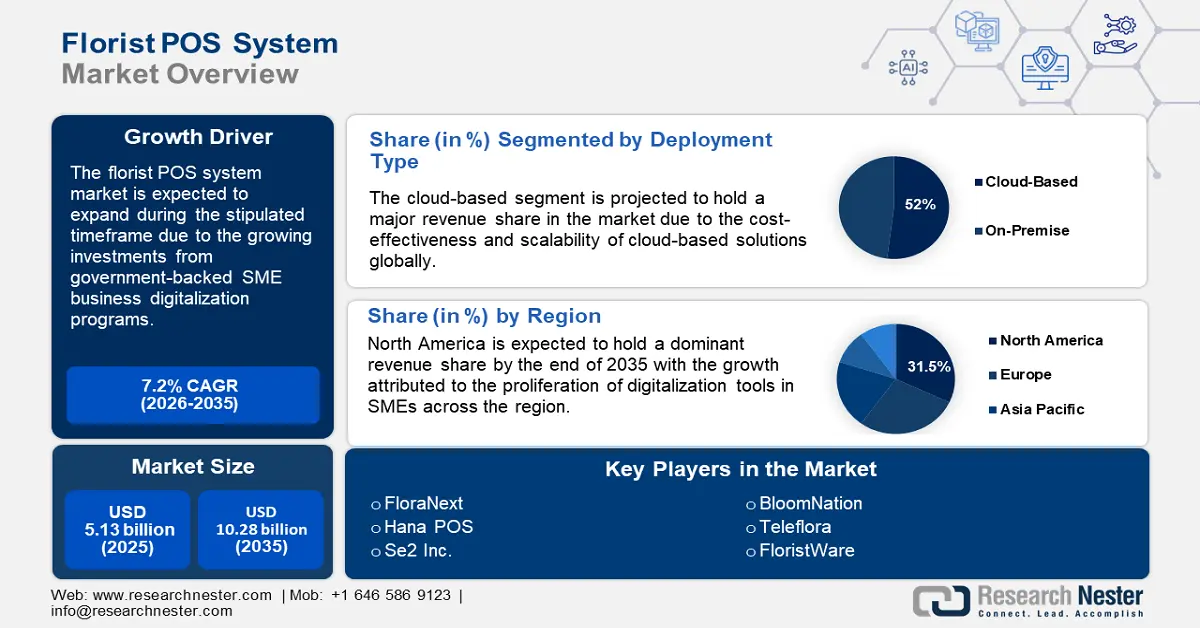

Florist POS System Market size was over USD 5.13 billion in 2025 and is anticipated to cross USD 10.28 billion by 2035, witnessing more than 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of florist POS system is assessed at USD 5.46 billion.

The growing adoption of digital solutions by florists worldwide is fueling the expansion of the florist POS system market. With floral businesses embracing modernization, cloud-based POS platforms are gaining traction due to their ability to integrate multi-channel sales, order tracking, and inventory management. Organizations such as the Society of American Florists have emphasized the role of digital tools in reducing waste through real-time stock updates to align with sustainability goals. Moreover, the POS system solutions are experiencing greater adoption rates during celebrations such as Mother’s Day and Valentine’s Day owing to their effective sales management during spikes. The table below highlights consumer trends reported by the Flower Council of the UK.

Consumer Trends in the Flower Sector (2023)

|

Flower Sector |

Details |

|

Consumer view on the sustainability influence of the floriculture sector |

41% of consumers believe in a positive impact. |

|

Percentage of consumers who reported that the floriculture sector will have a better future by taking responsibility for sustainability |

31% of consumers believe positively on sustainability responsibility. |

|

Percentage of consumers who are impacted by sustainability labels |

50% of consumers reported coming across sustainability levels while 29% of them reported that the label influenced their decision to purchase. |

Source: The Flower Council of the UK

The consumer preference trends highlight that sustainability labels can benefit florists by expanding their sales. The factor is expected to be a major catalyst in boosting the adoption rates of florist POS systems. Moreover, a surge in e-commerce floral sales post-2021 has accelerated POS adoption, with platforms able to offer omnichannel capabilities to unify in-store, online, and delivery workflows. The U.S. Department of Agriculture (USDA) notes a 23% rise in direct-to-consumer floral purchases since 2021, underscoring opportunities for the adoption of systems that can handle complex logistics such as perishable goods tracking.

An emerging factor of the florist POS system market’s growth is the rise of mobile POS solutions, enabling florists to process payments at pop-up events or weddings. Furthermore, growing partnerships between POS vendors and floral wholesalers such as the integration of bloom forecasting tools, assist businesses optimize procurement, and reduce overstock, and spoilage. The macroeconomic trends highlight a surging consumer demand for sustainable supply chains, creating opportunities for POS systems that can track the carbon footprints of floral shipments. Additionally, high-income sustainability-concerned consumer groups are a niche segment that florists can target by integrating POS systems and showcasing a sustainable supply chain. The trends indicate favorable opportunities for the growth of the florist POS system market.

Key Florist POS System Market Insights Summary:

Regional Highlights:

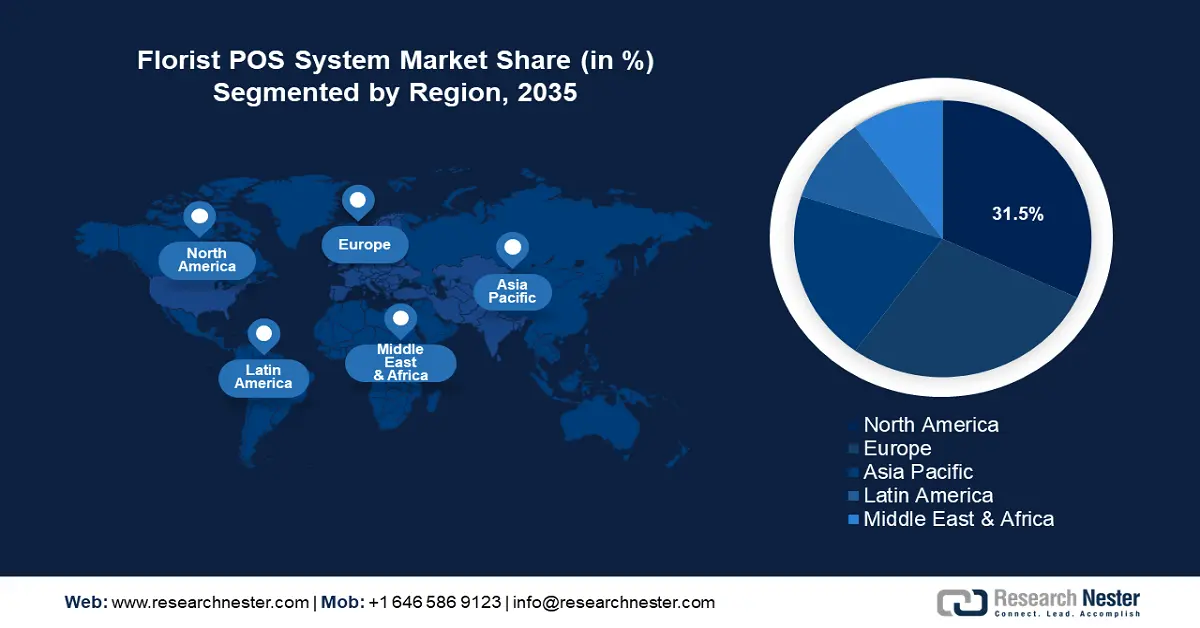

- North America leads the Florist POS System Market with a 31.5% share, propelled by demand for tracking hyper-local floral supply chains and omnichannel retail adoption, ensuring sustained growth through 2026–2035.

- Europe's Florist POS System Market is expected to grow rapidly by 2035, driven by increasing retail digitalization and demand for sustainable supply chain tracking solutions.

Segment Insights:

- The Cloud-based segment is poised for substantial growth from 2026-2035, driven by scalability, real-time data access, and AI-enhanced demand forecasting, capturing a 52% share.

Key Growth Trends:

- Rise of government-backed small business digitization programs

- Surge in hyper-local florist networks

Major Challenges:

- Unpredictable demand spikes in hyper-local networks

- Cultural customization at scale

- Key Players: Floranext, Hana POS, Posiflex, Curate, The Floral POS, FloristWare, Ularas, BloomNation, SE2 Inc., FTD, Teleflora.

Global Florist POS System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.13 billion

- 2026 Market Size: USD 5.46 billion

- Projected Market Size: USD 10.28 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Florist POS System Market Growth Drivers and Challenges:

Growth Drivers

- Rise of government-backed small business digitization programs: The U.S. Small Business Administration (SBA) reported a 28% increase in grants for retail tech adoption between 2021 to 2023, which bolsters florists in leveraging funds to upgrade POS systems for compliance with digital tax reporting mandates. With the U.S. remaining a vital market globally, successful integration rates bode well for the adoption in emerging sectors. In Europe, the Digital Europe program allocated USD 604.5 million to assist SMEs adopt advanced retail technologies including POS platforms with multi-language and cross-border VAT handling. These initiatives support SME digitization bolstering adoption rates of retail software solutions.

- Surge in hyper-local florist networks: The growth in hyper-local florist networks is an emerging trend benefiting the expansion of the florist POS system market. Moreover, the increasing consumer preference for local products and services has led to the growth of hyperlocal delivery models in the floral industry. This trend supports the adoption of POS systems capable of managing real-time orders and logistics to ensure accurate deliveries. The USDA 2022 census of agriculture highlighted that the U.S. flower farms blossomed under traditional flower cultivation. The census also indicated that florist greens raised around USD 763 million in 2022 in the U.S. which highlights the importance of inventory management for florists.

- Integration with emerging payment ecosystems: The florist POS system market is set to benefit from integration with emerging payment ecosystems such as contactless payments and digital currencies. In 2023, the World Bank reported that the advent of CBDC assists the florists in pilot regions in the adoption of CBDC-ready systems moreover the Federal Reserve Payments Study indicates that more than 60% of floral sales in urban hubs are now driven through contactless payments via POS systems. Opportunities are arising for advanced POS systems that can seamlessly integrate the emerging payment ecosystems to offer customers secure transaction options.

Challenges

- Unpredictable demand spikes in hyper-local networks: Florist POS systems can face challenges in the management of the perishable nature of floral inventory. The demand spikes in hyper-local networks can be unpredictable and the shelf lives are typically shorter. Despite the challenge, it also creates an opportunity for manufacturers to integrate predictive analytics tailored to microclimates or hyper-local events. Moreover, if the POS system fails to mitigate spoilage risks, then the adoption rates can be affected.

- Cultural customization at scale: Floristry is deeply tied to cultural symbolism where POS systems may fail to adapt to the nuances. For instance, a POS system designed for U.S. florists may lack the templates for India’s marigold-heavy festival demand or Japan’s Ikebana-style arrangements. This leads to florists having to manually adjust POS interfaces to reflect regional nuances which increases errors and slows checkout times.

Florist POS System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 5.13 billion |

|

Forecast Year Market Size (2035) |

USD 10.28 billion |

|

Regional Scope |

|

Florist POS System Market Segmentation:

Deployment Type (Cloud-Based, On-Premise)

Cloud-based segment is predicted to account for florist POS system market share of around 52% by 2035. The segment’s growth is driven by its scalability, real-time data accessibility, and cost efficiency. Cloud-based solutions are experiencing greater adoption by businesses managing multiple delivery channels for seasonal demand spikes. Furthermore, the advent of AI has improved demand forecasting and synchronization with third-party delivery platforms such as DoorDash, Blinkit, etc. Initiatives such as the U.S. SBAs DCOI Strategic Plan to heighten SME adoption of cloud services also boost the segment’s growth potential.

Functionality (Inventory Management, Order Processing, Customer Management, Analytics)

The inventory management segment of florist POS system market is set to expand during the stipulated timeline of the industry’s analysis. The inventory management functionality is a major feature of reducing waste while optimizing the supply chains. With florists prioritizing hyper-local sourcing and perishable stock control, the requirement for the functionality has heightened. Advanced systems are able to integrate real-time tracking of flower freshness, by leveraging IoT sensors to monitor temperature and humidity during storage. The requirement to reduce annual floral waste is suggested by the U.S. Environmental Protection Agency’s Sustainability Plan. Moreover, the Farm-to-Fork strategy of the European Union (EU) enables florists to align orders with the harvest cycle of regional growers via inventory management.

Our in-depth analysis of the global florist POS system market includes the following segments:

|

Deployment Type |

|

|

Functionality |

|

|

Business Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Florist POS System Market Regional Analysis:

North America Market Forecast

North America in florist POS system market is likely to account for around 31.5% revenue share by 2035, owing to growing demand to track hyper-local supply chains driven by collaborative federal and industry initiatives. The Local Agriculture Market Program (LAMP) funded with USD 50 million annually incentivizes florists to adopt POS systems that verify locally grown flowers to reduce carbon footprints. The regional cohesion is bolstered by omnichannel retail mandates which assist North America in maintaining its dominant position in tech-driven floral commerce.

The U.S. florist POS system market is set to expand during the forecast period. The growing sales of flowers in the U.S. are poised to assist the continued demand for florist POS systems. For instance, USDA’s Census of Agriculture in 2022 reported a USD 90 million worth of increase in cut-flower sales in the country, while the cut-flower imports were valued at USD 1.9 billion. Furthermore, the advent of social media platforms has enabled florists to promote their services effectively while creating the demand for aestheticism floral arrangements in weddings. The trends indicate rife opportunities for vendors to offer florist POS systems to manage sales and demands.

The Canada florist pos system market is projected to exhibit growth during the stipulated timeline. The market is defined by bilingual compliance and support for the indigenous floral ecosystems. POS adoption benefits florists sourcing from indigenous-owned nurseries, in the backdrop of sustained demand for ethical supply chains by consumers. Additionally, the complexity of the tax structure in Canada, which includes a combination of national GST, provincial PST, QST, and harmonized HST sales taxes drives the requirement of POS solutions capable of accurate tax calculations.

Europe Market Forecast:

The Europe florist POS system market is poised to register the second-fastest growth by the end of 2035. The increasing digitalization of retail operations in the region is a major factor in the growth. Florists in several economies in Europe are driving the demand for efficient transaction management solutions. Furthermore, the European Green Digital Coalition bolsters the adoption of solutions that can facilitate the tracking of a sustainable supply chain that is set to benefit the horticulture sector.

The Germany florist POS system market is poised to expand during the forecast period. The Energiewende goals of Germany are poised to play a factor in the market’s growth. Opportunities arise for POS platforms to sync with municipal compositing schedules to mitigate floral waste. Additionally, POS systems incorporate Industry 4.0 principles to support predictive maintenance for refrigeration units storing perishable high-value flowers. Moreover, the surging adoption of digitalization across retailers in Germany is poised to provide lucrative opportunities for vendors.

The France florist POS system market is projected to exhibit robust growth between 2025 and 2035. The World Bank reported that imported cut-flowers worth USD 0.33 million in 2022. The imports highlight the requirement of supply chain visibility and management, creating opportunities for florist POS systems. Moreover, the POS system market in France has a dynamic mixture of modern chains and traditional independent merchants. Furthermore, the integration of mobile POS systems is a hallmark of the market which is expected to create continued opportunities for investors.

Key Florist POS System Market Players:

- Floranext

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hana POS

- Posiflex Technology Inc.

- Curate

- The Floral POS

- FloristWare

- Ularas

- BloomNation

- SE2 Inc.

- FTD

- Teleflora

The florist POS system market is projected to expand during the stipulated timeframe. Key players operating in the sector are actively pursuing strategies to bolster revenue shares in the growing industry. A significant approach involves the development and integration of cloud-based solutions, which offer florists improved flexibility. Recent market news is the integration of SurgePays, Inc. fully integrated with ClearLine software marketing platform with Clover’s POS system to offer cutting-edge marketing tools for SMBs.

Here are some key players in the florist POS system market:

Recent Developments

- In October 2024, Fiserv Inc. announced further investment in small business solutions by launching all-in-one Clover solutions. The all-in-one solutions combine flexible hardware with software that addresses the unique needs of individual businesses.

- In September 2024, Harris announced the acquisition of SE2 Inc. and its point of sale (POS) system. Alice POS offers cloud software designed for retail, both for boutiques and store chains (multi-sites, franchises, purchasing groups, and corporate networks).

- Report ID: 7122

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Florist POS System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.